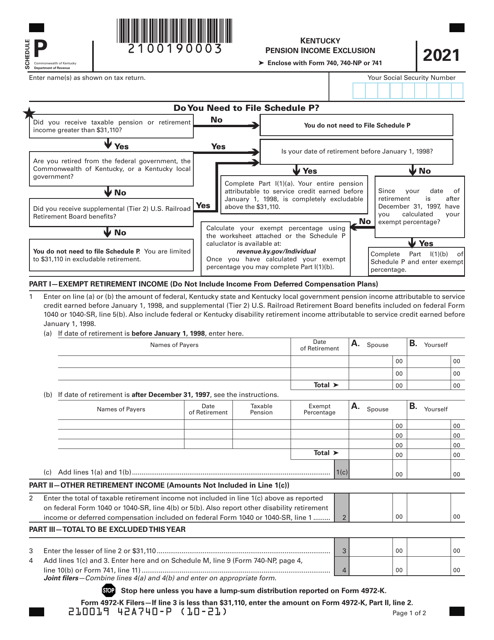

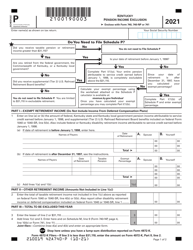

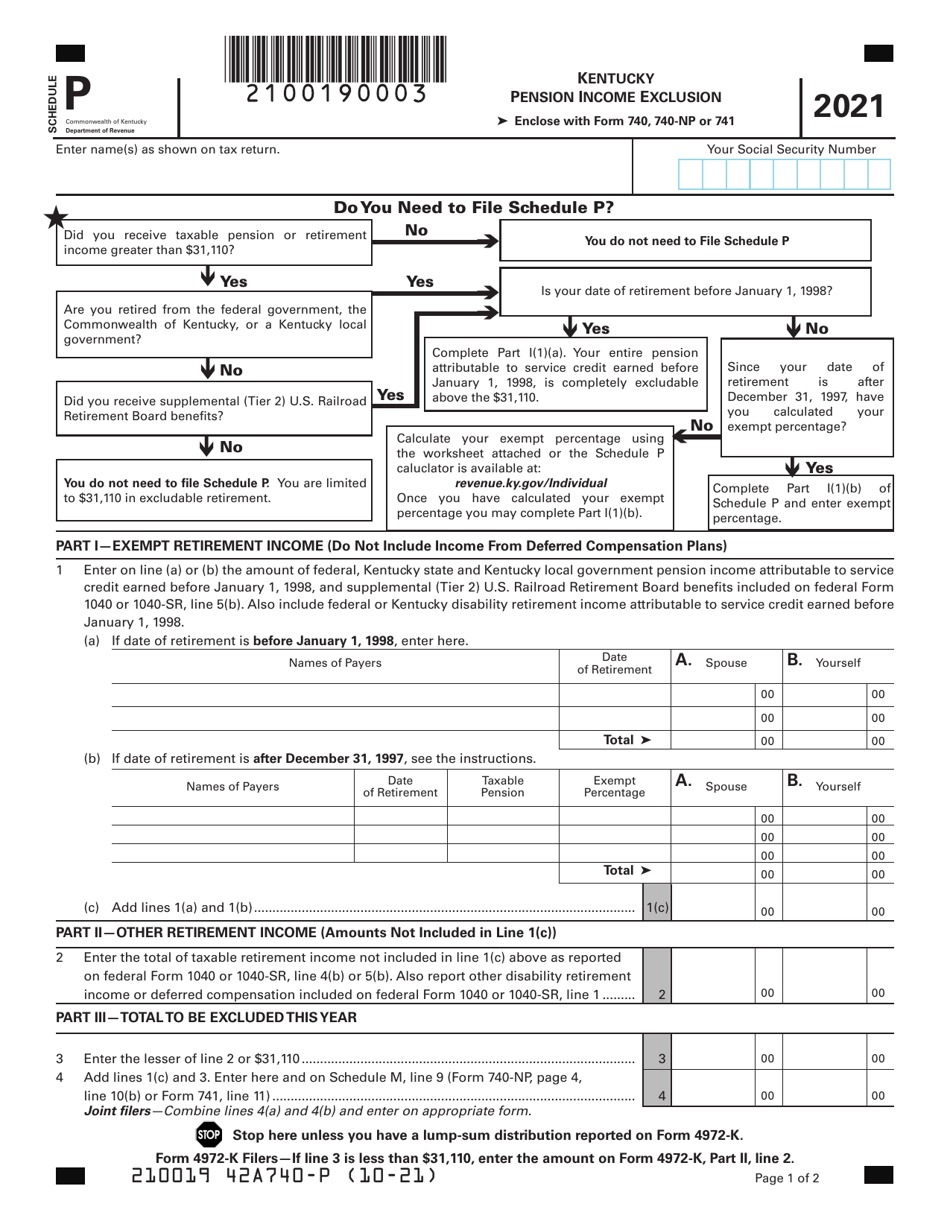

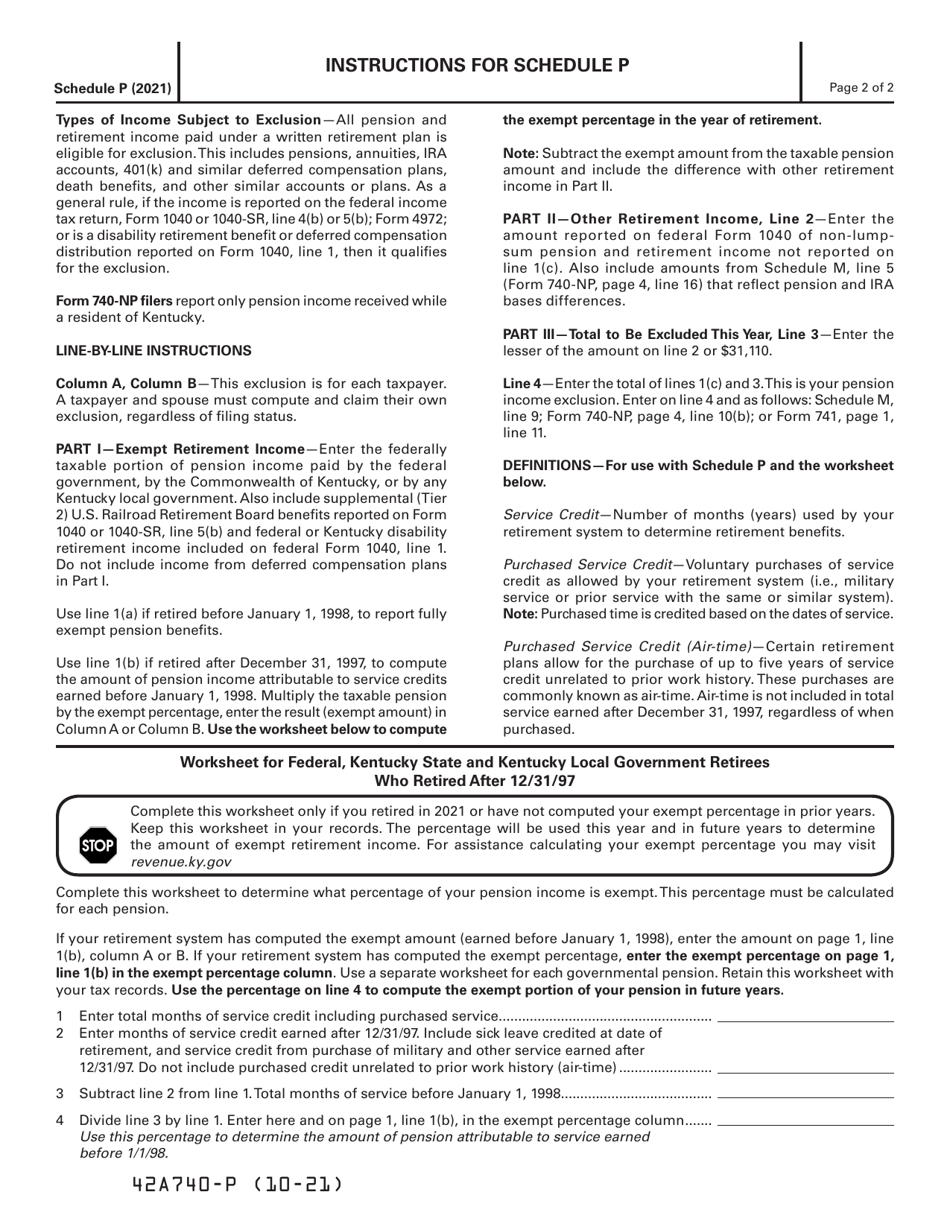

Schedule P Kentucky Pension Income Exclusion - Kentucky

What Is Schedule P?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule P?

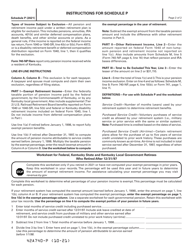

A: Schedule P is a tax form used in Kentucky to calculate the exclusion of pension income from state taxes.

Q: What is the Kentucky Pension Income Exclusion?

A: The Kentucky Pension Income Exclusion is a tax benefit that allows residents of Kentucky to exclude a portion of their pension income from their state taxable income.

Q: Who is eligible for the Kentucky Pension Income Exclusion?

A: Kentucky residents who receive pension income from qualified retirement plans, including pensions, annuities, and certain disability benefits, may be eligible for this exclusion.

Q: How much pension income can be excluded?

A: For taxpayers who are 65 or older, up to $31,110 of pension income can be excluded. For taxpayers under 65, the exclusion is limited to $31,110 or the amount of Social Security income received, whichever is less.

Q: How does Schedule P work?

A: Taxpayers need to complete Schedule P and submit it along with their Kentucky state tax return. The form calculates the amount of pension income that can be excluded.

Q: Is the Kentucky Pension Income Exclusion available to non-residents?

A: No, the Kentucky Pension Income Exclusion is only available to residents of Kentucky.

Q: Are there any other requirements to qualify for the exclusion?

A: Yes, taxpayers may need to meet certain requirements, such as being retired or disabled, in order to qualify for the Kentucky Pension Income Exclusion.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule P by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.