This version of the form is not currently in use and is provided for reference only. Download this version of

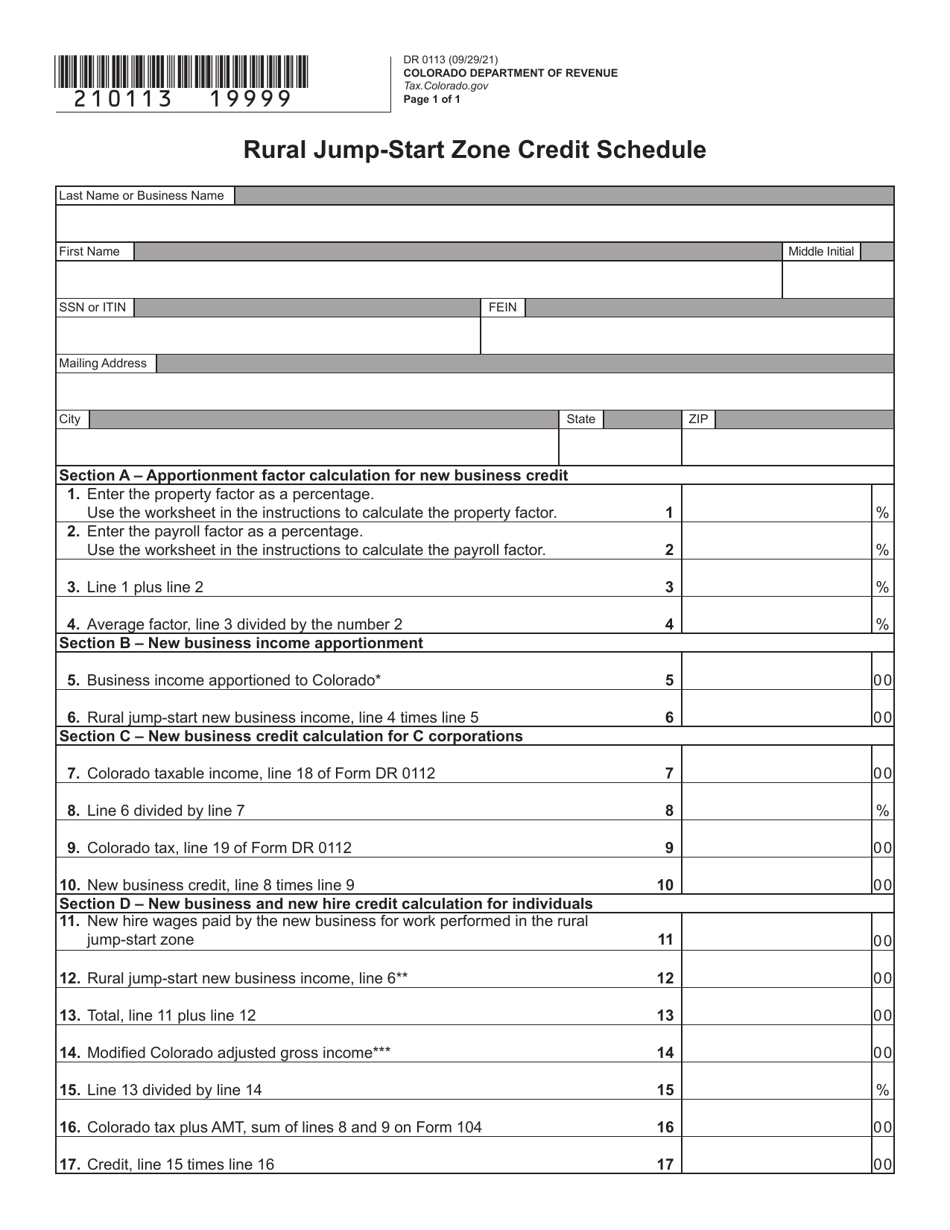

Form DR0113

for the current year.

