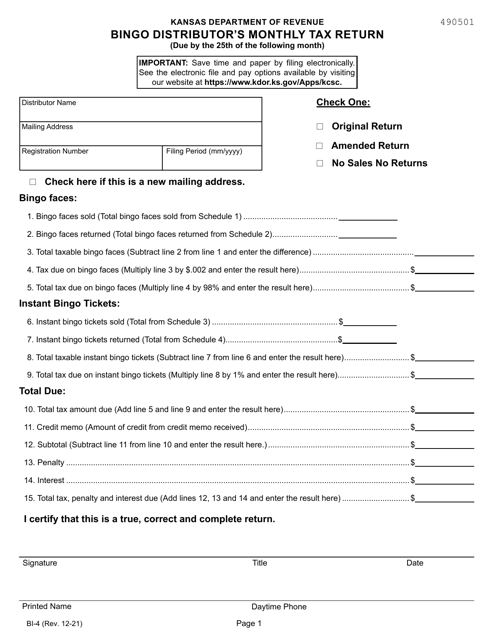

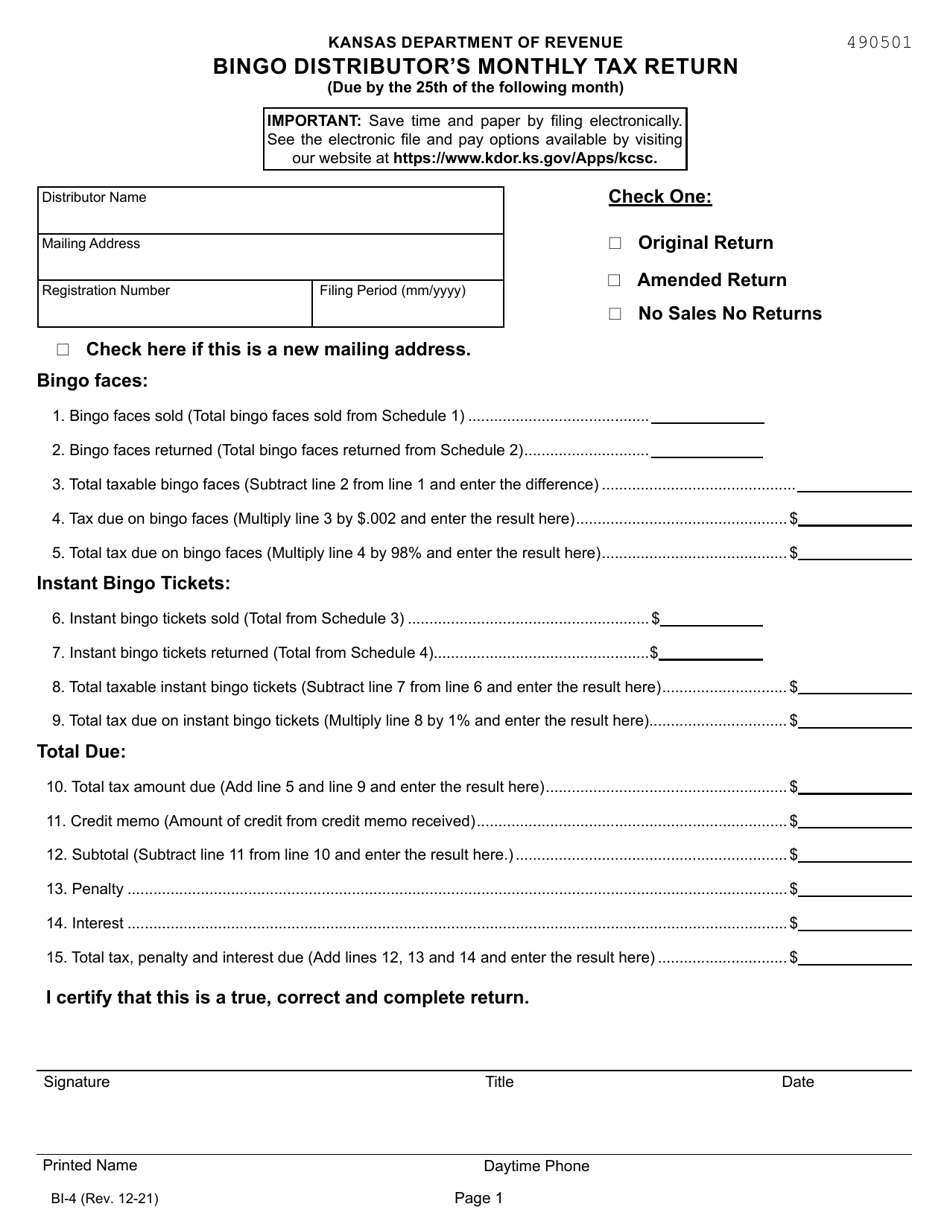

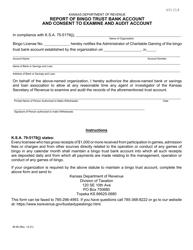

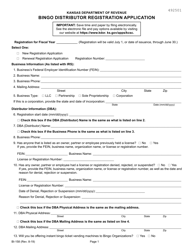

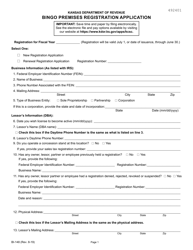

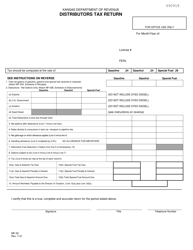

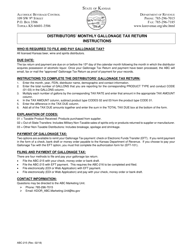

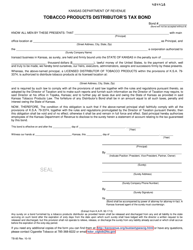

Form BI-4 Bingo Distributor's Monthly Tax Return - Kansas

What Is Form BI-4?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BI-4?

A: Form BI-4 is the Bingo Distributor's Monthly Tax Return in Kansas.

Q: Who needs to file Form BI-4?

A: Bingo distributors in Kansas need to file Form BI-4.

Q: What is the purpose of Form BI-4?

A: The purpose of Form BI-4 is to report and pay the monthly tax on bingo sales in Kansas.

Q: How often is Form BI-4 filed?

A: Form BI-4 is filed monthly.

