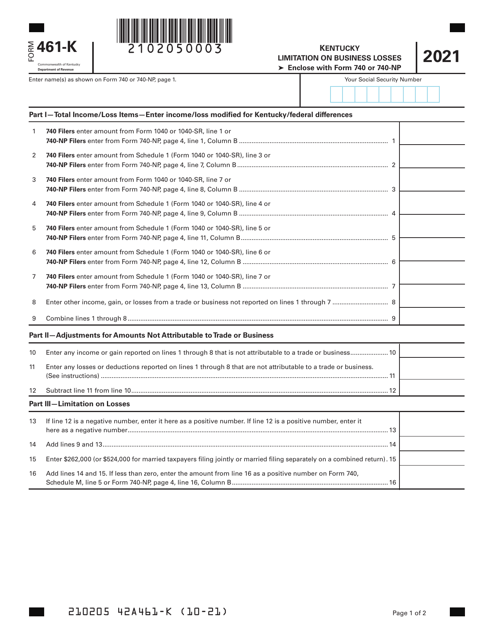

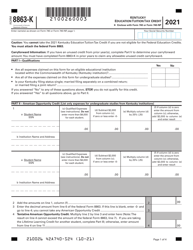

Form 461-K Kentucky Education Tuition Tax Credit - Kentucky

What Is Form 461-K?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 461-K?

A: Form 461-K is the Kentucky Education Tuition Tax Credit form.

Q: What is the purpose of Form 461-K?

A: The purpose of Form 461-K is to claim the Kentucky Education Tuition Tax Credit.

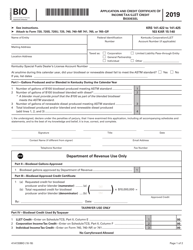

Q: Who is eligible to claim the Kentucky Education Tuition Tax Credit?

A: Individuals and corporations who contributed to an eligible educational institution in Kentucky are eligible to claim the tax credit.

Q: What is the maximum amount of tax credit that can be claimed?

A: The maximum amount of tax credit that can be claimed is $1,000 for individuals and $10,000 for corporations.

Q: What is considered an eligible educational institution in Kentucky?

A: An eligible educational institution in Kentucky includes public or private elementary or secondary schools, as well as colleges and universities.

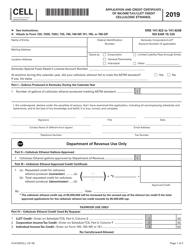

Q: Can the tax credit be carried forward to future years?

A: No, the tax credit cannot be carried forward to future years. It must be claimed in the same tax year as the contribution.

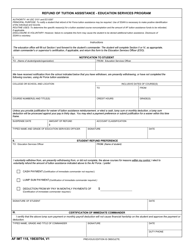

Q: What documents are required to claim the tax credit?

A: To claim the tax credit, individuals and corporations must provide documentation from the eligible educational institution that shows the contribution amount.

Q: When is the deadline to file Form 461-K?

A: Form 461-K must be filed with the Kentucky Department of Revenue by April 15 of the following year.

Q: Is there an income limit to claim the tax credit?

A: No, there is no income limit to claim the Kentucky Education Tuition Tax Credit.

Q: Can the tax credit be claimed on both the state and federal tax returns?

A: No, the tax credit can only be claimed on the state tax return.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 461-K by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.