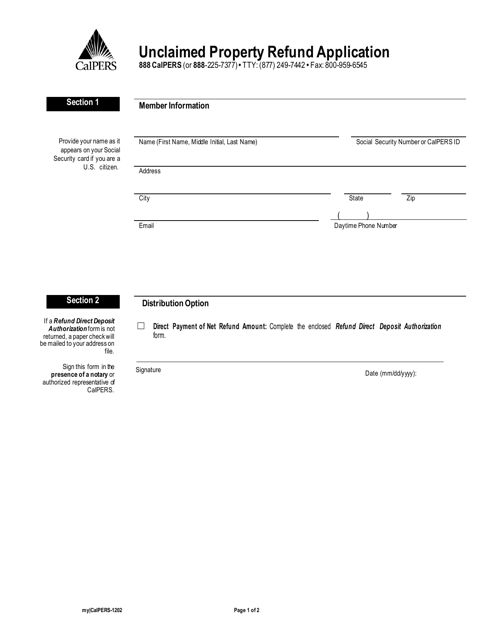

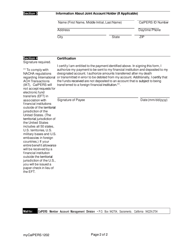

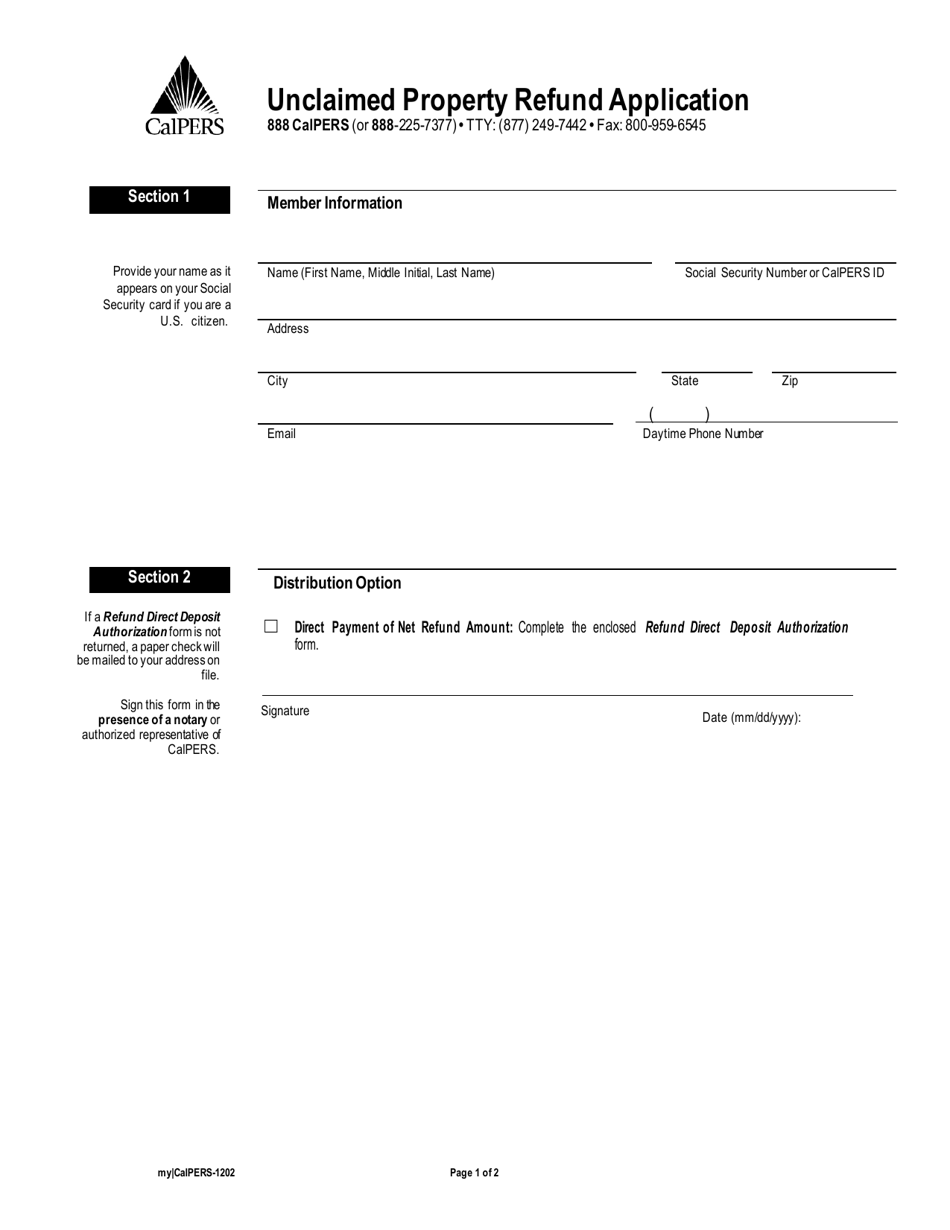

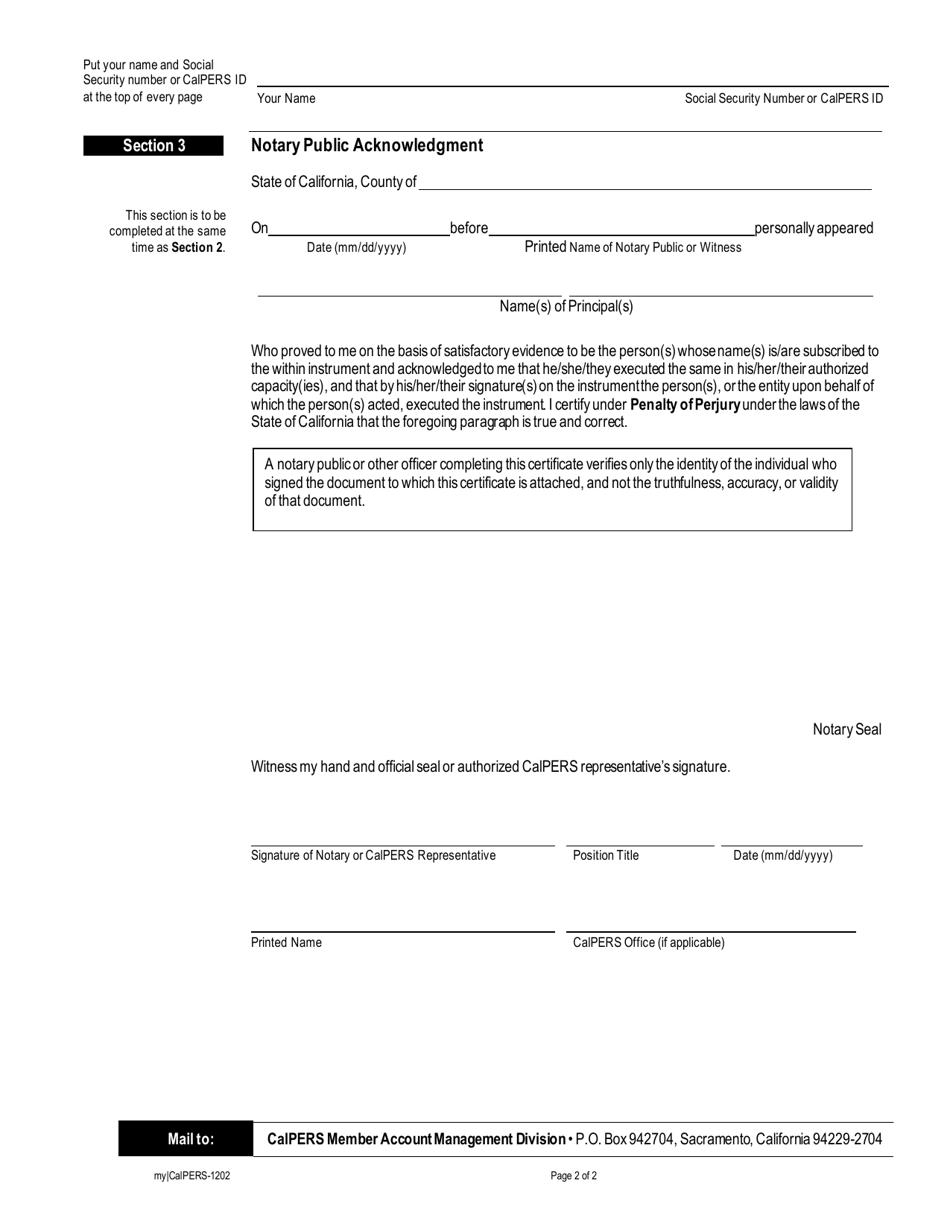

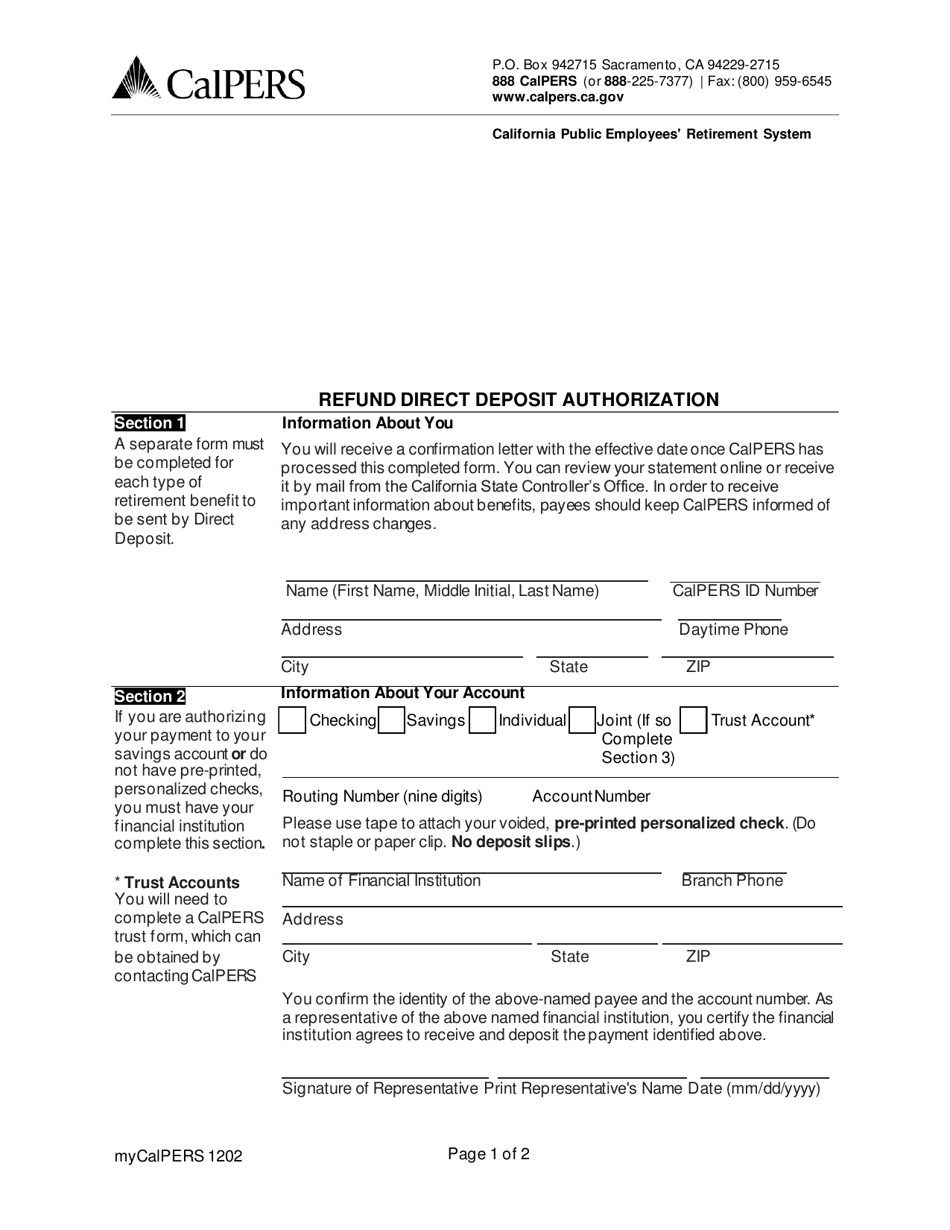

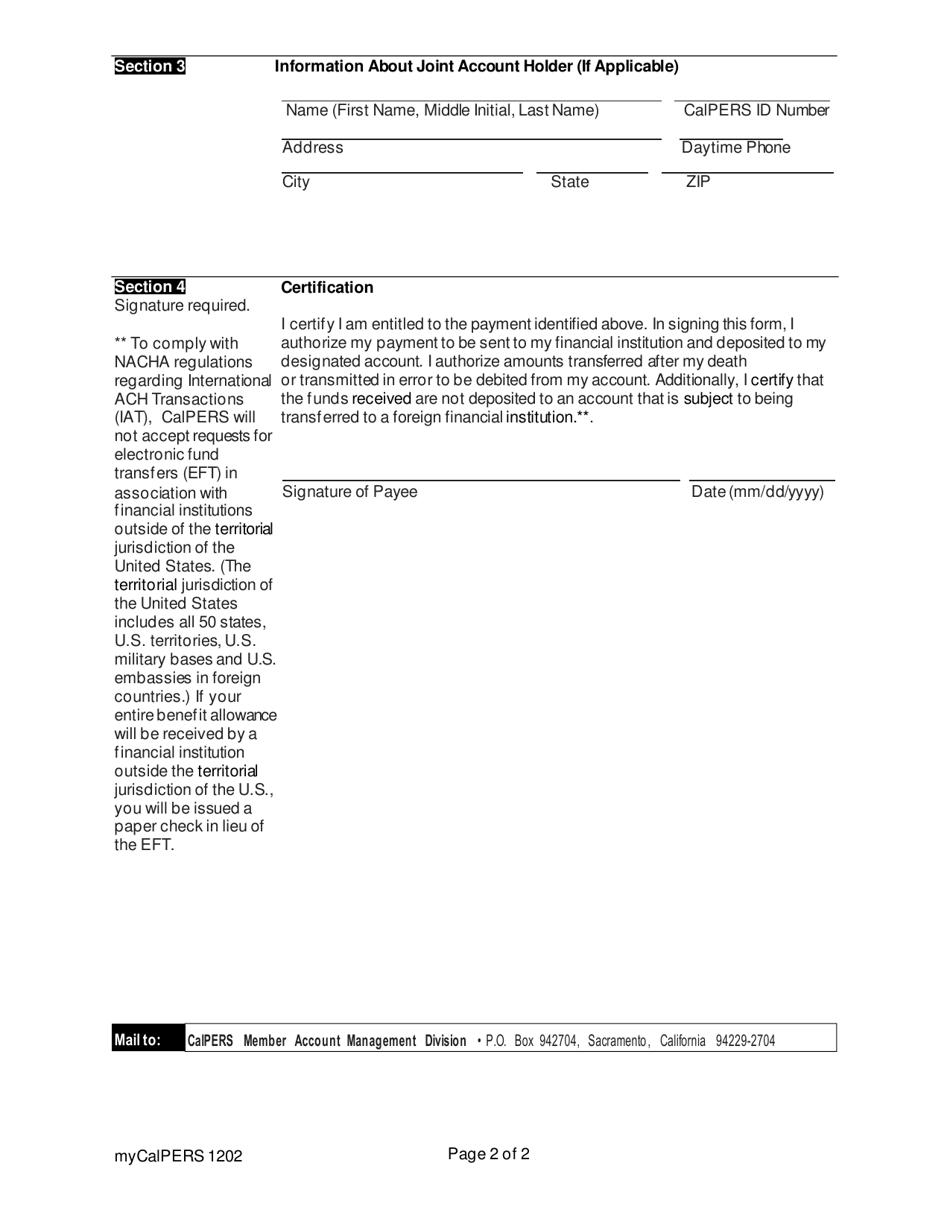

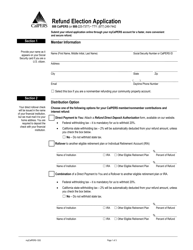

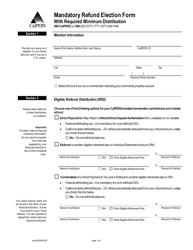

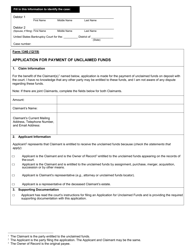

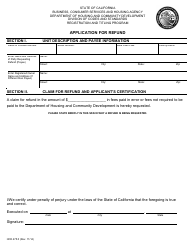

Form my|CalPERS-1202 Unclaimed Property Refund Application - California

What Is Form my|CalPERS-1202?

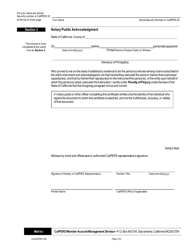

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