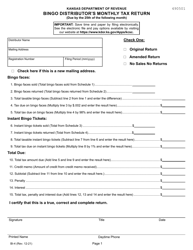

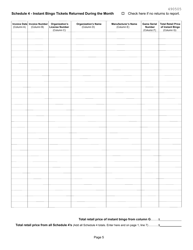

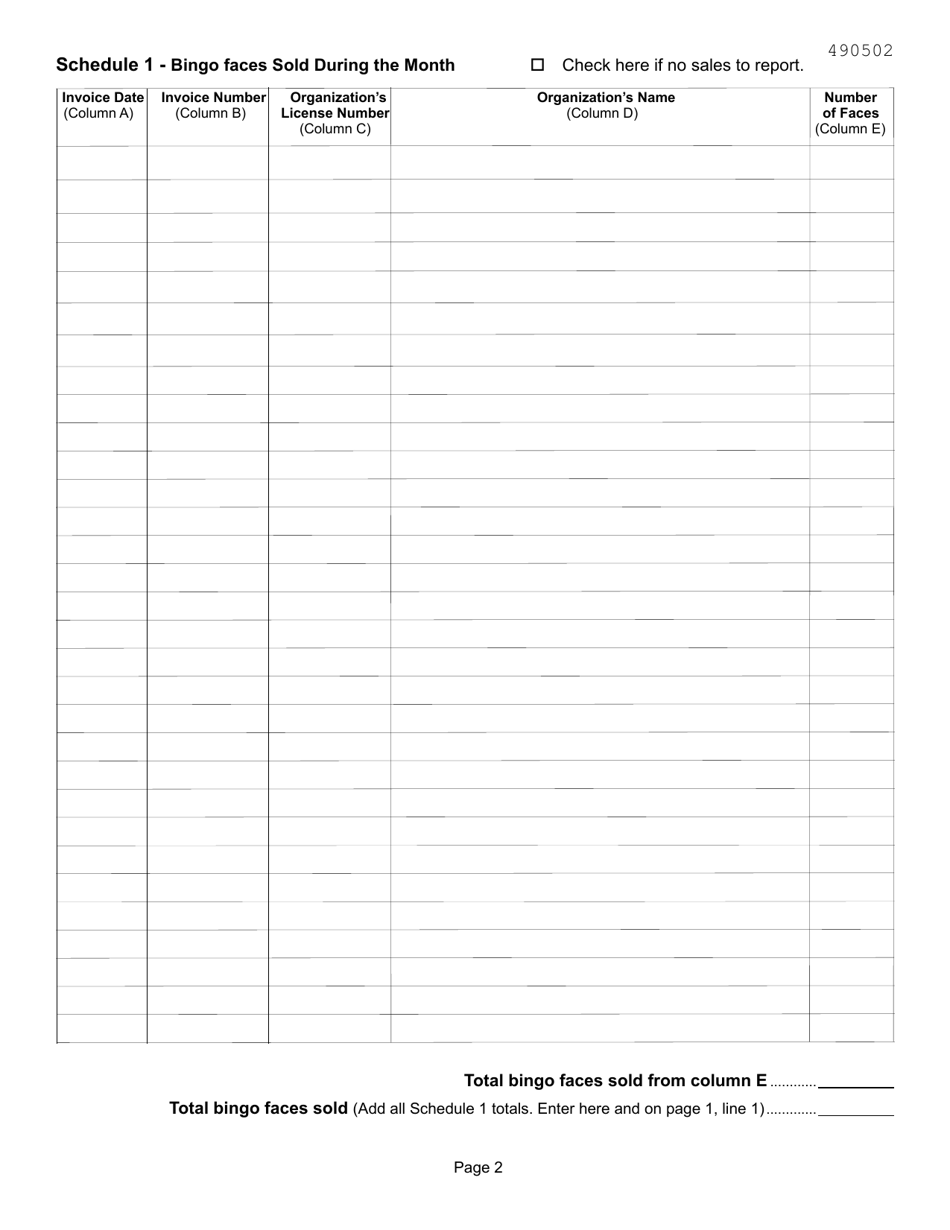

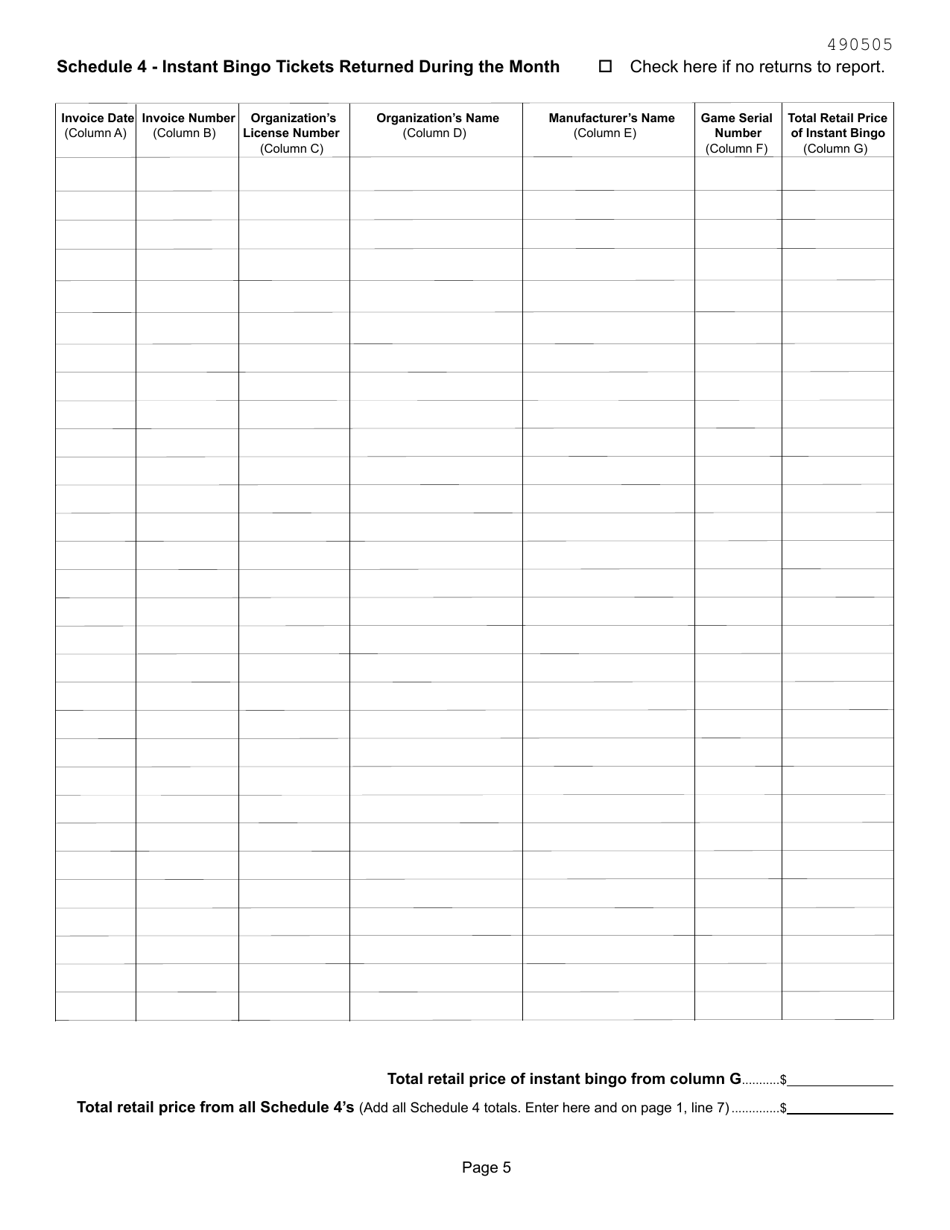

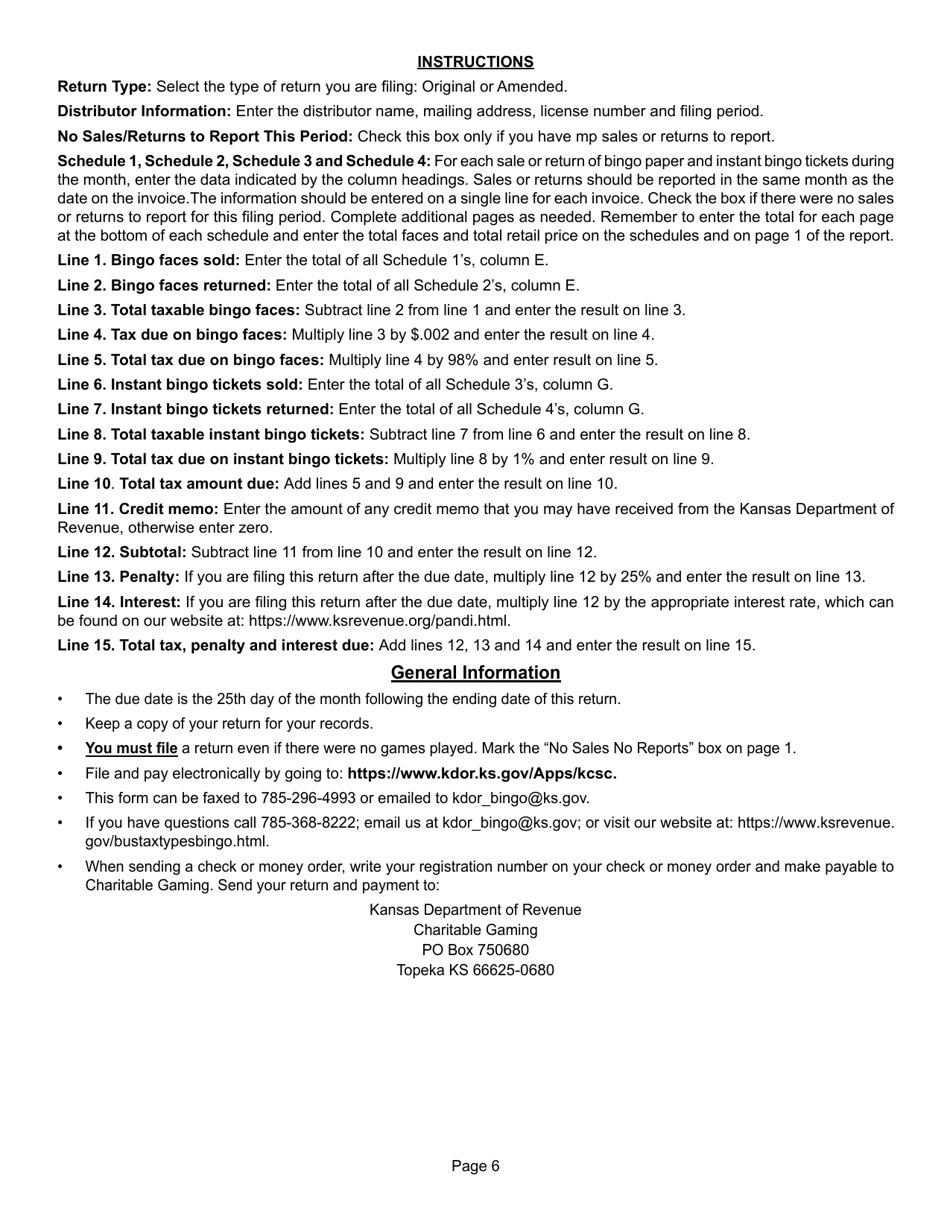

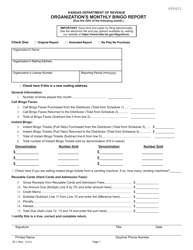

Q: What information is required on Form BI-4?

A: Form BI-4 requires information such as total sales of bingo supplies, gross receipts from bingo sales, and the amount of tax due.

Q: What is the deadline for filing Form BI-4?

A: Form BI-4 must be filed and paid by the 25th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form BI-4?

A: Yes, there are penalties for late or incorrect filing of Form BI-4, including interest charges and possible criminal charges.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BI-4 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.