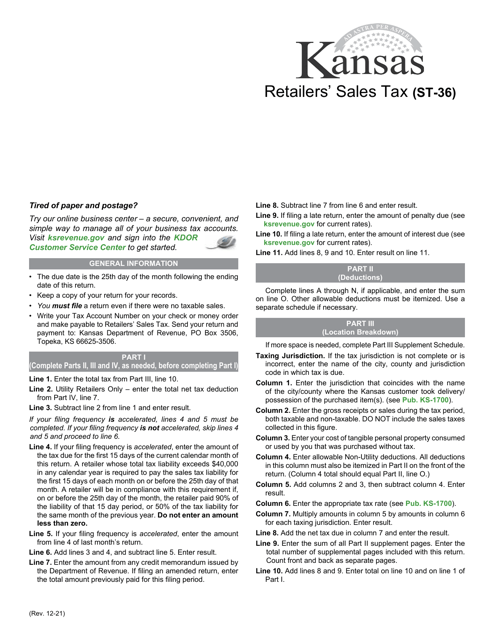

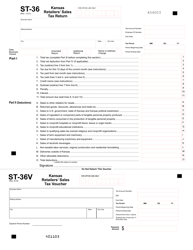

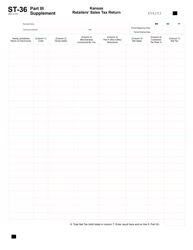

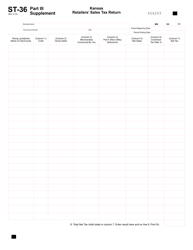

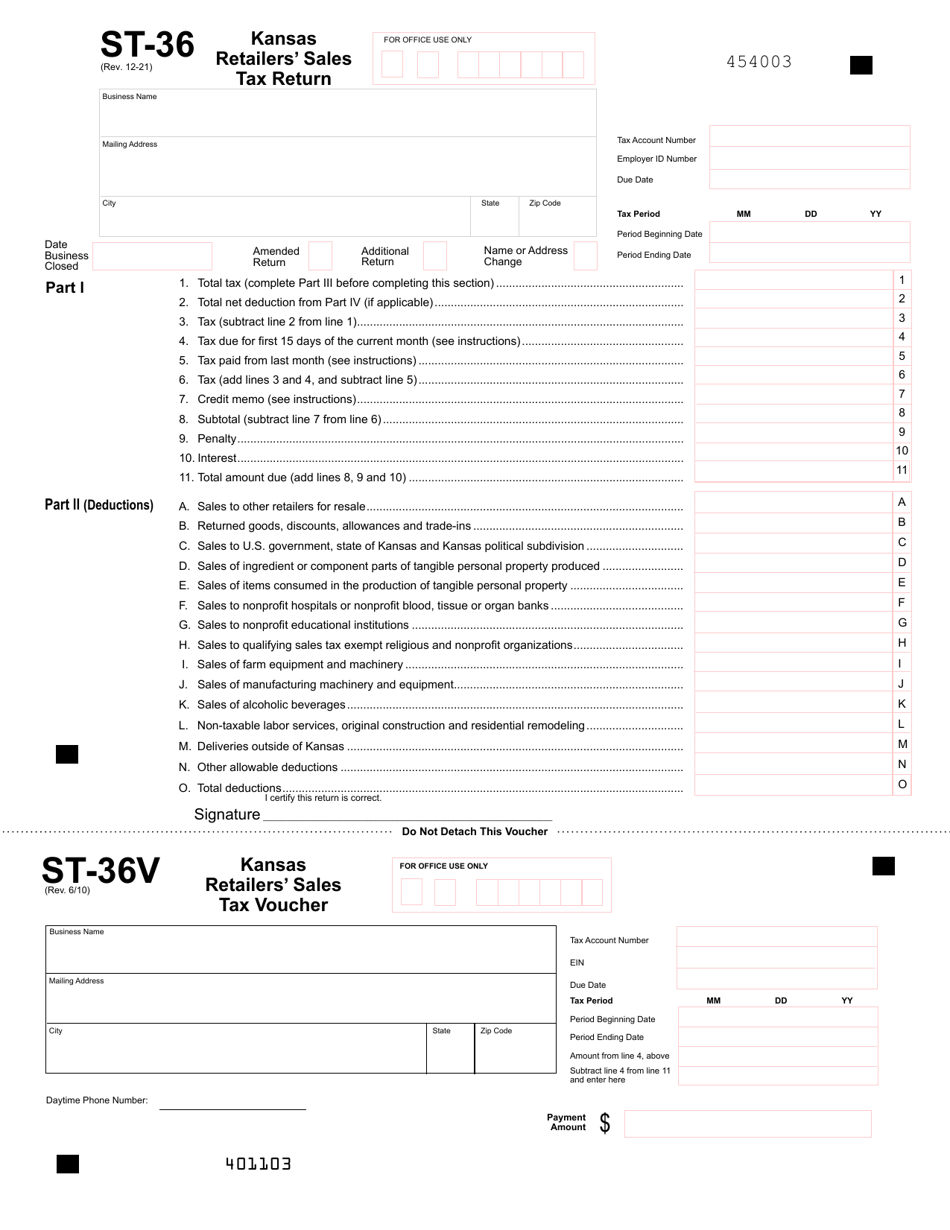

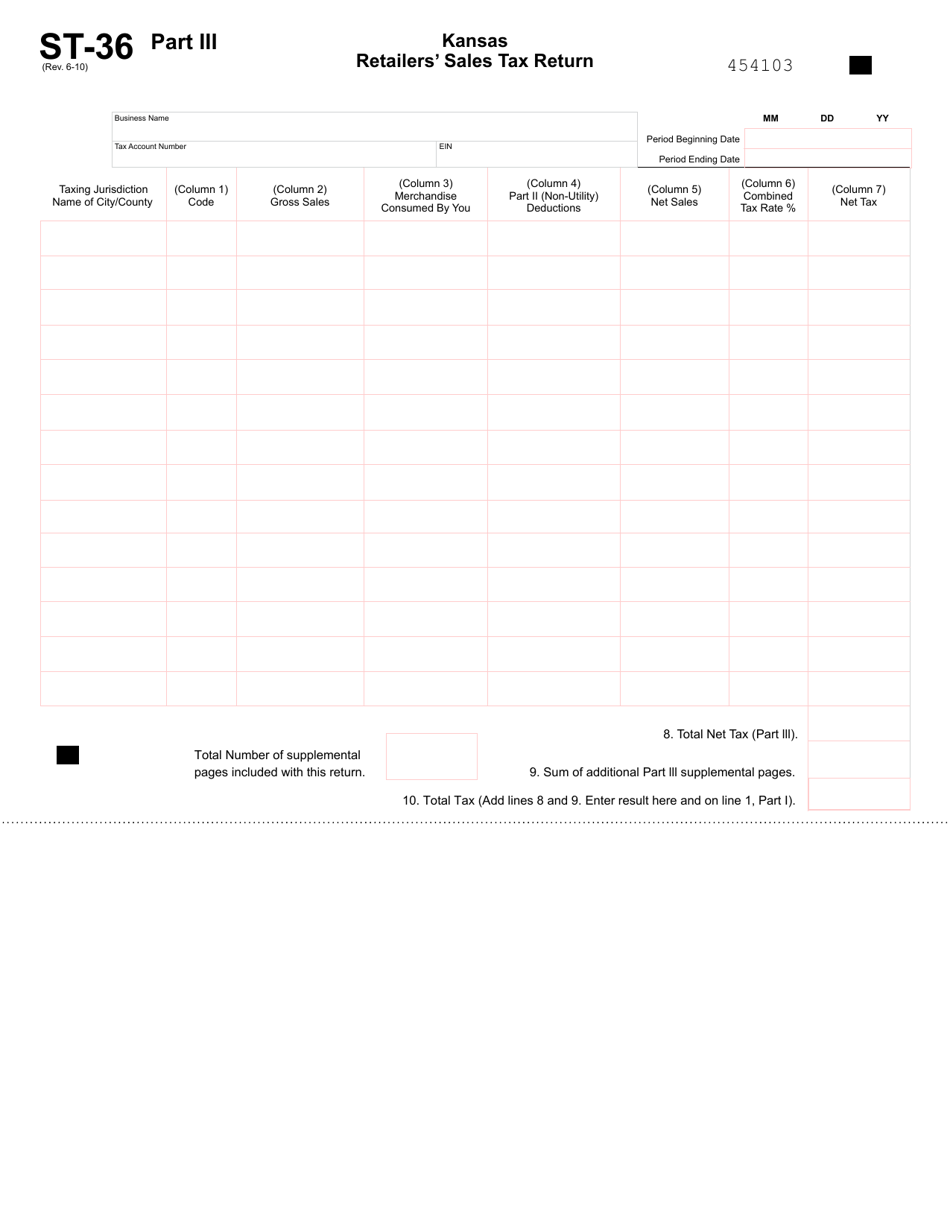

