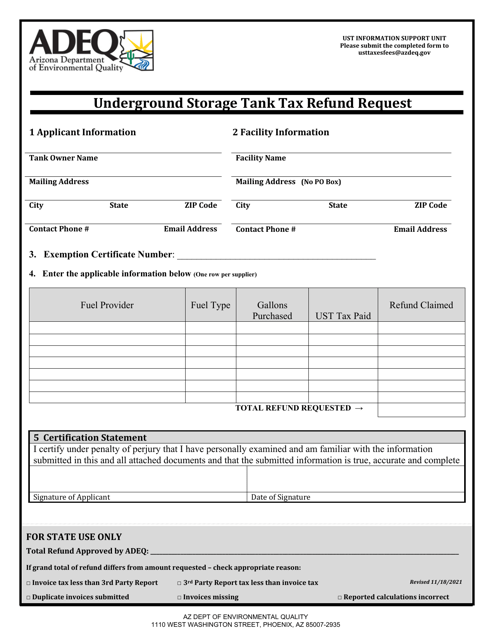

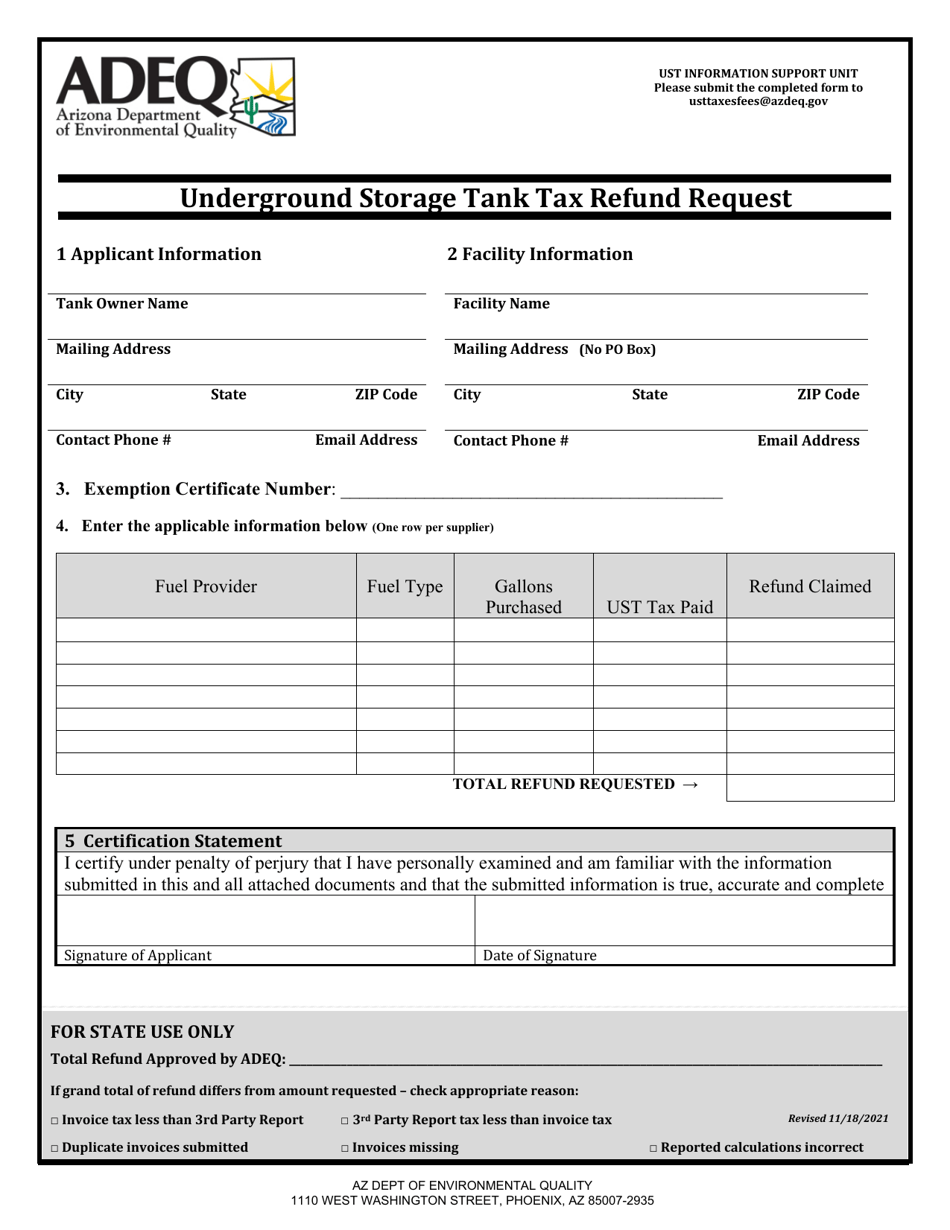

Underground Storage Tank Tax Refund Request - Arizona

Underground Storage Tank Tax Refund Request is a legal document that was released by the Arizona Department of Environmental Quality - a government authority operating within Arizona.

