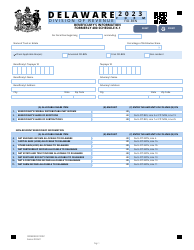

This version of the form is not currently in use and is provided for reference only. Download this version of

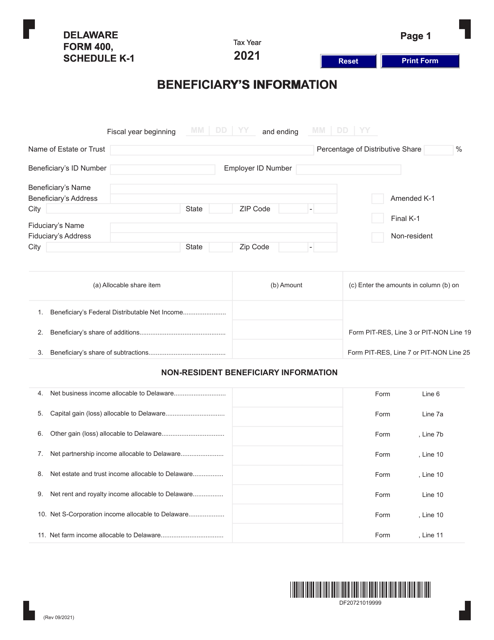

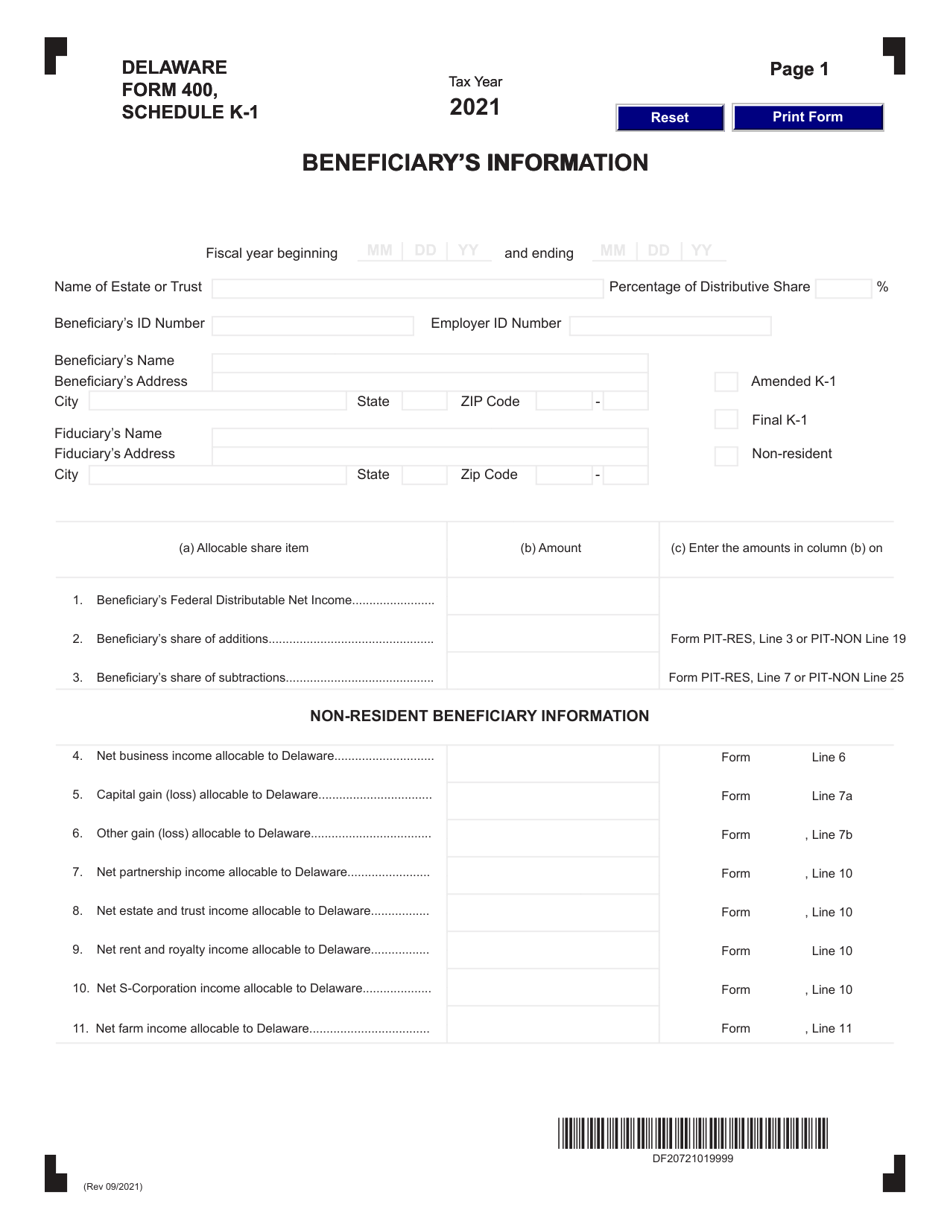

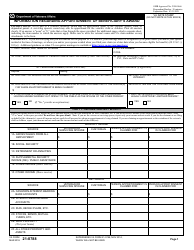

Form 400 Schedule K-1

for the current year.

Form 400 Schedule K-1 Beneficiary's Information - Delaware

What Is Form 400 Schedule K-1?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware.The document is a supplement to Form 400, Delaware Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 400 Schedule K-1?

A: Form 400 Schedule K-1 is a tax form that reports the beneficiary's share of income, deductions, and credits from a Delaware entity, such as a partnership or limited liability company (LLC).

Q: Who needs to file Form 400 Schedule K-1?

A: Anyone who is a beneficiary of a Delaware entity and has received income, deductions, or credits from that entity during the tax year needs to file Form 400 Schedule K-1.

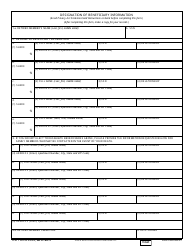

Q: What information is required on Form 400 Schedule K-1?

A: Form 400 Schedule K-1 requires the beneficiary's personal information, such as their name, address, and social security number. Additionally, it requires details about the income, deductions, and credits allocated to the beneficiary.

Q: When is the deadline to file Form 400 Schedule K-1?

A: The deadline to file Form 400 Schedule K-1 is typically April 15th, which is the same as the general tax filing deadline.

Q: Are there any penalties for not filing Form 400 Schedule K-1?

A: Yes, there can be penalties for not filing Form 400 Schedule K-1, such as late filing penalties and interest on any unpaid tax amounts. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 400 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.