This version of the form is not currently in use and is provided for reference only. Download this version of

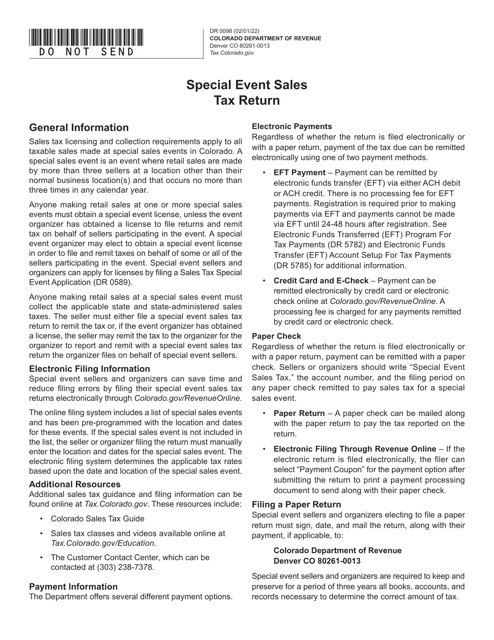

Form DR0098

for the current year.

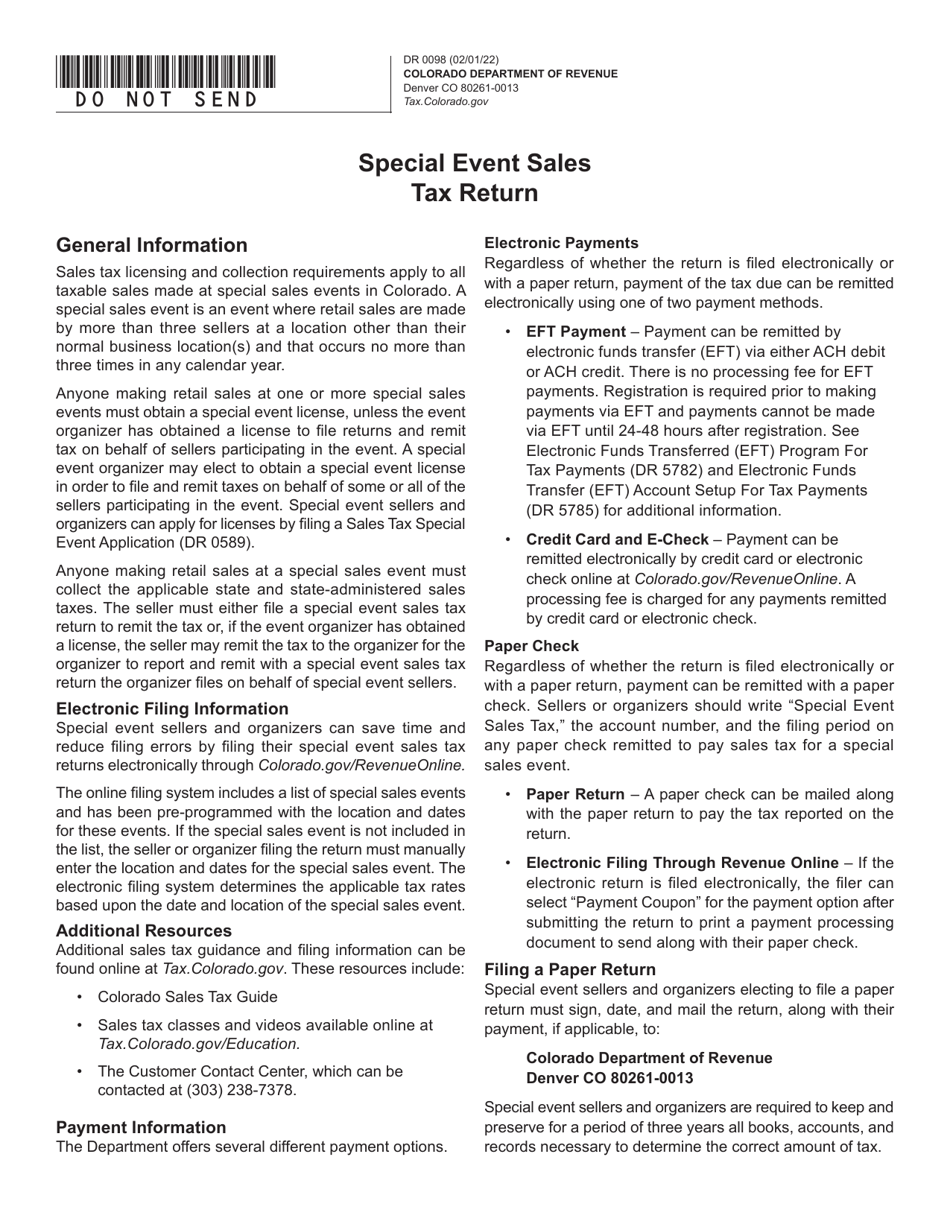

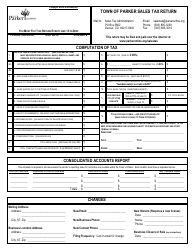

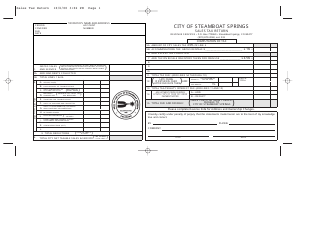

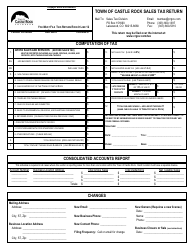

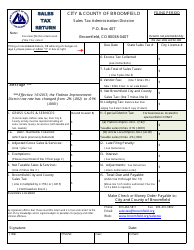

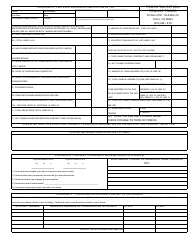

Form DR0098 Special Event Sales Tax Return - Colorado

What Is Form DR0098?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR0098?

A: The Form DR0098 is the Special EventSales Tax Return specific to Colorado.

Q: Who needs to file the Form DR0098?

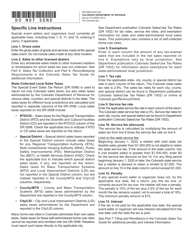

A: Individuals or organizations hosting special events in Colorado that involve sales or rentals subject to state, county, or municipal sales tax need to file the Form DR0098.

Q: What is considered a special event?

A: A special event is an activity such as a trade show, craft fair, flea market, or any similar event that is temporary in nature and involves sales or rentals that are subject to sales tax.

