This version of the form is not currently in use and is provided for reference only. Download this version of

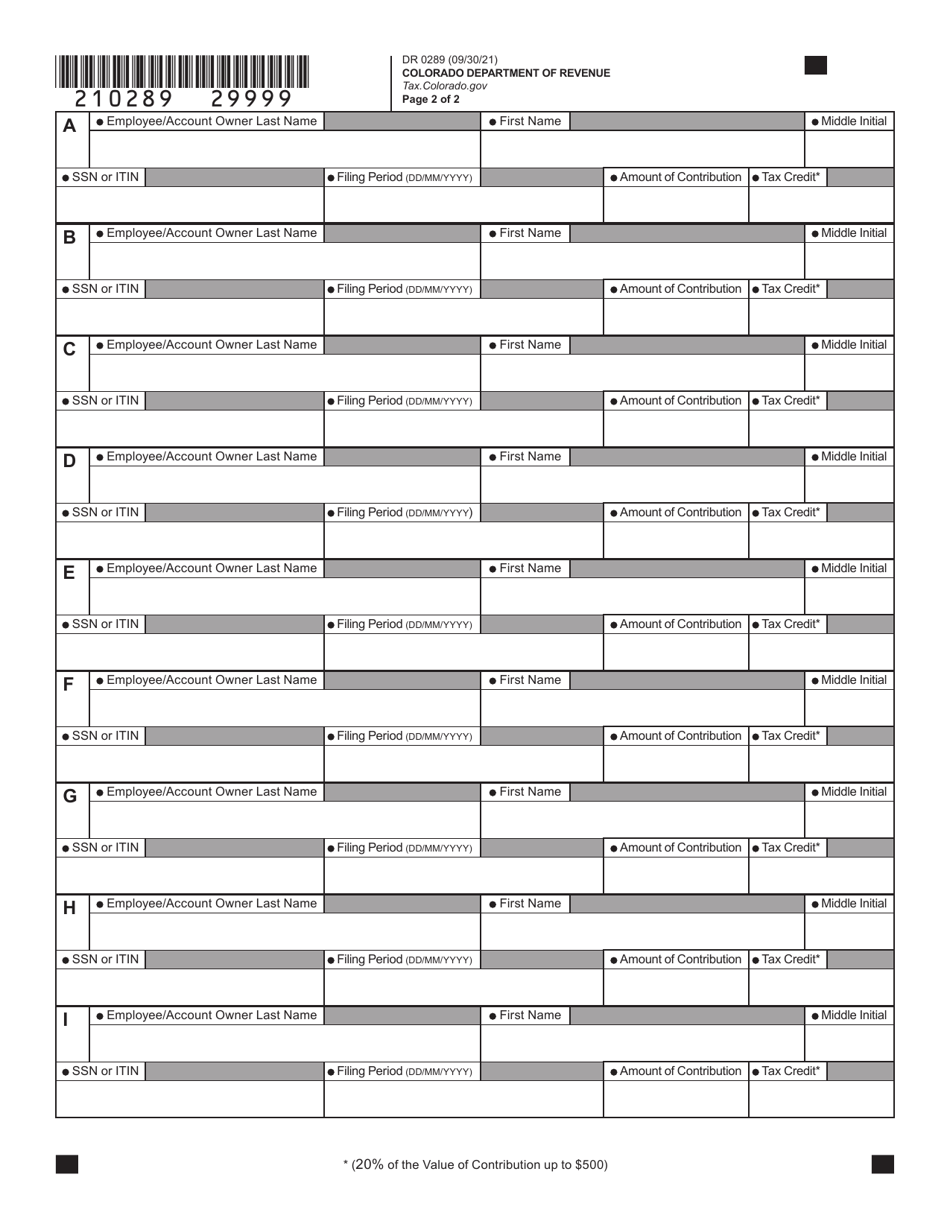

Form DR0289

for the current year.

