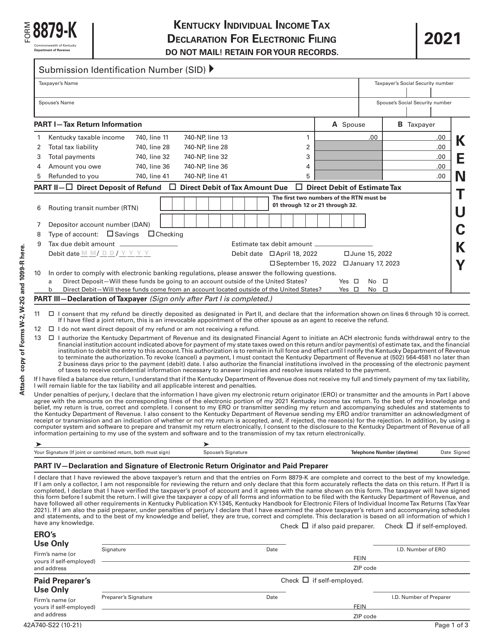

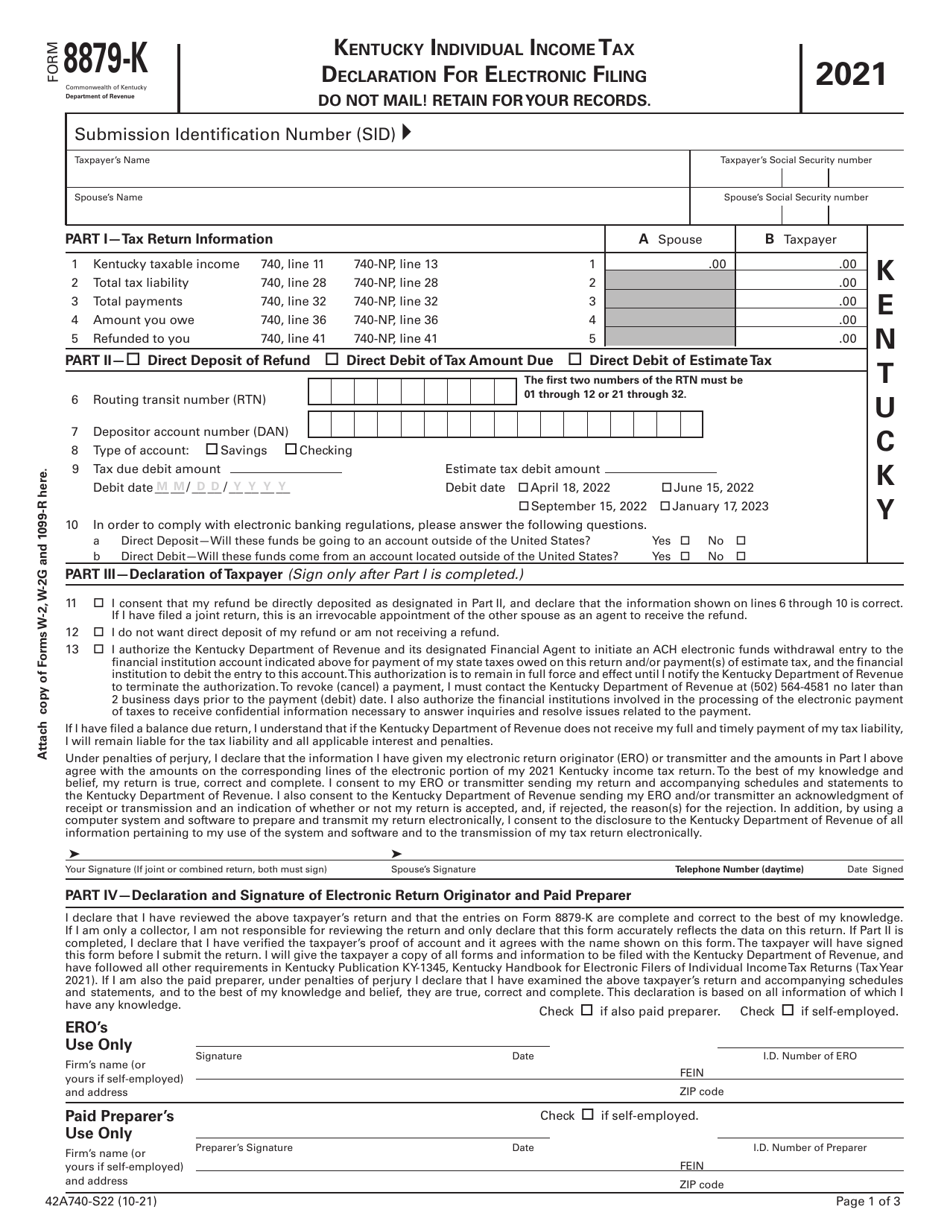

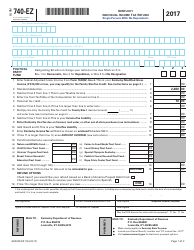

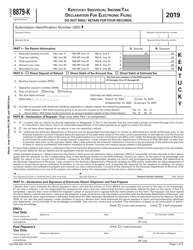

Form 8879-K Kentucky Individual Income Tax Declaration for Electronic Filing - Kentucky

What Is Form 8879-K?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8879-K?

A: Form 8879-K is the Kentucky Individual Income Tax Declaration for Electronic Filing.

Q: What is the purpose of Form 8879-K?

A: The purpose of Form 8879-K is to authorize the electronic filing of an individual's Kentucky income tax return.

Q: Who needs to file Form 8879-K?

A: Form 8879-K needs to be filed by individuals who are electronically filing their Kentucky income tax return.

Q: Is Form 8879-K specific to Kentucky residents only?

A: Yes, Form 8879-K is specific to Kentucky residents.

Q: What information do I need to provide on Form 8879-K?

A: You will need to provide your name, Social Security number, Kentucky individual taxpayer identification number (if applicable), and other relevant personal information.

Q: Can I e-sign Form 8879-K?

A: Yes, you can electronically sign Form 8879-K.

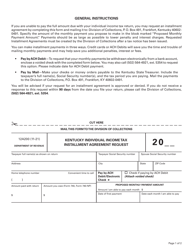

Q: Do I need to mail Form 8879-K to the Kentucky Department of Revenue?

A: No, you do not need to mail Form 8879-K to the Kentucky Department of Revenue. It should be retained by the taxpayer for recordkeeping purposes.

Q: When do I need to file Form 8879-K?

A: Form 8879-K should be filed prior to or with the submission of your electronic tax return.

Q: What if I make a mistake on Form 8879-K?

A: If you make a mistake on Form 8879-K, you should correct it and submit the corrected form.

Q: Can I file my Kentucky income tax return electronically without using Form 8879-K?

A: No, Form 8879-K is required for electronic filing of a Kentucky income tax return.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 8879-K by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.