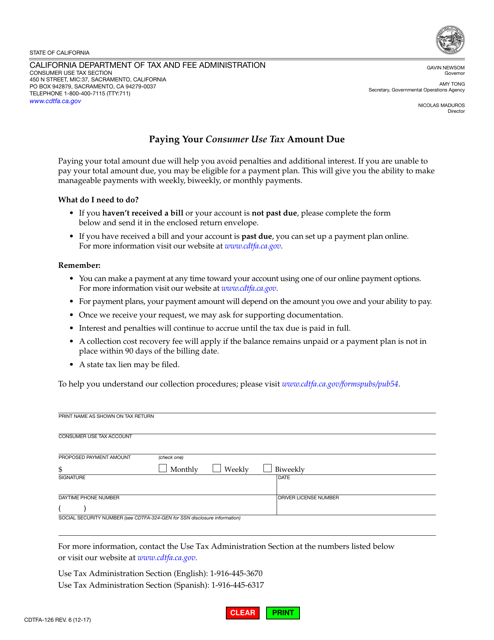

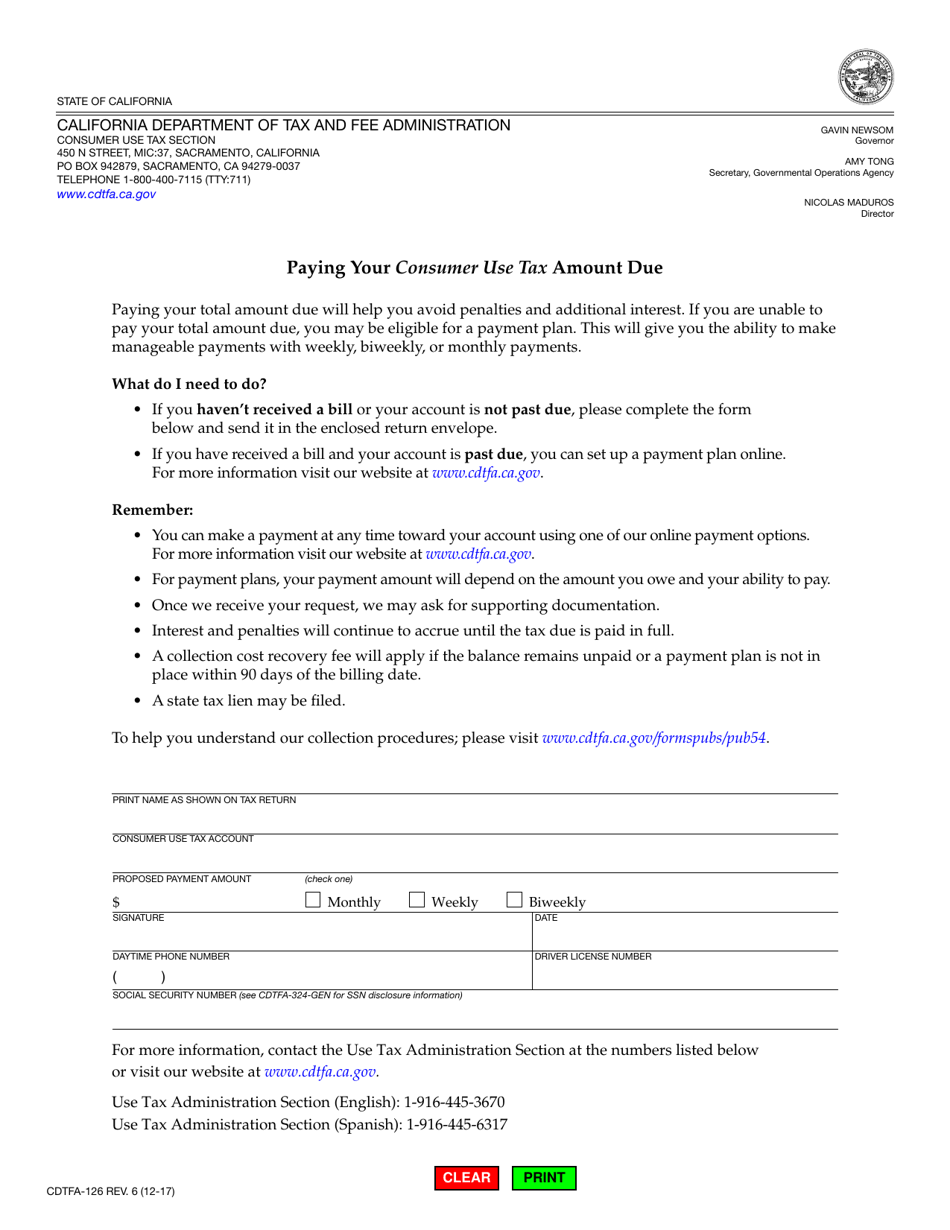

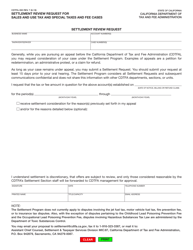

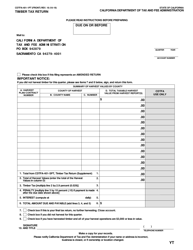

Form CDTFA-126 Paying Your Consumer Use Tax Amount Due - California

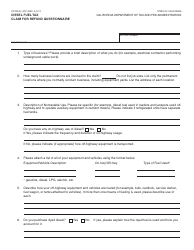

What Is Form CDTFA-126?

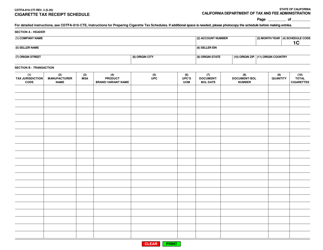

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-126?

A: Form CDTFA-126 is a form used for paying your consumer use taxamount due in California.

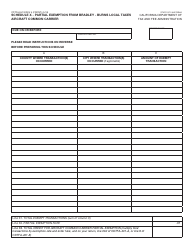

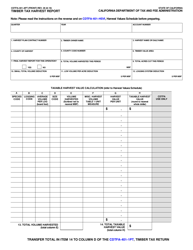

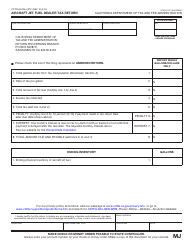

Q: What is consumer use tax?

A: Consumer use tax is a tax imposed on the use, storage, or consumption of tangible personal property in California.

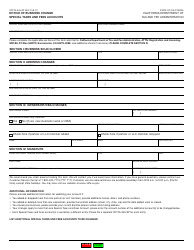

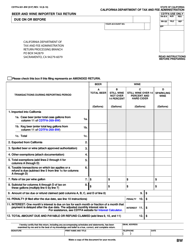

Q: How do I pay my consumer use tax amount due?

A: You can pay your consumer use tax amount due by filling out Form CDTFA-126 and following the instructions on the form.

Q: When is Form CDTFA-126 due?

A: Form CDTFA-126 is generally due on or before the last day of the month following the reporting period.

Q: Do I need to fill out Form CDTFA-126 if I don't owe any consumer use tax?

A: No, if you don't owe any consumer use tax, you do not need to fill out Form CDTFA-126.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-126 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.