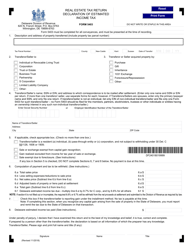

This version of the form is not currently in use and is provided for reference only. Download this version of

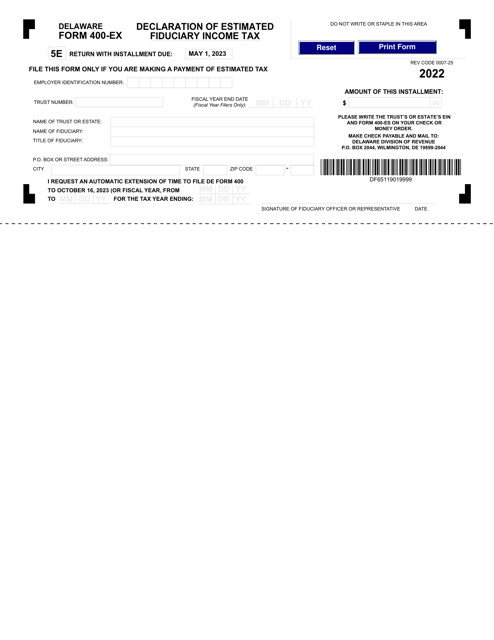

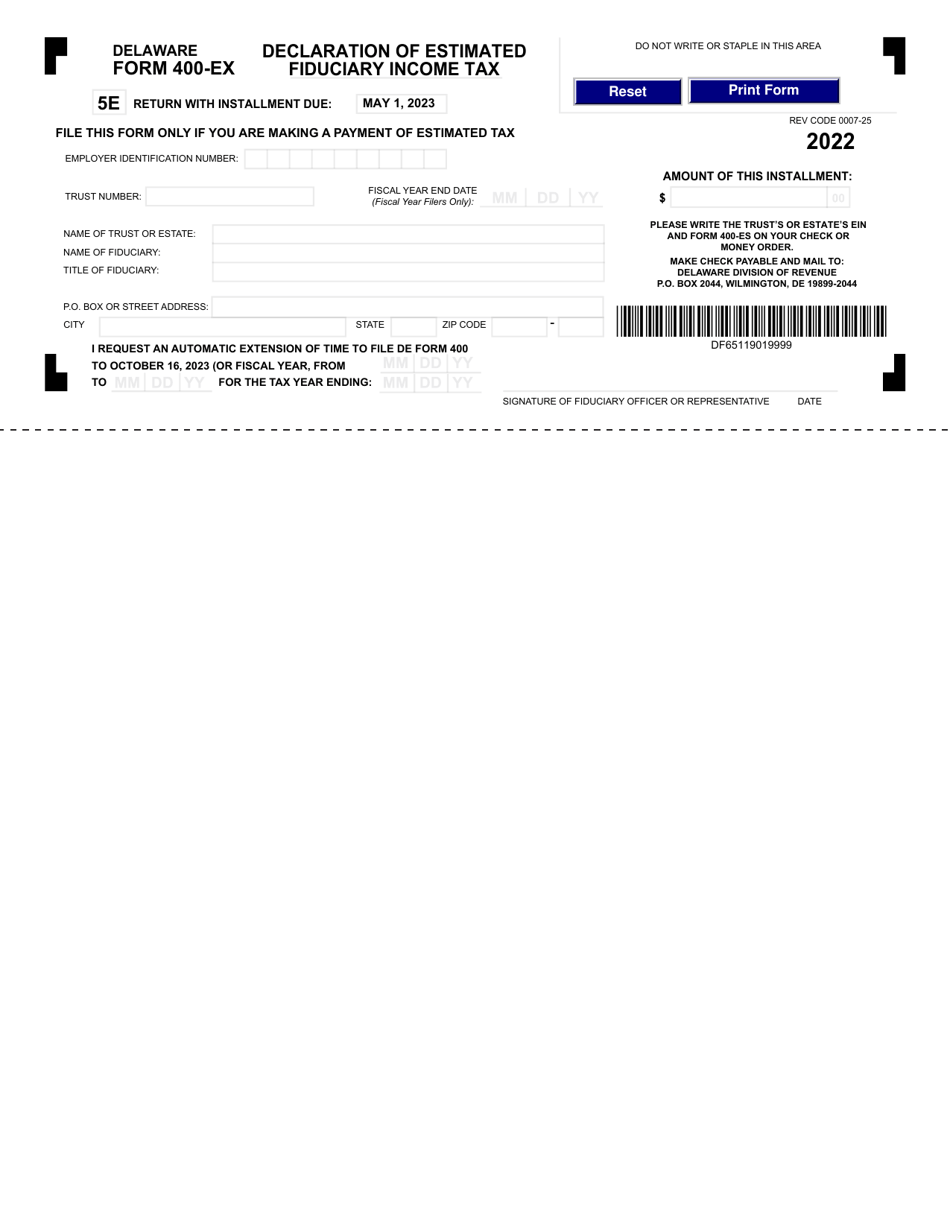

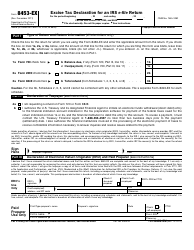

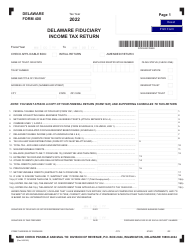

Form 400-EX

for the current year.

Form 400-EX Declaration of Estimated Fiduciary Income Tax - Delaware

What Is Form 400-EX?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 400-EX?

A: Form 400-EX is the Declaration of Estimated Fiduciary Income Tax for the state of Delaware.

Q: Who needs to file Form 400-EX?

A: Fiduciaries who are required to pay estimated income tax in Delaware must file Form 400-EX.

Q: What is the purpose of Form 400-EX?

A: The purpose of Form 400-EX is to calculate and report estimated income tax payments for fiduciaries in Delaware.

Q: When is Form 400-EX due?

A: Form 400-EX is due on April 30th of the current tax year for calendar-year filers.

Q: Are there any penalties for not filing Form 400-EX?

A: Yes, there may be penalties for failing to file Form 400-EX or for underpayment of estimated tax.

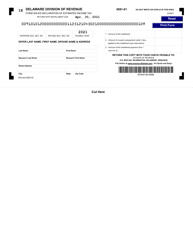

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 400-EX by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.