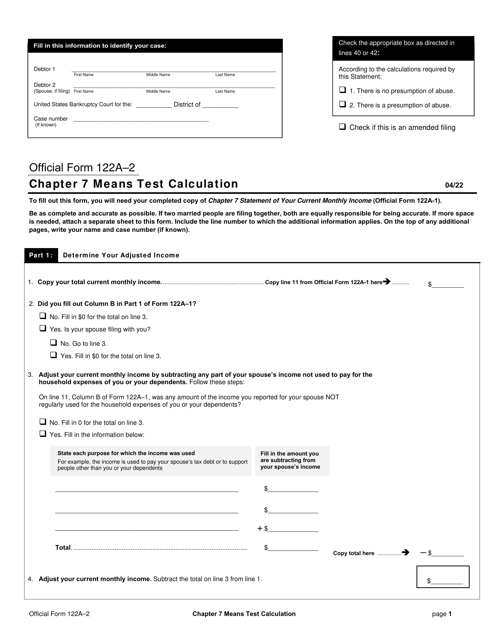

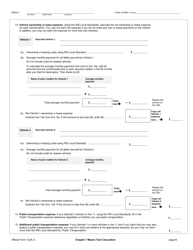

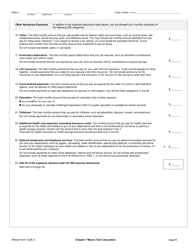

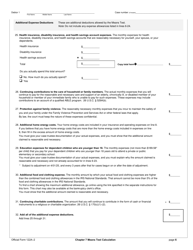

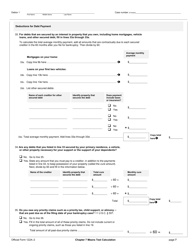

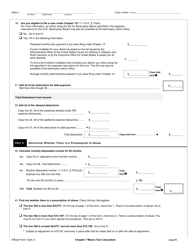

