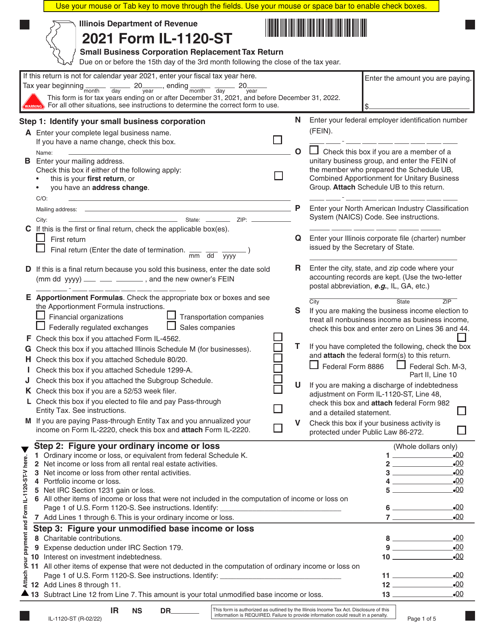

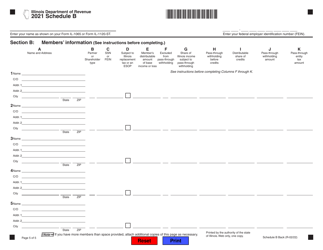

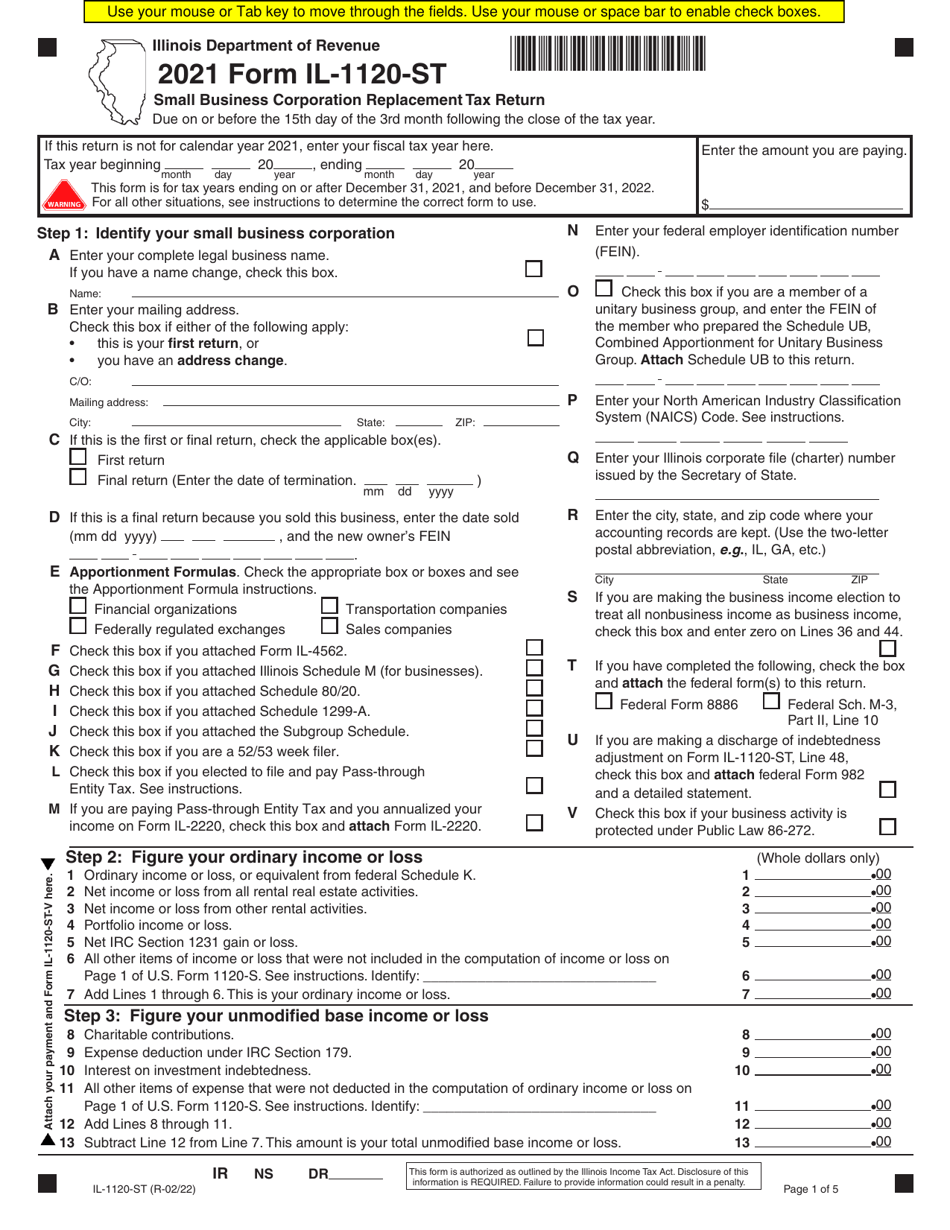

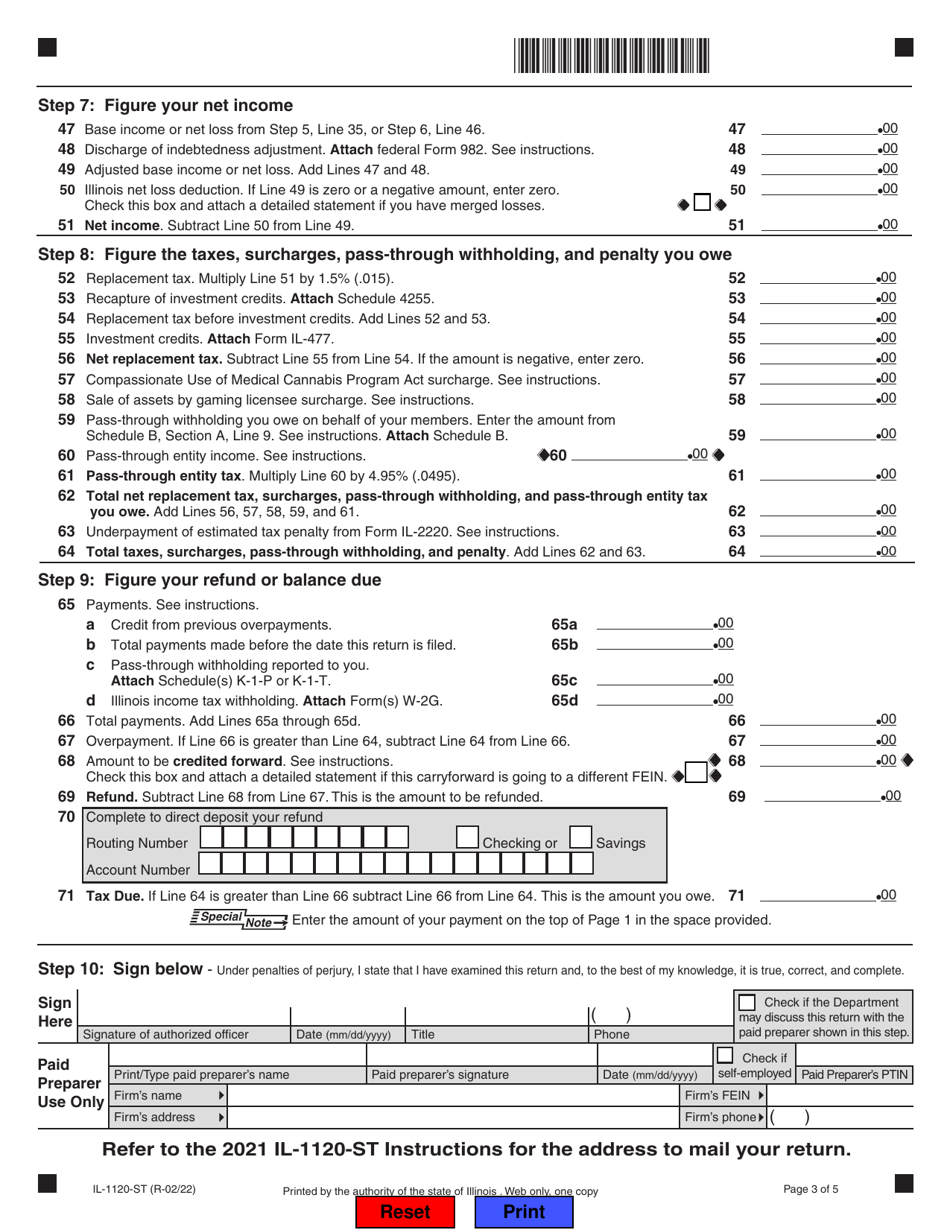

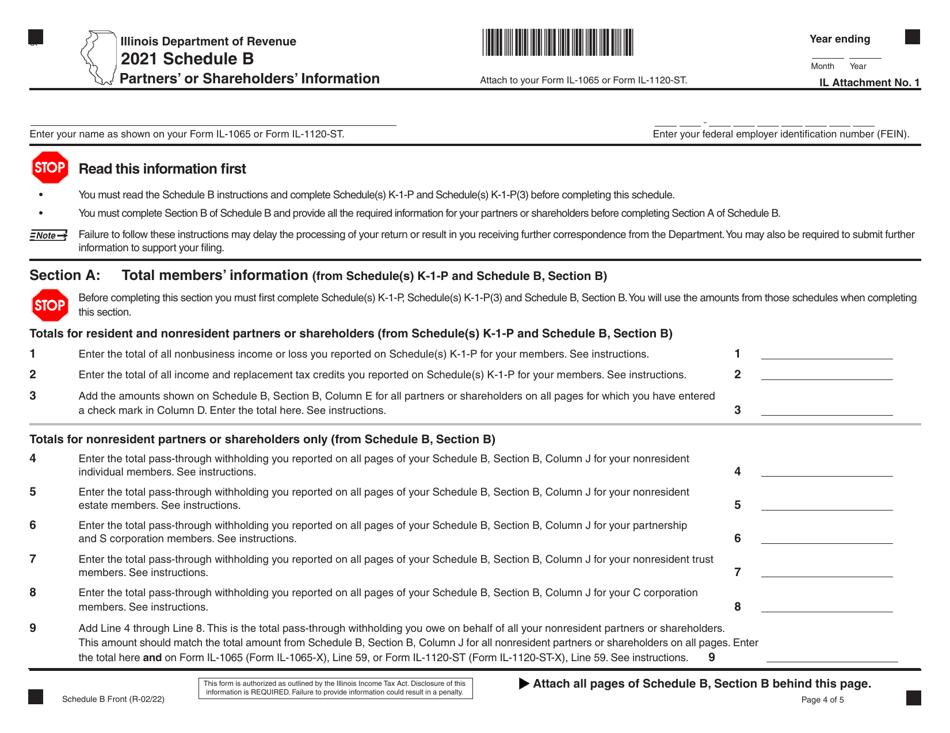

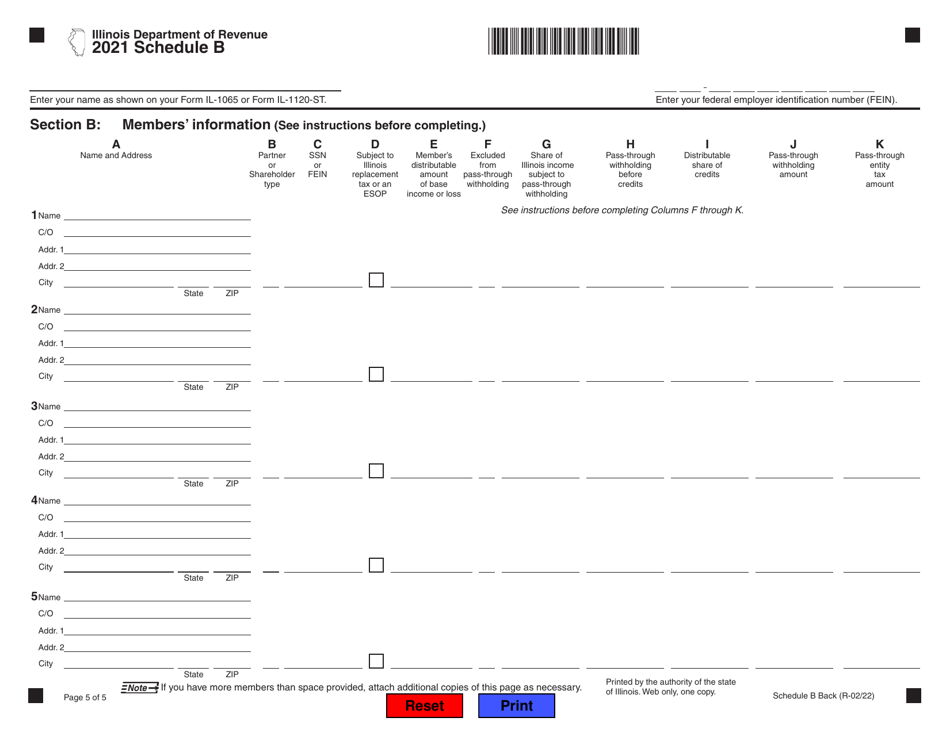

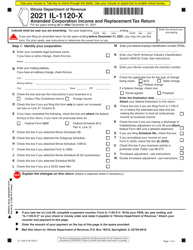

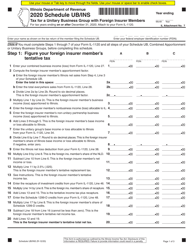

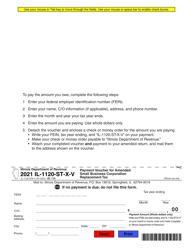

Form IL-1120-ST Small Business Corporation Replacement Tax Return - Illinois

What Is Form IL-1120-ST?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1120-ST?

A: Form IL-1120-ST is the Small Business Corporation Replacement Tax Return for the state of Illinois.

