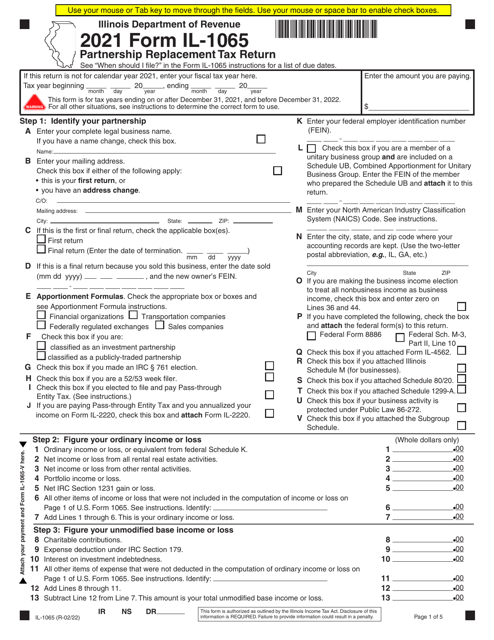

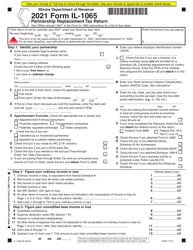

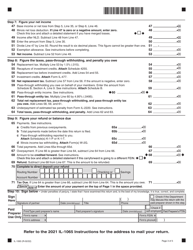

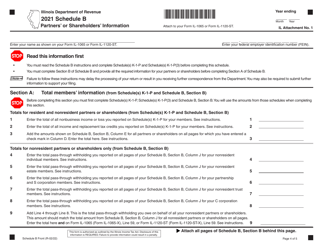

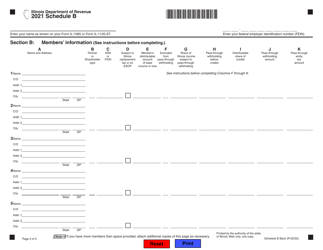

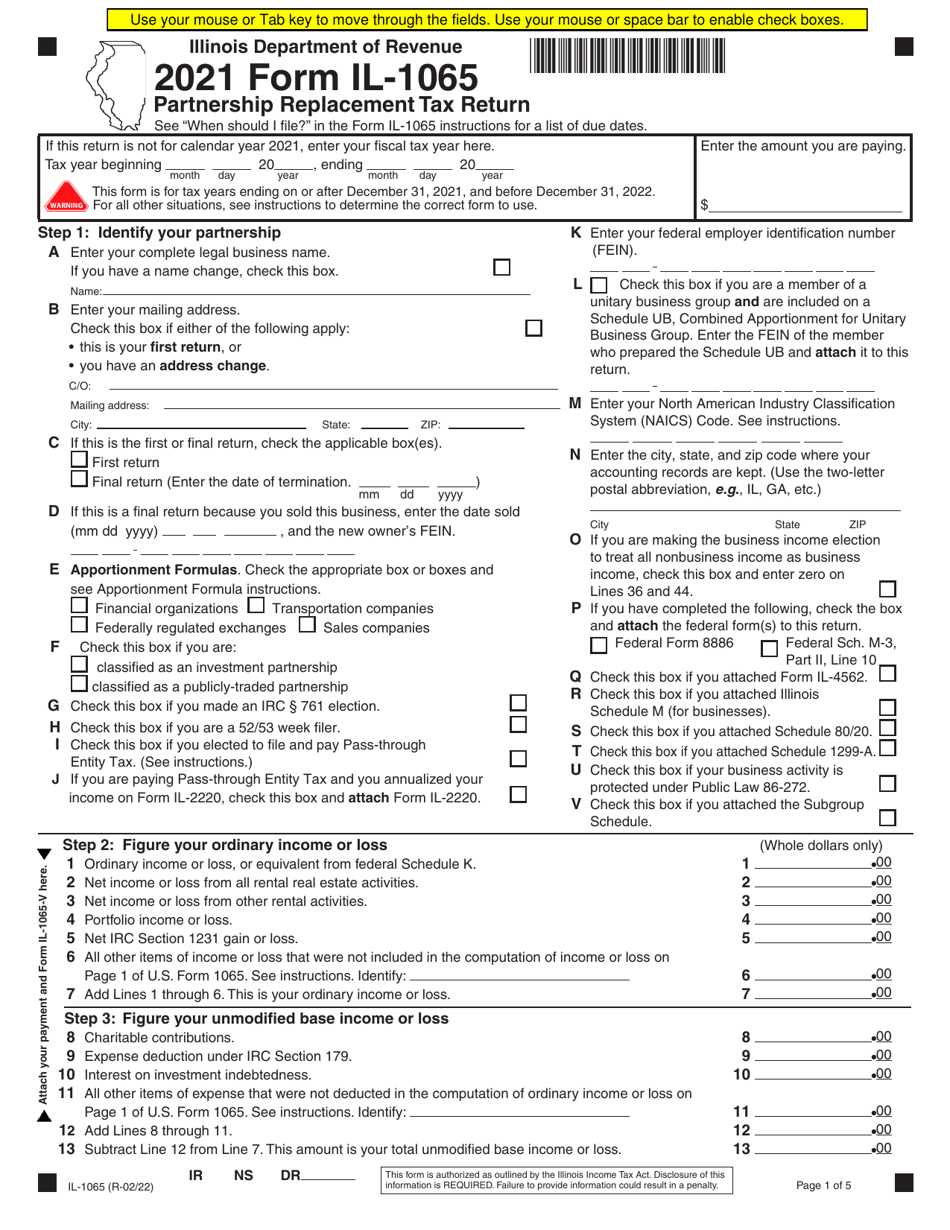

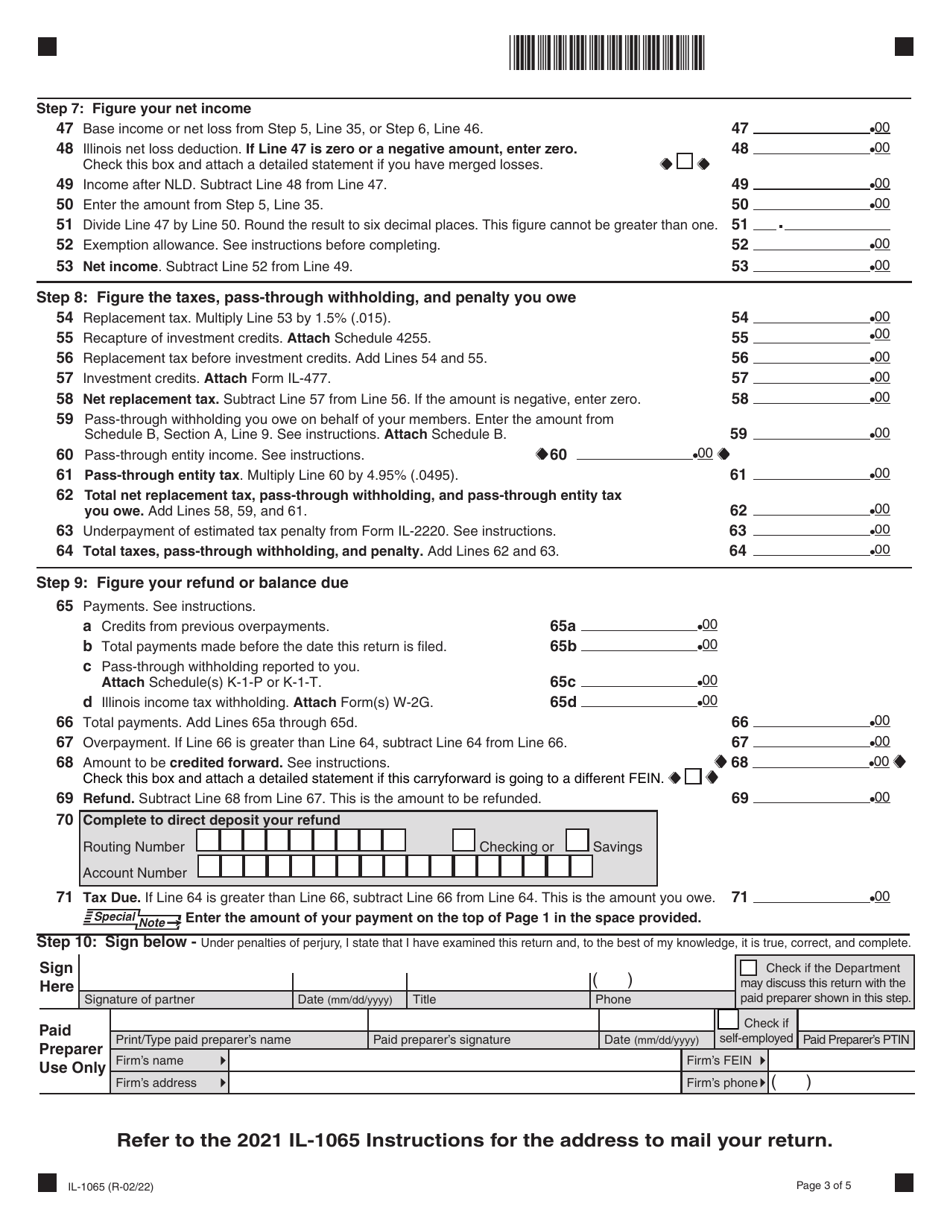

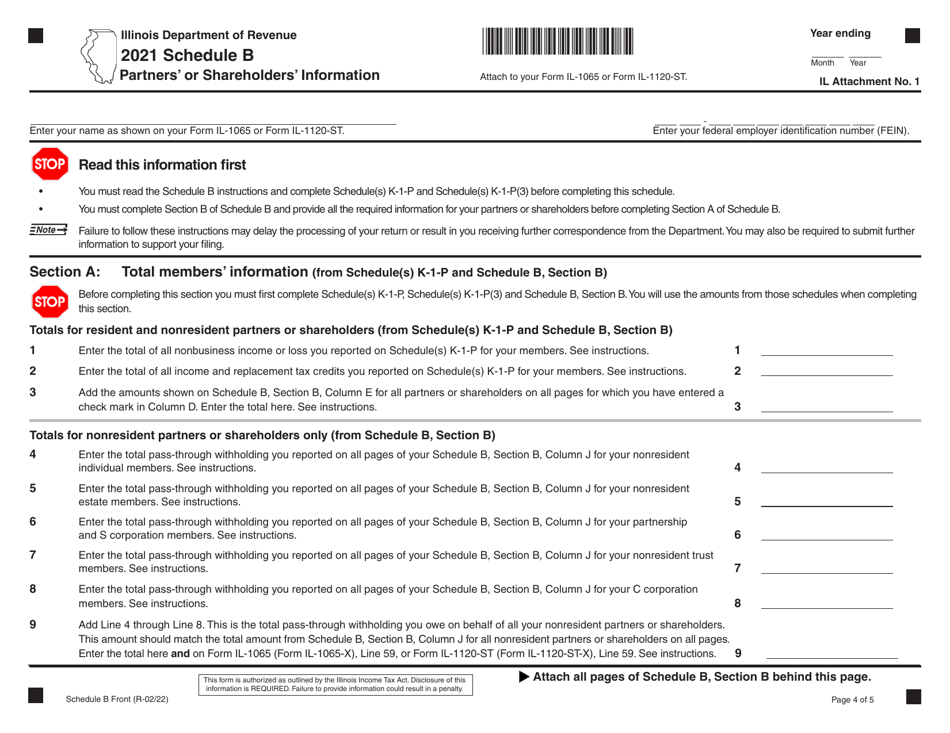

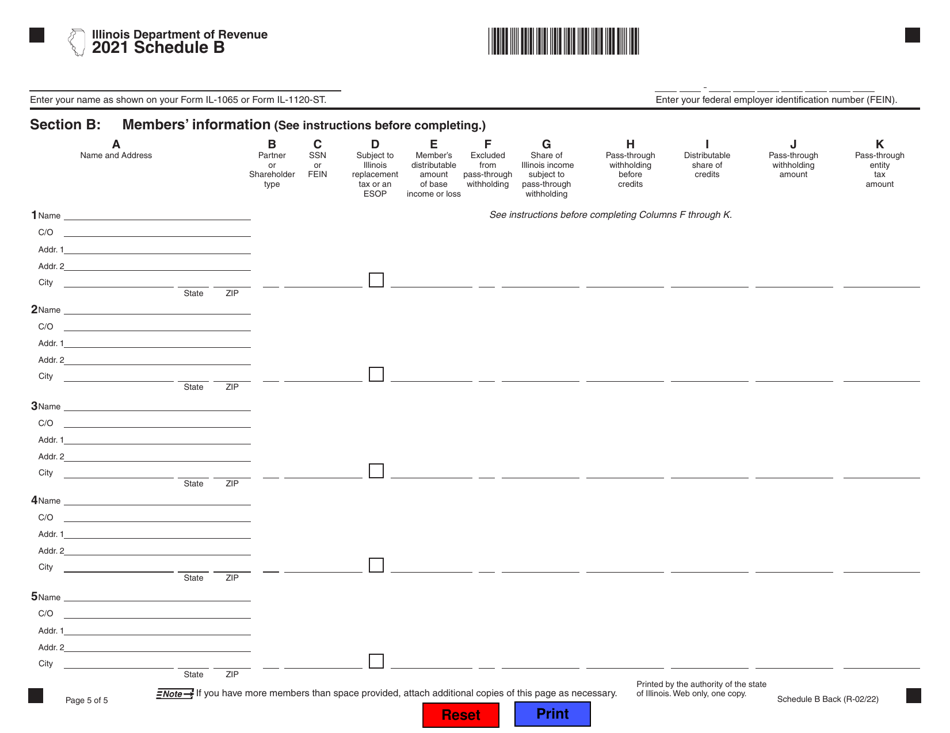

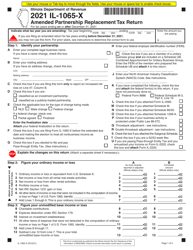

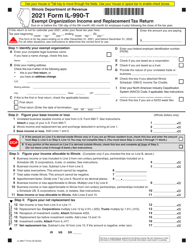

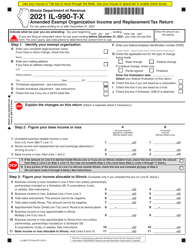

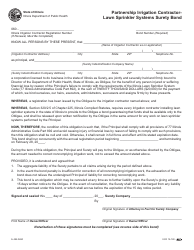