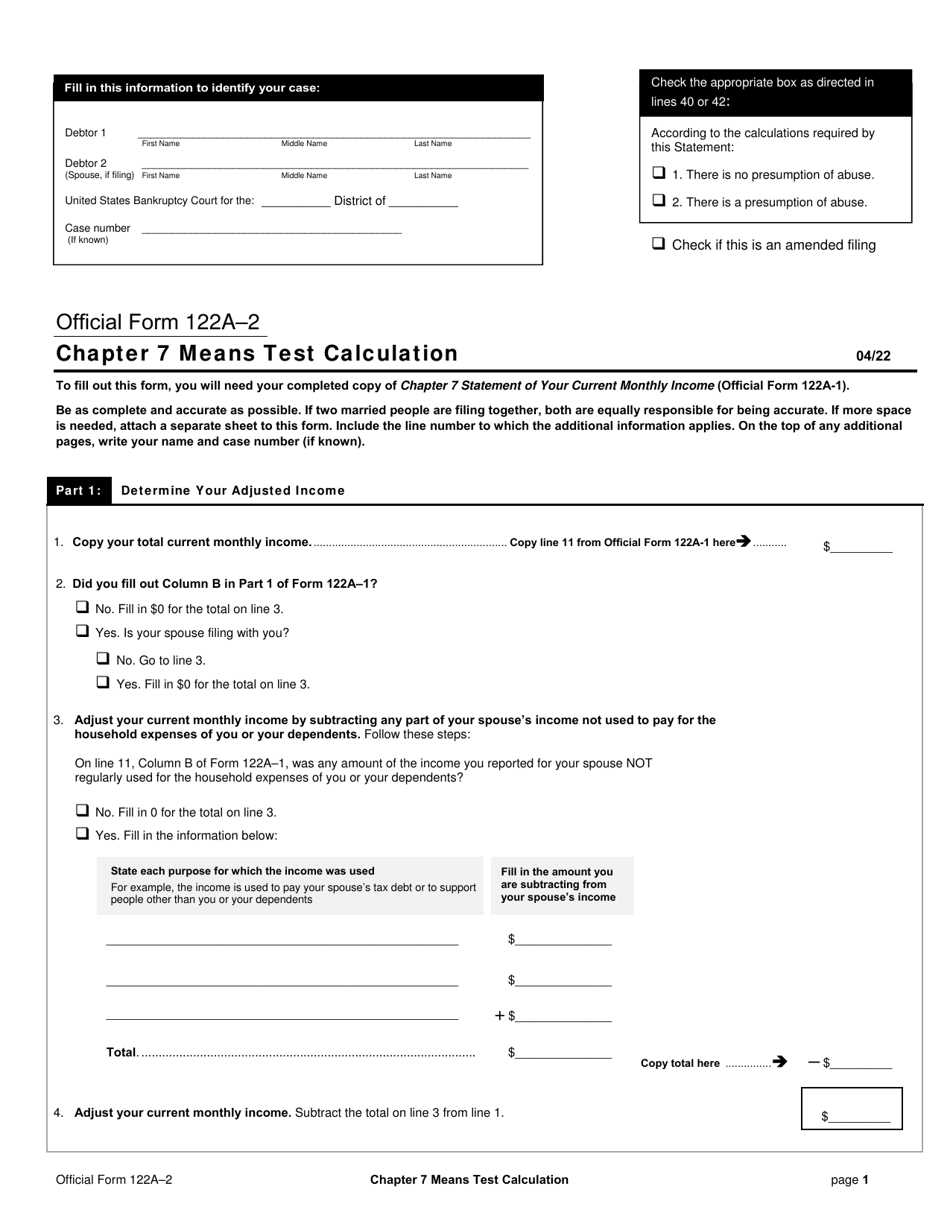

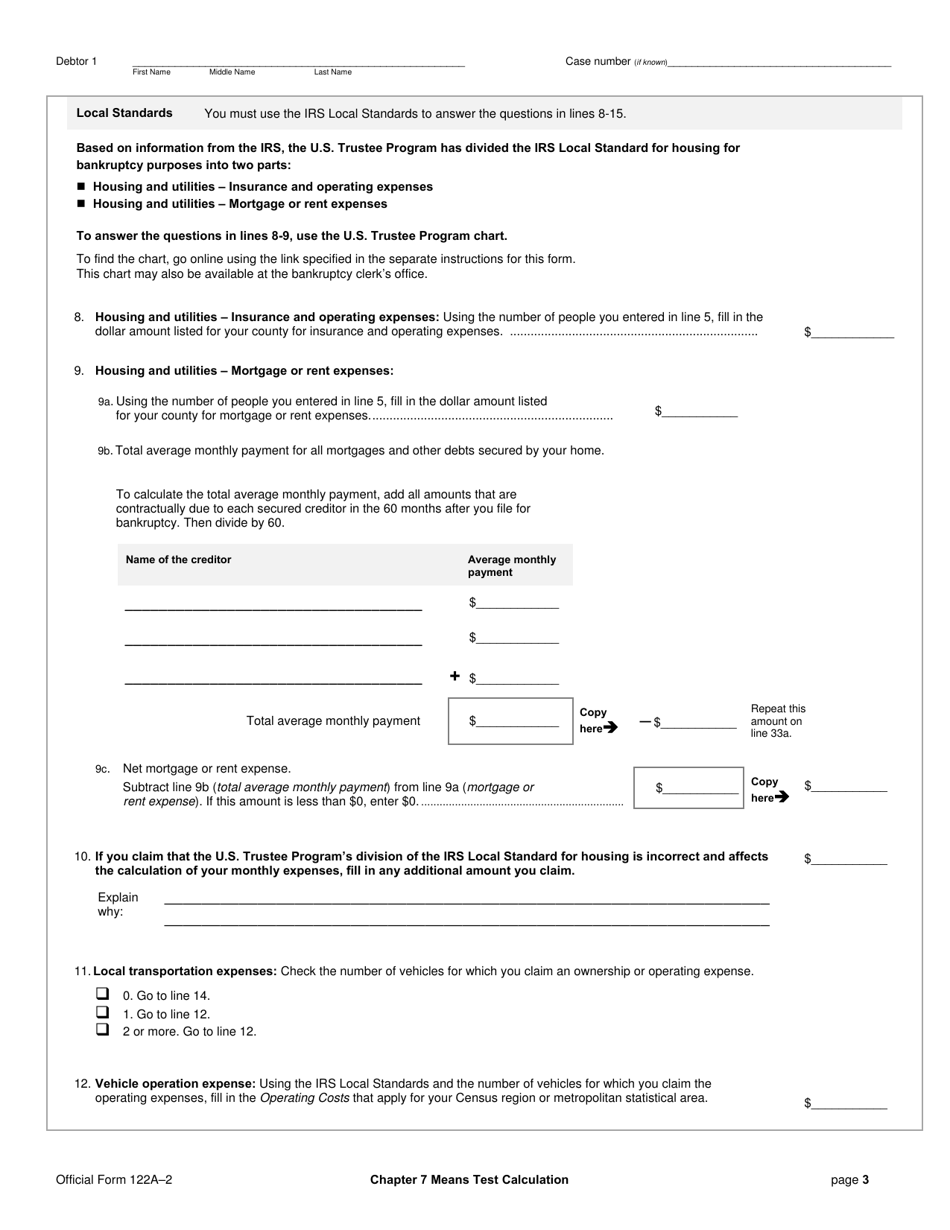

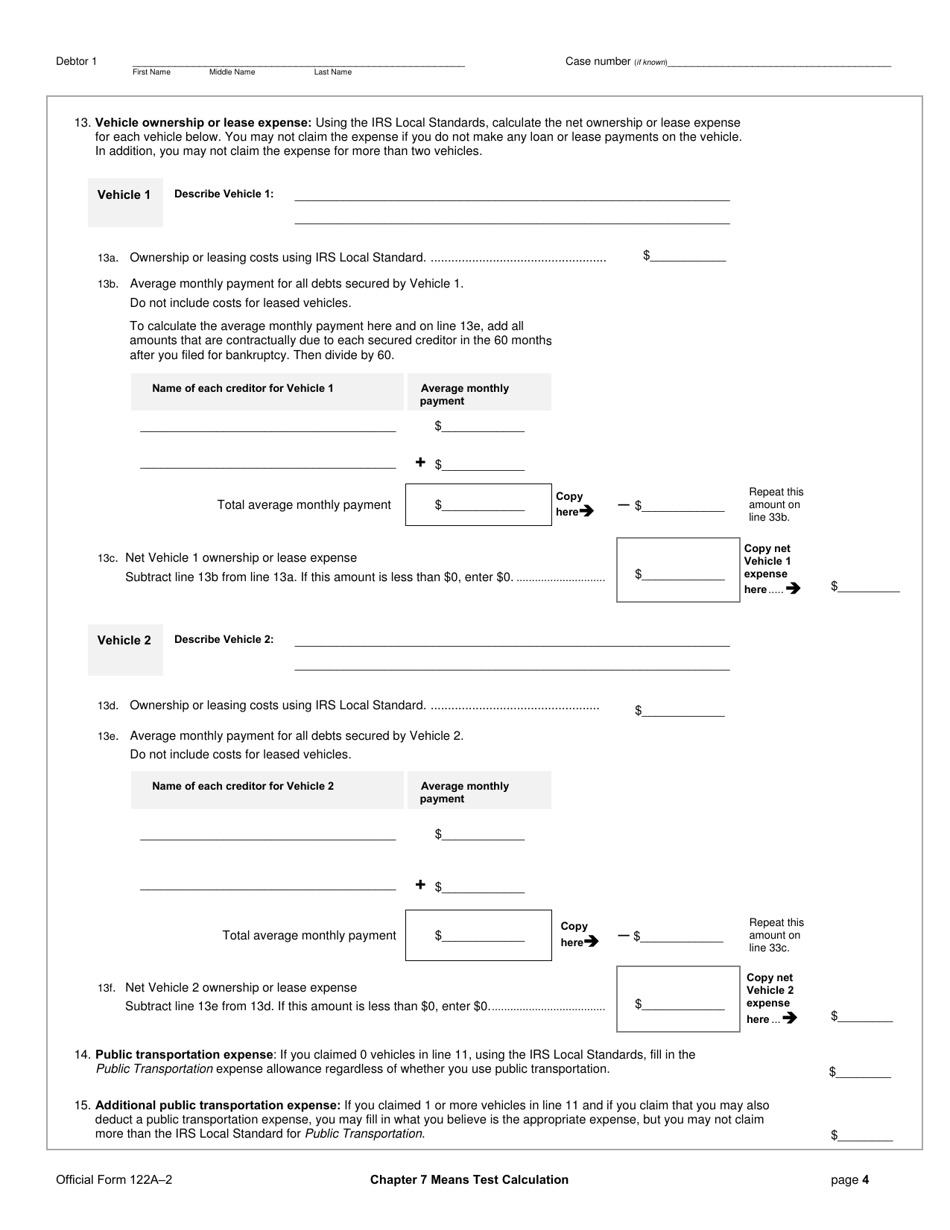

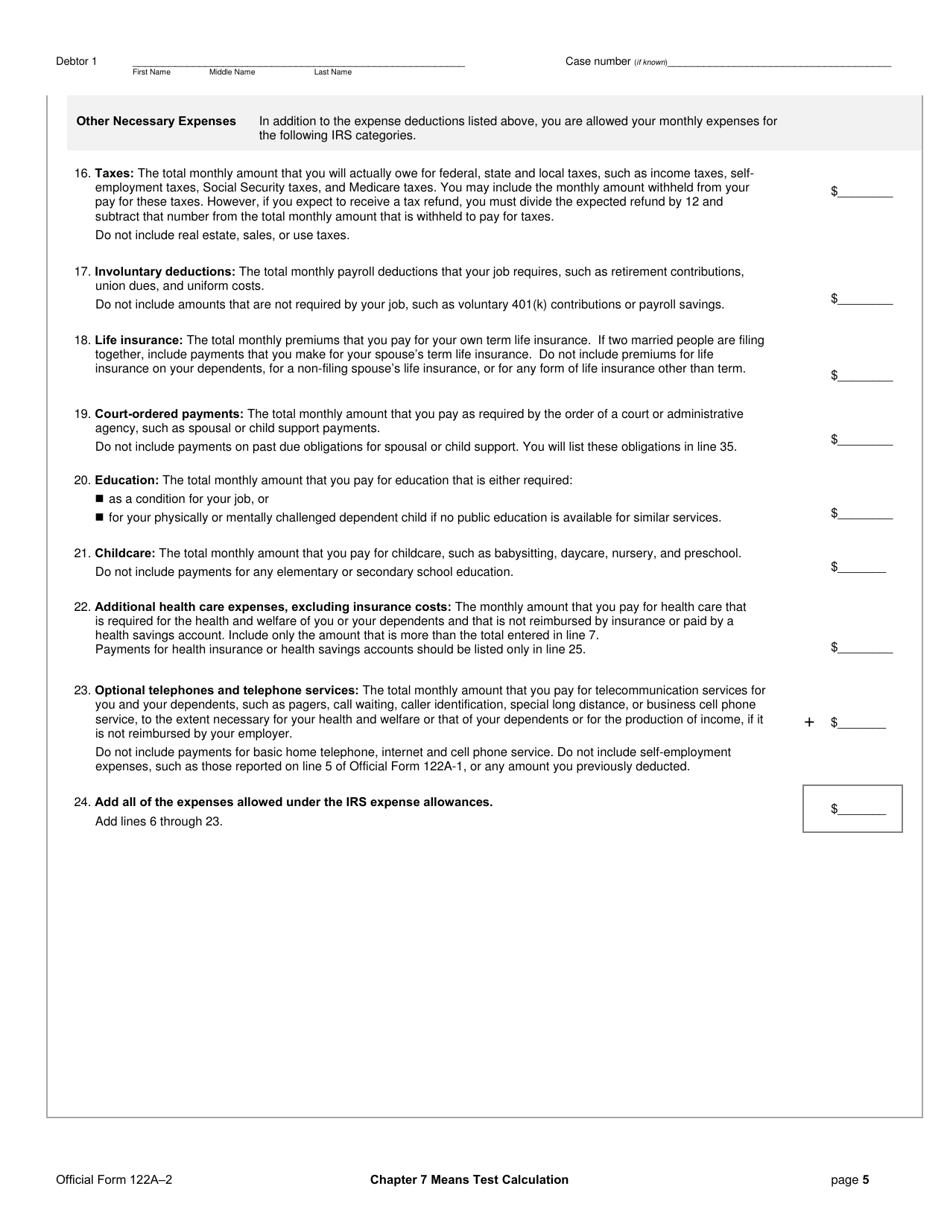

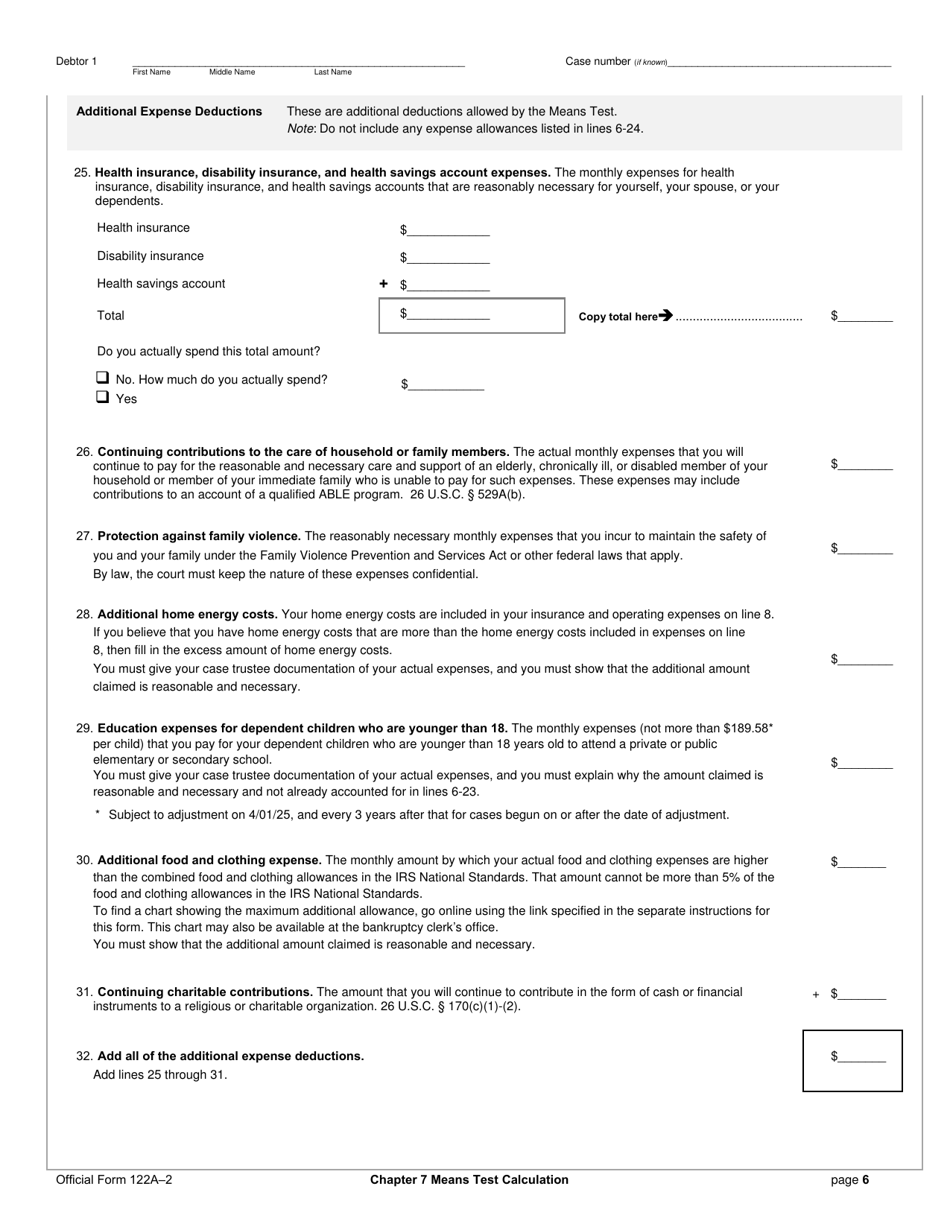

Official Form 122A-2 Chapter 7 Means Test Calculation

What Is Official Form 122A-2?

This is a legal form that was released by the United States Bankruptcy Court on April 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 122A-2?

A: Form 122A-2 is an official form used for the Chapter 7 Means Test calculation.

Q: What is the Chapter 7 Means Test?

A: The Chapter 7 Means Test is used to determine if a person qualifies for Chapter 7 bankruptcy.

Q: Who needs to complete Form 122A-2?

A: Anyone filing for Chapter 7 bankruptcy needs to complete Form 122A-2.

Q: What is the purpose of Form 122A-2?

