This version of the form is not currently in use and is provided for reference only. Download this version of

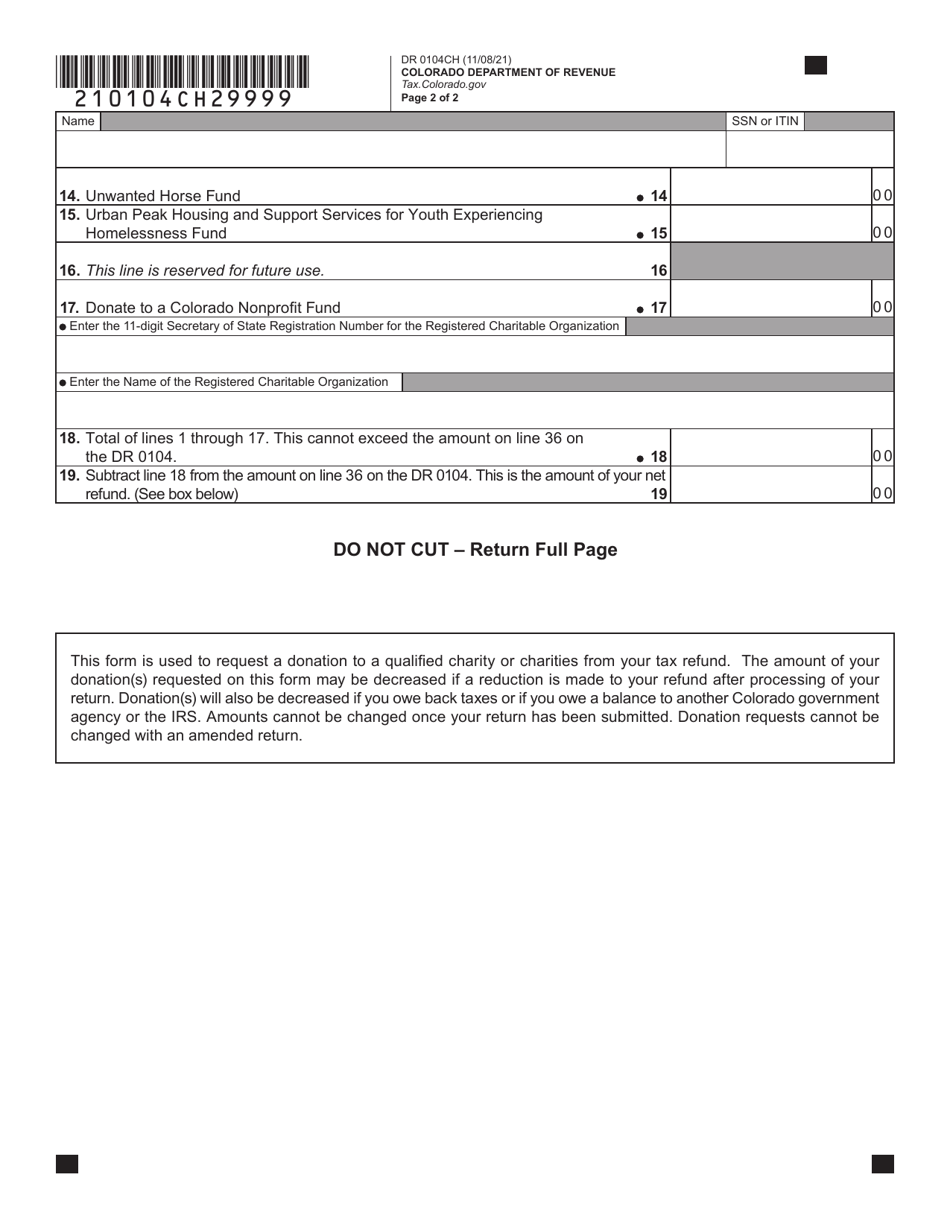

Form DR0104CH

for the current year.

