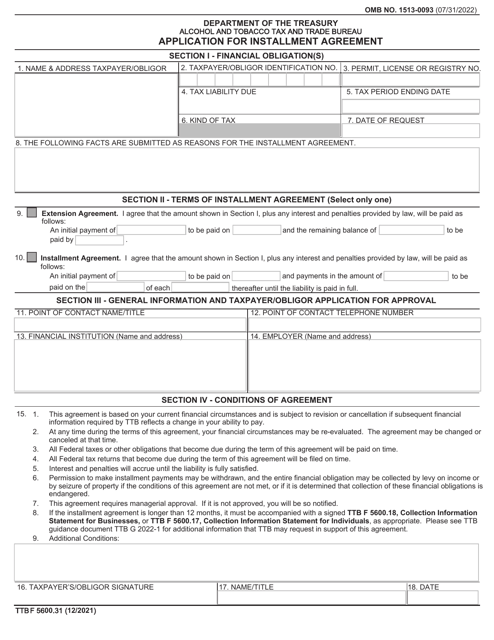

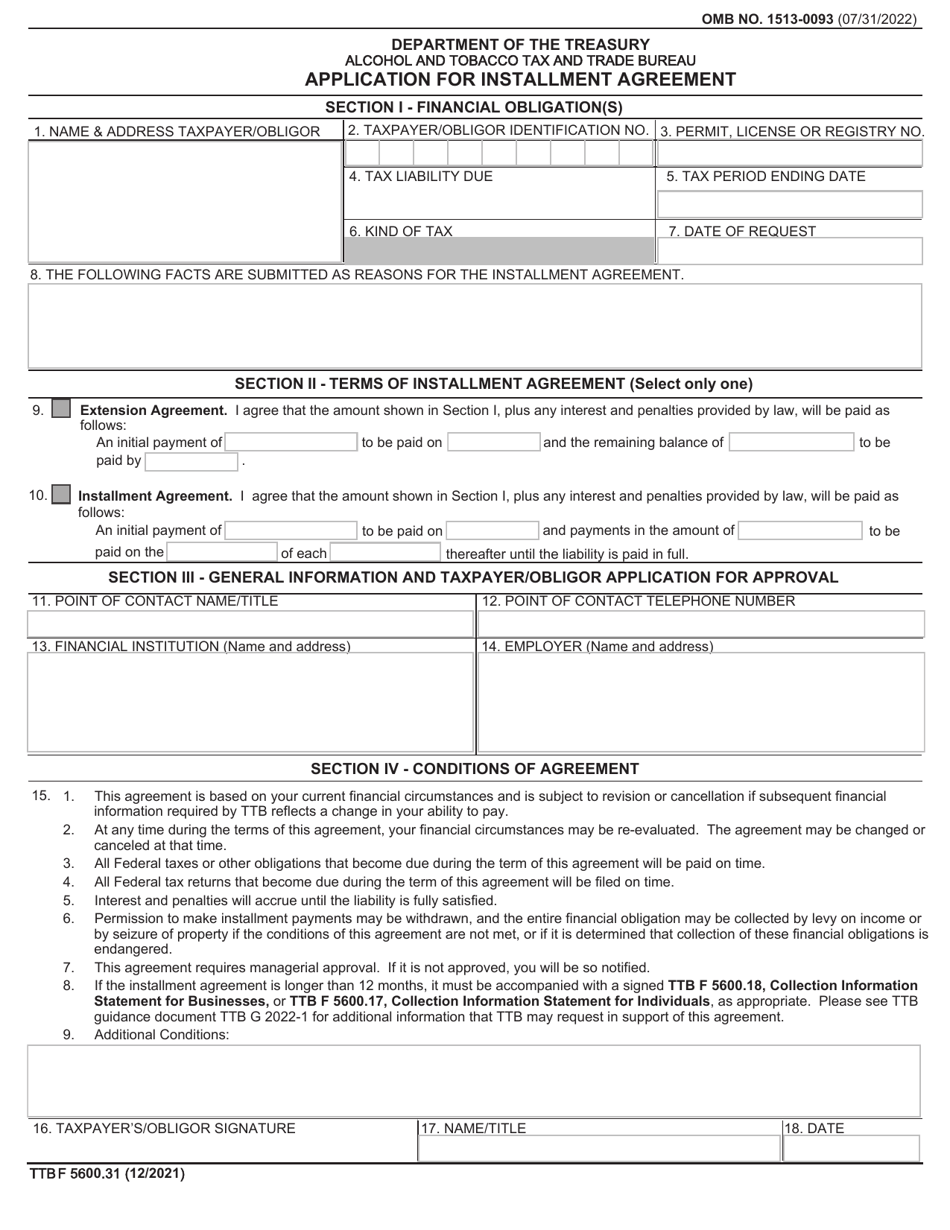

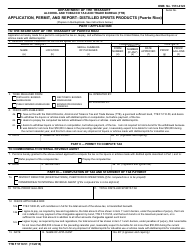

TTB Form 5600.31 Application for Installment Agreement

What Is TTB Form 5600.31?

