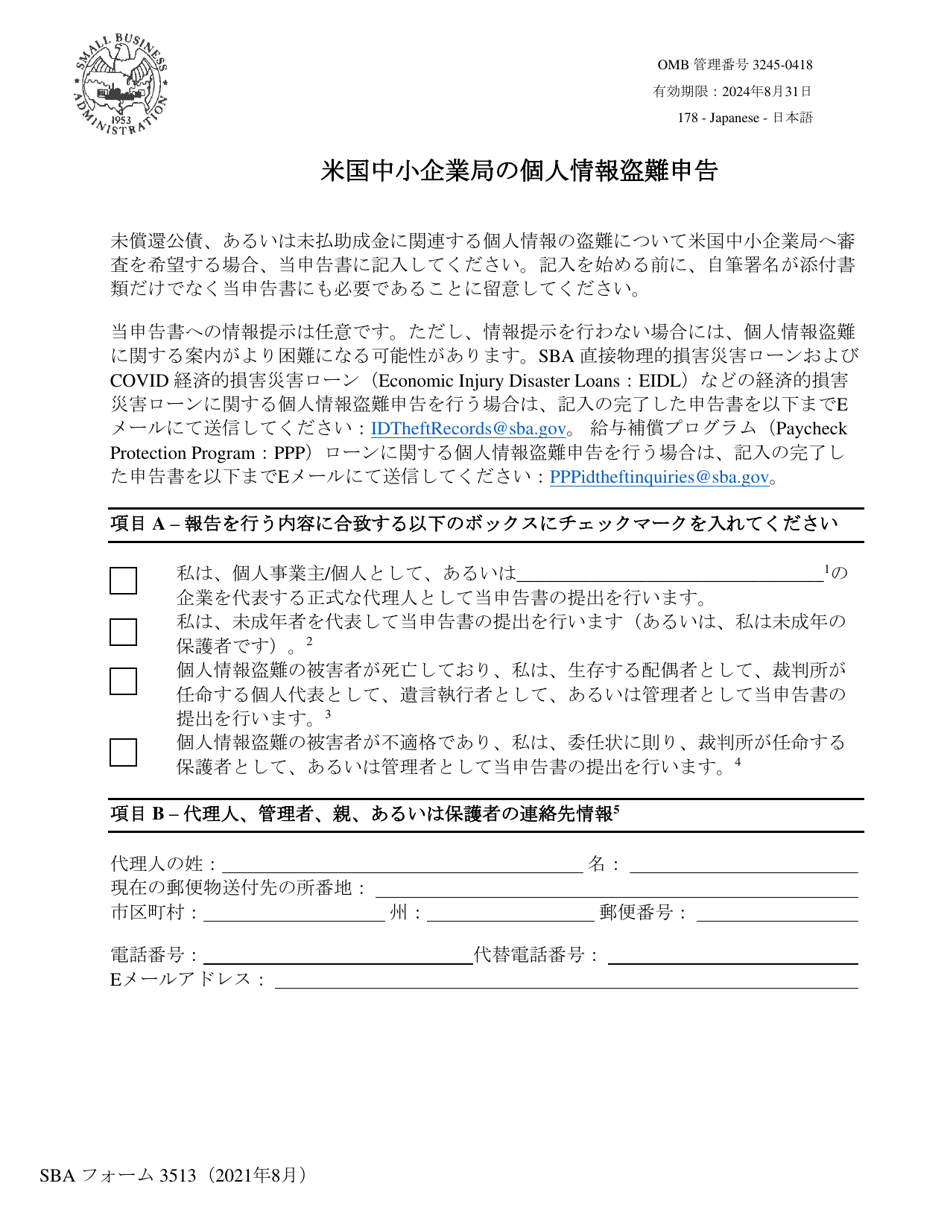

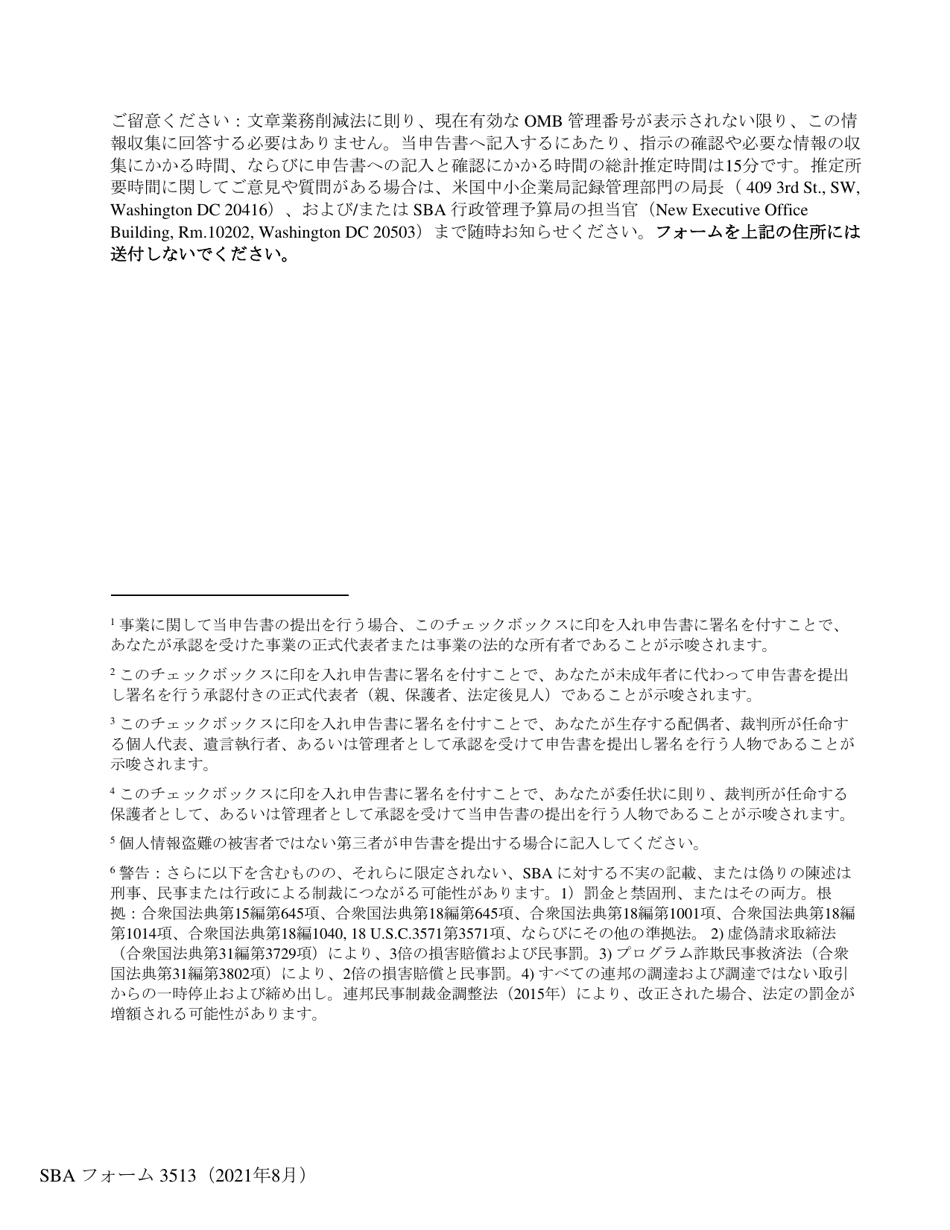

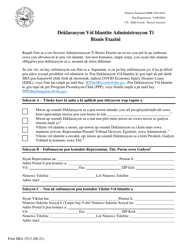

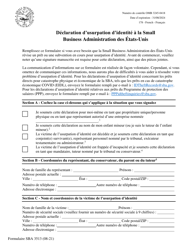

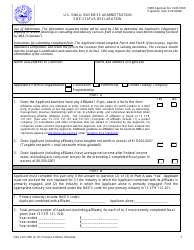

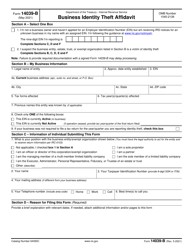

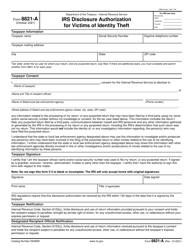

SBA Form 3513 Declaration of Identity Theft (Japanese)

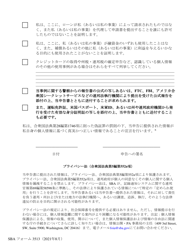

This is a legal form that was released by the U.S. Small Business Administration on August 1, 2021 and used country-wide. The document is provided in Japanese. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

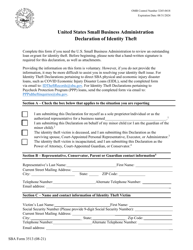

Q: What is SBA Form 3513 Declaration of Identity Theft?

A: SBA Form 3513 is a document used to report identity theft to the Small Business Administration (SBA).

Q: Why would I need to fill out SBA Form 3513?

