This version of the form is not currently in use and is provided for reference only. Download this version of

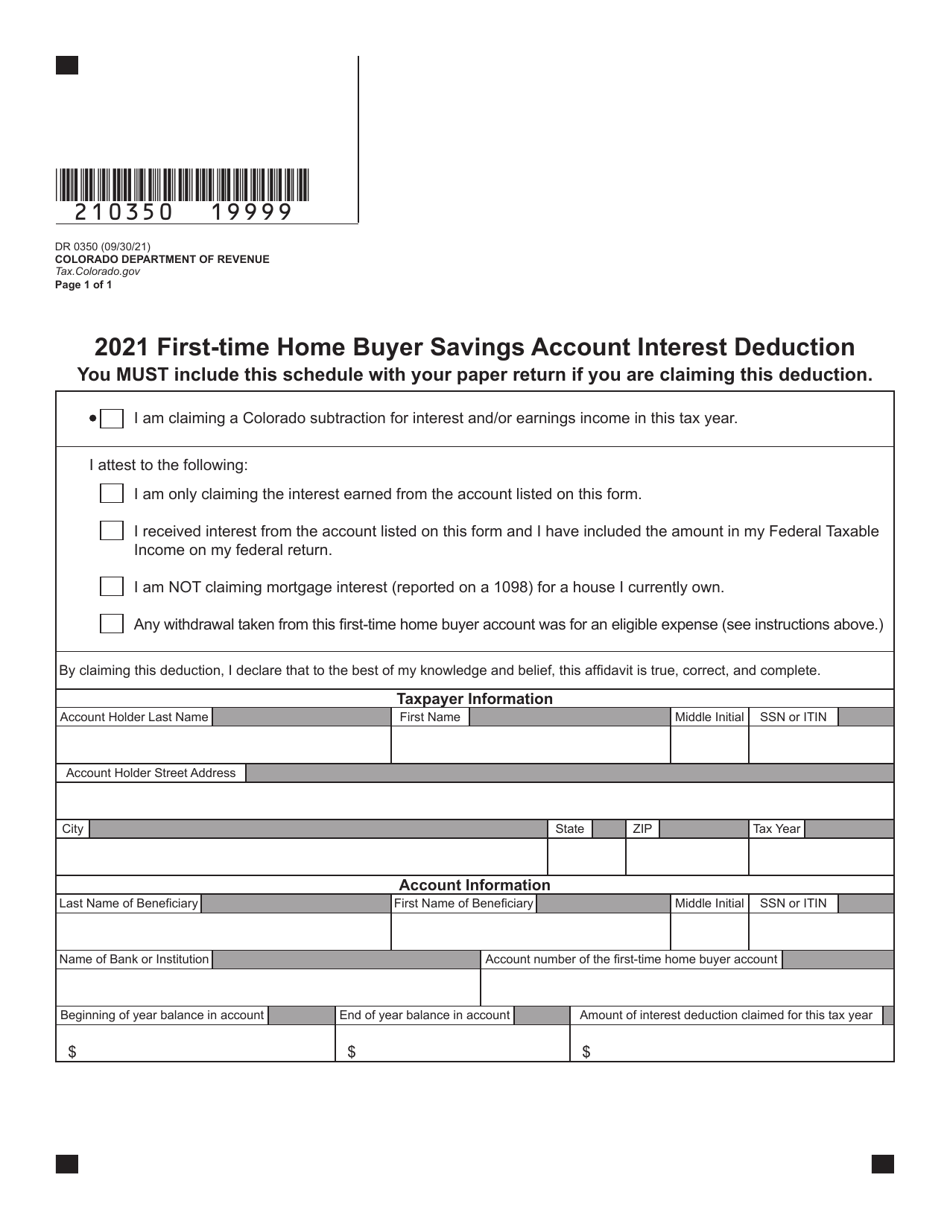

Form DR0350

for the current year.

Form DR0350 First-Time Home Buyer Savings Account Interest Deduction - Colorado

What Is Form DR0350?

