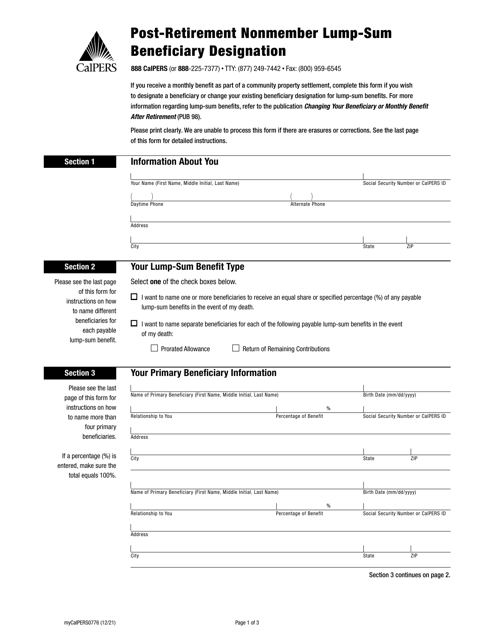

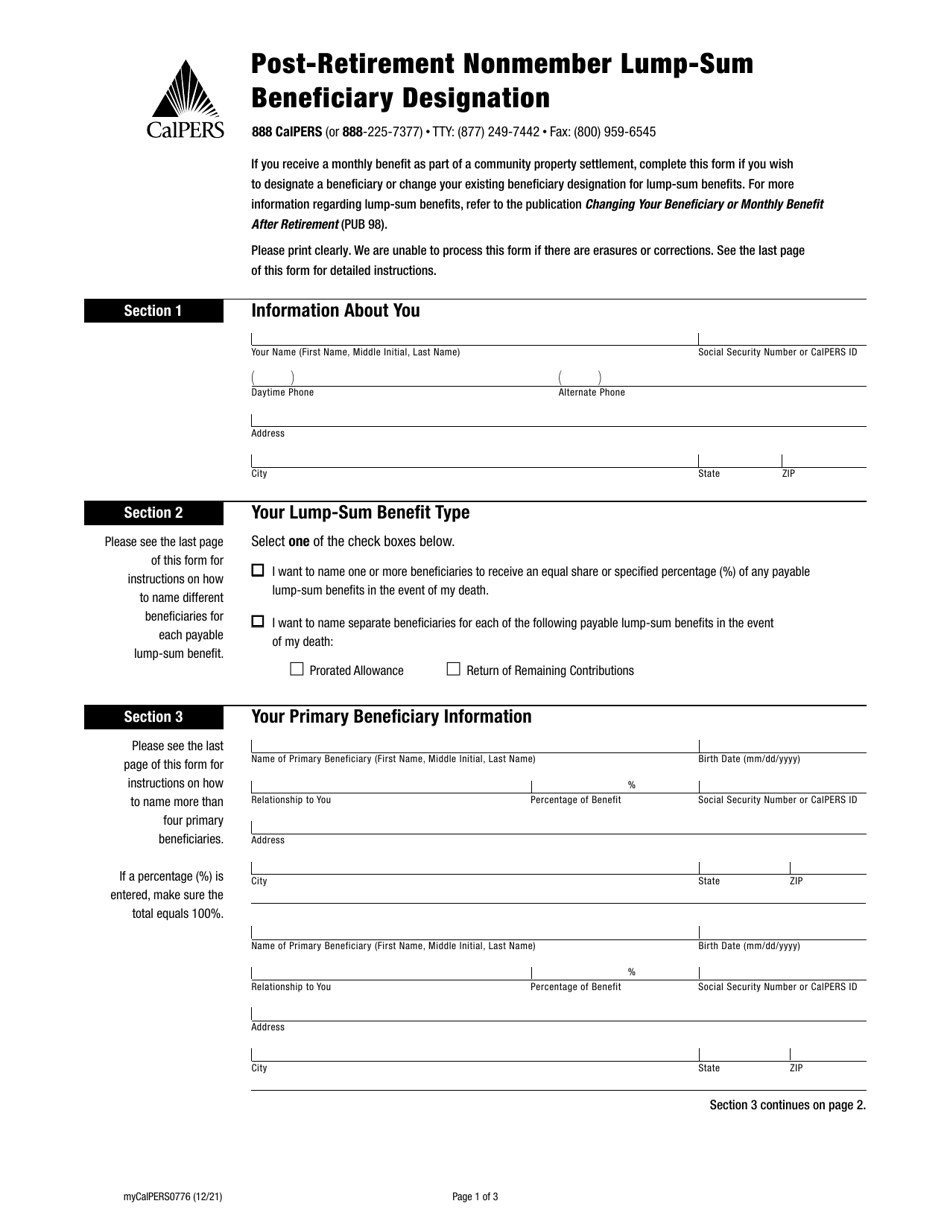

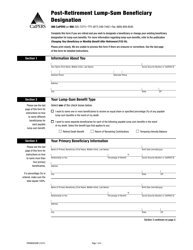

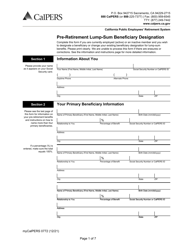

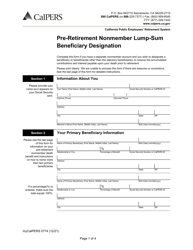

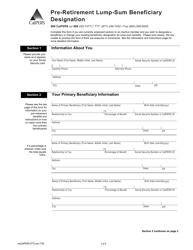

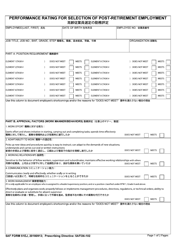

Form myCalPERS0776 Post-retirement Nonmember Lump-Sum Beneficiary Designation - California

What Is Form myCalPERS0776?

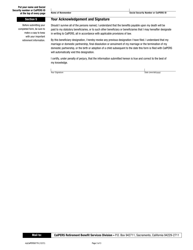

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the myCalPERS0776 form?

A: The myCalPERS0776 form is a document used to designate a beneficiary to receive a lump-sum payment in the event of a post-retirement member's death.

Q: Who can use the myCalPERS0776 form?

A: The form is specifically for post-retirement nonmembers who are eligible for a lump-sum payment from CalPERS.

Q: How do I fill out the myCalPERS0776 form?

