This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR0617

for the current year.

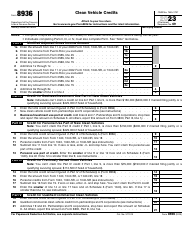

Form DR0617 Innovative Motor Vehicle and Truck Credits - Colorado

What Is Form DR0617?

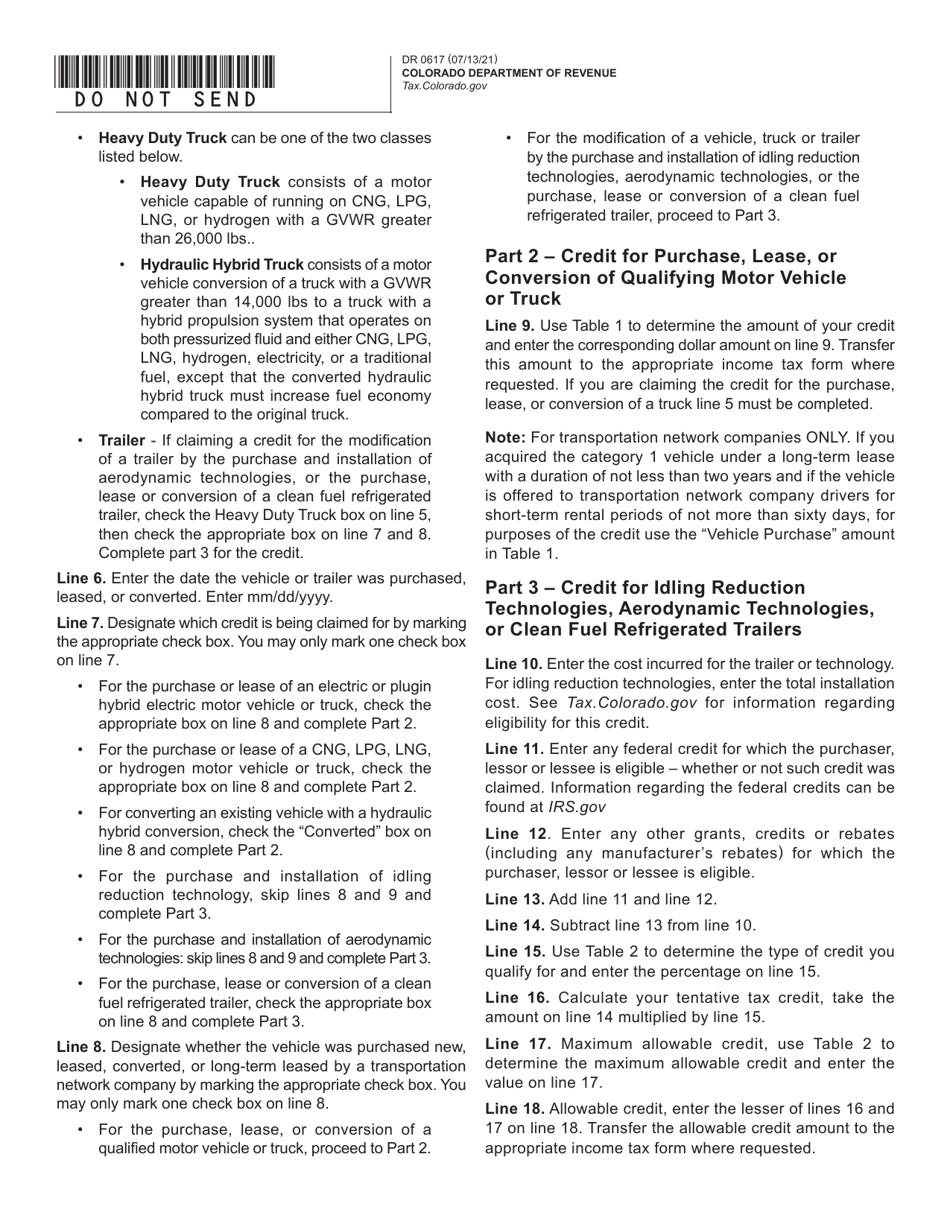

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0617?

A: Form DR0617 is the official form used in Colorado to claim innovative motor vehicle and truck credits.

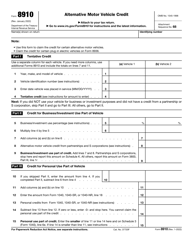

Q: What are innovative motor vehicle and truck credits?