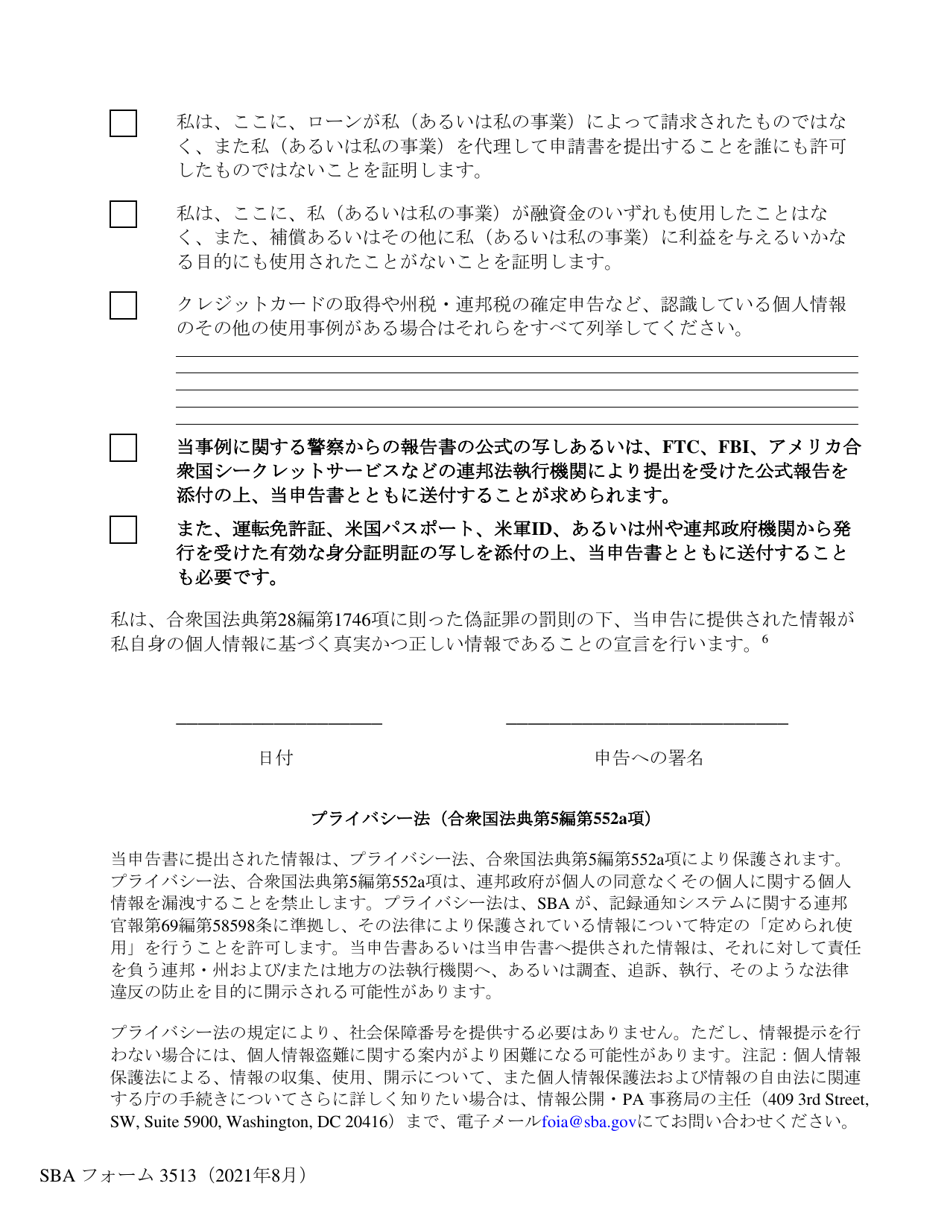

A: You would fill out SBA Form 3513 if you believe your identity has been stolen and used to commit fraud related to SBA programs or loans.

Q: Can I fill out SBA Form 3513 if I am a victim of identity theft in Japan?

A: Yes, you can fill out SBA Form 3513 if you are a victim of identity theft in Japan and this identity theft relates to SBA programs or loans.

