This version of the form is not currently in use and is provided for reference only. Download this version of

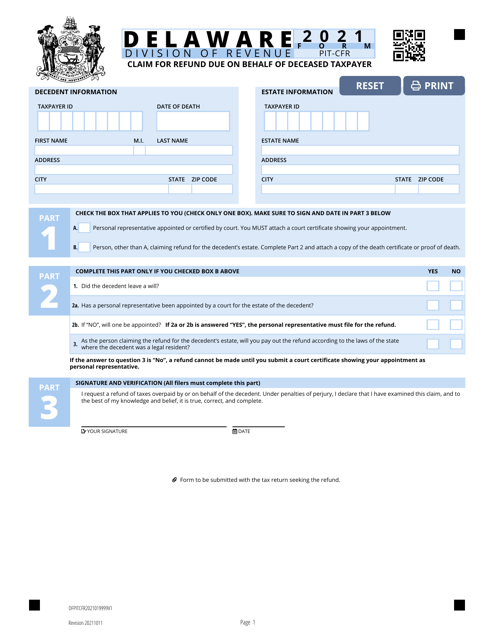

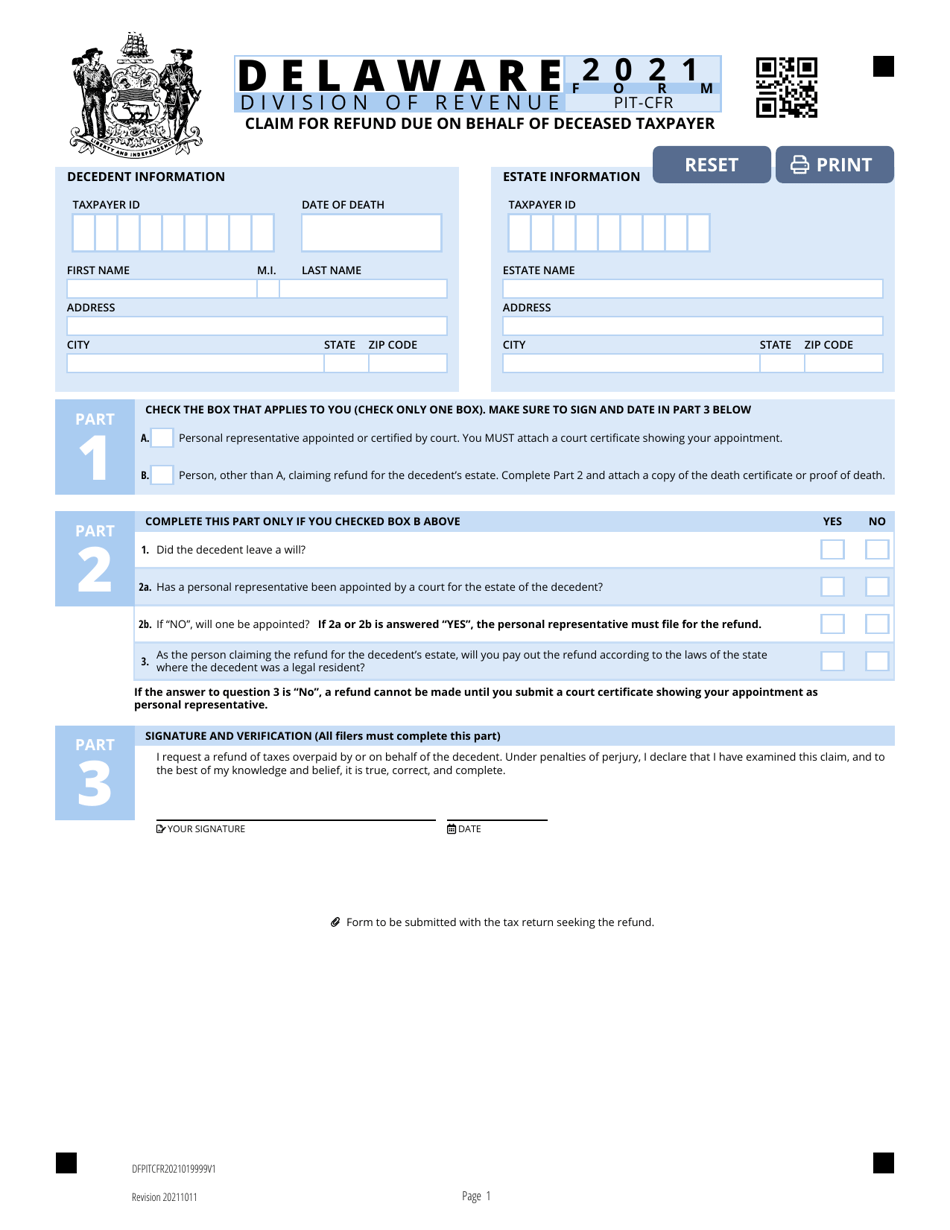

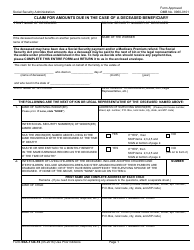

Form PIT-CFR

for the current year.

Form PIT-CFR Claim for Refund Due on Behalf of Deceased Taxpayer - Delaware

What Is Form PIT-CFR?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

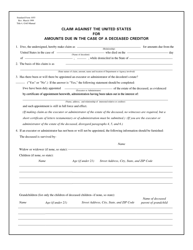

Q: What is a PIT-CFR claim?

A: A PIT-CFR claim is a claim for refund filed on behalf of a deceased taxpayer.

Q: Who can file a PIT-CFR claim?

A: The executor or personal representative of the deceased taxpayer's estate can file a PIT-CFR claim.

Q: What is the purpose of filing a PIT-CFR claim?

A: The purpose of filing a PIT-CFR claim is to request a refund of any excess taxes paid by the deceased taxpayer or their estate.

Q: How do I file a PIT-CFR claim for a deceased taxpayer in Delaware?

A: To file a PIT-CFR claim for a deceased taxpayer in Delaware, you will need to complete and submit the necessary forms to the Delaware Division of Revenue.

Q: What documentation do I need to provide when filing a PIT-CFR claim?

A: When filing a PIT-CFR claim, you will generally need to provide supporting documentation such as the deceased taxpayer's death certificate, copies of their tax returns, and any other relevant documents.

Q: Is there a deadline for filing a PIT-CFR claim?

A: Yes, there is a deadline for filing a PIT-CFR claim. In Delaware, the claim must generally be filed within 3 years from the due date of the original tax return or 2 years from the date of the tax payment, whichever is later.

Q: Can I file a PIT-CFR claim for a deceased taxpayer if I am not the executor or personal representative of their estate?

A: No, only the executor or personal representative of the deceased taxpayer's estate can file a PIT-CFR claim.

Form Details:

- Released on October 11, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PIT-CFR by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.