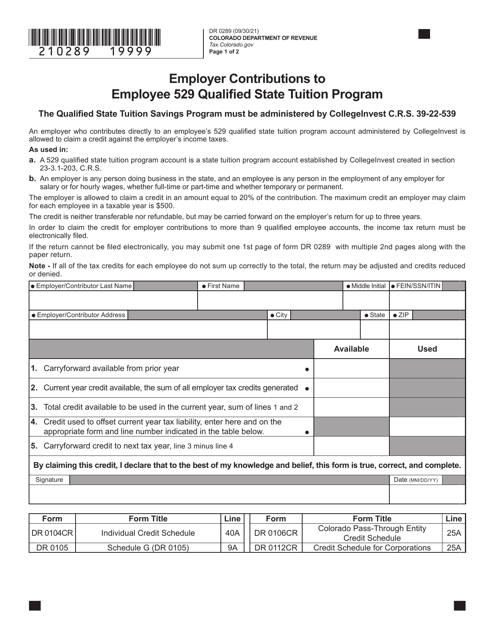

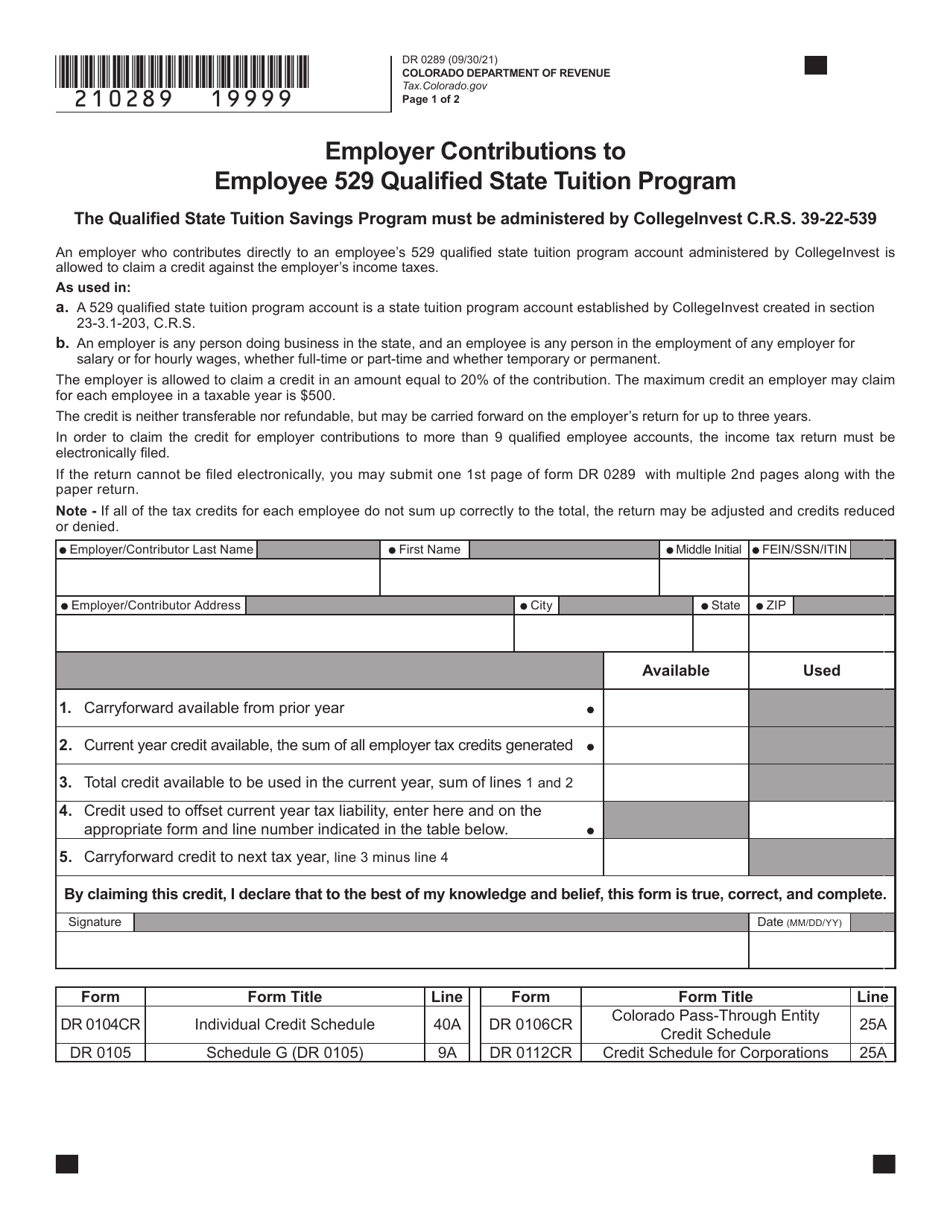

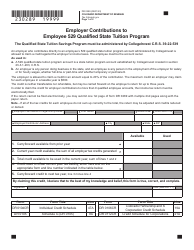

Form DR0289 Employer Contributions to Employee 529 Qualified State Tuition Program - Colorado

What Is Form DR0289?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0289?

A: Form DR0289 is a form used to report employer contributions to an employee's 529 Qualified State Tuition Program in Colorado.

Q: What is a 529 Qualified State Tuition Program?

A: A 529 Qualified State Tuition Program is a tax-advantaged savings plan designed to help individuals and families save for future education expenses.

Q: Who should use Form DR0289?

A: Employers who have made contributions to their employees' 529 Qualified State Tuition Program in Colorado should use Form DR0289 to report these contributions.

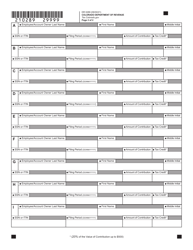

Q: What information is required on Form DR0289?

A: Form DR0289 requires the employer to provide information about the employee, including their name, Social Security number, and the amount of contributions made.

Q: When is Form DR0289 due?

A: Form DR0289 is generally due by January 31st of the year following the calendar year in which the contributions were made.

Q: Is there a penalty for not filing Form DR0289?

A: Yes, there may be penalties for not filing Form DR0289 or filing it late. It is important to comply with the deadlines set by the Colorado Department of Revenue.

Form Details:

- Released on September 30, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0289 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.