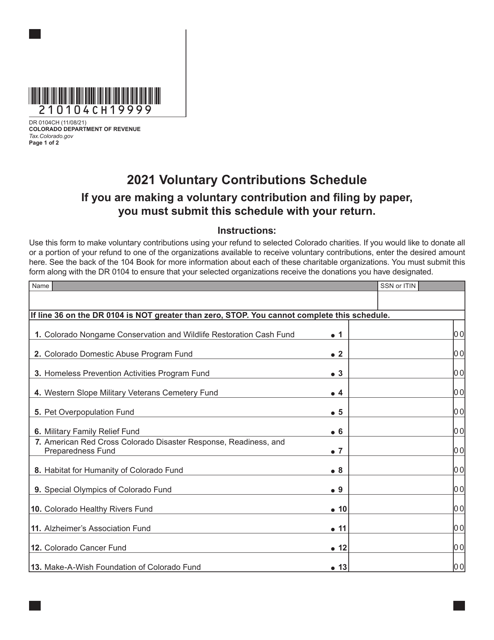

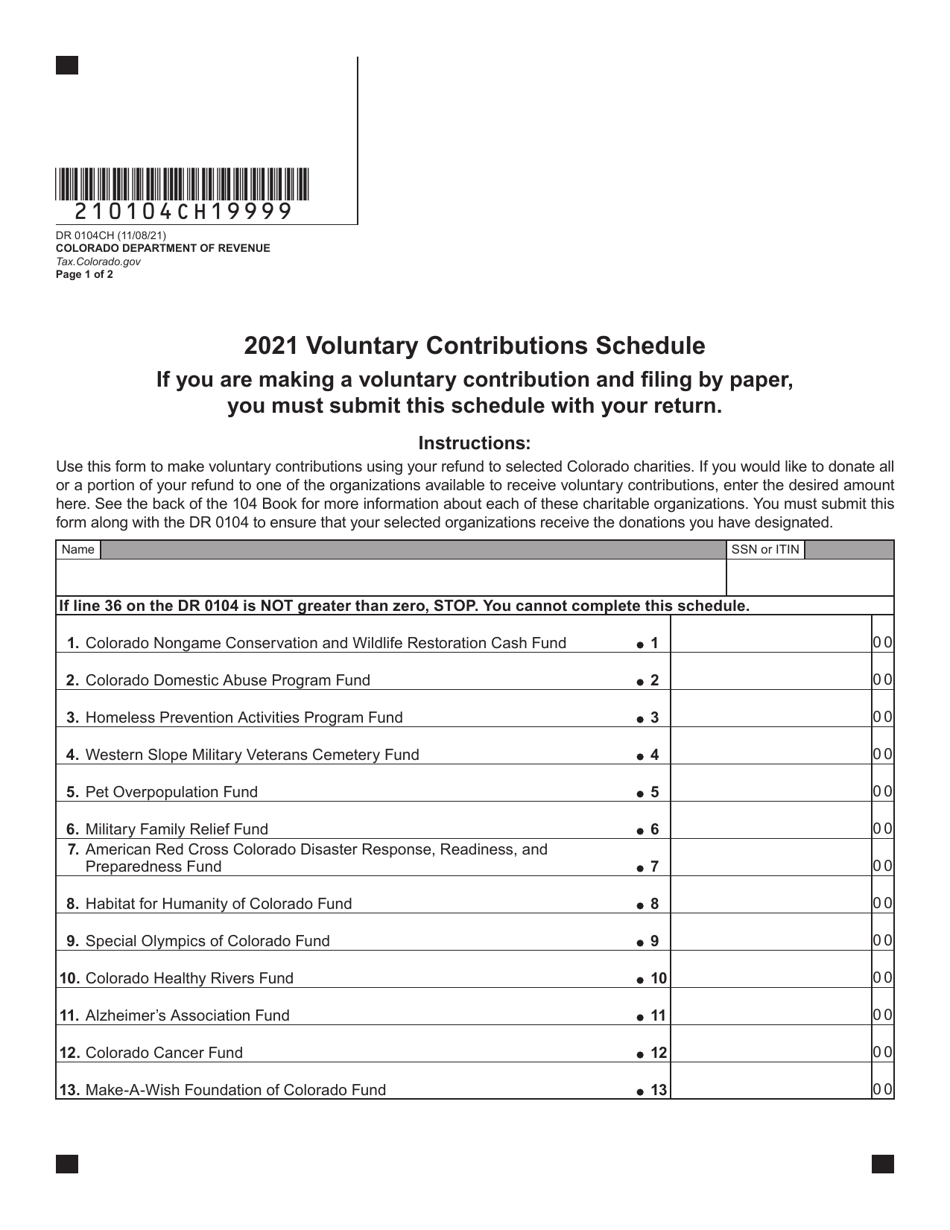

Form DR0104CH Voluntary Contributions Schedule - Colorado

What Is Form DR0104CH?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0104CH?

A: Form DR0104CH is the Voluntary Contributions Schedule for the state of Colorado.

Q: What is the purpose of Form DR0104CH?

A: The purpose of Form DR0104CH is to allow taxpayers to make voluntary contributions to various charitable causes in Colorado.

Q: Who needs to file Form DR0104CH?

A: Taxpayers in Colorado who wish to make voluntary contributions to charitable causes can file Form DR0104CH.

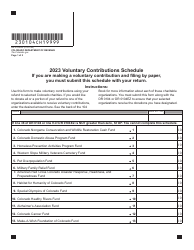

Q: What charitable causes can I contribute to using Form DR0104CH?

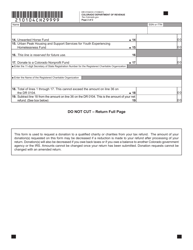

A: Form DR0104CH provides options for voluntary contributions to various programs and causes in Colorado, such as the Colorado Cancer Fund, the Pet Overpopulation Fund, and the Colorado Multiple Sclerosis Fund, among others.

Q: When is the deadline to file Form DR0104CH?

A: The deadline to file Form DR0104CH is the same as the deadline to file your Colorado state tax return, which is usually April 15th.

Q: Is there a limit on the amount I can contribute on Form DR0104CH?

A: Yes, there may be limits on the amount you can contribute to certain charitable causes on Form DR0104CH. Please refer to the specific instructions provided with the form.

Q: Are contributions made on Form DR0104CH tax-deductible?

A: Contributions made on Form DR0104CH may be tax-deductible. However, it is recommended to consult a tax professional or refer to the applicable tax laws for more information.

Q: Can I make voluntary contributions on my federal tax return?

A: No, Form DR0104CH is specific to the state of Colorado and cannot be used for voluntary contributions on your federal tax return.

Q: What happens to the contributions I make on Form DR0104CH?

A: The contributions made on Form DR0104CH are used to support the charitable causes and programs specified on the form. The funds are typically administered by the respective government agencies or organizations associated with each cause.

Form Details:

- Released on November 8, 2021;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0104CH by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.