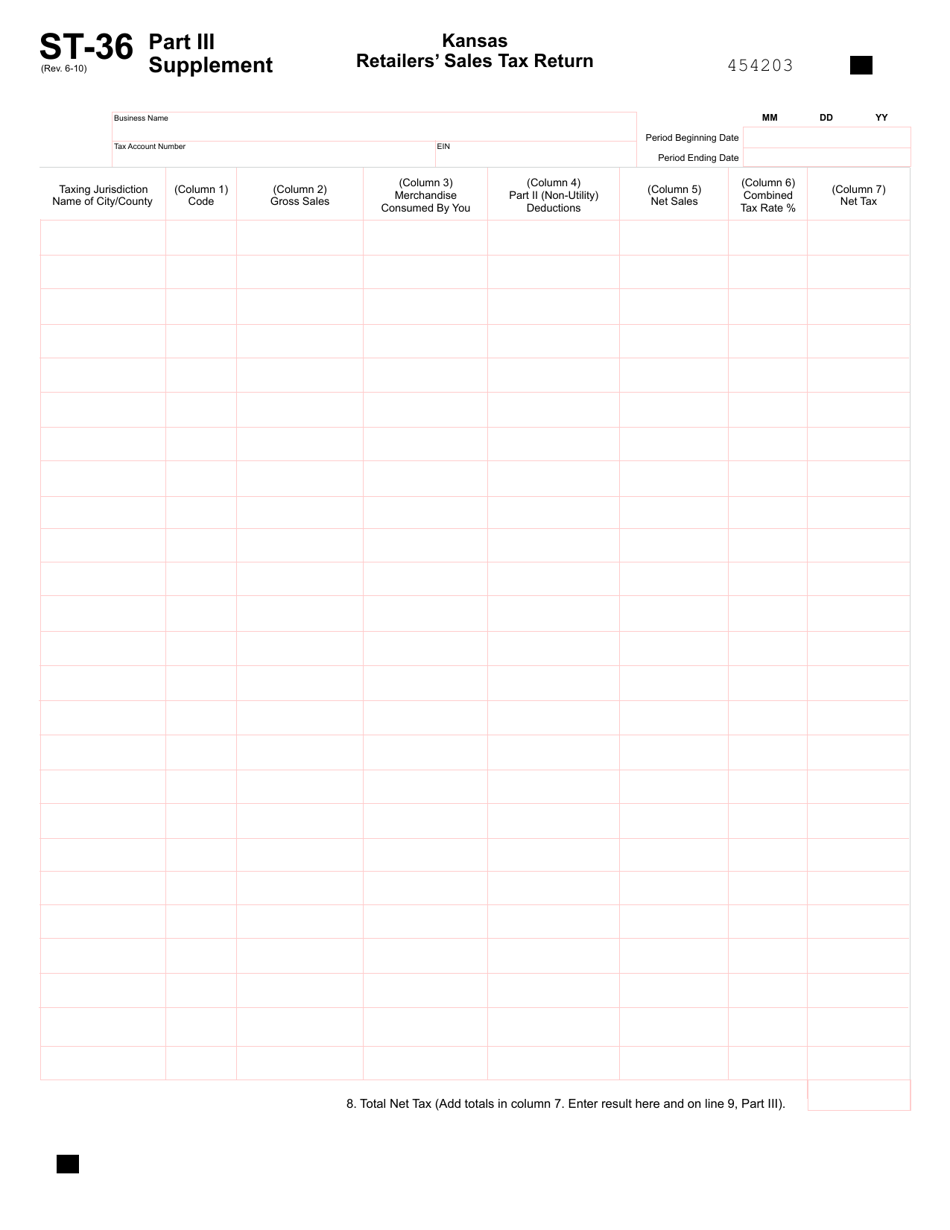

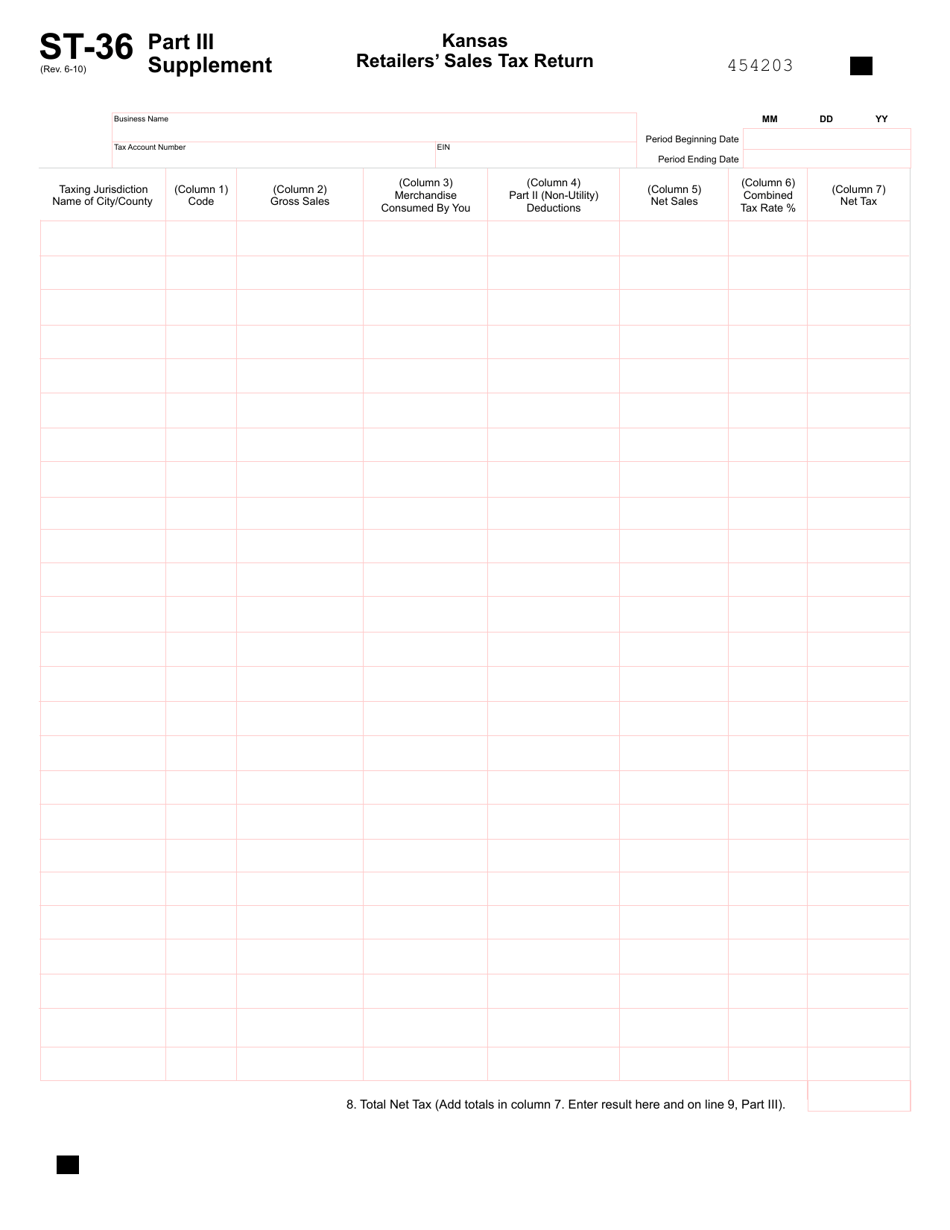

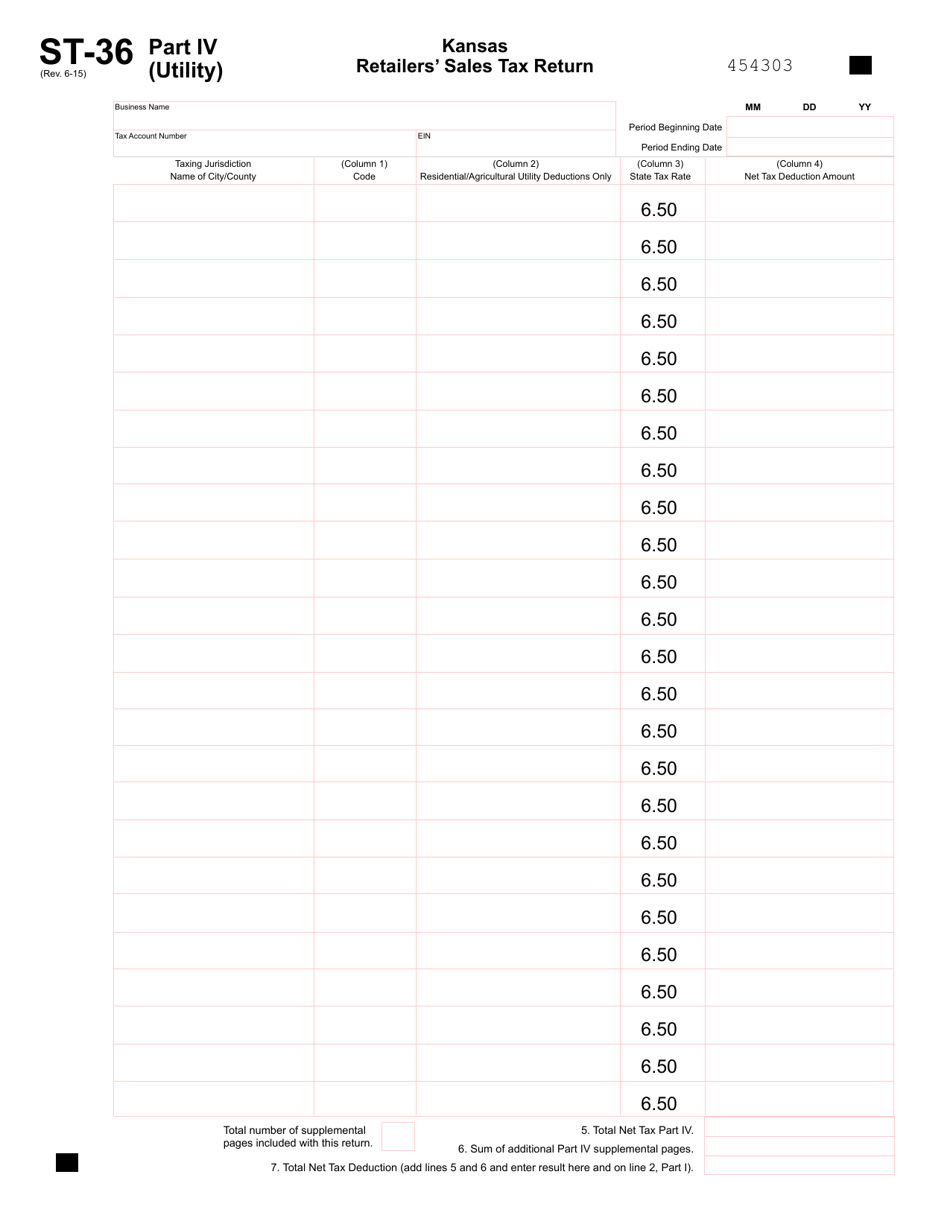

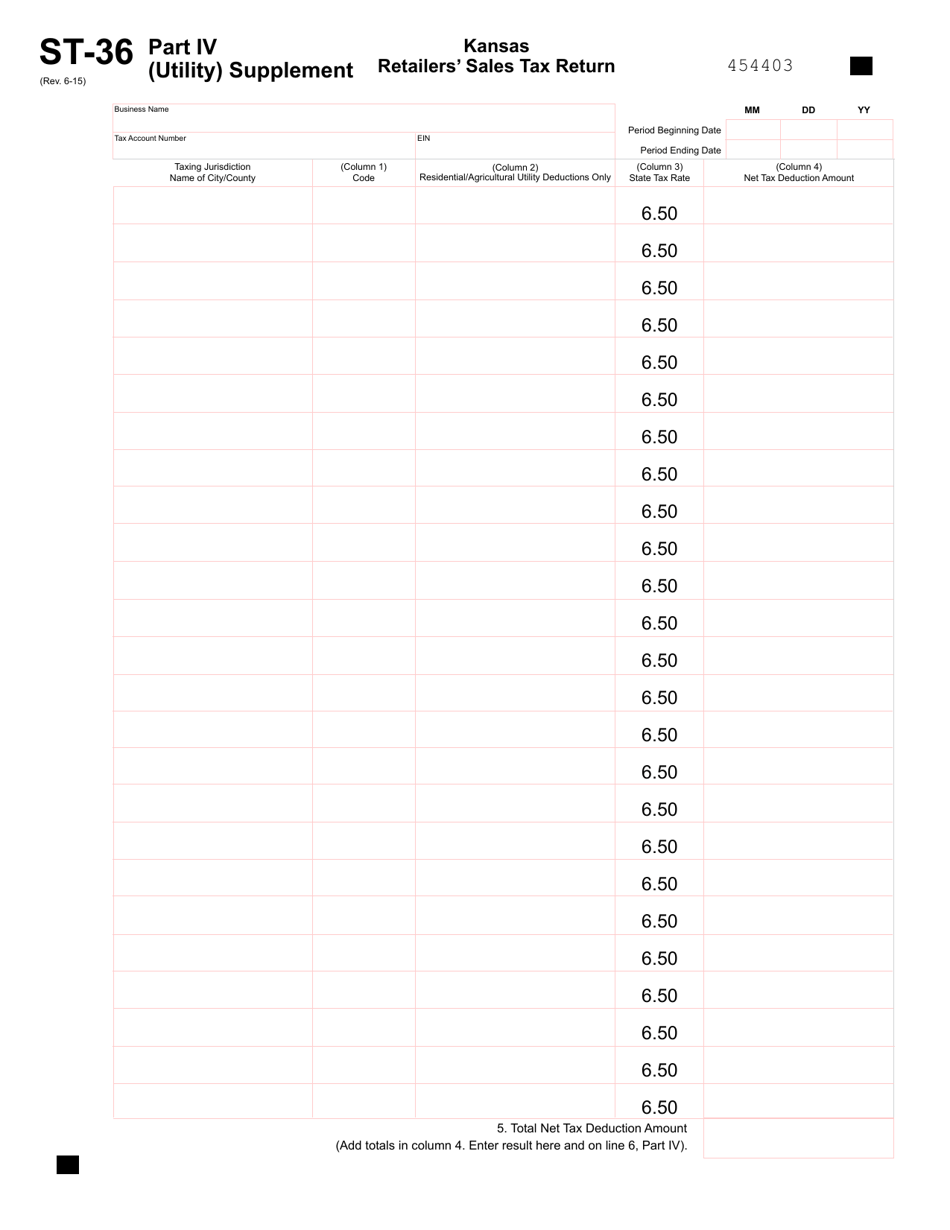

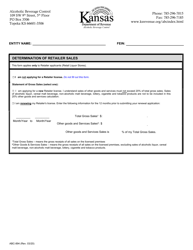

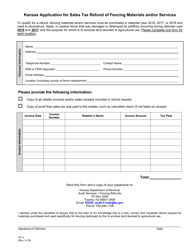

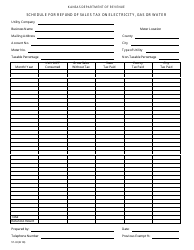

Form ST-36 Kansas Retailers' Sales Tax Return - Kansas

What Is Form ST-36?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-36?

A: Form ST-36 is the Kansas Retailers' Sales Tax Return.

Q: Who is required to file Form ST-36?

A: Kansas retailers are required to file Form ST-36.

Q: What is the purpose of Form ST-36?

A: The purpose of Form ST-36 is to report and remit sales tax collected by retailers in Kansas.

Q: When is Form ST-36 due?

A: Form ST-36 is generally due on the 25th day of the month following the reporting period.

Q: Are there any penalties for late filing or non-filing of Form ST-36?

A: Yes, penalties may be assessed for late filing or non-filing of Form ST-36.

Q: What should I do if I have questions or need assistance with Form ST-36?

A: If you have questions or need assistance with Form ST-36, you can contact the Kansas Department of Revenue for guidance.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-36 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.