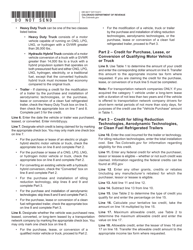

A: Innovative motor vehicle and truck credits are tax credits that are available to individuals and businesses in Colorado for purchasing or leasing qualified electric, plug-in hybrid, and alternative fuel vehicles.

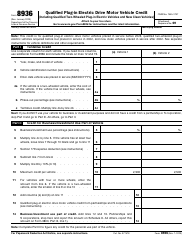

Q: Who can claim innovative motor vehicle and truck credits?

A: Both individuals and businesses in Colorado can claim these credits, as long as they meet the eligibility criteria.

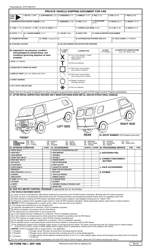

Q: What vehicles qualify for these credits?

A: Qualified vehicles include electric vehicles, plug-in hybrid electric vehicles, and vehicles that run on compressed natural gas, liquefied natural gas, liquefied petroleum gas, hydrogen, or any combination of these fuels.

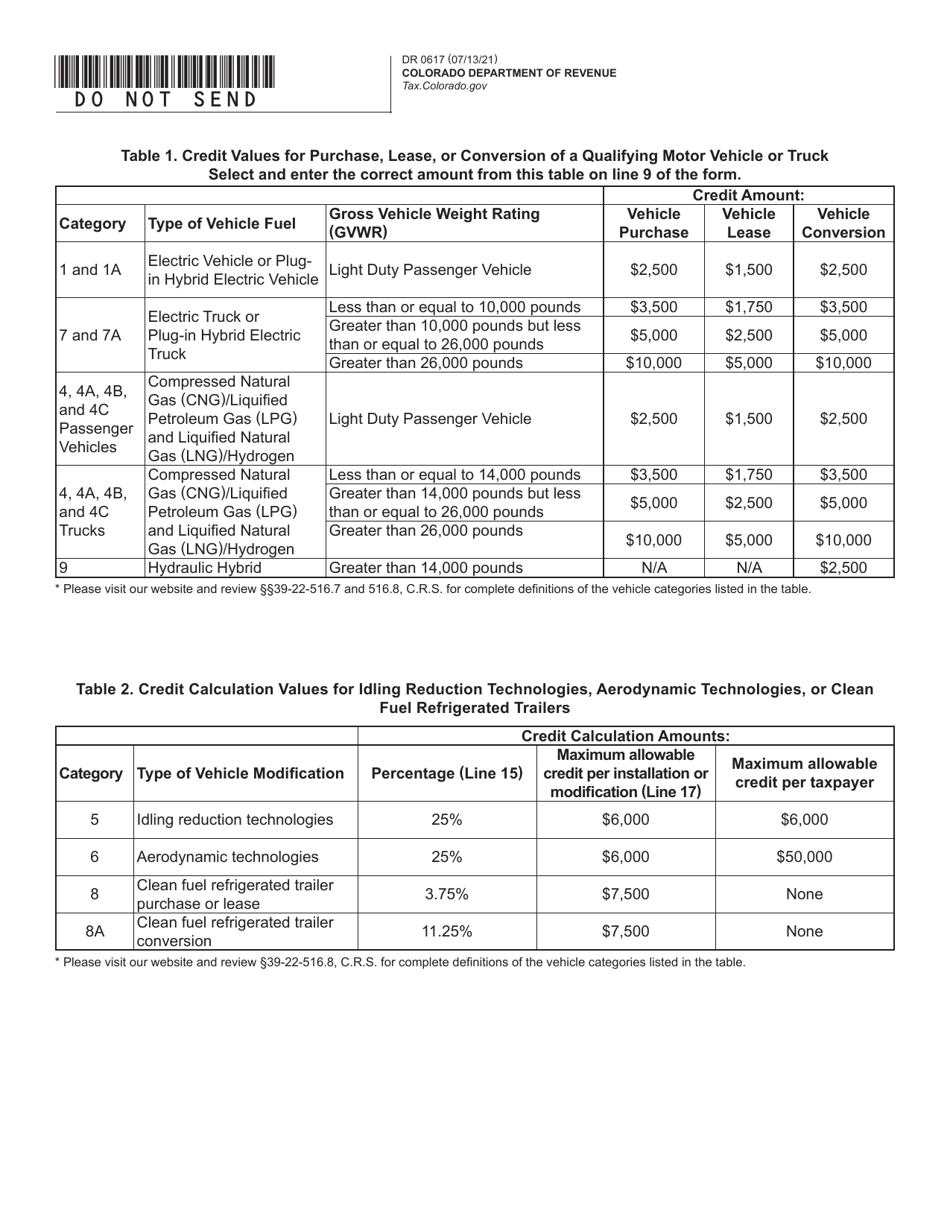

Q: How much is the credit amount?