FAQ

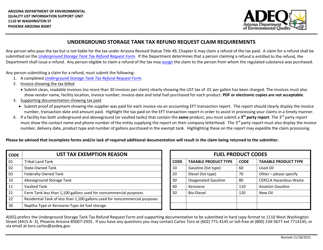

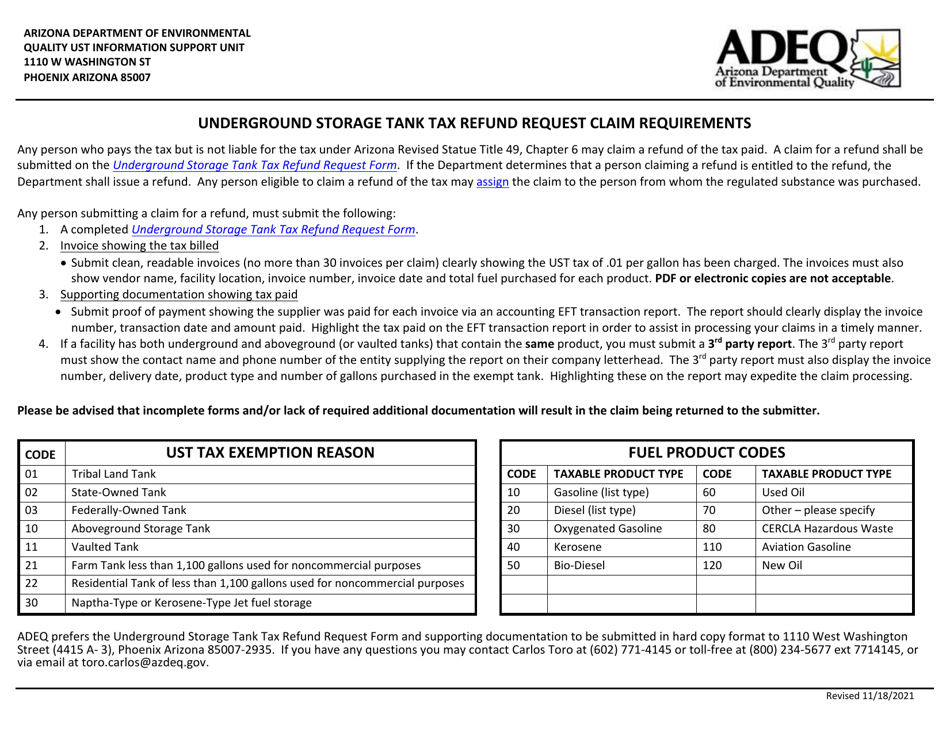

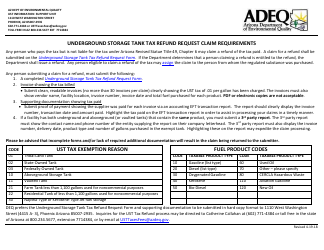

Q: What is an Underground Storage Tank Tax?

A: The Underground Storage Tank Tax is a tax imposed on the sale of motor fuels in Arizona, which is collected to fund the cleanup of underground storage tank leaks and spills.

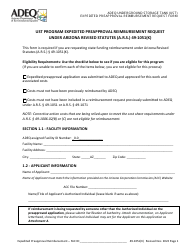

Q: Who is eligible for a refund of the Underground Storage Tank Tax?

A: Owners and operators of underground storage tanks who have paid the tax are eligible for a refund if they meet certain criteria.

Q: What are the criteria to qualify for a refund?

A: To qualify for a refund of the Underground Storage Tank Tax, the owner/operator must have paid the tax, the tank must be in compliance with applicable regulations, and the owner/operator must have proof of cleanup and closure.

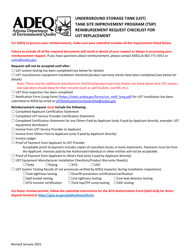

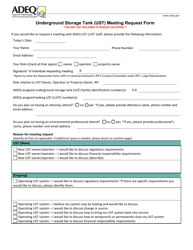

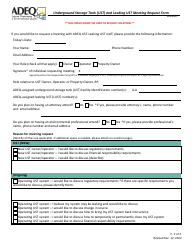

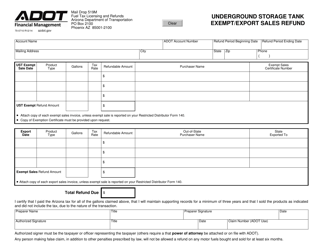

Q: How can I request a refund of the Underground Storage Tank Tax?

A: To request a refund of the Underground Storage Tank Tax in Arizona, owners/operators must complete and submit the Underground Storage Tank Refund Request Form to the Arizona Department of Revenue.

Q: What documentation is required for the refund request?

A: The refund request must include proof of payment of the tax, proof of compliance with regulations, and documentation showing the cleanup and closure of the underground storage tank.

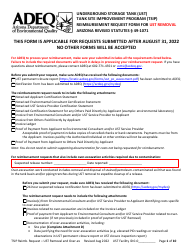

Q: Is there a deadline to submit the refund request?

A: Yes, the refund request must be submitted within three years from the date the tax was paid or within three years from the date of cleanup and closure, whichever is later.

Q: How long does it take to process the refund request?

A: The processing time for the Underground Storage Tank Tax refund request can vary, but the Arizona Department of Revenue aims to process refund requests within 90 days.

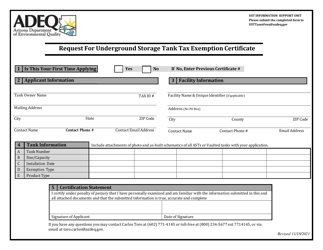

Form Details:

- Released on November 18, 2021;

- The latest edition currently provided by the Arizona Department of Environmental Quality;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Environmental Quality.