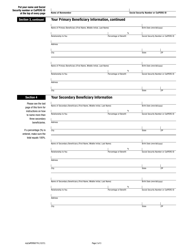

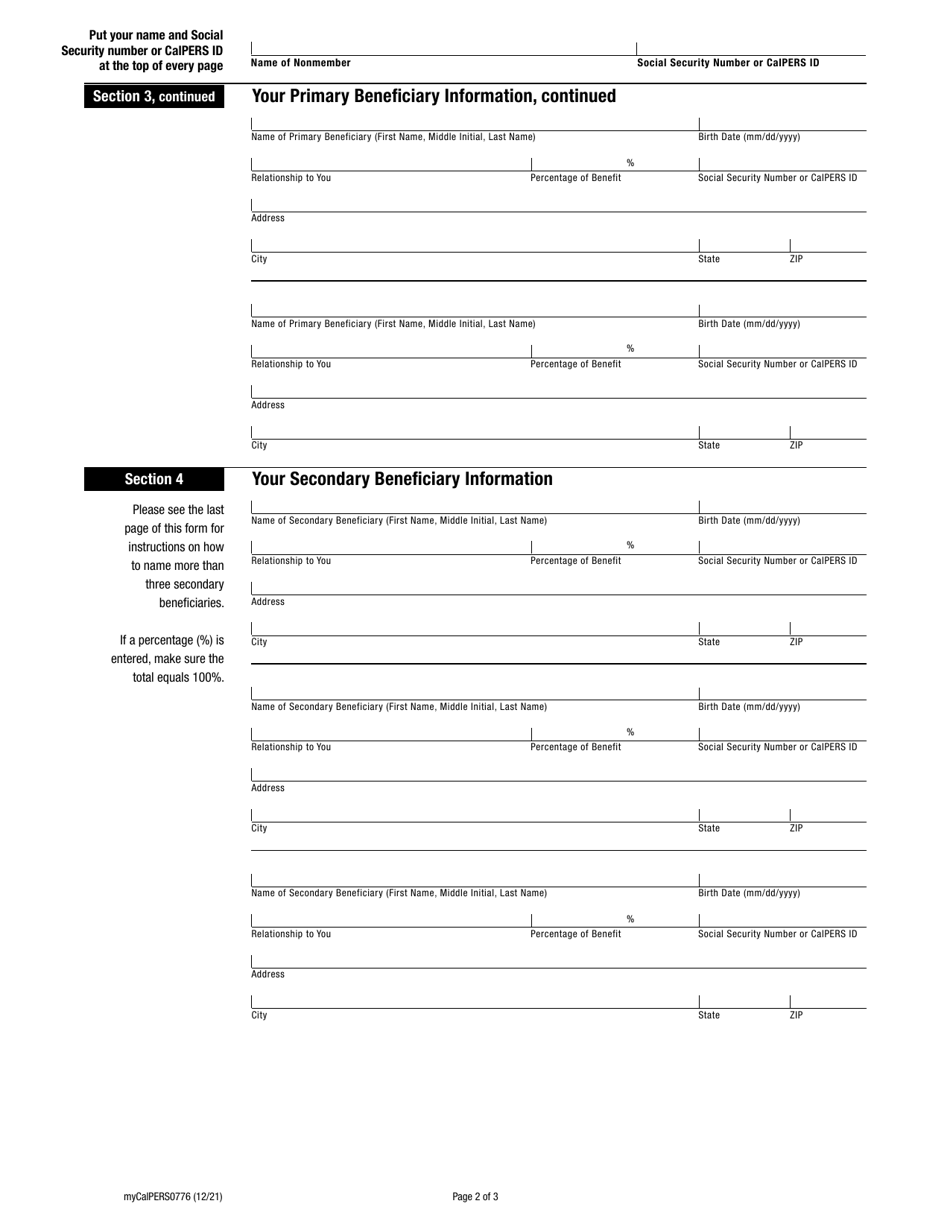

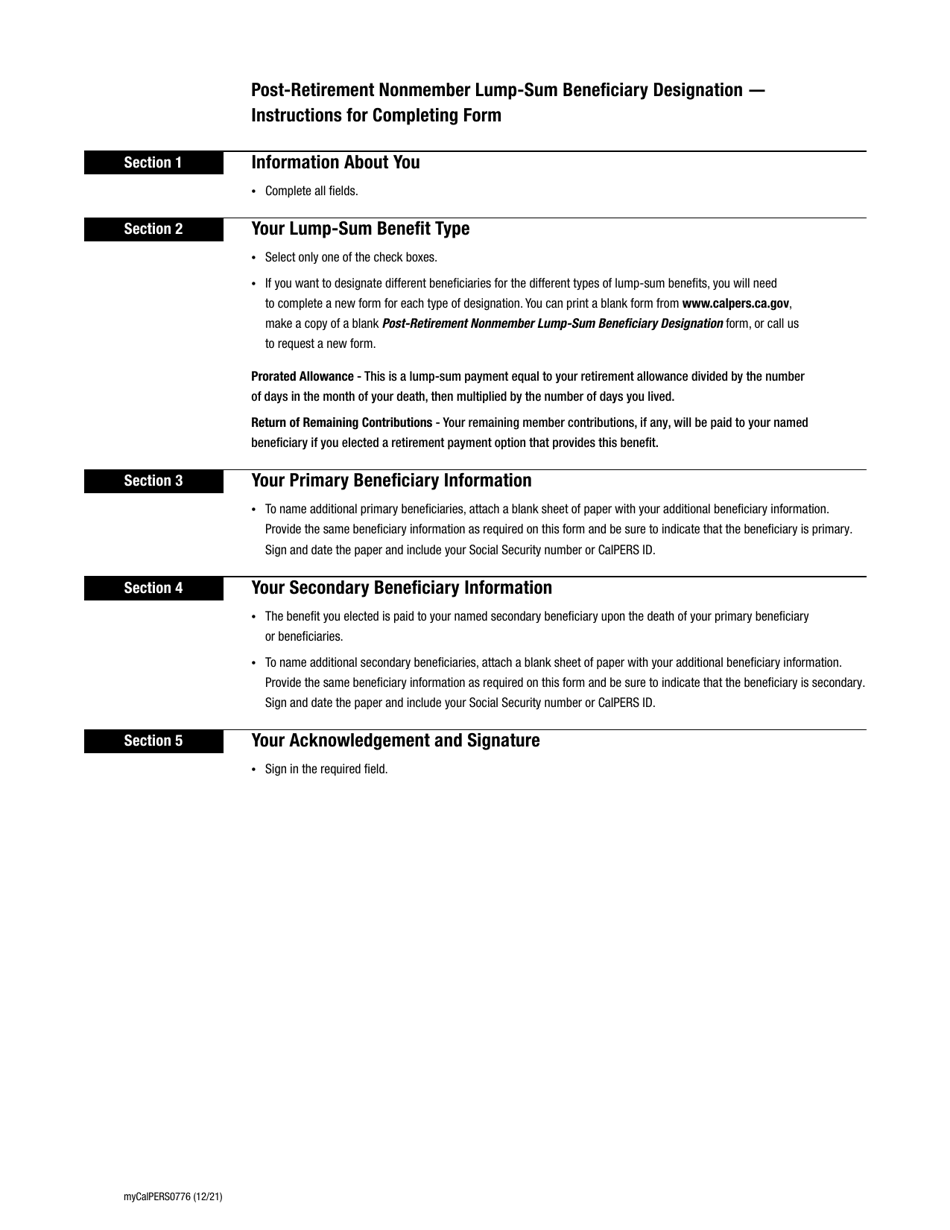

A: You will need to provide your personal information, such as your name, address, and contact details, as well as the name and relationship of your chosen beneficiary.

