This version of the form is not currently in use and is provided for reference only. Download this version of

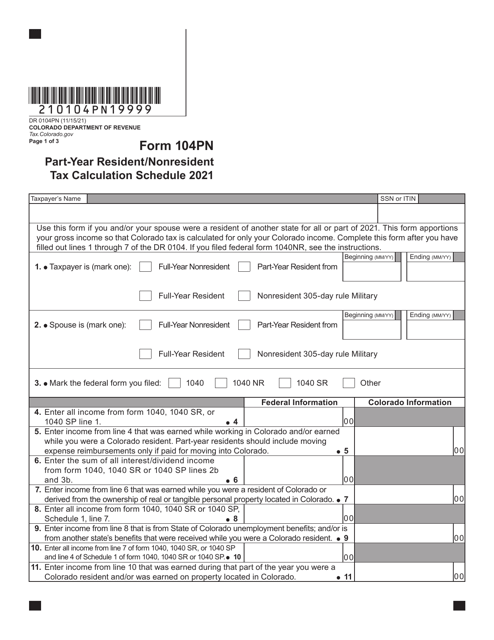

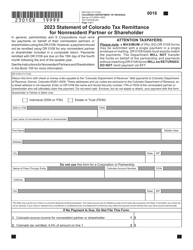

Form DR0104PN

for the current year.

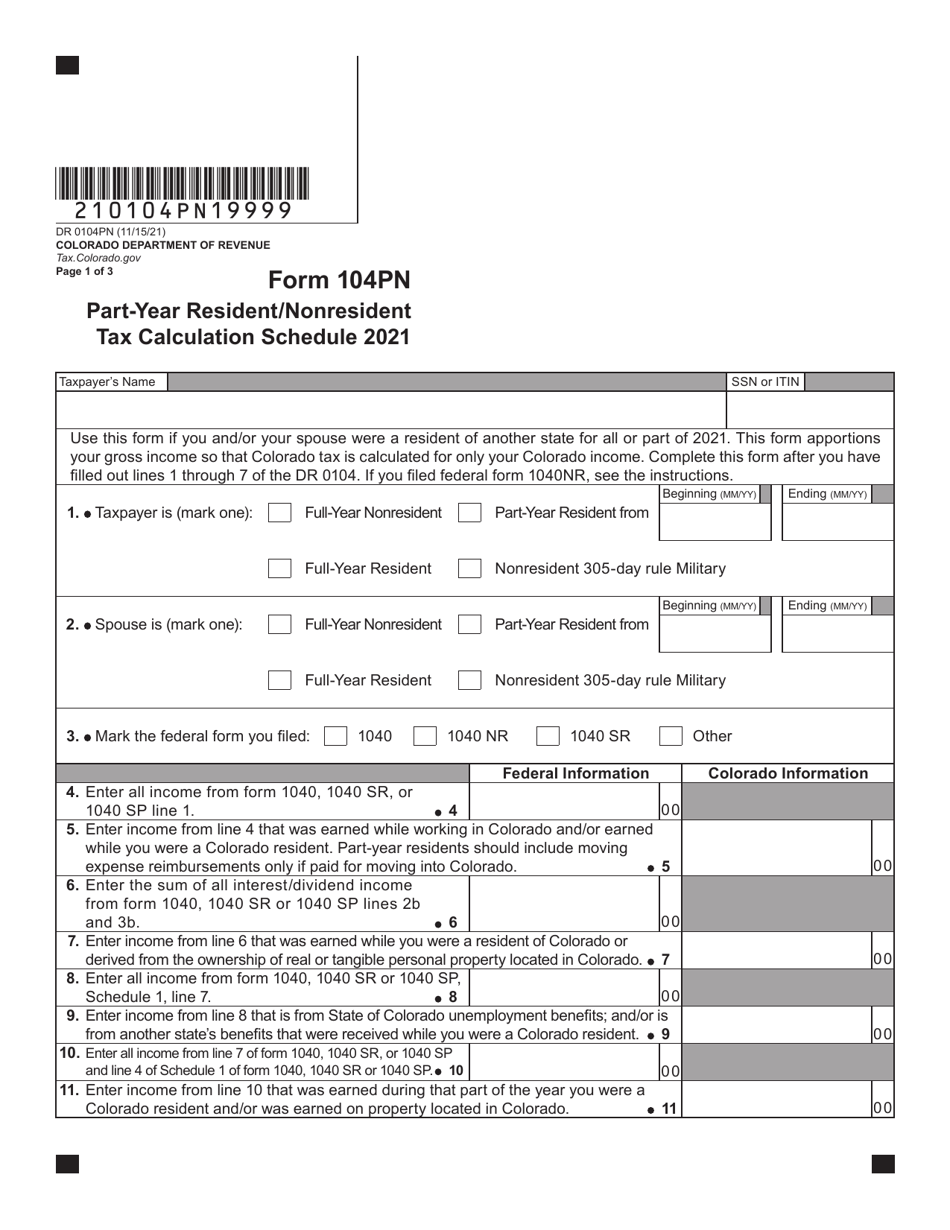

Form DR0104PN Part-Year Resident / Nonresident Tax Calculation Schedule - Colorado

What Is Form DR0104PN?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0104PN?