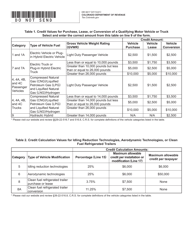

A: The credit amount varies depending on the type of vehicle and its battery capacity. It can range from $2,500 to $6,000 for passenger vehicles and from $10,000 to $20,000 for trucks.

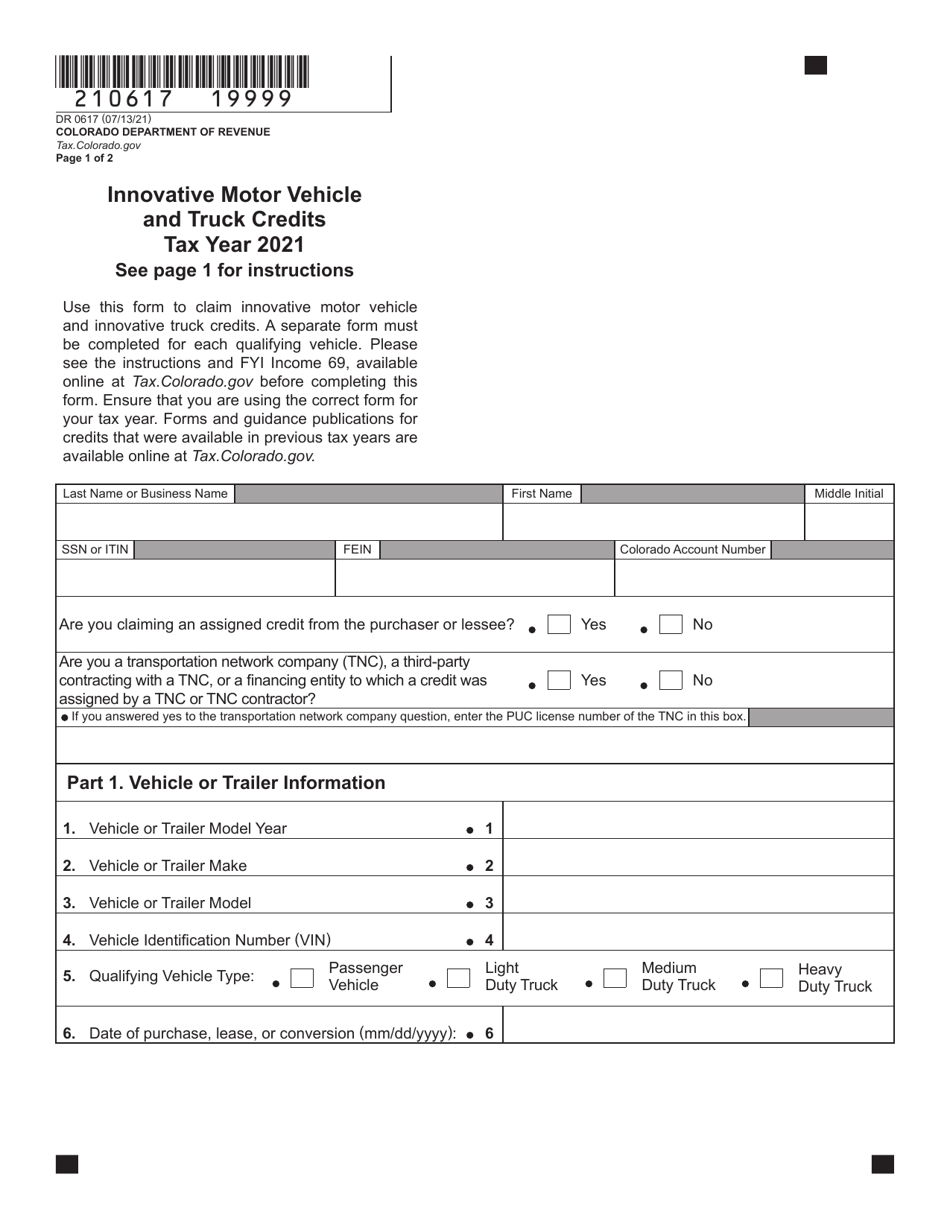

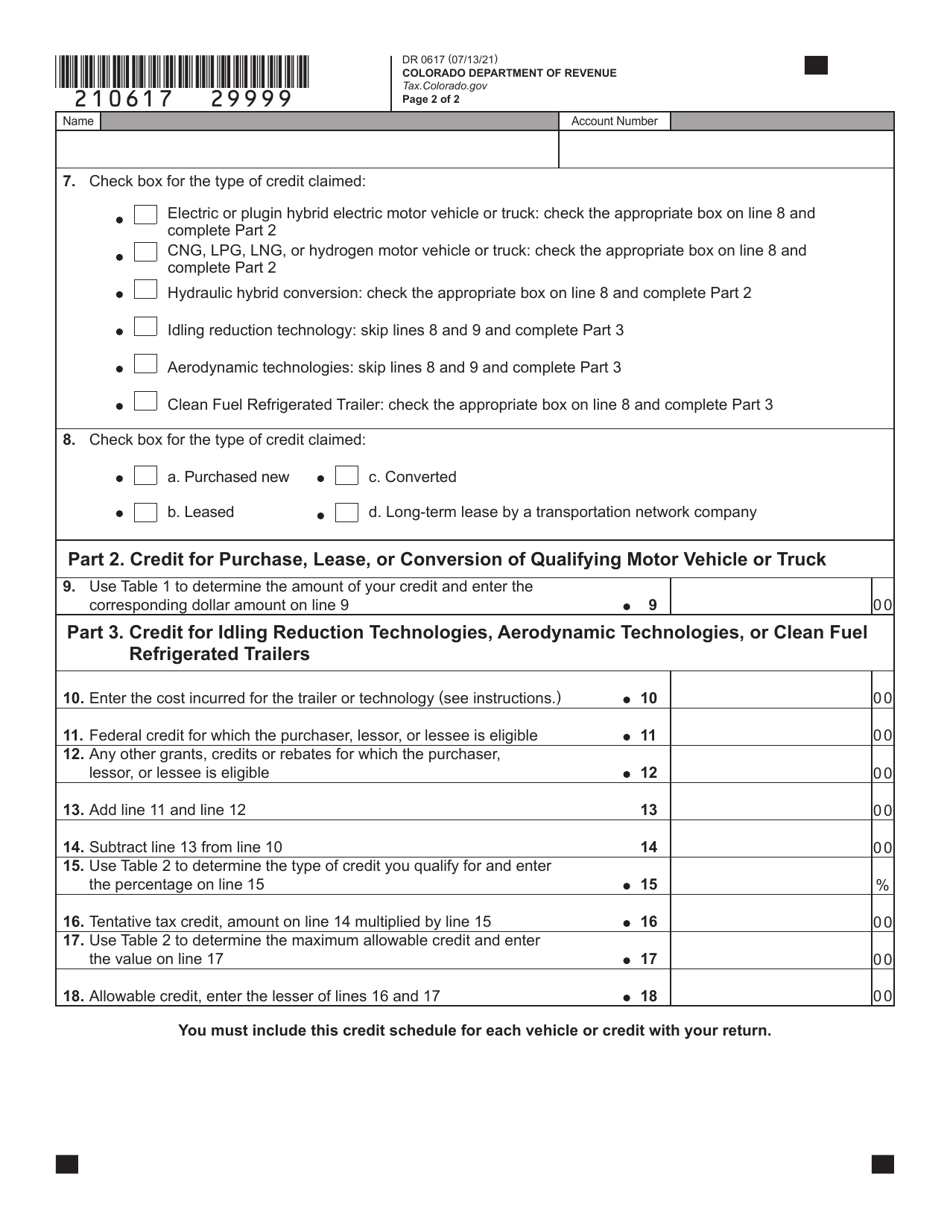

Q: How do I claim these credits?

A: To claim the credits, you must complete and file Form DR0617 with the Colorado Department of Revenue along with any required documentation.

Q: Is there a deadline for claiming these credits?

A: Yes, the credits must be claimed within 6 months from the date of purchase or lease of the qualified vehicle.

Q: Are there any limitations or restrictions on these credits?

A: Yes, there are certain limitations and restrictions, such as a maximum credit amount per vehicle and a maximum credit amount per taxpayer.

Form Details:

- Released on July 13, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0617 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.