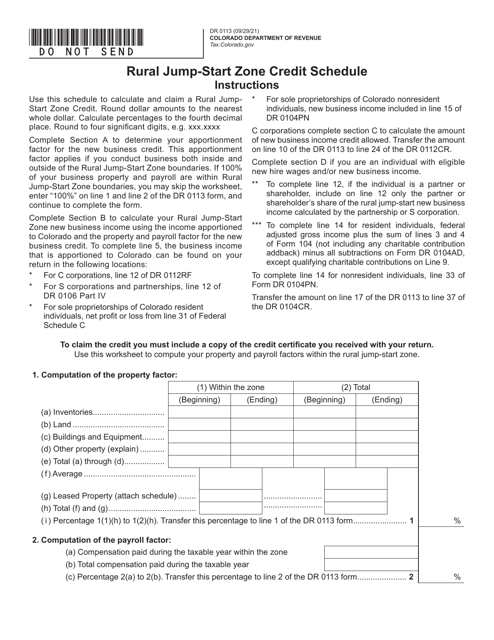

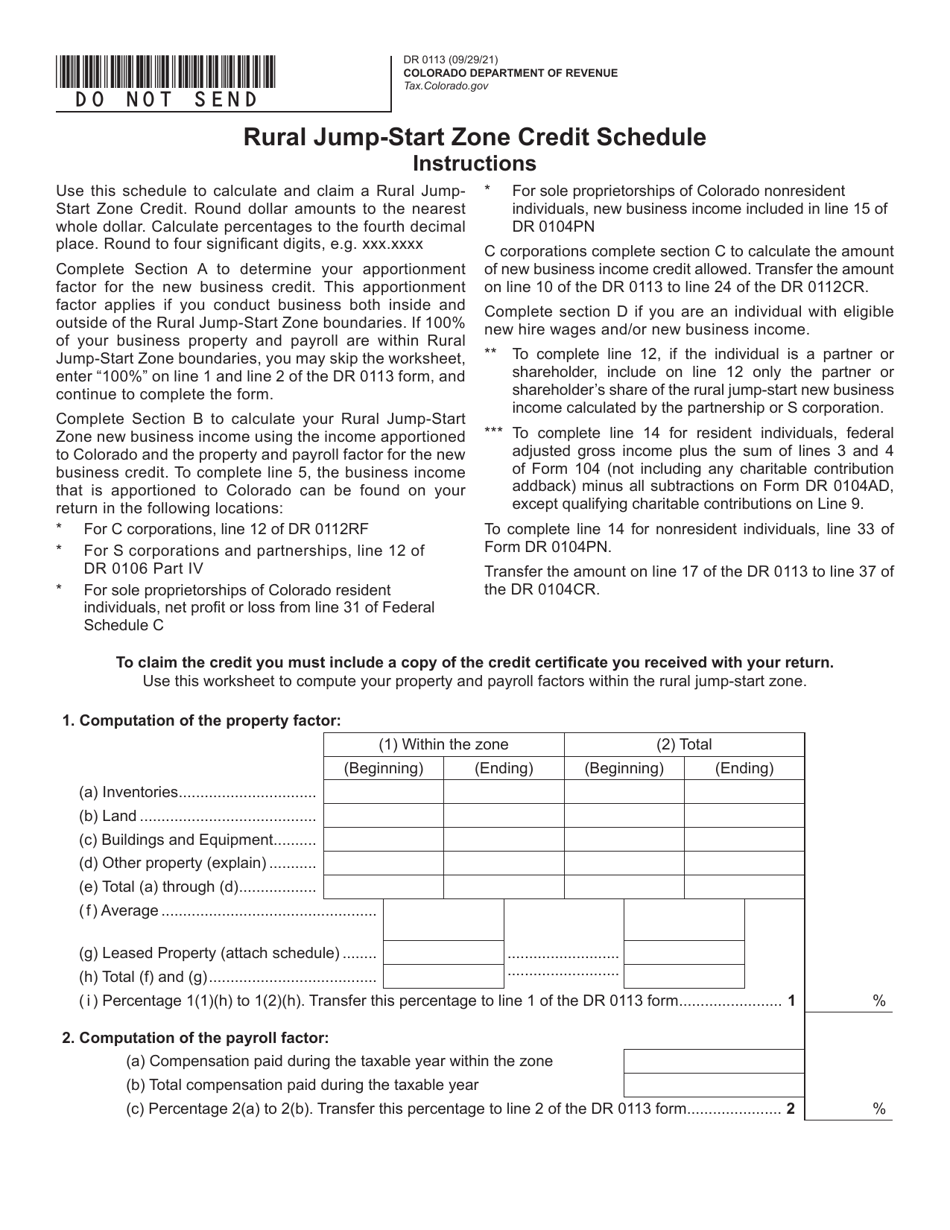

Form DR0113 Rural Jump-Start Zone Credit Schedule - Colorado

What Is Form DR0113?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0113?

A: Form DR0113 is the Rural Jump-Start Zone Credit Schedule for Colorado.

Q: What is the purpose of Form DR0113?

A: The purpose of Form DR0113 is to claim the Rural Jump-Start Zone Credit in Colorado.

Q: Who needs to fill out Form DR0113?

A: Any taxpayer who wishes to claim the Rural Jump-Start Zone Credit in Colorado needs to fill out Form DR0113.

Q: What is the Rural Jump-Start Zone Credit?

A: The Rural Jump-Start Zone Credit is a tax credit offered by Colorado to businesses located in designated rural jump-start zones.

Q: How do I qualify for the Rural Jump-Start Zone Credit?

A: To qualify for the Rural Jump-Start Zone Credit, you must be a business located in a designated rural jump-start zone in Colorado.

Q: When is Form DR0113 due?

A: Form DR0113 is generally due on the same date as your Colorado income tax return, which is April 15th.

Q: Can I e-file Form DR0113?

A: Yes, you can e-file Form DR0113 if you are e-filing your Colorado income tax return.

Q: What should I do if I have questions about Form DR0113?

A: If you have questions about Form DR0113, you can contact the Colorado Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on September 29, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0113 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.