This version of the form is not currently in use and is provided for reference only. Download this version of

GSA Form 3667

for the current year.

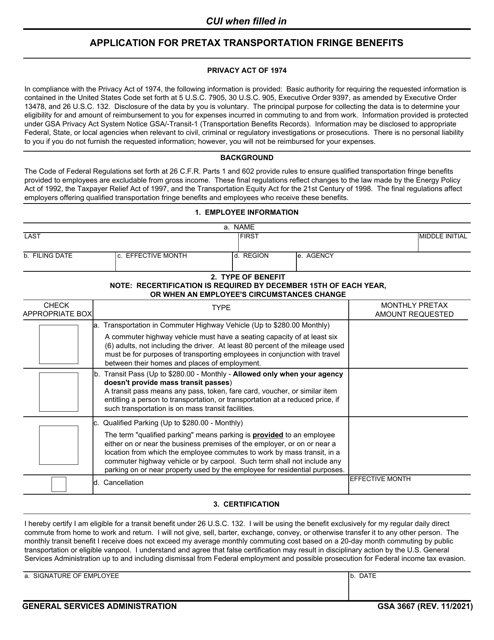

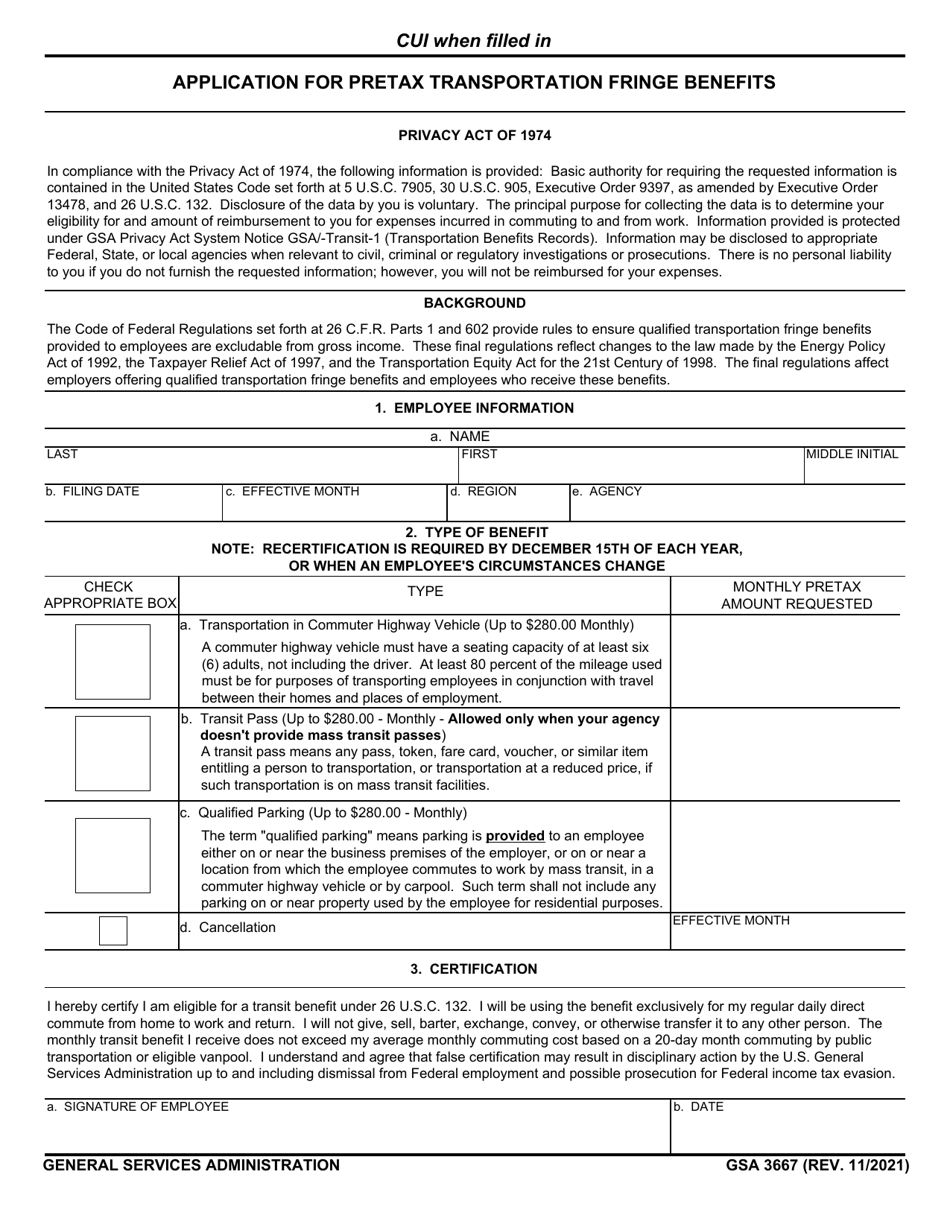

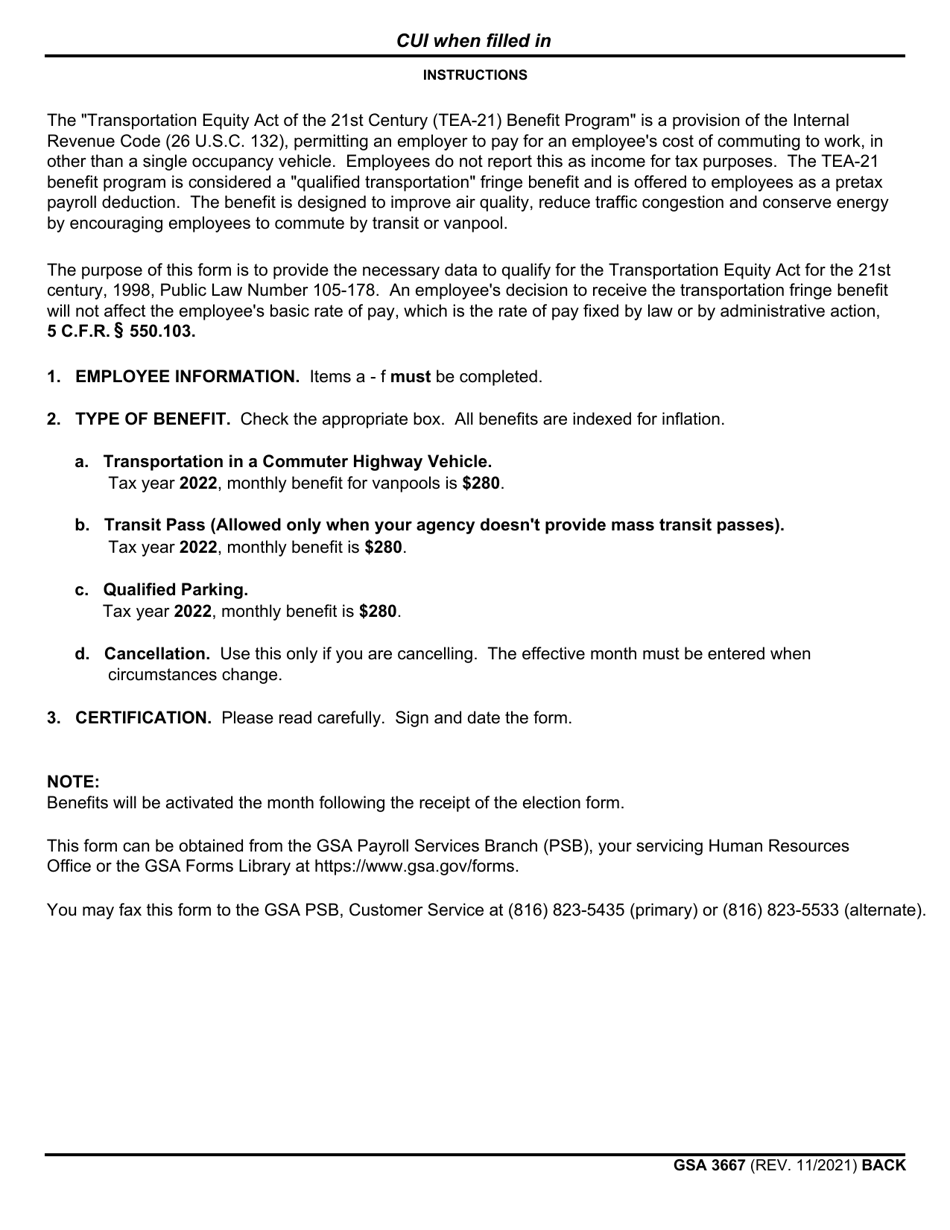

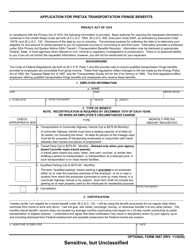

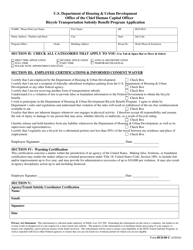

GSA Form 3667 Application for Pretax Transportation Fringe Benefits

What Is GSA Form 3667?

This is a legal form that was released by the U.S. General Services Administration on November 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GSA Form 3667?

A: The GSA Form 3667 is an application for pretax transportation fringe benefits.

Q: What are pretax transportation fringe benefits?

A: Pretax transportation fringe benefits are employer-provided benefits that allow employees to use pre-tax dollars to pay for their commuting expenses, such as public transit passes or qualified parking.

Q: Who can apply for pretax transportation fringe benefits?

A: Employees who are eligible for their employer's pretax transportation fringe benefit program can apply for these benefits.

Q: How can I apply for pretax transportation fringe benefits?

A: You can apply for pretax transportation fringe benefits by completing and submitting the GSA Form 3667 to your employer.

Q: What information is required on the GSA Form 3667?

A: The GSA Form 3667 requires information such as your name, employee identification number, commuting expenses, and the type of transportation benefit you are applying for.

Q: Is there a deadline to submit the GSA Form 3667?

A: The deadline to submit the GSA Form 3667 may vary depending on your employer's policies. It is best to check with your employer for their specific deadline.

Q: What are the benefits of participating in a pretax transportation fringe benefit program?

A: Participating in a pretax transportation fringe benefit program can help you save money by reducing your taxable income and lowering your commuting expenses.

Q: Are the pretax transportation fringe benefits available to everyone?

A: No, pretax transportation fringe benefits are only available to employees who are eligible for their employer's program and meet the necessary requirements.

Q: Can I make changes to my pretax transportation fringe benefit selections?

A: Yes, you can make changes to your pretax transportation fringe benefit selections during certain periods, such as open enrollment or qualifying life events. It is important to check with your employer for their specific guidelines.

Form Details:

- Released on November 1, 2021;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of GSA Form 3667 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.