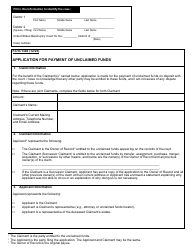

Q: What is the CalPERS-1202 Unclaimed Property Refund Application?

A: The CalPERS-1202 Unclaimed Property Refund Application is a form used to claim a refund of unclaimed property held by the California Public Employees' Retirement System (CalPERS).

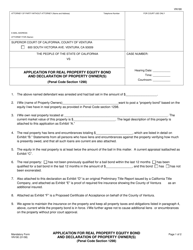

Q: Who can use the CalPERS-1202 Unclaimed Property Refund Application?

A: Current or former members of CalPERS who have unclaimed property held by CalPERS can use the CalPERS-1202 Unclaimed Property Refund Application.

Q: What is unclaimed property?

A: Unclaimed property refers to assets or funds that have been abandoned or forgotten by their rightful owner. It can include things like uncashed checks, insurance benefits, or retirement account balances.

Q: What documents do I need to submit with the CalPERS-1202 Unclaimed Property Refund Application?

A: You will need to submit a completed CalPERS-1202 form, along with any supporting documentation requested by CalPERS, such as proof of identity.

Q: How long does it take to process the CalPERS-1202 Unclaimed Property Refund Application?

A: Processing times can vary, but CalPERS aims to process refund applications within 60 days of receiving all required documentation.

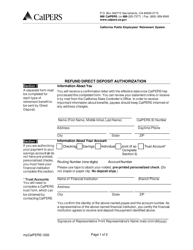

Q: What happens if my CalPERS-1202 Unclaimed Property Refund Application is approved?

A: If your application is approved, CalPERS will issue a refund of the unclaimed property to you.

Q: What happens if my CalPERS-1202 Unclaimed Property Refund Application is denied?

A: If your application is denied, CalPERS will provide you with a written explanation for the denial and instructions on how to appeal the decision.

Form Details:

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form my|CalPERS-1202 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.