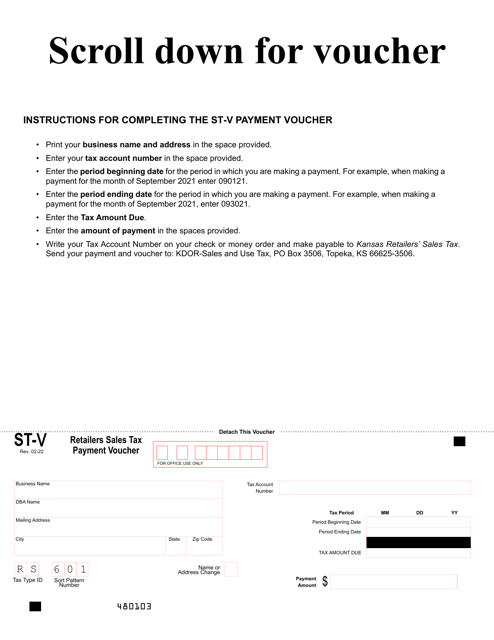

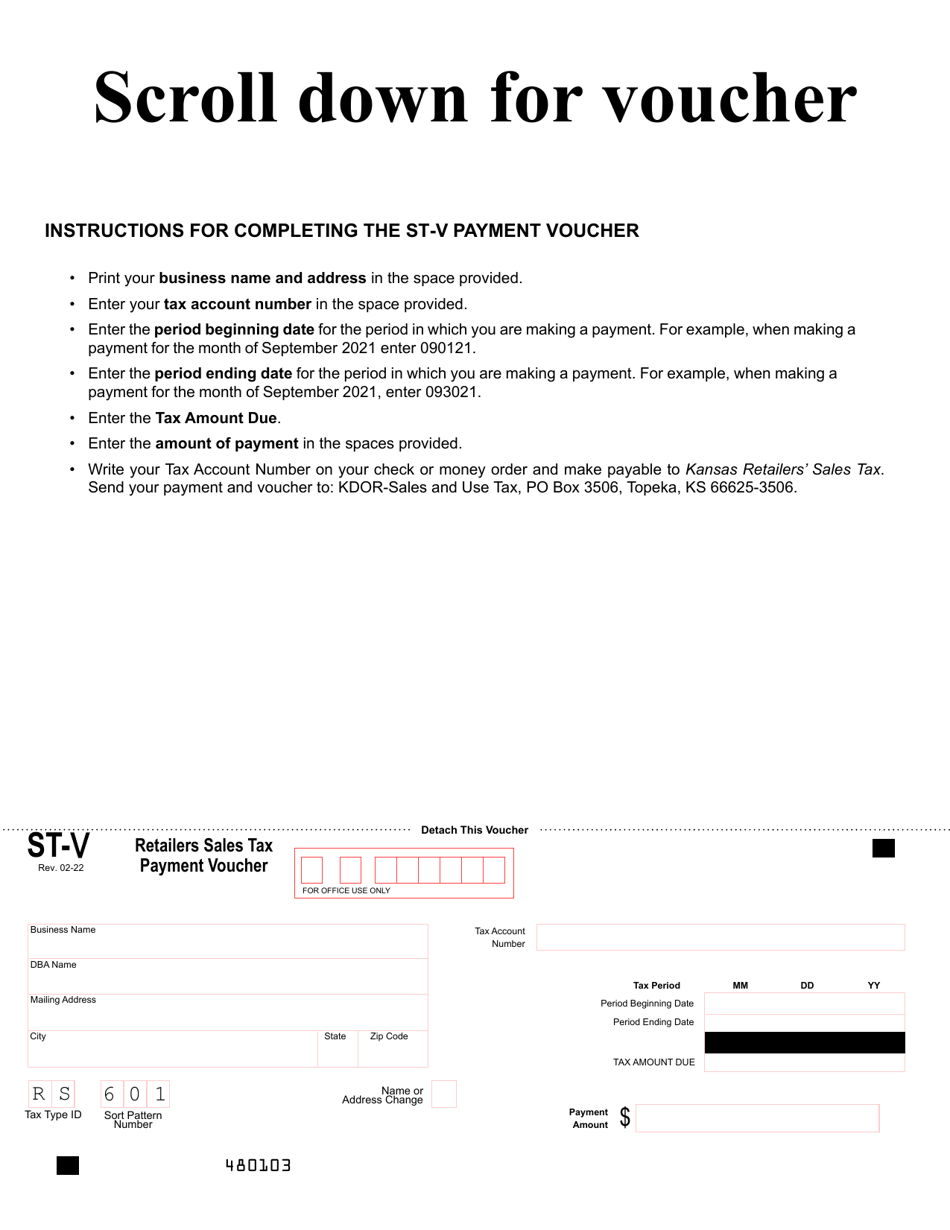

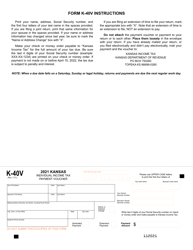

Form ST-V Retailers Sales Tax Payment Voucher - Kansas

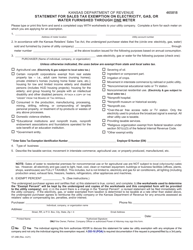

What Is Form ST-V?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-V?

A: Form ST-V stands for Retailers Sales Tax Payment Voucher in Kansas.

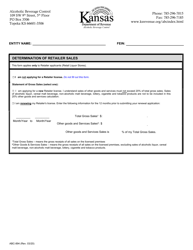

Q: Who needs to use Form ST-V?

A: Retailers in Kansas who are required to collect sales tax must use Form ST-V to report and pay their sales tax liability.

Q: What is the purpose of Form ST-V?

A: Form ST-V is used to report and remit sales tax collected from customers to the Kansas Department of Revenue.

Q: How often do retailers need to file Form ST-V?

A: Retailers in Kansas generally need to file Form ST-V on a monthly basis, unless they qualify to file quarterly or annually.

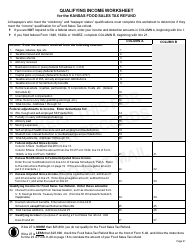

Q: What information is required on Form ST-V?

A: Retailers need to provide their business information, sales tax collected, and calculate the amount of sales tax due on Form ST-V.

Q: What happens if retailers do not file Form ST-V or pay sales tax?

A: Failure to file Form ST-V or pay sales tax can result in penalties and interest being assessed by the Kansas Department of Revenue.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-V by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.