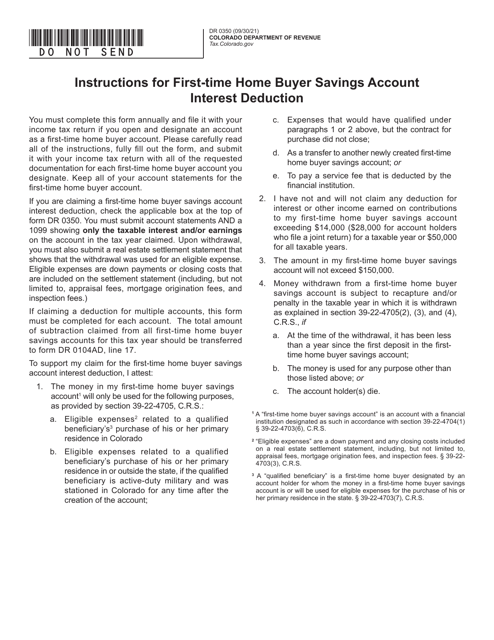

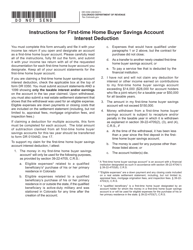

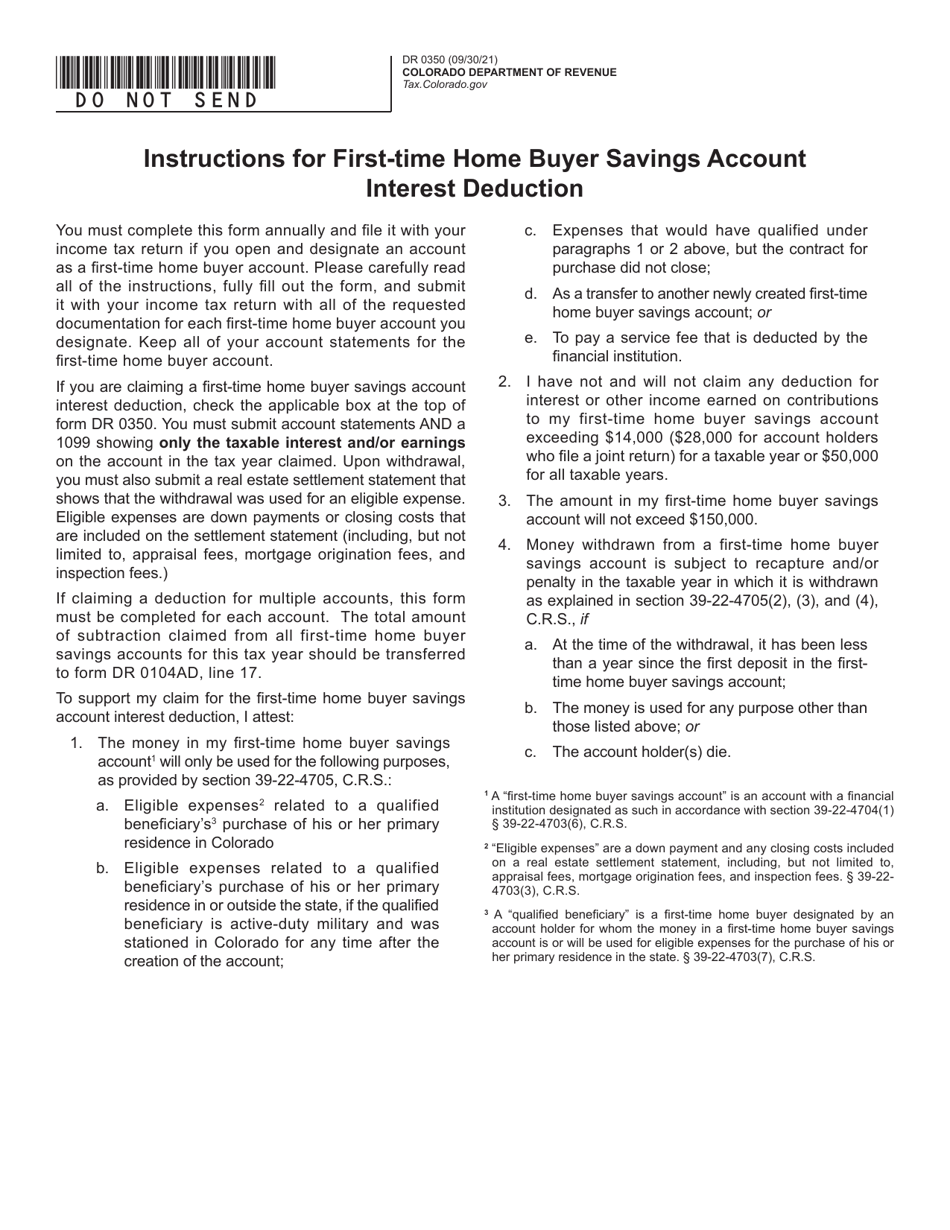

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0350?

A: Form DR0350 is a form used in Colorado to claim the First-Time Home Buyer Savings Account Interest Deduction.

Q: What is the First-Time Home Buyer Savings Account Interest Deduction?

A: The First-Time Home Buyer Savings Account Interest Deduction is a deduction allowed in Colorado for the interest earned on savings accounts designated for first-time home buyers.

Q: Who can claim the First-Time Home Buyer Savings Account Interest Deduction?

A: Colorado residents who have a First-Time Home Buyer Savings Account and meet certain eligibility criteria can claim this deduction.

Q: What is the purpose of the First-Time Home Buyer Savings Account?

A: The purpose of the First-Time Home Buyer Savings Account is to help individuals save money for the purchase of their first home.

Q: How do I claim the First-Time Home Buyer Savings Account Interest Deduction?

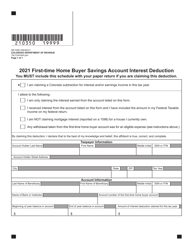

A: To claim the deduction, you need to fill out Form DR0350 and include it with your Colorado state tax return.

Q: Are there any limitations or restrictions on the deduction?

A: Yes, there are limitations and restrictions on the deduction, such as maximum contribution amounts and income limits. These details can be found in the instructions for Form DR0350.

Form Details:

- Released on September 30, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0350 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.