A: Form DR0104PN is the Part-Year Resident/Nonresident Tax Calculation Schedule for Colorado.

Q: Who needs to file Form DR0104PN?

A: Form DR0104PN needs to be filed by individuals who were either part-year residents or nonresidents of Colorado during the tax year.

Q: What is the purpose of Form DR0104PN?

A: The purpose of Form DR0104PN is to calculate the Colorado income tax liability for individuals who were only residents or nonresidents for part of the tax year.

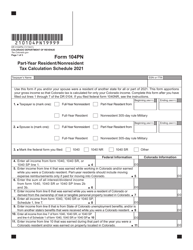

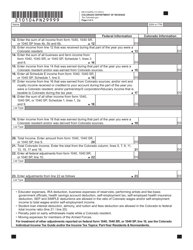

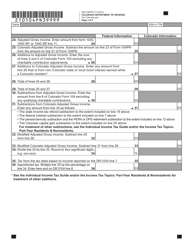

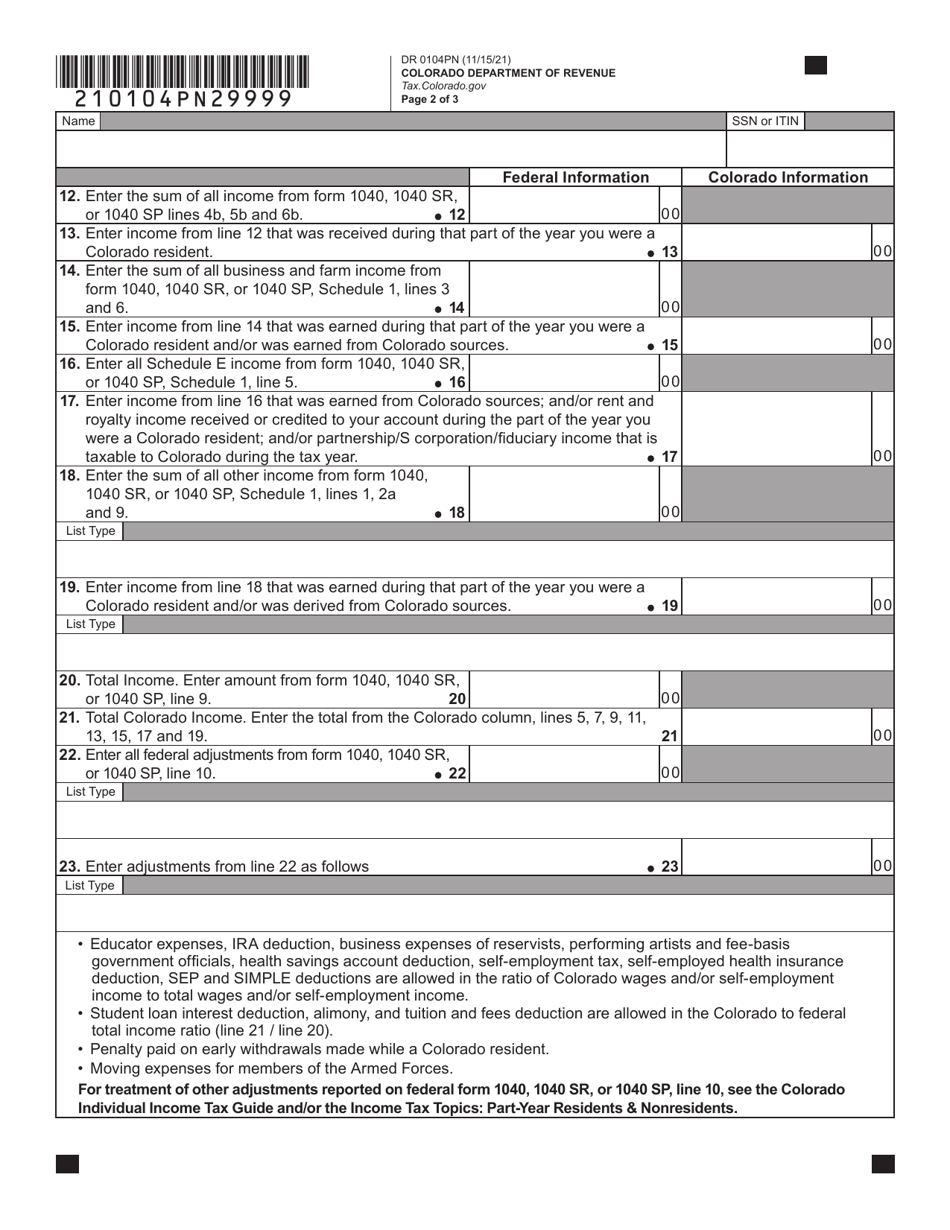

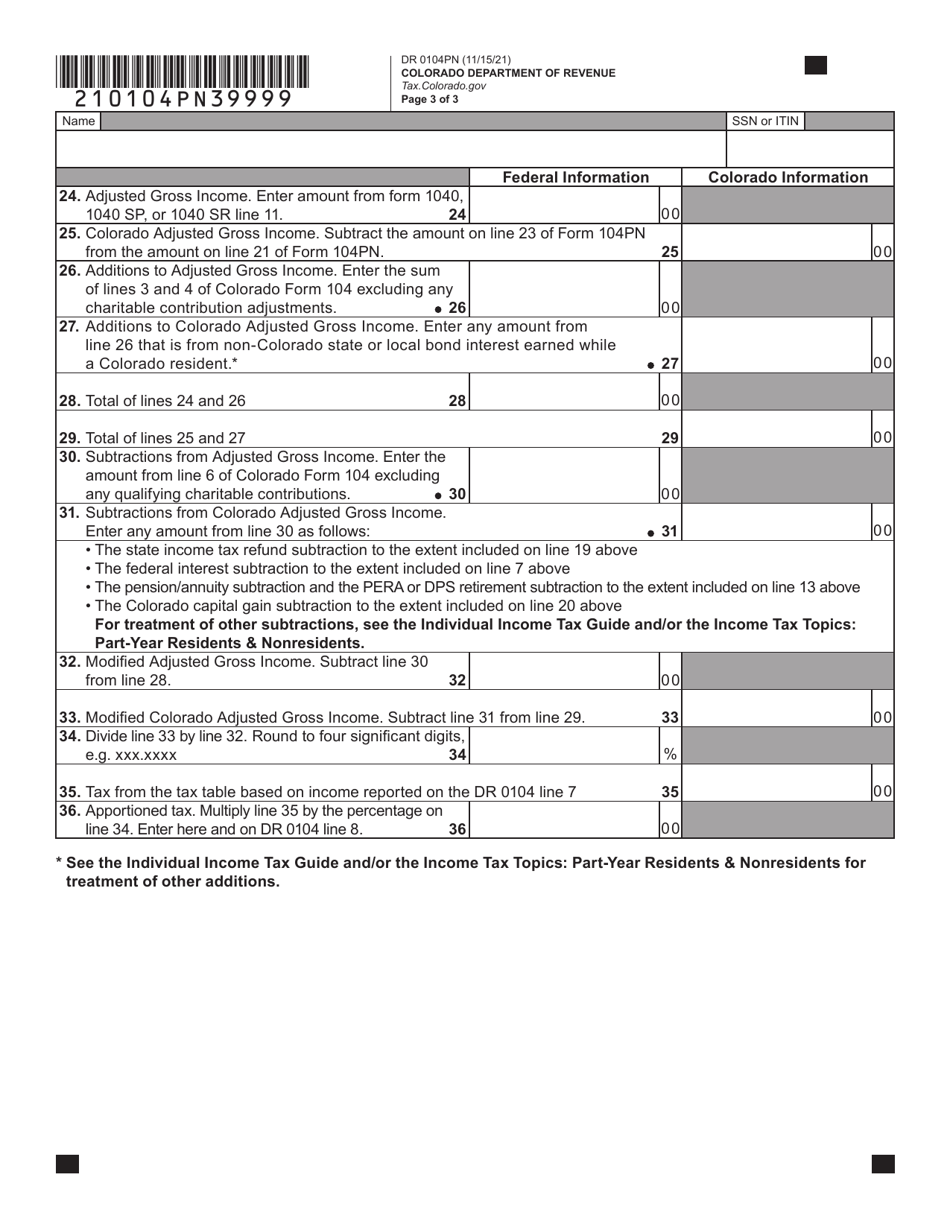

Q: What information is required on Form DR0104PN?

A: Form DR0104PN requires individuals to provide their personal information, income details, and deductions or credits applicable to their part-year or nonresident status.

Q: When is Form DR0104PN due?

A: Form DR0104PN is due on the same date as the Colorado individual income tax return, which is typically April 15th of the following year.

Q: Do I need to file Form DR0104PN if I was a full-year resident of Colorado?

A: No, Form DR0104PN is only for individuals who were part-year residents or nonresidents of Colorado.

Q: Can I e-file Form DR0104PN?

A: Yes, you can e-file Form DR0104PN if you are filing your Colorado individual income tax return electronically.

Form Details:

- Released on November 15, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0104PN by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.