Q: Who needs to file Form IL-1120-ST?

A: Small business corporations in Illinois need to file Form IL-1120-ST.

Q: What is the purpose of Form IL-1120-ST?

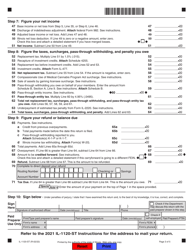

A: The purpose of Form IL-1120-ST is to calculate and report the replacement tax owed by small business corporations in Illinois.

Q: Is Form IL-1120-ST for individuals or businesses?

A: Form IL-1120-ST is for businesses, specifically small business corporations.

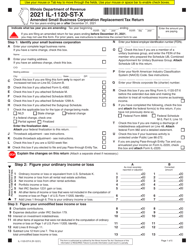

Q: Is there a deadline for filing Form IL-1120-ST?

A: Yes, the deadline for filing Form IL-1120-ST is generally the same as the federal income tax deadline, which is April 15th.

Q: Are there any penalties for late filing of Form IL-1120-ST?

A: Yes, there may be penalties for late filing of Form IL-1120-ST, so it's important to submit it on time.

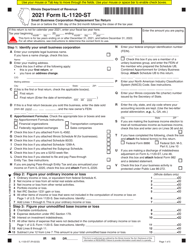

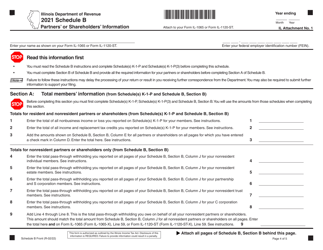

Q: Do I need to include any supporting documents with Form IL-1120-ST?

A: Yes, you may need to include supporting documents such as schedules and attachments, depending on your business's circumstances.

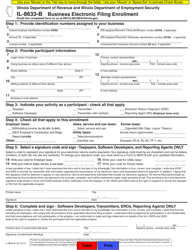

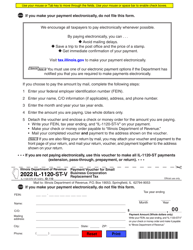

Q: Can I file Form IL-1120-ST electronically?

A: Yes, you can file Form IL-1120-ST electronically using the Illinois Department of Revenue's e-filing system.

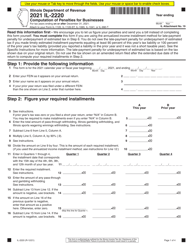

Q: What should I do if I have questions or need assistance with Form IL-1120-ST?

A: If you have questions or need assistance with Form IL-1120-ST, you can contact the Illinois Department of Revenue for help.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1120-ST by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.