Q: Is the myCalPERS0776 form only for residents of California?

A: Yes, the form is specifically for residents of California who are eligible for CalPERS benefits.

Q: Can I change my beneficiary designation after submitting the myCalPERS0776 form?

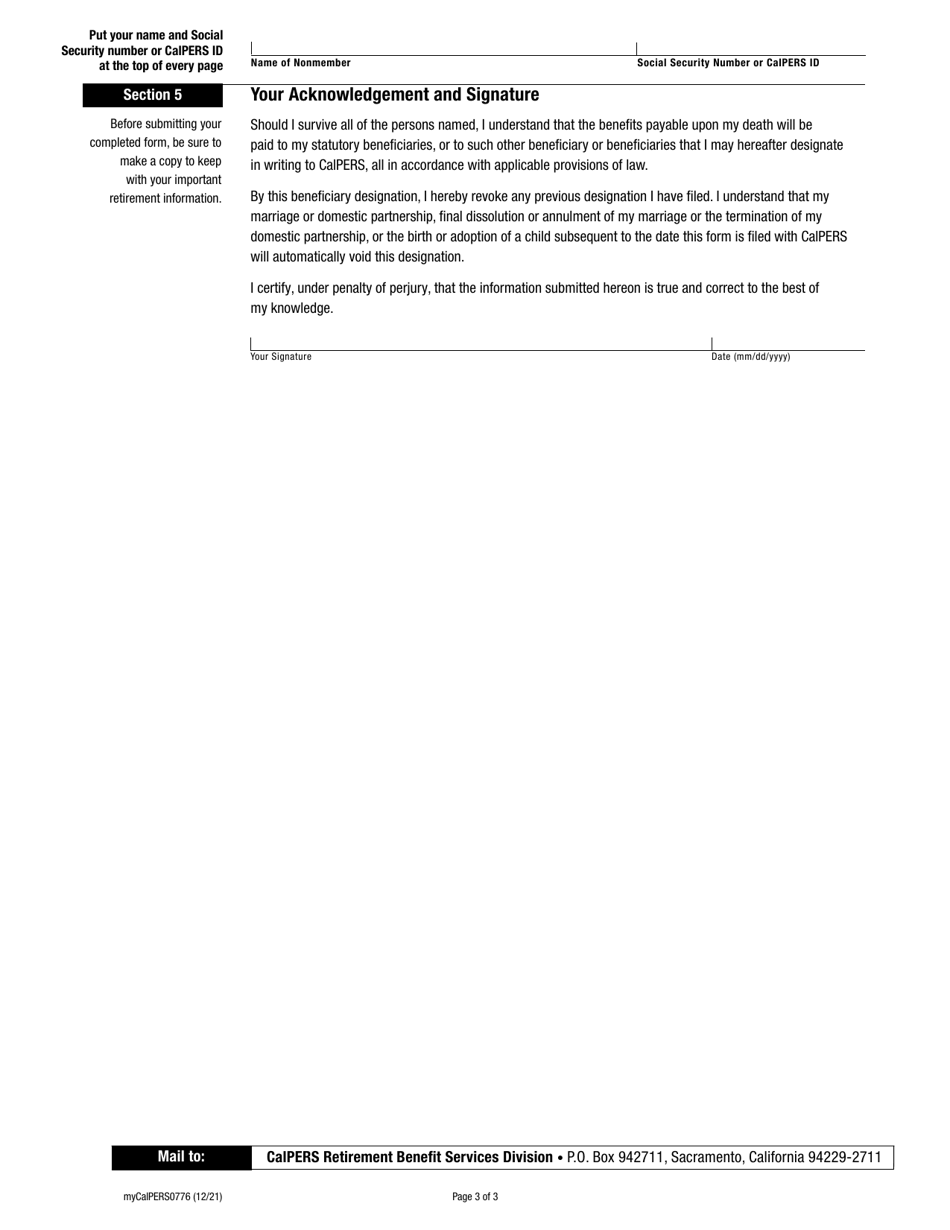

A: Yes, you can update your beneficiary designation at any time by submitting a new form to CalPERS.

Q: Are there any fees associated with submitting the myCalPERS0776 form?

A: There are no fees associated with submitting the form.

Q: How long does it take for the beneficiary designation to take effect?

A: The beneficiary designation takes effect as soon as CalPERS processes the form.

Q: What happens if I don't designate a beneficiary using the myCalPERS0776 form?

A: If you don't designate a beneficiary, your lump-sum payment will be made to your estate or according to the laws of intestate succession.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form myCalPERS0776 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.