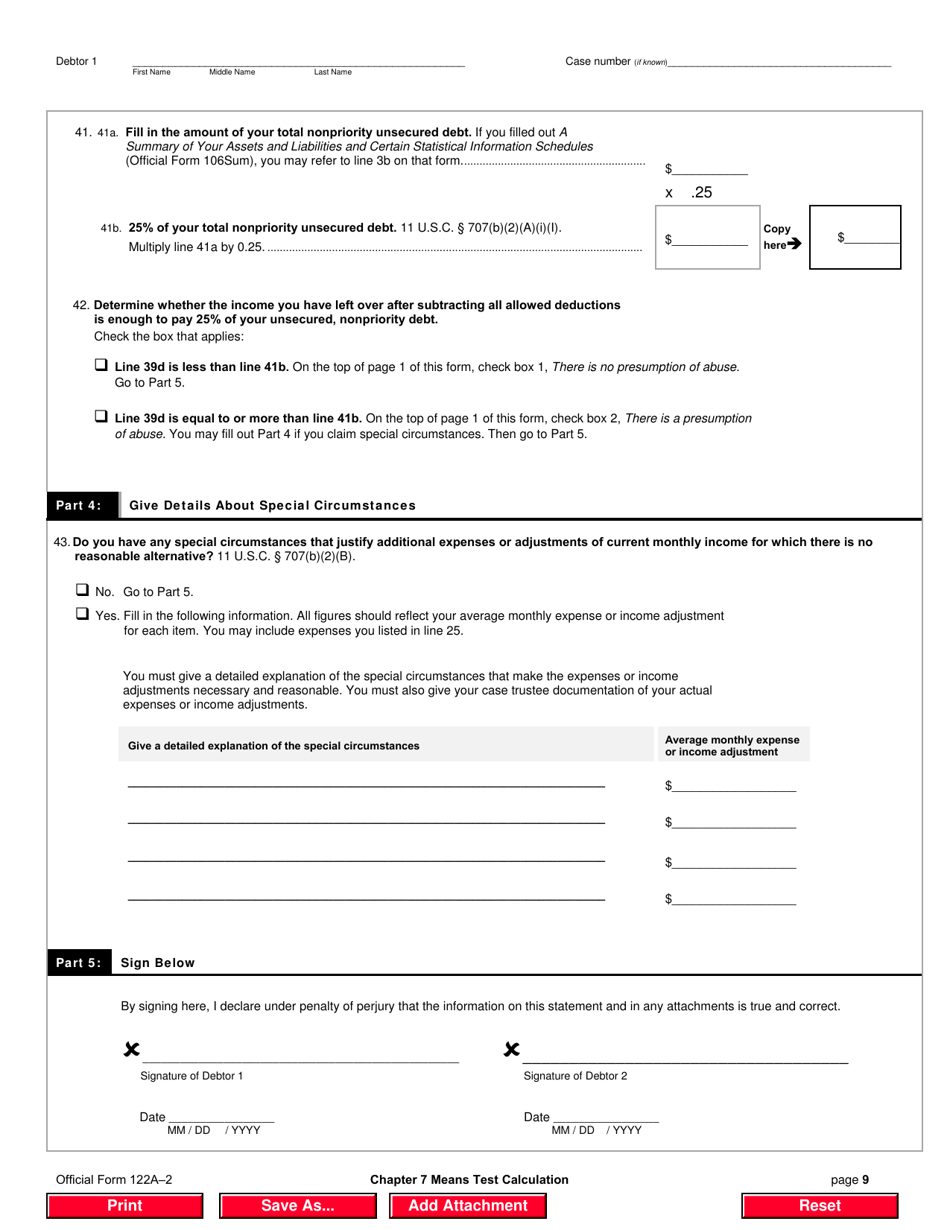

A: The purpose of Form 122A-2 is to assess a person's income and expenses to determine their eligibility for Chapter 7 bankruptcy.