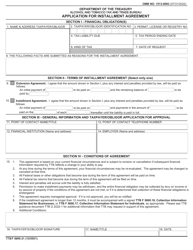

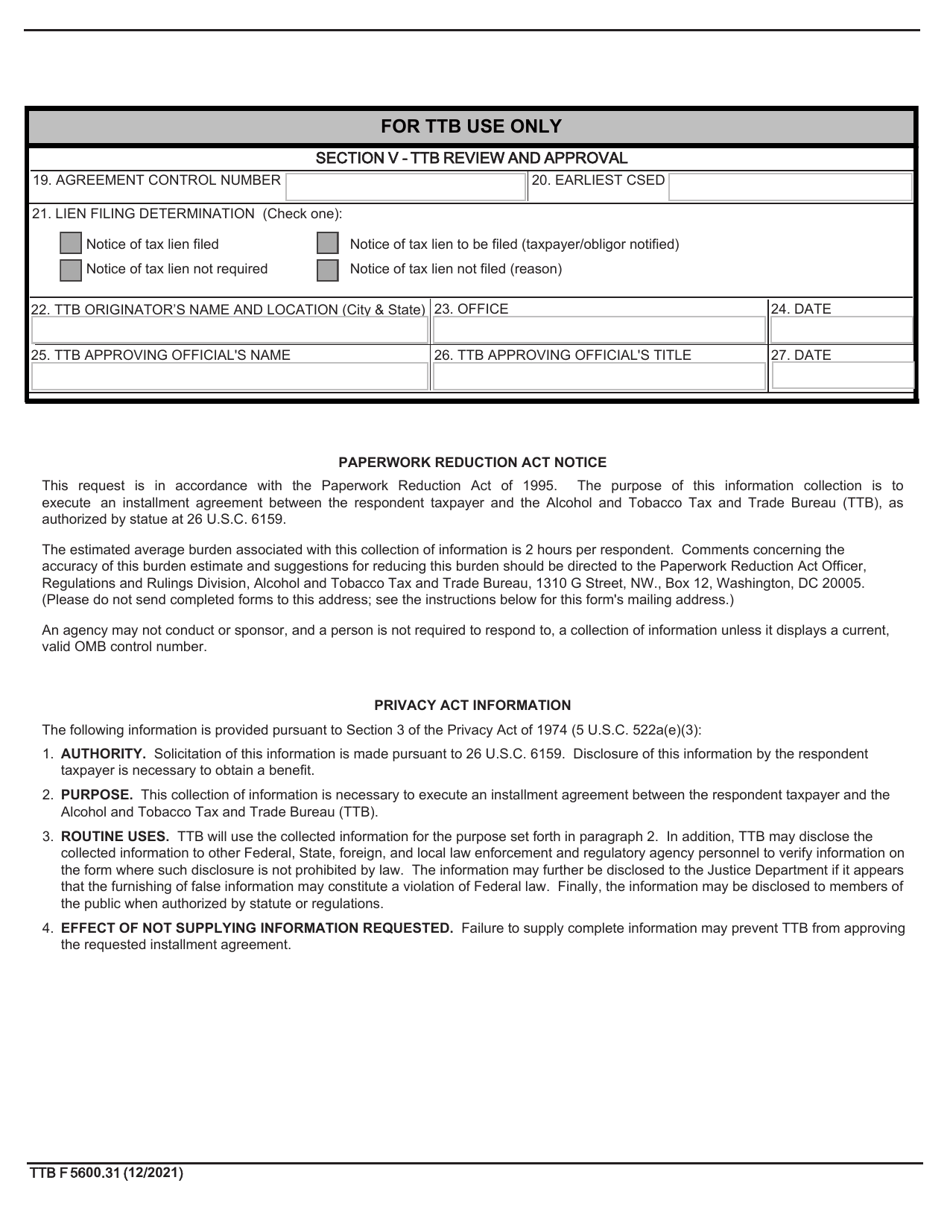

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on December 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5600.31?

A: TTB Form 5600.31 is an Application for Installment Agreement.

Q: What is an Installment Agreement?

A: An Installment Agreement is a payment plan that allows taxpayers to pay their tax liability in monthly installments.

Q: Who can use TTB Form 5600.31?

