This version of the form is not currently in use and is provided for reference only. Download this version of

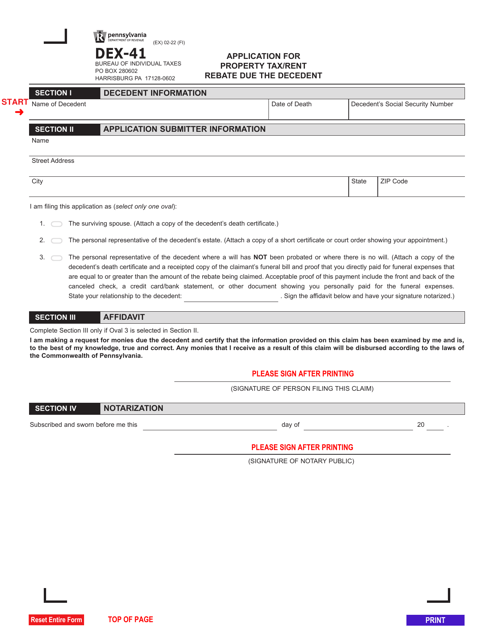

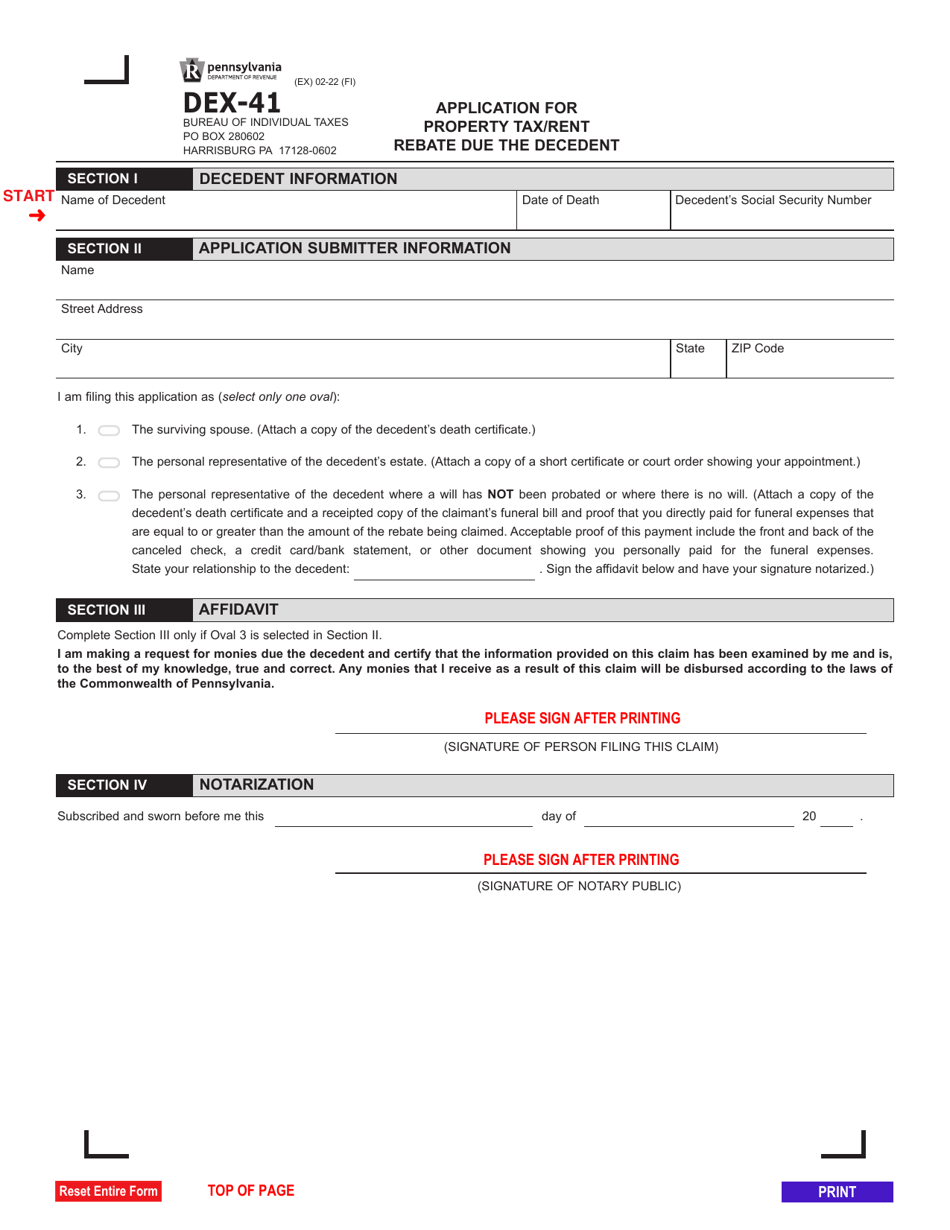

Form DEX-41

for the current year.

Form DEX-41 Application for Property Tax / Rent Rebate Due the Decedent - Pennsylvania

What Is Form DEX-41?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DEX-41?

A: Form DEX-41 is an application for Property Tax/Rent Rebate Due the Decedent in Pennsylvania.

Q: What is the purpose of Form DEX-41?

A: The purpose of Form DEX-41 is to apply for a property tax/rent rebate on behalf of a deceased individual.

Q: Who can use Form DEX-41?

A: Form DEX-41 can be used by individuals who are applying for the property tax/rent rebate on behalf of a deceased person in Pennsylvania.

Q: What information is required on Form DEX-41?

A: Form DEX-41 requires information such as the decedent's name, social security number, date of death, and details about their property or rent payments.

Q: When is the deadline to submit Form DEX-41?

A: The deadline to submit Form DEX-41 is generally December 31st of the year following the year in which the individual passed away.

Q: Is there a fee to submit Form DEX-41?

A: No, there is no fee to submit Form DEX-41.

Q: What should I do after completing Form DEX-41?

A: After completing Form DEX-41, you should mail it to the Pennsylvania Department of Revenue for processing.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DEX-41 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.