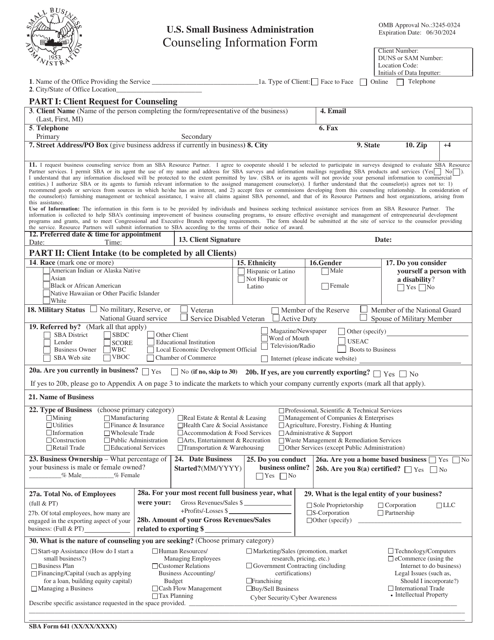

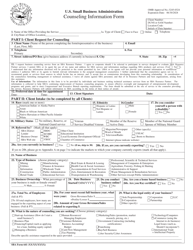

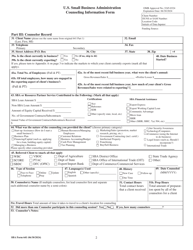

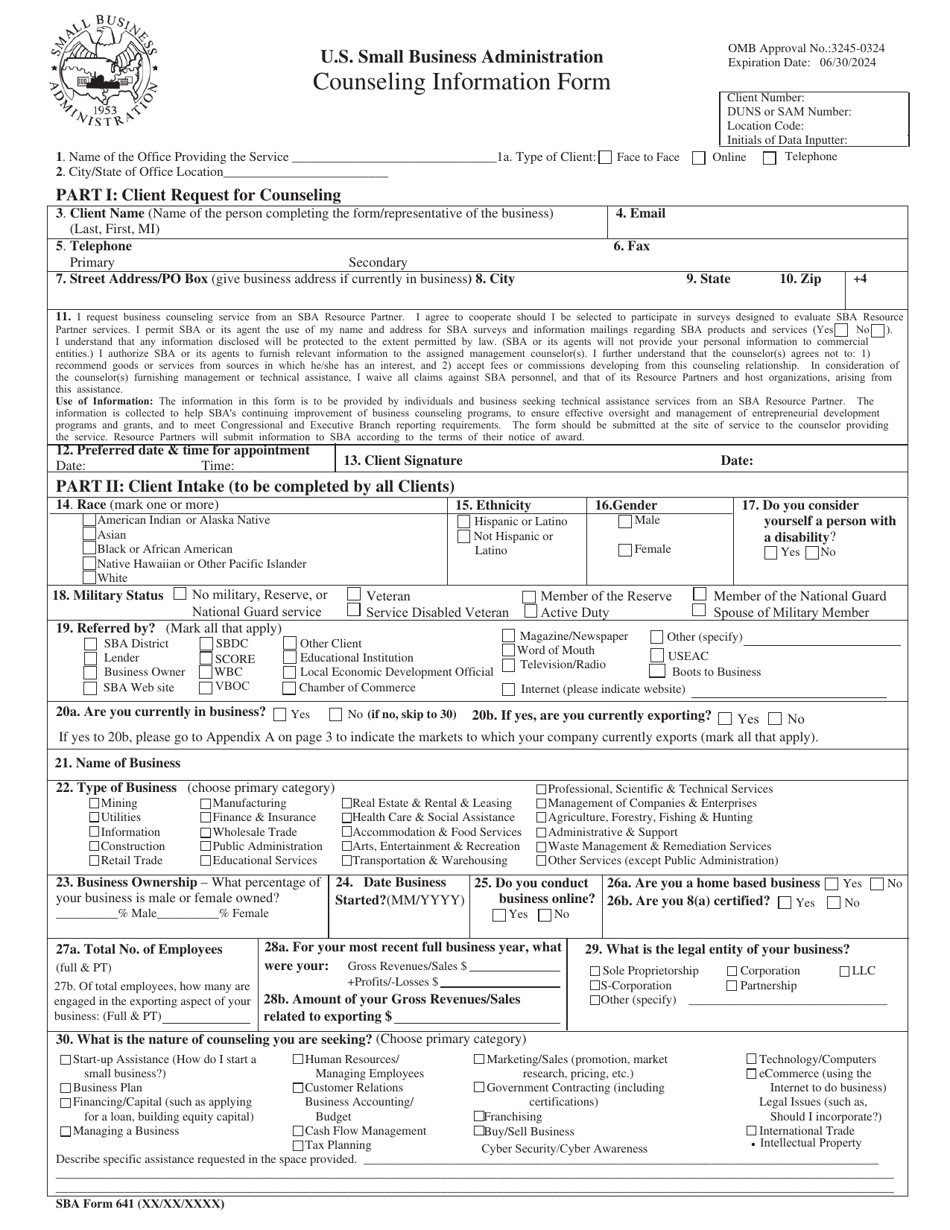

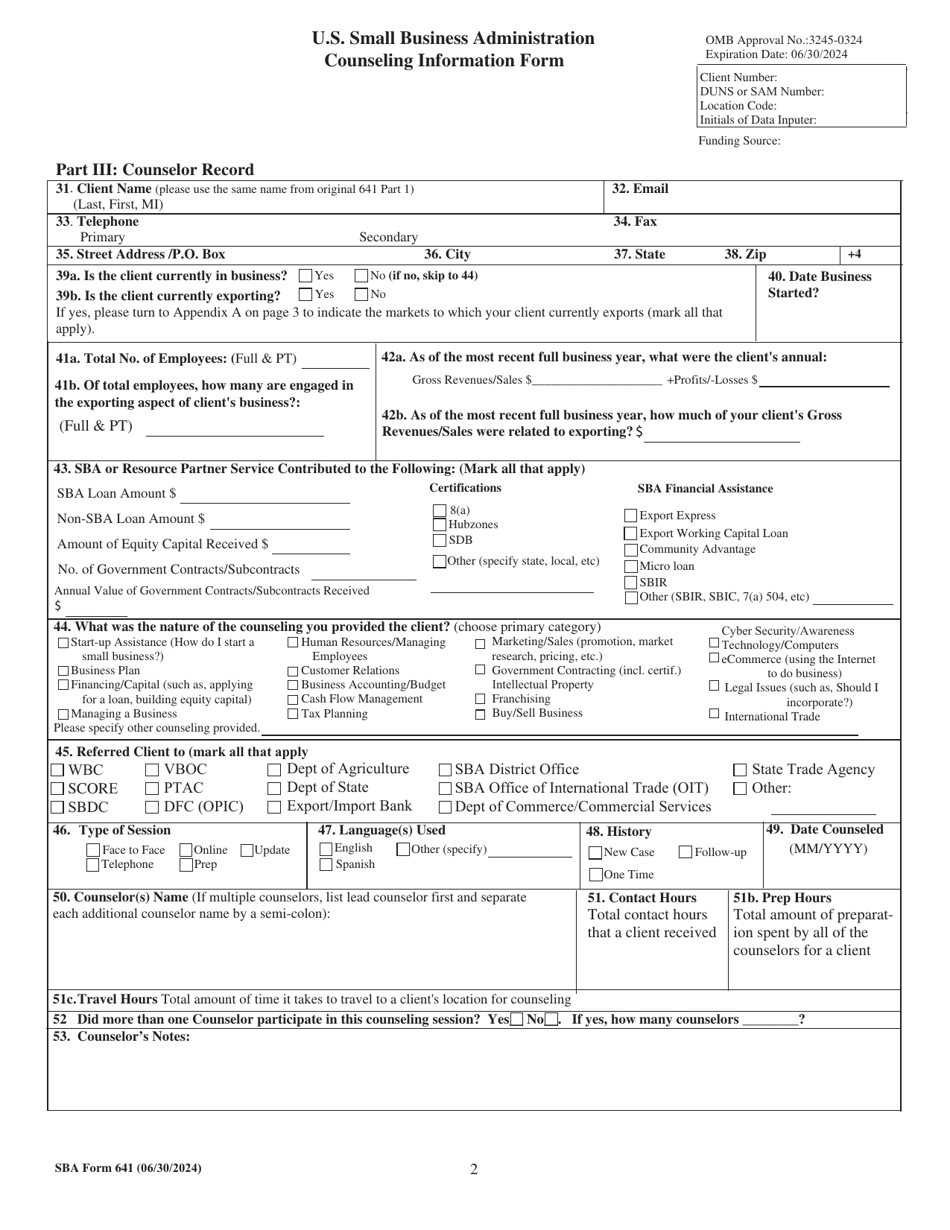

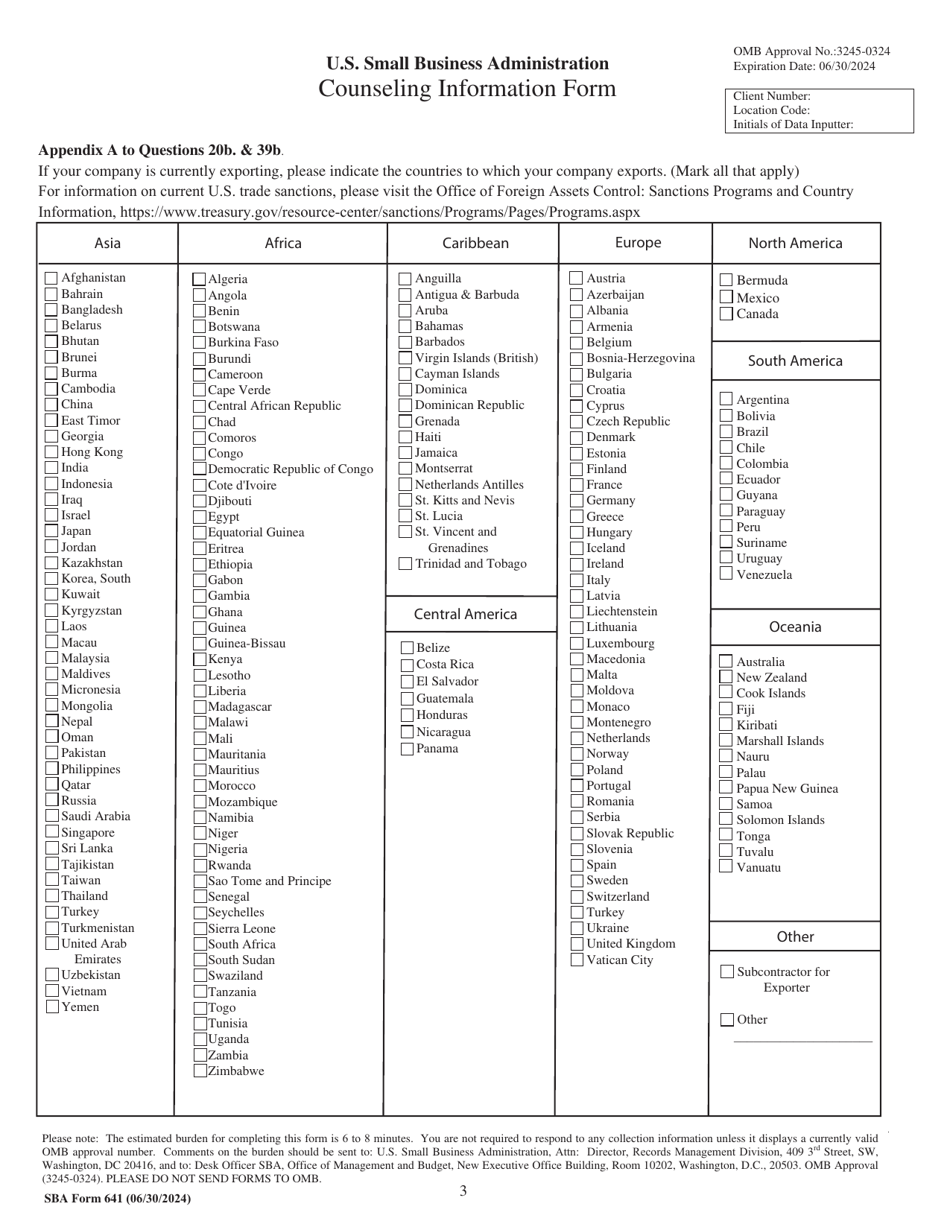

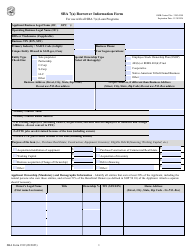

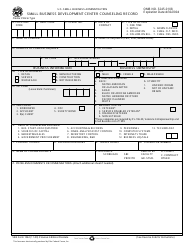

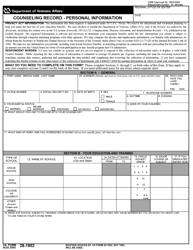

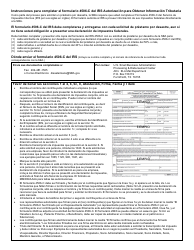

SBA Form 641 Counseling Information Form

What Is SBA Form 641?

This is a legal form that was released by the U.S. Small Business Administration and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 641?

A: SBA Form 641 is the Counseling Information Form.

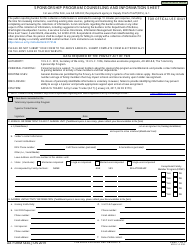

