This version of the form is not currently in use and is provided for reference only. Download this version of

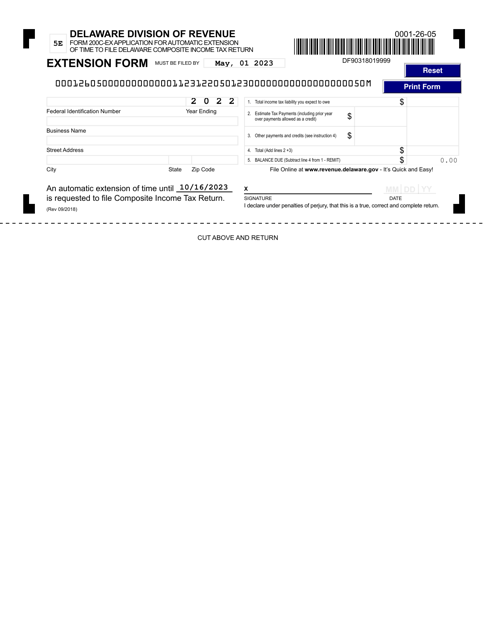

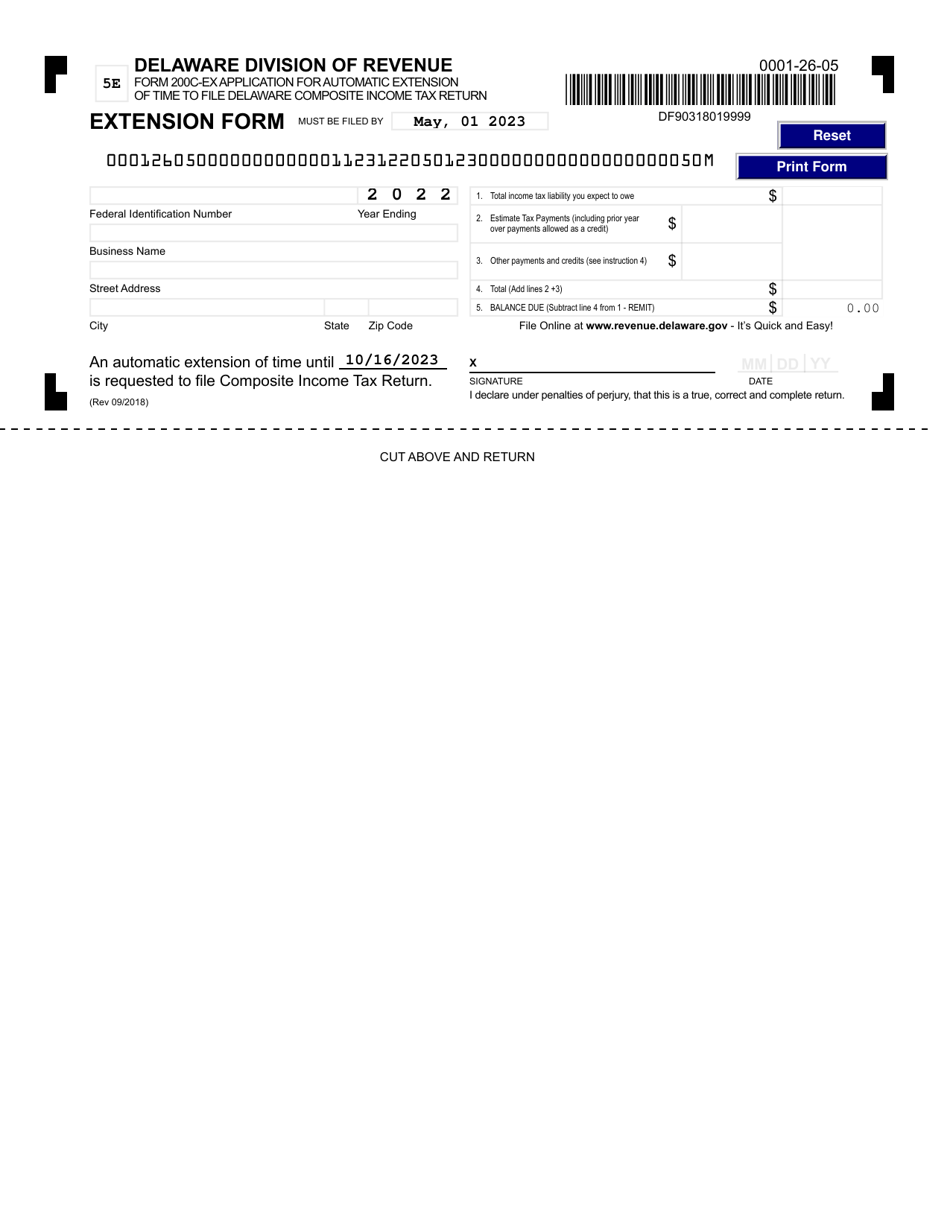

Form 200C-EX

for the current year.

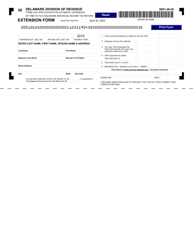

Form 200C-EX Application for Automatic Extension of Time to File Delaware Composite Income Tax Return - Delaware

What Is Form 200C-EX?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 200C-EX?

A: Form 200C-EX is the application for automatic extension of time to file Delaware Composite Income Tax Return.

Q: What is the purpose of filing Form 200C-EX?

A: The purpose of filing Form 200C-EX is to request an extension of time to file the Delaware Composite Income Tax Return.

Q: Who needs to file Form 200C-EX?

A: Individuals who are included in a Delaware composite income tax return and need additional time to file must use Form 200C-EX.

Q: What is the deadline for filing Form 200C-EX?

A: Form 200C-EX must be filed on or before the original due date of the Delaware Composite Income Tax Return.

Q: Is there a penalty for late filing of Form 200C-EX?

A: Yes, there is a penalty for late filing of Form 200C-EX. The penalty is 1.5% of the tax due per month, up to a maximum of 25%.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200C-EX by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.