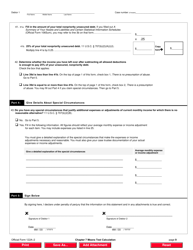

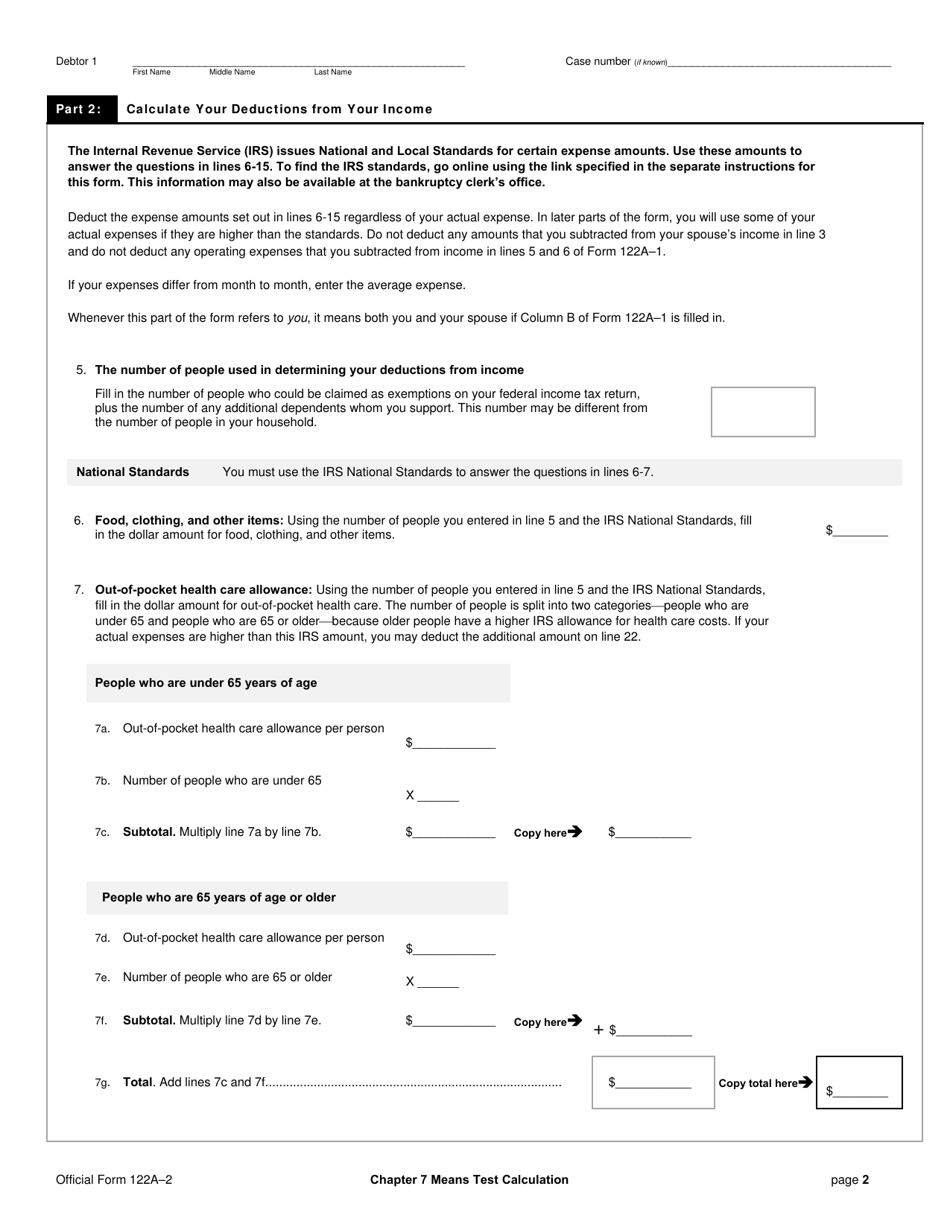

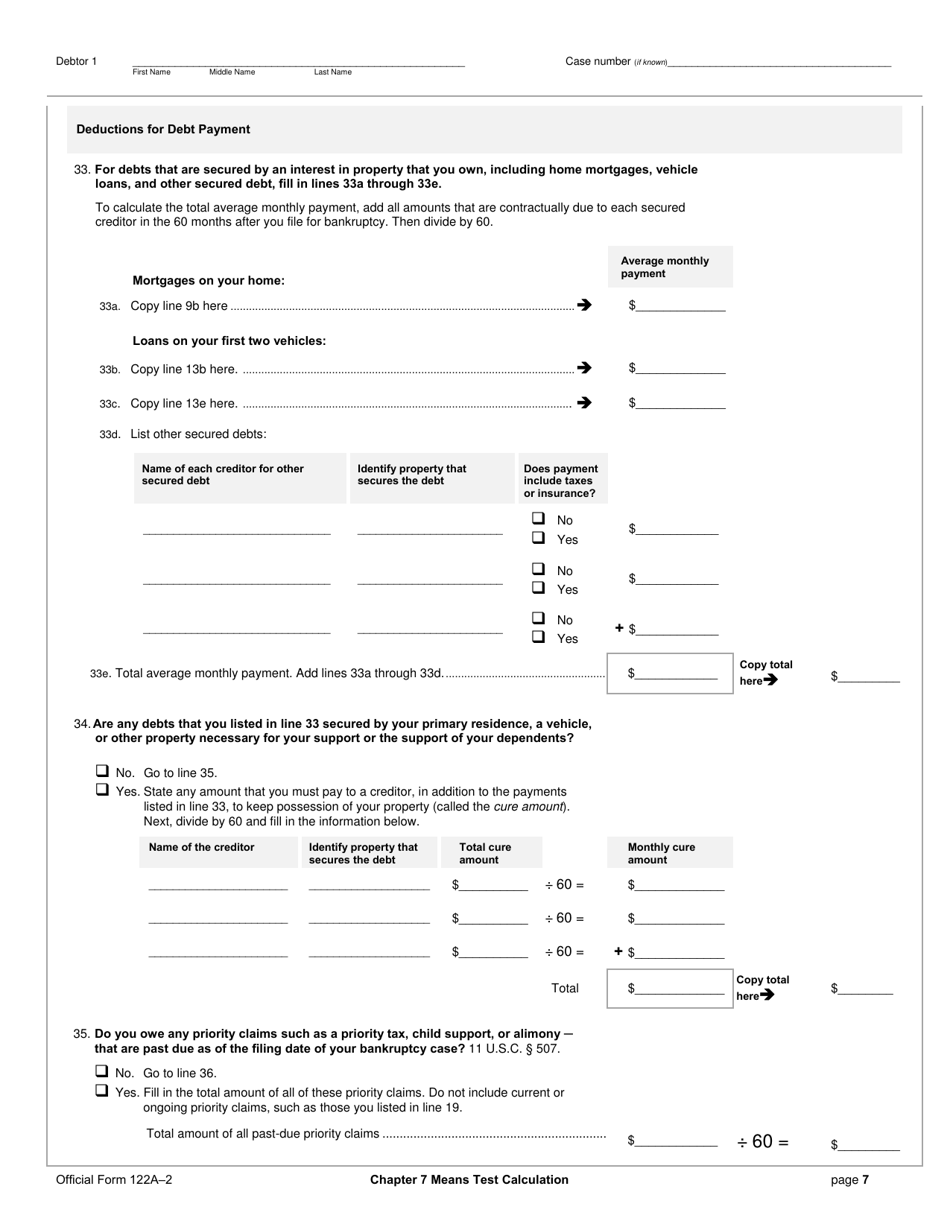

Q: What information is required for Form 122A-2?

A: Form 122A-2 requires information about a person's income, expenses, and certain deductions.