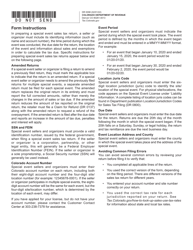

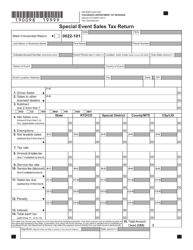

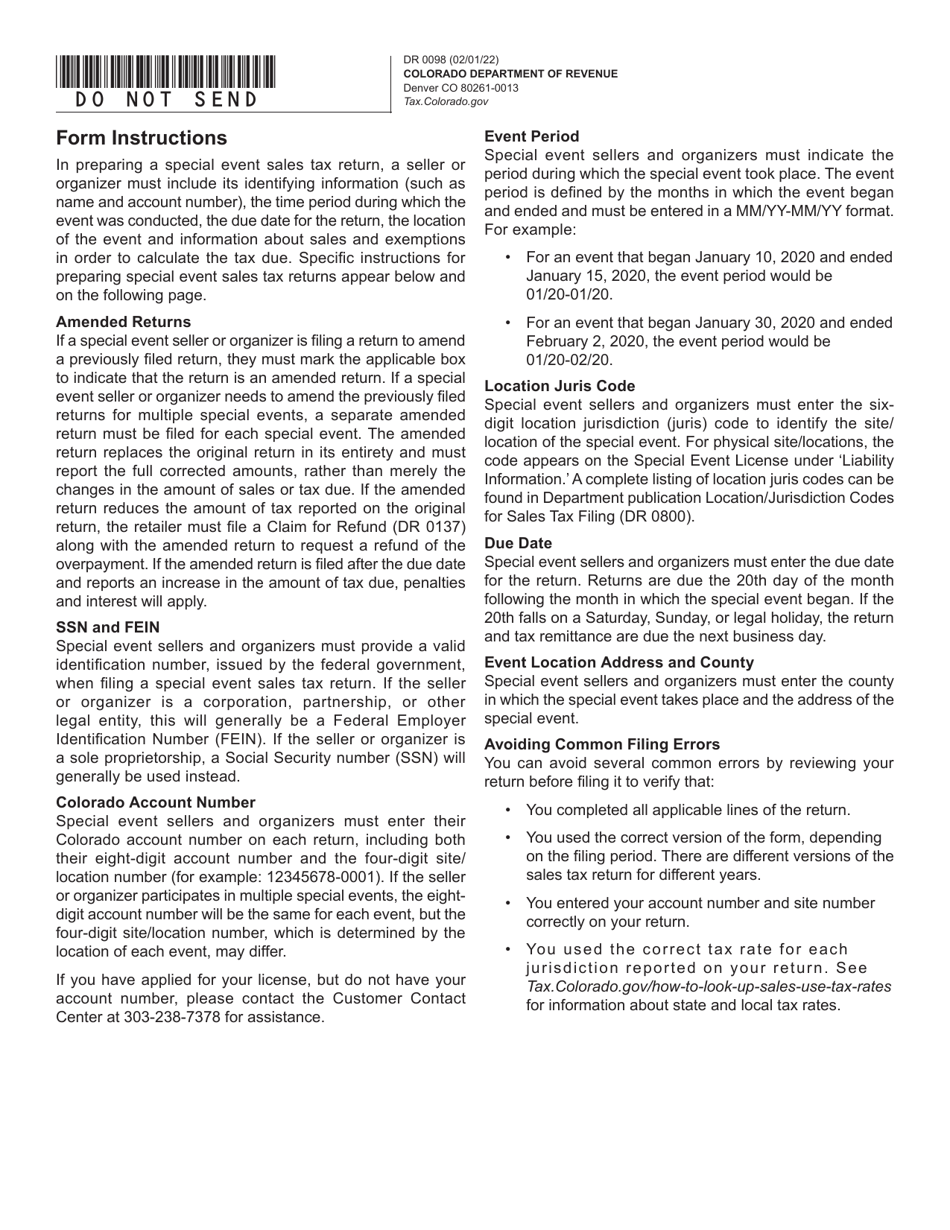

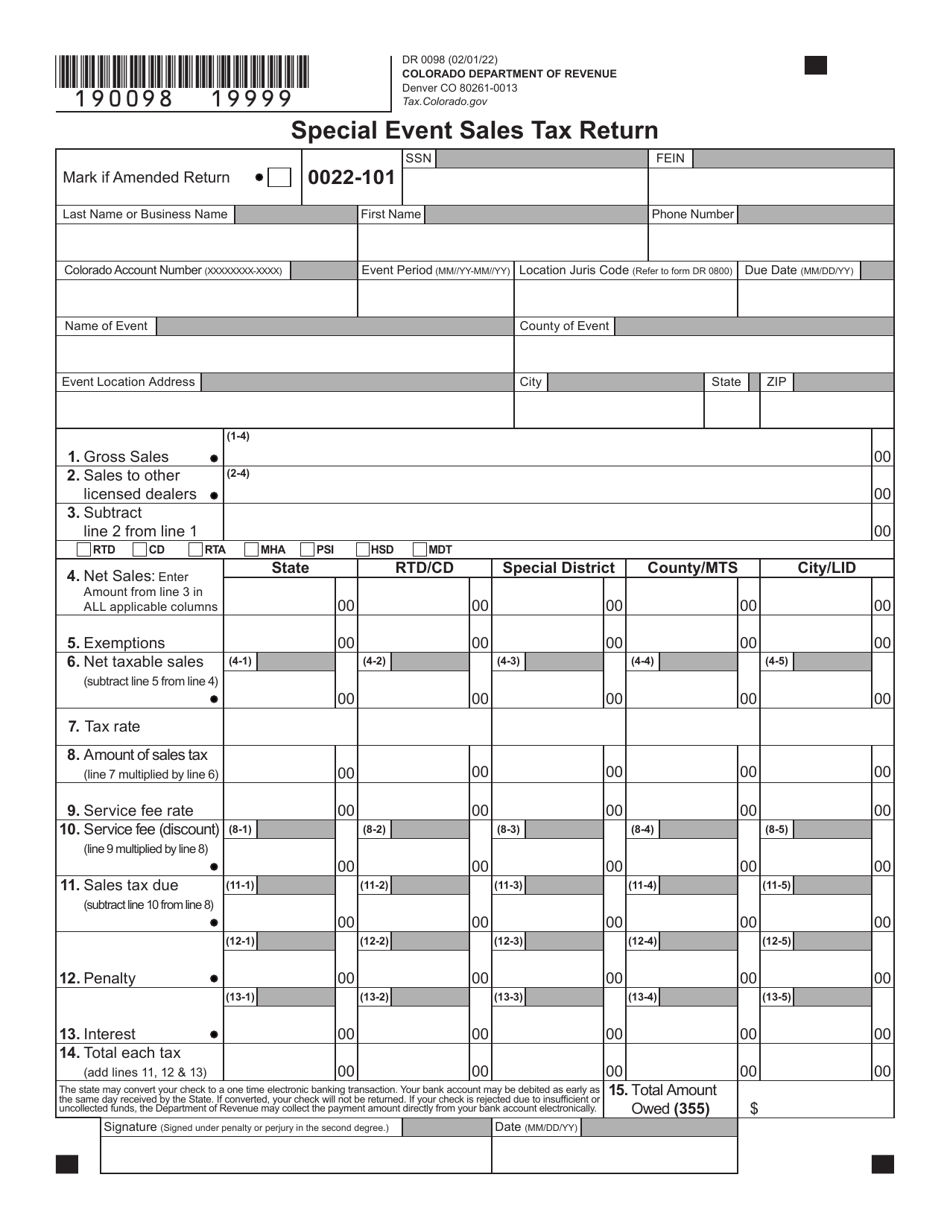

Q: What information is required on the Form DR0098?

A: The form requires information such as event details, total sales, taxable sales, tax due, and any exemptions claimed.

Q: When is the Form DR0098 due?

A: The Form DR0098 is due within 30 days from the last day of the special event.

Q: Are there any penalties for late or incorrect filing of the Form DR0098?

A: Yes, there may be penalties for late or incorrect filing, including interest charges and potential legal action.

Q: Can I claim exemptions on the Form DR0098?

A: Yes, you can claim exemptions on the Form DR0098 if you meet the eligibility requirements.

Q: Who can I contact for more information about the Form DR0098?

A: For more information about the Form DR0098, you can reach out to the Colorado Department of Revenue or consult a tax professional.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0098 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.