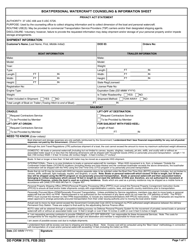

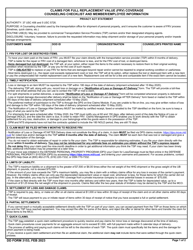

Q: What is the purpose of SBA Form 641?

A: The purpose of SBA Form 641 is to collect information for counseling sessions with the Small Business Administration (SBA).

Q: Is SBA Form 641 mandatory?

A: Whether or not SBA Form 641 is mandatory depends on the specific counseling program or service you are participating in. It is best to consult with your SBA counselor for specific requirements.

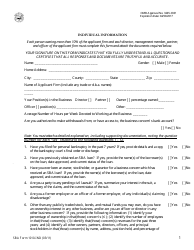

Q: What information does SBA Form 641 collect?

A: SBA Form 641 collects information about your personal background, business experience, financial history, and other details relevant to the counseling process.

Q: How should I fill out SBA Form 641?

A: You should carefully read the instructions provided with SBA Form 641 and provide accurate and complete information in the required fields.

Q: Are there any fees associated with SBA Form 641?

A: Generally, there are no fees associated with completing and submitting SBA Form 641. However, some counseling programs may have their own fees or eligibility requirements.

Q: Can I update or modify my SBA Form 641?

A: If you need to update or modify your SBA Form 641, you should contact your SBA counselor for guidance on the appropriate process.

Form Details:

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 641 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.