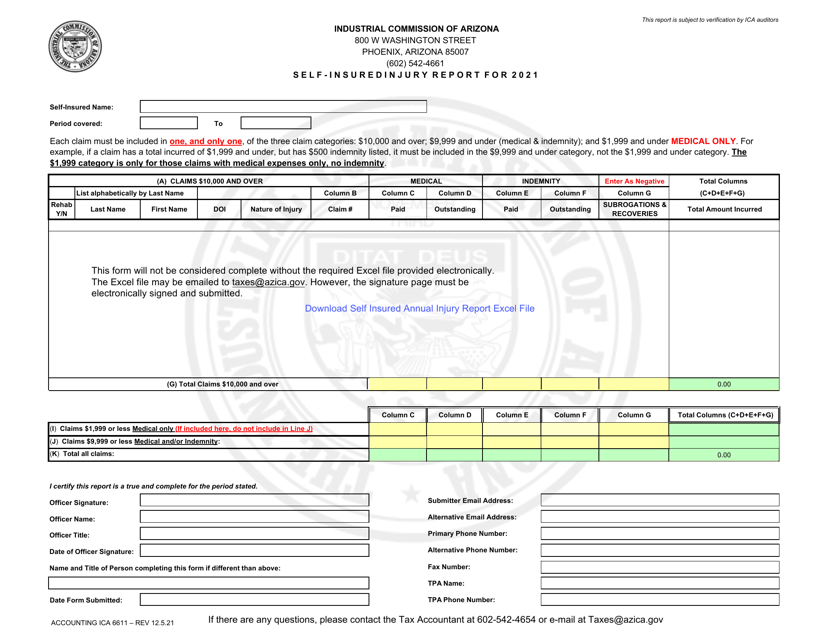

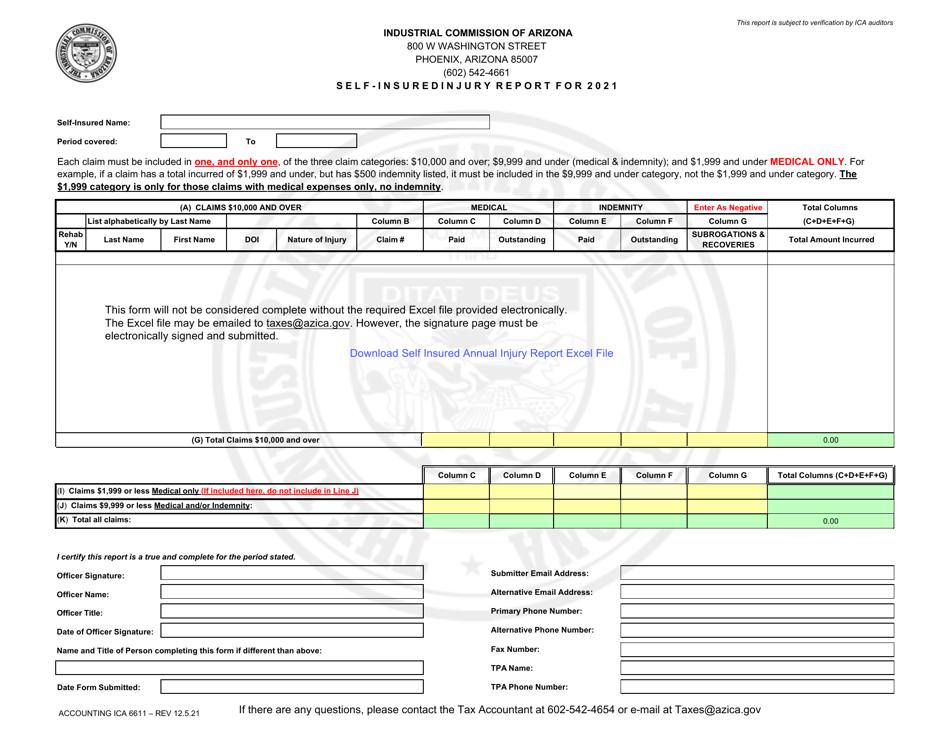

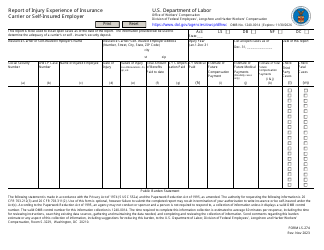

This version of the form is not currently in use and is provided for reference only. Download this version of

Form Accounting ICA6611

for the current year.

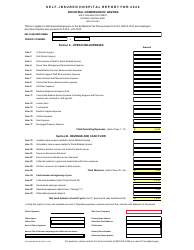

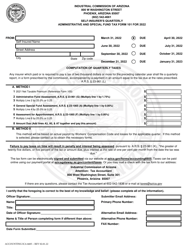

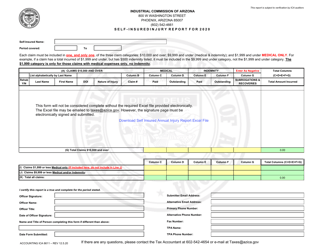

Form Accounting ICA6611 Self - Insured Injury Report - Arizona

What Is Form Accounting ICA6611?

This is a legal form that was released by the Industrial Commission of Arizona - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

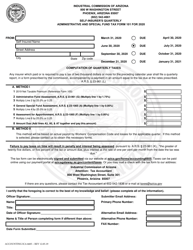

Q: What is the purpose of the Accounting ICA6611 Self-Insured Injury Report in Arizona?

A: The purpose of the report is to document self-insured injury incidents in Arizona.

Q: Who is responsible for filing the Accounting ICA6611 Self-Insured Injury Report in Arizona?

A: The employer or their designated representative is responsible for filing the report.

Q: What information is required to be included in the report?

A: The report should include details about the injured employee, the injury incident, and any medical treatment provided.

Q: When should the Accounting ICA6611 Self-Insured Injury Report be filed?

A: The report should be filed within 10 days of the injury incident.

Q: Are there any fees associated with filing the Accounting ICA6611 Self-Insured Injury Report?

A: No, there are no fees associated with filing the report.

Q: What happens if the Accounting ICA6611 Self-Insured Injury Report is not filed?

A: Failure to file the report may result in penalties or fines for the employer.

Q: Is the Accounting ICA6611 Self-Insured Injury Report confidential?

A: Yes, the report is confidential and should only be used for reporting and statistical purposes.

Q: Is the Accounting ICA6611 Self-Insured Injury Report required for all types of injuries?

A: Yes, the report is required for all self-insured injury incidents, regardless of the severity.

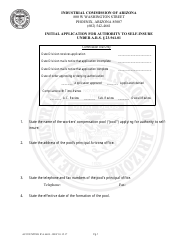

Form Details:

- Released on December 5, 2021;

- The latest edition provided by the Industrial Commission of Arizona;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Accounting ICA6611 by clicking the link below or browse more documents and templates provided by the Industrial Commission of Arizona.