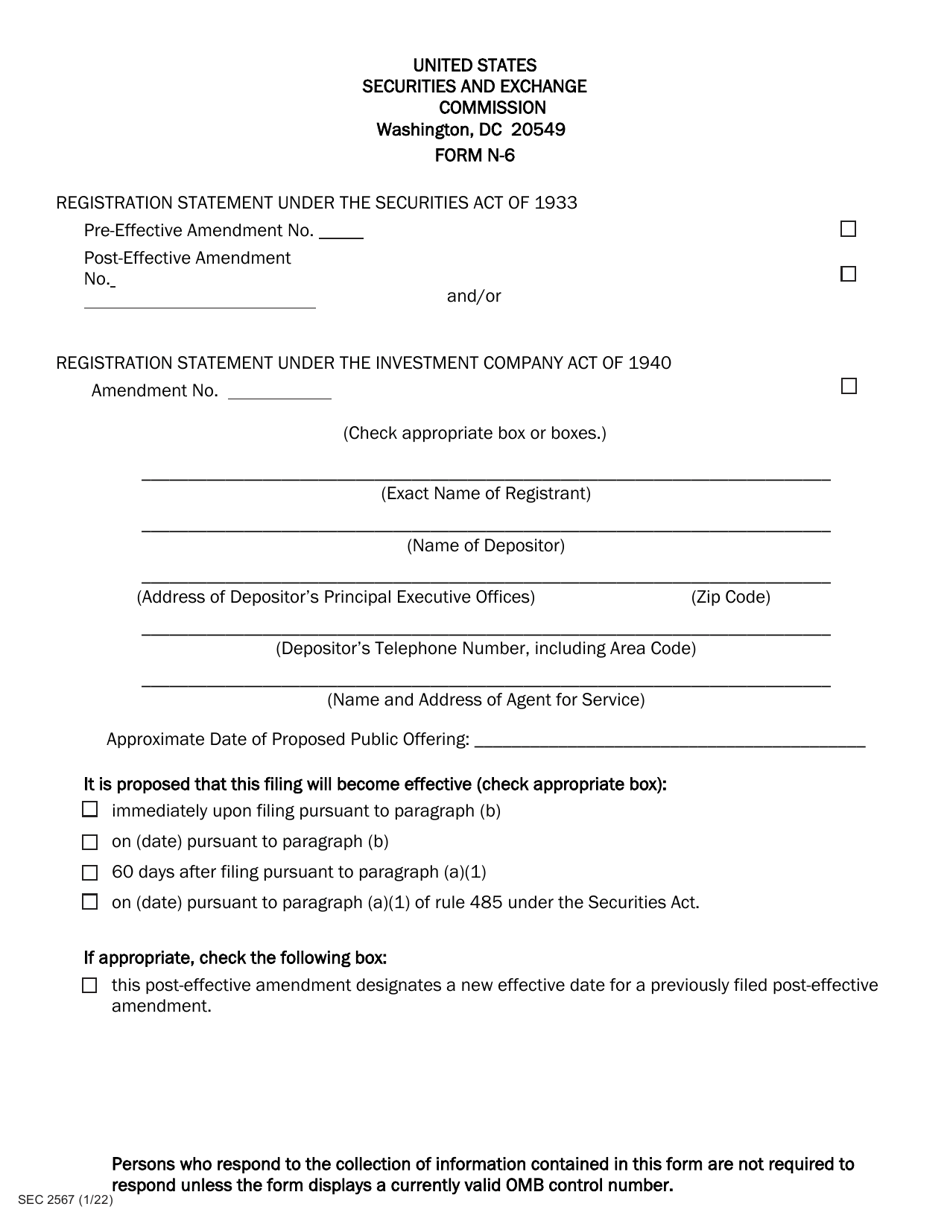

SEC Form 2567 (N-6) Registration Statement for Separate Accounts Organized as Unit Investment Trusts That Offer Variable Life Insurance Policies

What Is SEC Form 2567 (N-6)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on January 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SEC Form 2567 (N-6)?

