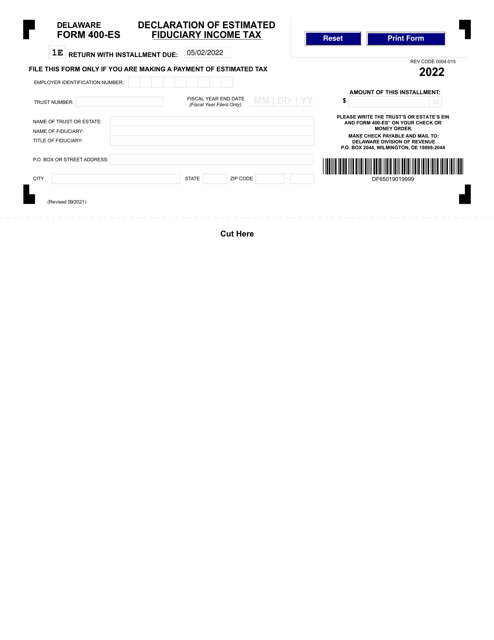

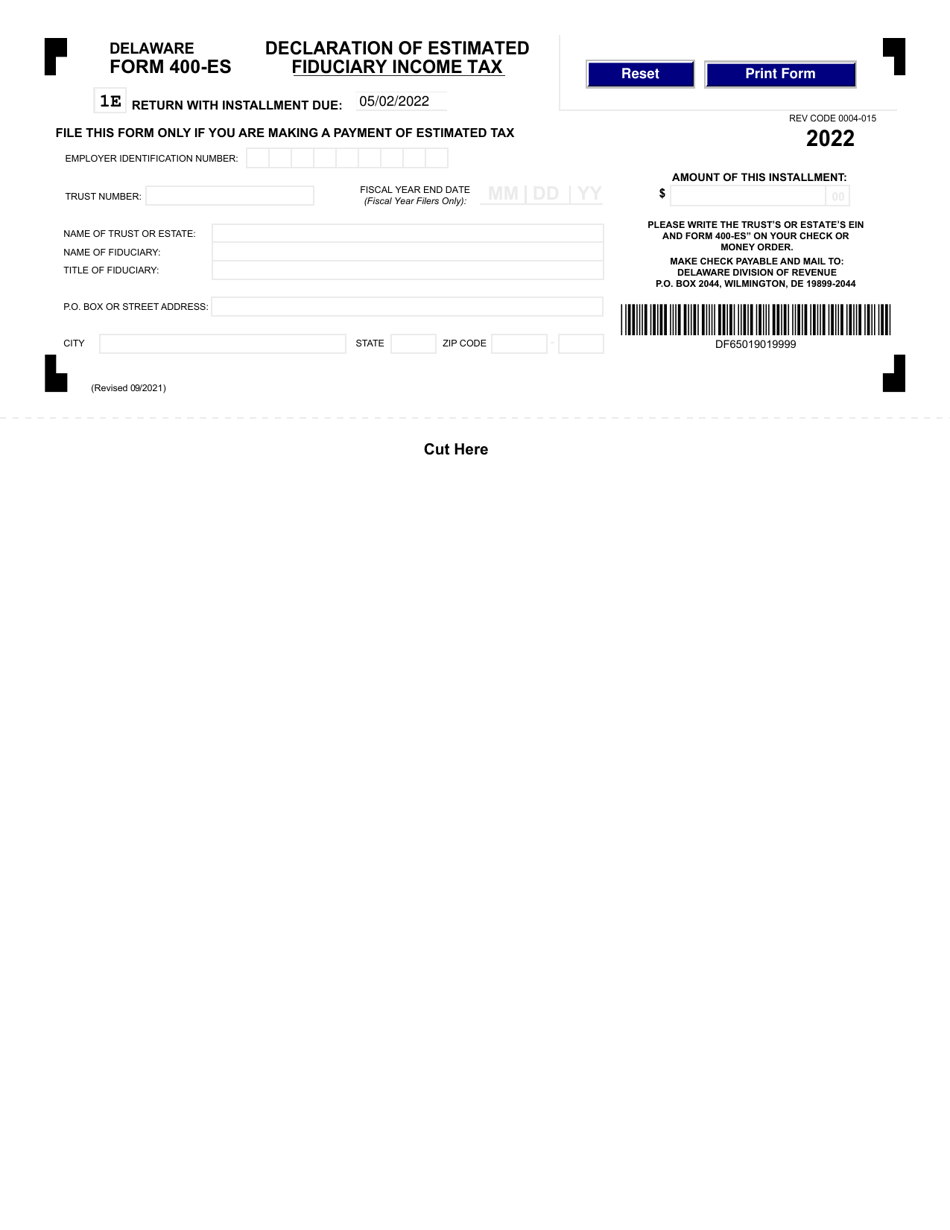

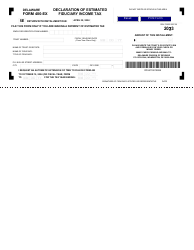

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 400-ES

for the current year.

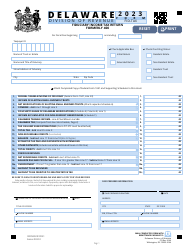

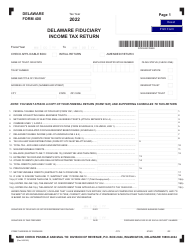

Form 400-ES Declaration of Estimated Fiduciary Income Tax - Delaware

What Is Form 400-ES?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 400-ES?

A: Form 400-ES is a declaration form for estimating the fiduciary income tax in Delaware.

Q: Who needs to file Form 400-ES?

A: Fiduciaries who expect to owe Delaware income tax and are required to make estimated tax payments should file Form 400-ES.

Q: What is the purpose of Form 400-ES?

A: The purpose of Form 400-ES is to report and pay estimated fiduciary income tax in Delaware.

Q: When is Form 400-ES due?

A: Form 400-ES is due on the 15th day of the 4th, 6th, and 9th months of the taxable year, and the 1st month following the close of the taxable year.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 400-ES by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.