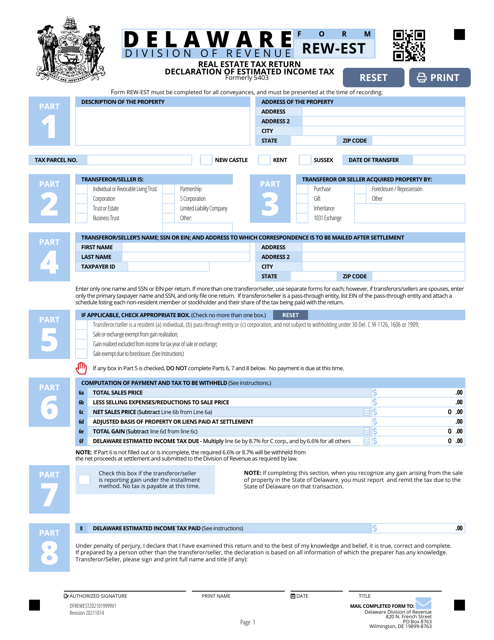

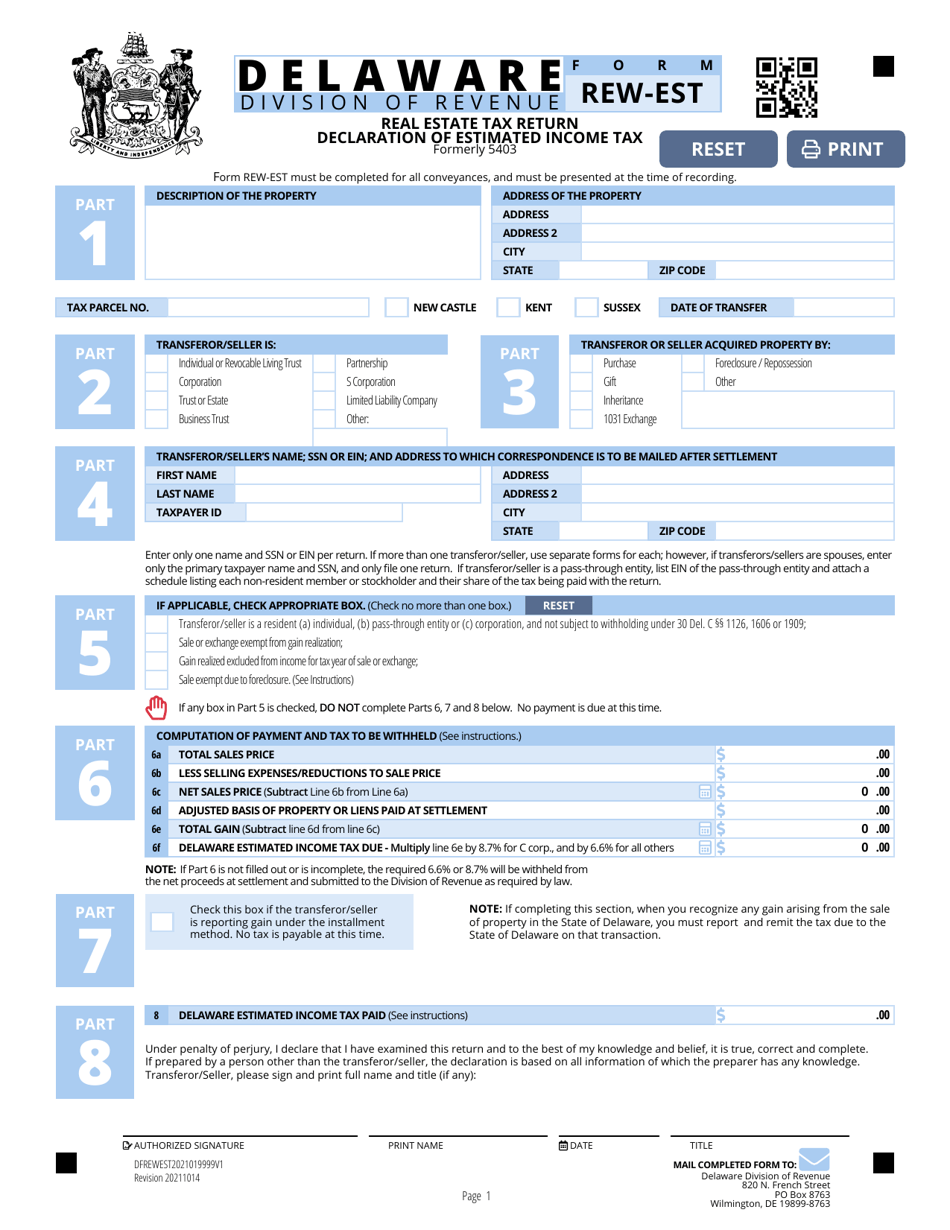

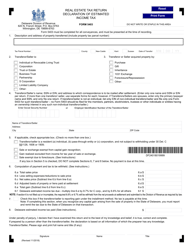

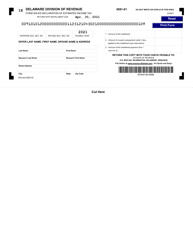

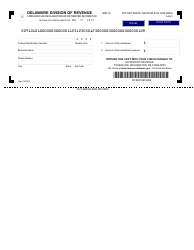

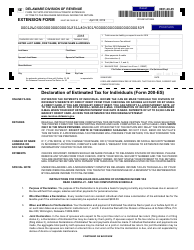

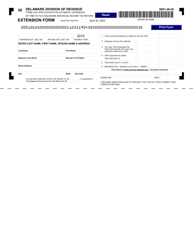

Form REW-EST Real Estate Tax Return - Declaration of Estimated Income Tax - Delaware

What Is Form REW-EST?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REW-EST?

A: Form REW-EST is the Real Estate Tax Return used to declare estimated income tax in Delaware.

Q: Who needs to file Form REW-EST?

A: Anyone who owns or leases real estate in Delaware and expects to owe income tax on rental or royalty income needs to file Form REW-EST.

Q: What information is required on Form REW-EST?

A: Form REW-EST requires you to provide your personal information, property details, and estimated income and deductions.

Q: When is Form REW-EST due?

A: Form REW-EST is due on April 30th of each year.

Q: Can I file Form REW-EST electronically?

A: Yes, Delaware allows electronic filing of Form REW-EST.

Q: What happens if I don't file Form REW-EST?

A: Failure to file Form REW-EST or pay the estimated tax due may result in penalties and interest.

Form Details:

- Released on October 14, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-EST by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.