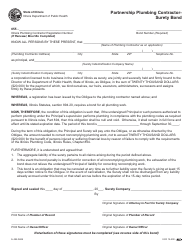

Form IL-1065 Partnership Replacement Tax Return - Illinois

What Is Form IL-1065?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1065?

A: Form IL-1065 is the Partnership Replacement Tax Return for the state of Illinois.

Q: Who needs to file Form IL-1065?

A: Partnerships conducting business in Illinois need to file Form IL-1065.

Q: What is the purpose of Form IL-1065?

A: The purpose of Form IL-1065 is to report partnership income, deductions, and tax liability to the state of Illinois.

Q: When is Form IL-1065 due?

A: Form IL-1065 is due on or before the 15th day of the 3rd month after the end of the partnership's tax year.

Q: Are there any extensions available for filing Form IL-1065?

A: Yes, extensions are available upon request, but the tax payment must still be made by the original due date.

Q: Do I need to attach any additional schedules or documents to Form IL-1065?

A: Yes, you may need to attach certain schedules and documents, such as Schedule K-1 and federal Form 1065, to Form IL-1065.

Q: What are the penalties for late filing of Form IL-1065?

A: Penalties for late filing of Form IL-1065 include a late filing penalty of $100 for each month or part of a month the return is late, up to a maximum of $5,000.

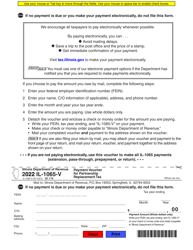

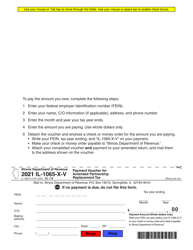

Q: Can Form IL-1065 be filed electronically?

A: Yes, Form IL-1065 can be filed electronically through the Illinois Department of Revenue's e-file system.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1065 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.