A: This form can be used by individuals, businesses, and organizations who owe taxes to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

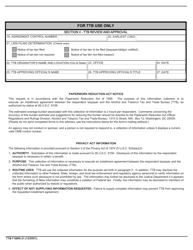

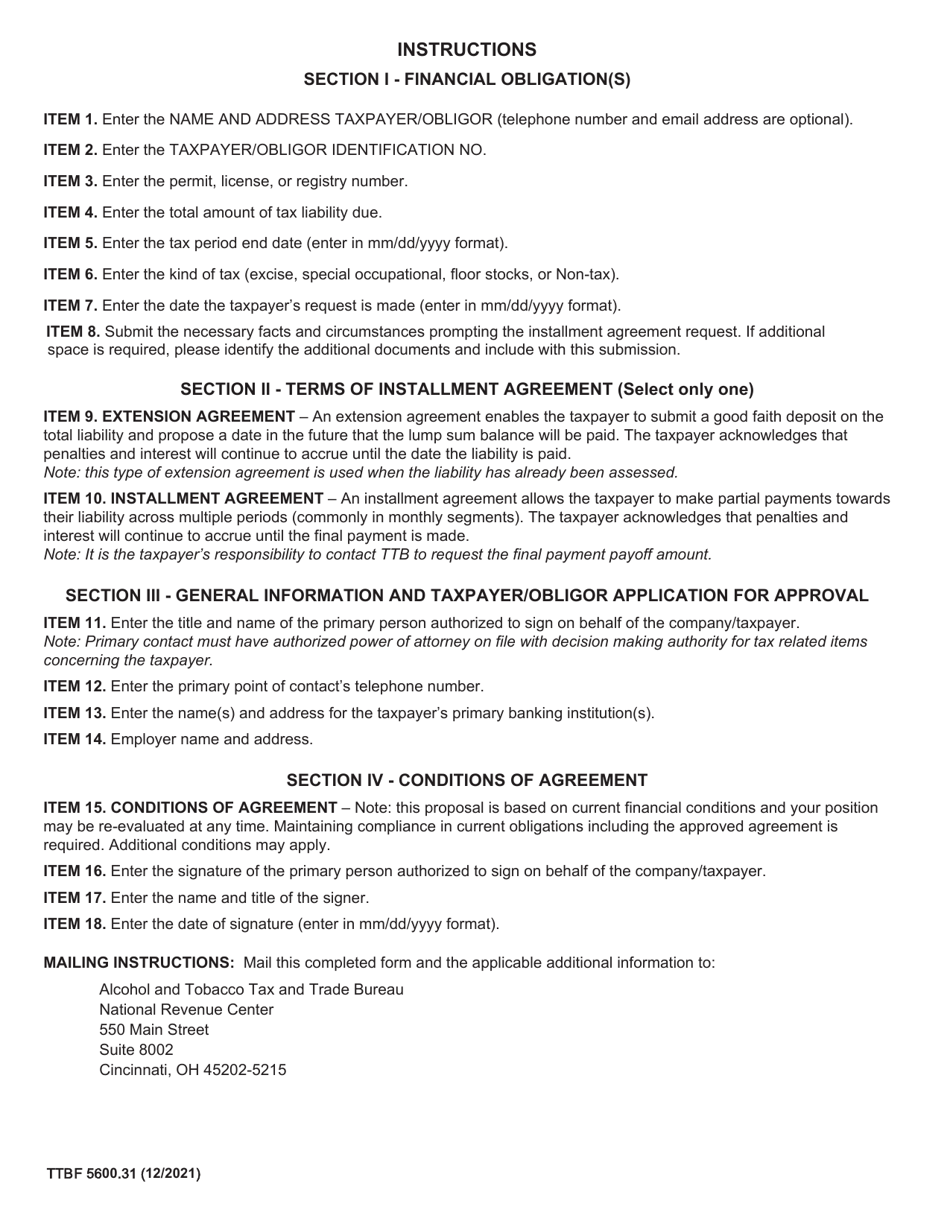

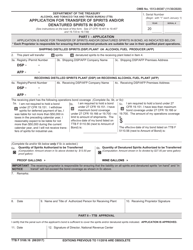

Q: What information is required on TTB Form 5600.31?

A: The form requires information such as taxpayer identification number, contact details, tax periods for which the liability exists, proposed installment payment amount, and financial information.

Q: Is there a fee to submit TTB Form 5600.31?

A: No, there is no fee to submit this form.

Q: What happens after I submit TTB Form 5600.31?

A: Once the TTB receives the form, they will review your application and determine whether to accept your proposed installment agreement.

Q: Can I modify or cancel my installment agreement?

A: Yes, you can request modifications or cancel your installment agreement by contacting the TTB.

Q: What if I can't afford the proposed installment payment?

A: If you cannot afford the proposed payment, you should contact the TTB to discuss alternative options.

Form Details:

- Released on December 1, 2021;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5600.31 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.