This version of the form is not currently in use and is provided for reference only. Download this version of

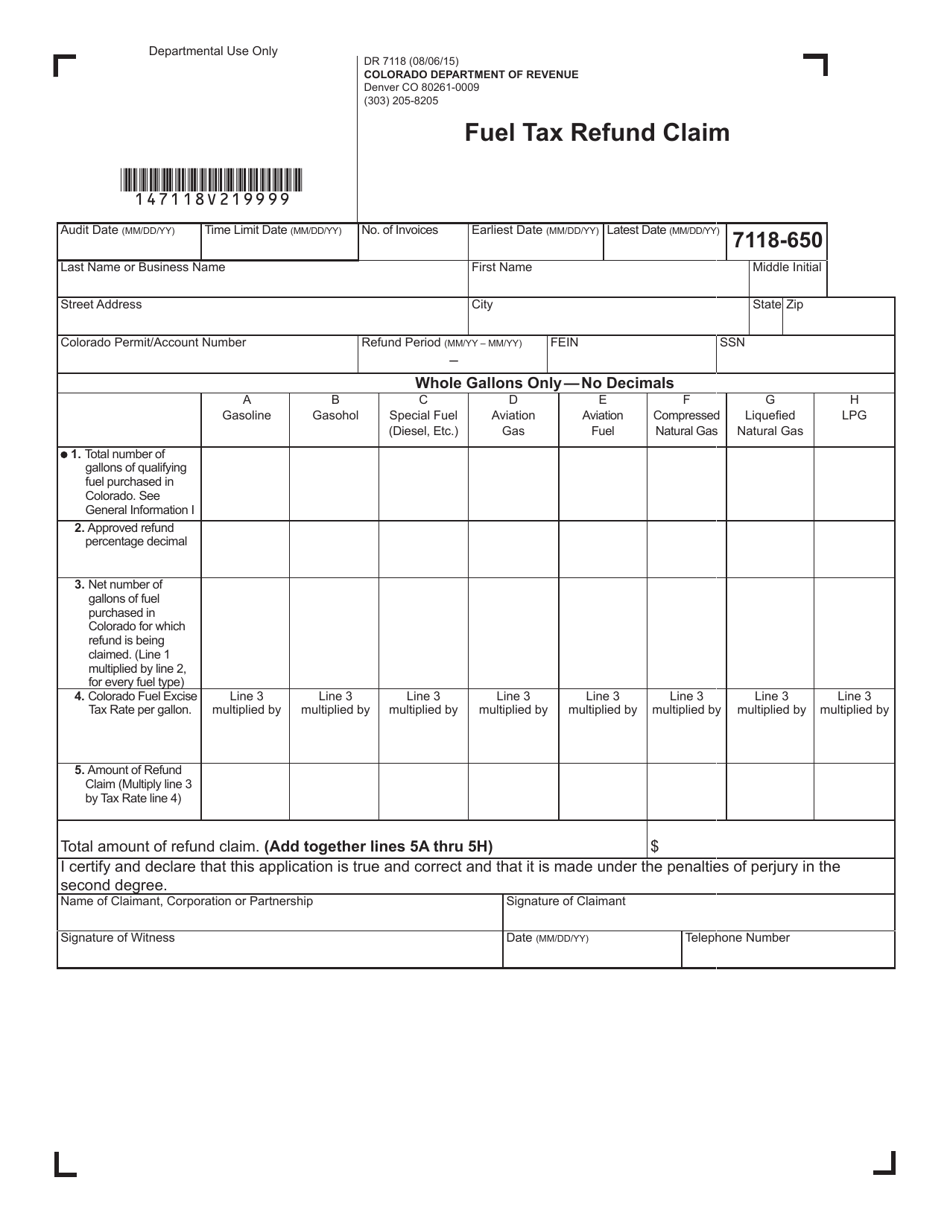

Form DR7118

for the current year.

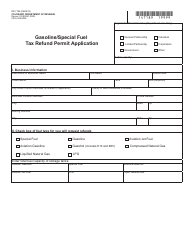

Form DR7118 Fuel Tax Refund Claim - Colorado

What Is Form DR7118?

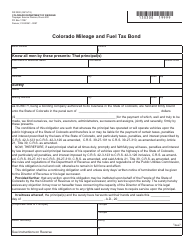

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR7118?

A: Form DR7118 is the Fuel Tax Refund Claim form used in Colorado.