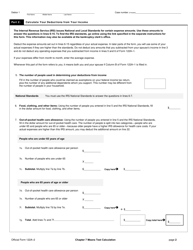

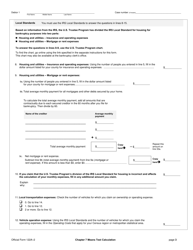

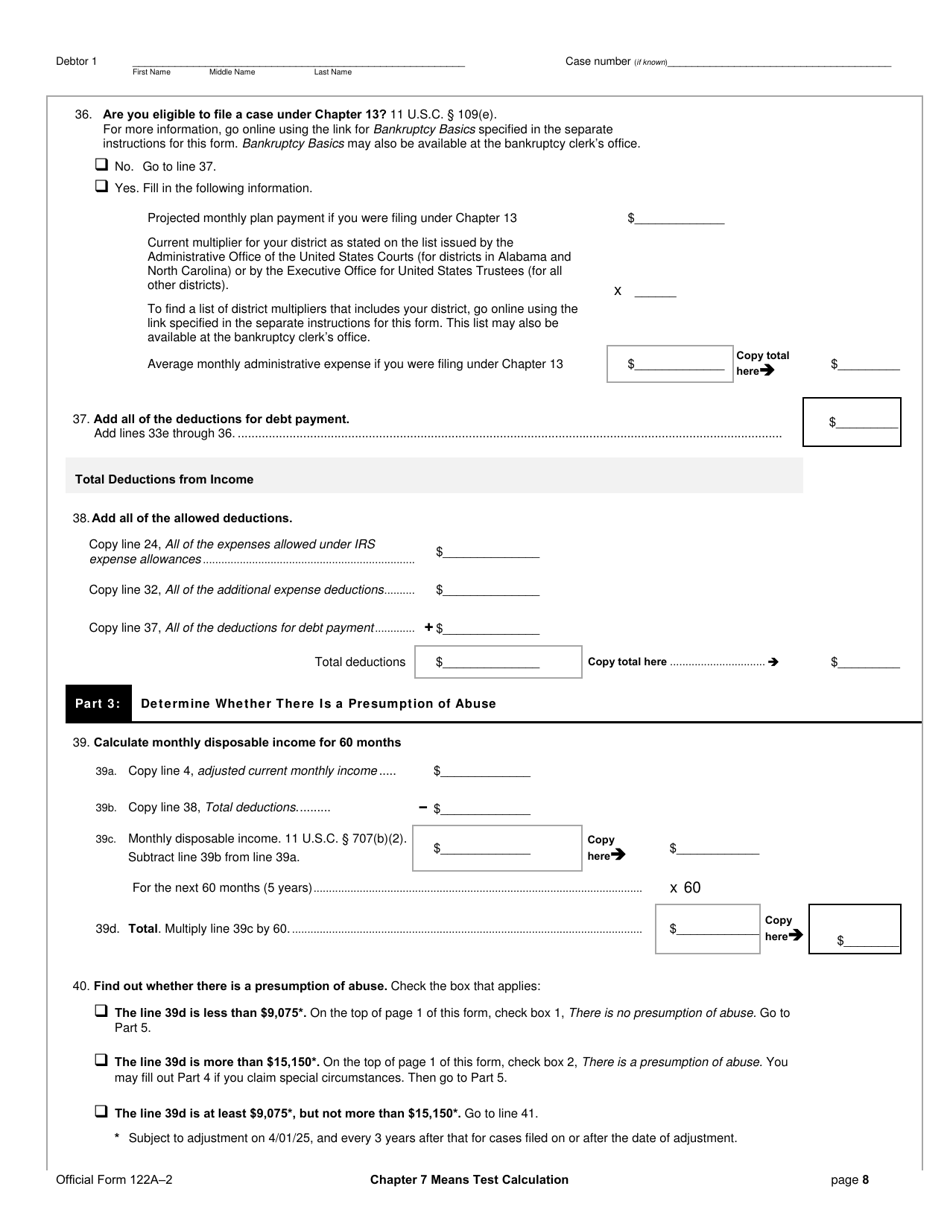

Q: How is the Chapter 7 Means Test calculation performed?

A: The Chapter 7 Means Test calculation is performed by subtracting certain allowable expenses from a person's average monthly income to determine their disposable income.

Q: What happens if a person's disposable income is below a certain threshold?

A: If a person's disposable income is below a certain threshold, they may qualify for Chapter 7 bankruptcy.

Q: What happens if a person's disposable income is above a certain threshold?

A: If a person's disposable income is above a certain threshold, they may be required to file for Chapter 13 bankruptcy instead.

Form Details:

- Released on April 1, 2022;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Official Form 122A-2 by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.