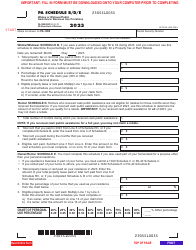

This version of the form is not currently in use and is provided for reference only. Download this version of

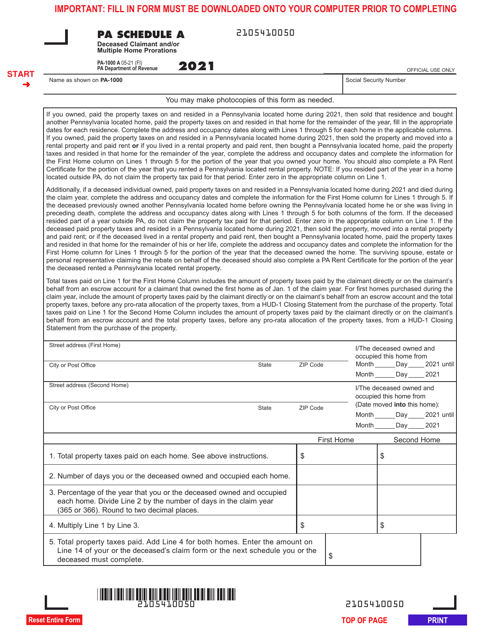

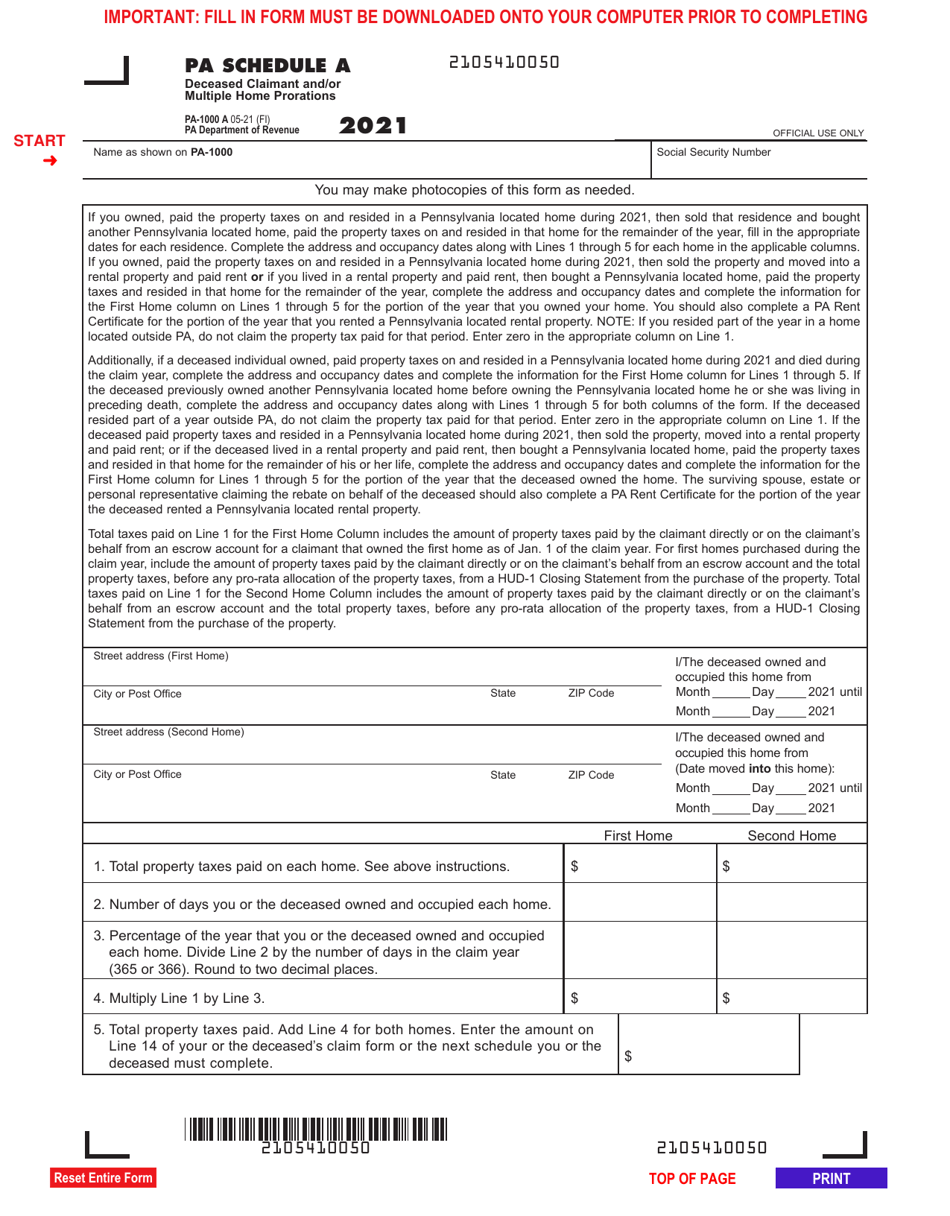

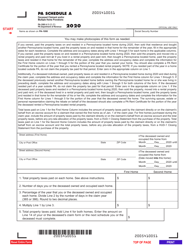

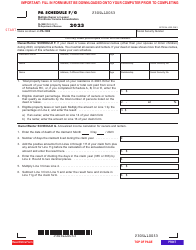

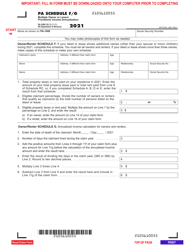

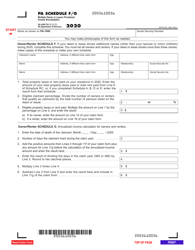

Form PA-1000 Schedule A

for the current year.

Form PA-1000 Schedule A Deceased Claimant and / or Multiple Home Prorations - Pennsylvania

What Is Form PA-1000 Schedule A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-1000, Property Tax or Rent Rebate Claim. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-1000 Schedule A?

A: Form PA-1000 Schedule A is a tax form used in Pennsylvania.

Q: What is the purpose of Form PA-1000 Schedule A?

A: Form PA-1000 Schedule A is used to claim the deceased claimant and/or multiple home prorations in Pennsylvania.

Q: Who should use Form PA-1000 Schedule A?

A: Form PA-1000 Schedule A should be used by individuals who need to claim the deceased claimant and/or multiple home prorations in Pennsylvania.

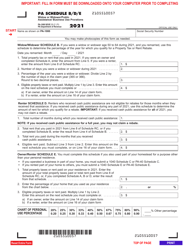

Q: What is a deceased claimant proration?

A: A deceased claimant proration is a reduction in property taxes based on the portion of the tax year in which the property owner was deceased.

Q: What is a multiple home proration?

A: A multiple home proration is a reduction in property taxes for homeowners who own more than one property in Pennsylvania.

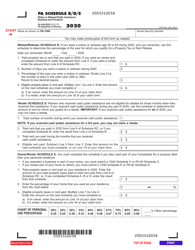

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.