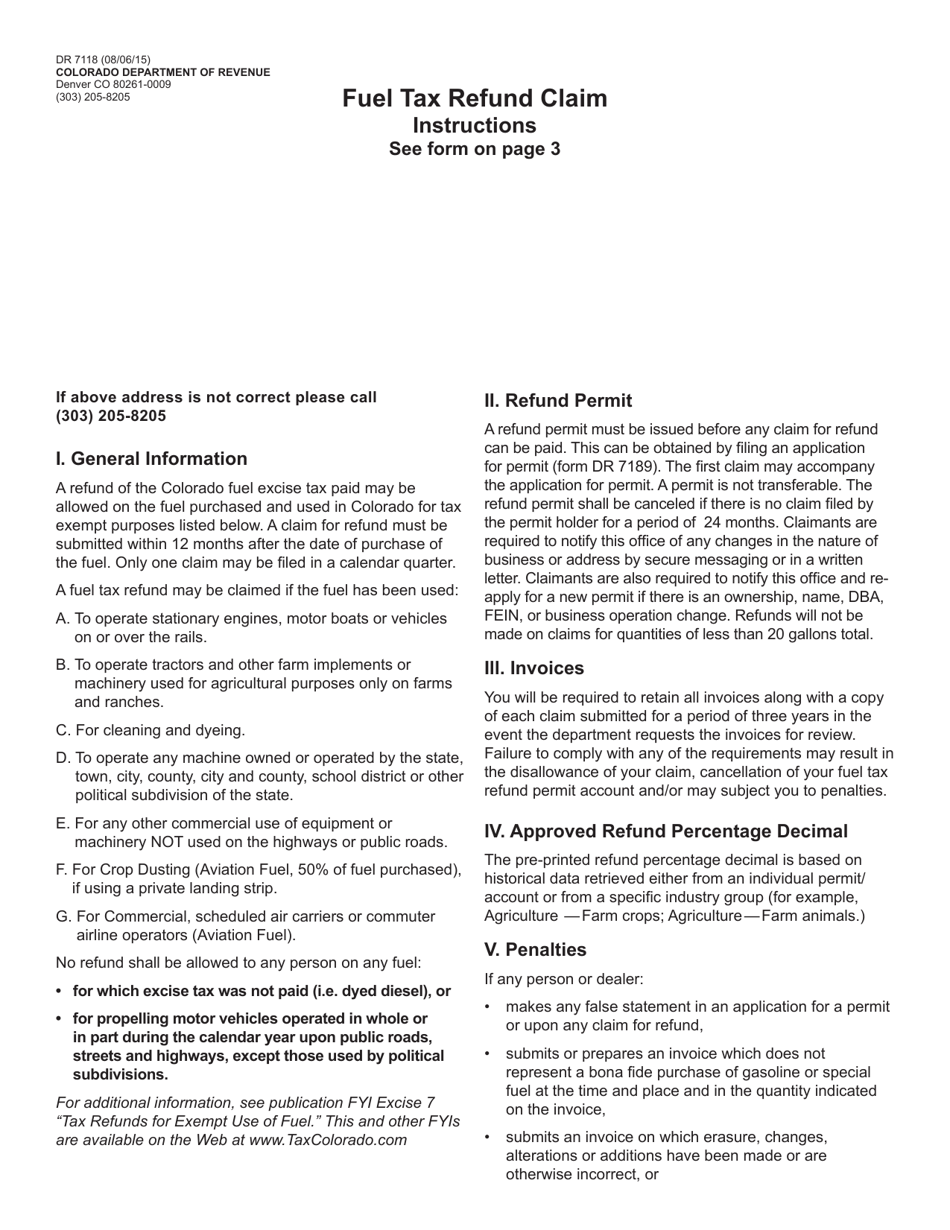

Q: What is a fuel tax refund claim?

A: A fuel tax refund claim is a request to receive a refund of taxes paid on fuel purchases.

Q: Who can file a fuel tax refund claim in Colorado?

A: Any individual or entity that paid fuel taxes in Colorado and meets the eligibility criteria can file a fuel tax refund claim.

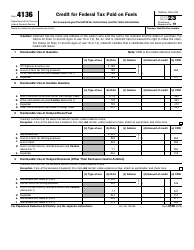

Q: What types of fuel are eligible for a refund in Colorado?

A: Most types of fuel used in motor vehicles and equipment, including gasoline and diesel, are generally eligible for a refund.

Q: What are the eligibility criteria for filing a fuel tax refund claim in Colorado?

A: The eligibility criteria for filing a fuel tax refund claim in Colorado may include having paid fuel taxes, retaining original receipts, and meeting specific requirements set by the Colorado Department of Revenue.

Q: When should I file Form DR7118?

A: Form DR7118 should be filed within the specified time frame as outlined by the Colorado Department of Revenue.

Q: What documentation do I need to submit with Form DR7118?

A: You will typically need to submit original receipts or other supporting documentation with Form DR7118 to substantiate your refund claim.

Q: How long does it take to receive a refund after filing Form DR7118?

A: The processing time for a fuel tax refund claim can vary, but you should generally expect to receive your refund within a few weeks to a few months.

Q: Are there any fees associated with filing a fuel tax refund claim in Colorado?

A: There may be certain fees associated with filing a fuel tax refund claim, as outlined by the Colorado Department of Revenue. It is recommended to review the instructions and guidelines provided with Form DR7118.

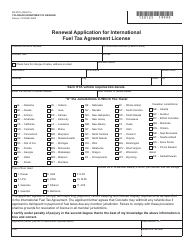

Q: Can I file a fuel tax refund claim for other states?

A: Yes, you can file fuel tax refund claims for other states if you meet the eligibility criteria and follow the specific requirements of each state.

Form Details:

- Released on August 6, 2015;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR7118 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.