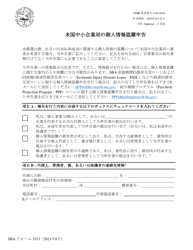

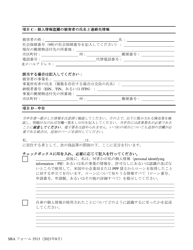

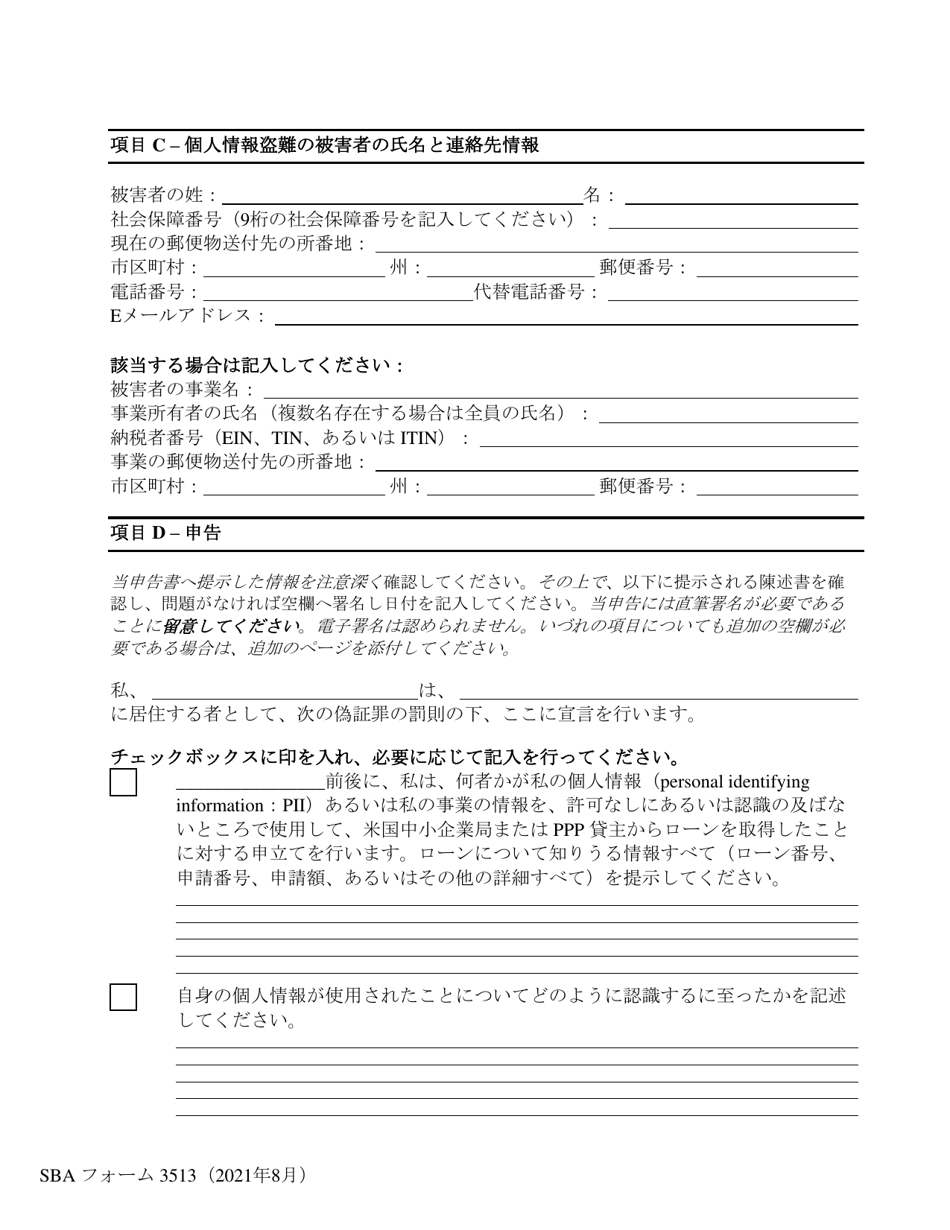

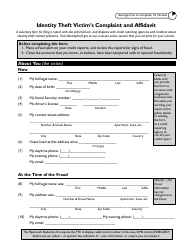

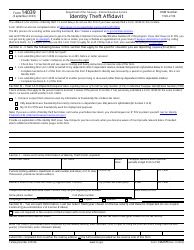

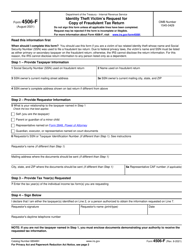

Q: What information is required on SBA Form 3513?

A: SBA Form 3513 requires information about the victim, the suspected identity thief, and details about the fraudulent activity.

Q: What happens after I submit SBA Form 3513?

A: After you submit SBA Form 3513, the SBA will review your claim and may take action to address the identity theft and prevent further fraudulent activity.

Q: Is there a deadline for submitting SBA Form 3513?

A: There is no specific deadline for submitting SBA Form 3513, but it is recommended to report identity theft as soon as possible.

Q: Can I get assistance with filling out SBA Form 3513?

A: Yes, you can seek assistance from the SBA or consult with an attorney if you need help filling out SBA Form 3513.

Form Details:

- Released on August 1, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Also available in Spanish;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

Download a printable version of SBA Form 3513 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.