A: SEC Form 2567 (N-6) is a registration statement for separate accounts organized as unit investment trusts that offer variable life insurance policies.

Q: What is a separate account?

A: A separate account is a type of investment vehicle used by insurance companies to manage and invest assets that support variable insurance products such as variable life insurance policies.

Q: What is a unit investment trust?

A: A unit investment trust is a type of investment company that offers shares or units in a fixed portfolio of securities, usually assembled by an independent manager.

Q: What are variable life insurance policies?

A: Variable life insurance policies are life insurance policies that allow policyholders to invest their premiums in a variety of investment options, such as stocks, bonds, and mutual funds.

Q: Why do separate accounts organize as unit investment trusts?

A: Separate accounts that offer variable life insurance policies often organize as unit investment trusts to provide a structure for managing the underlying investment assets and to comply with regulatory requirements.

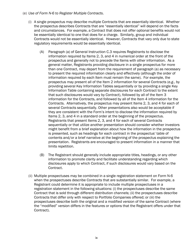

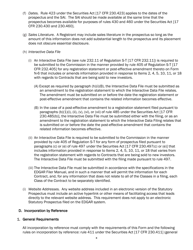

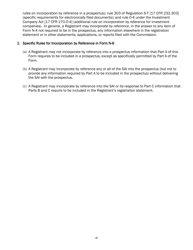

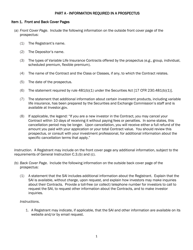

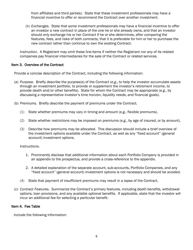

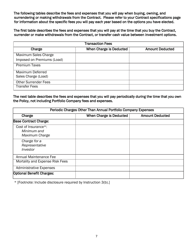

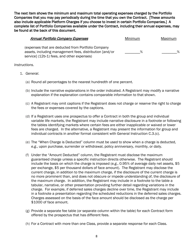

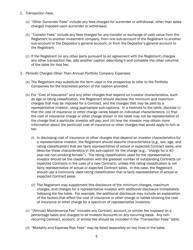

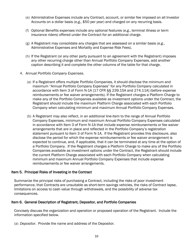

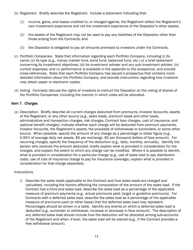

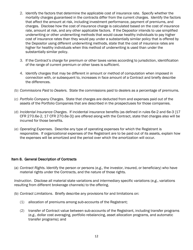

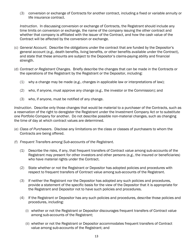

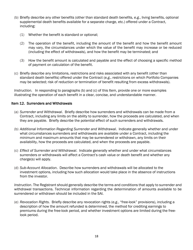

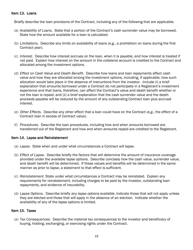

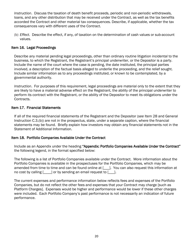

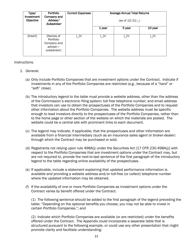

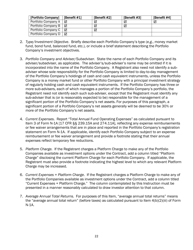

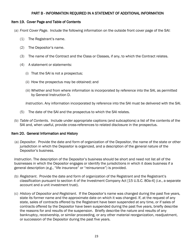

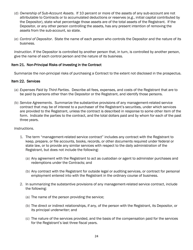

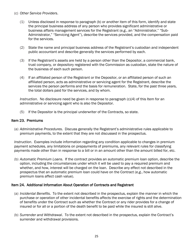

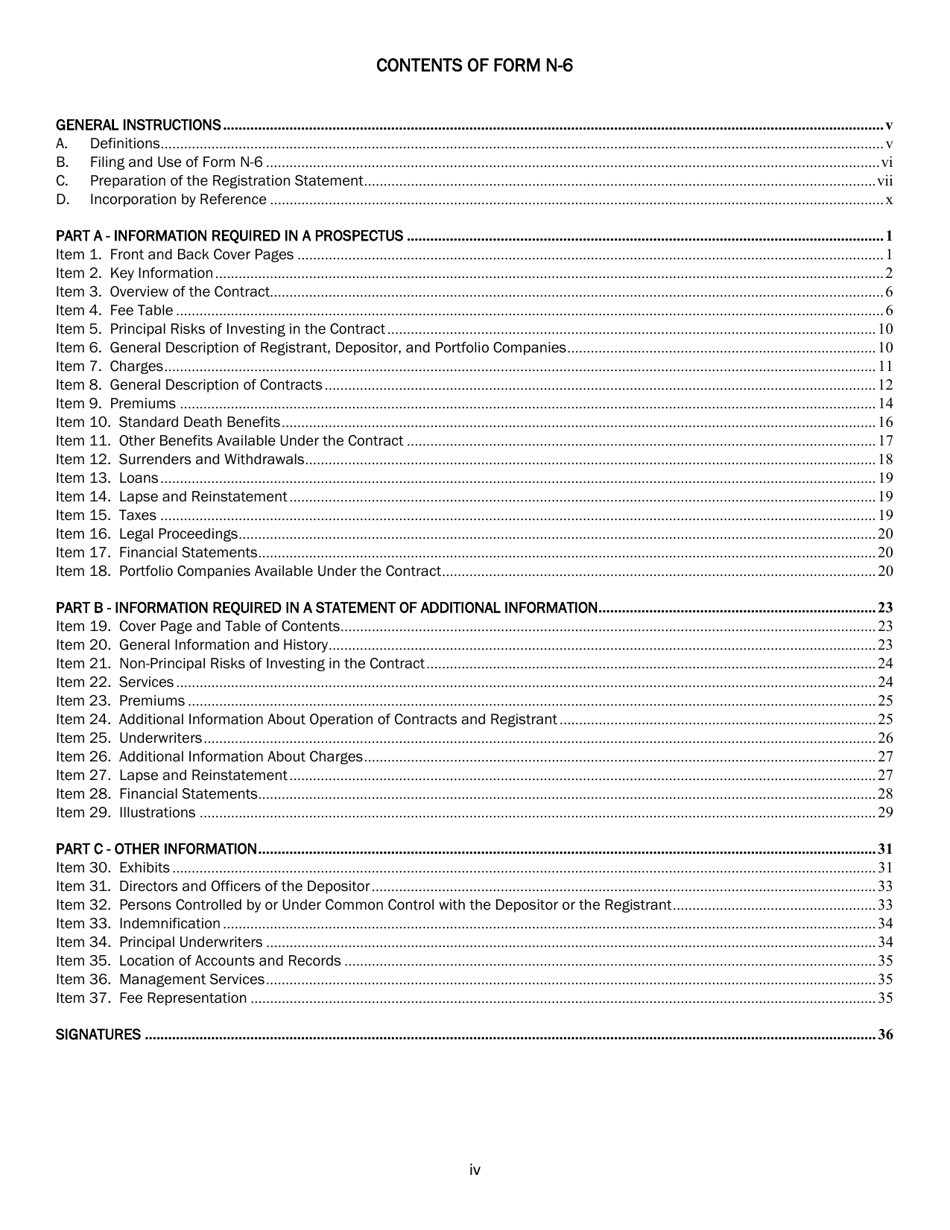

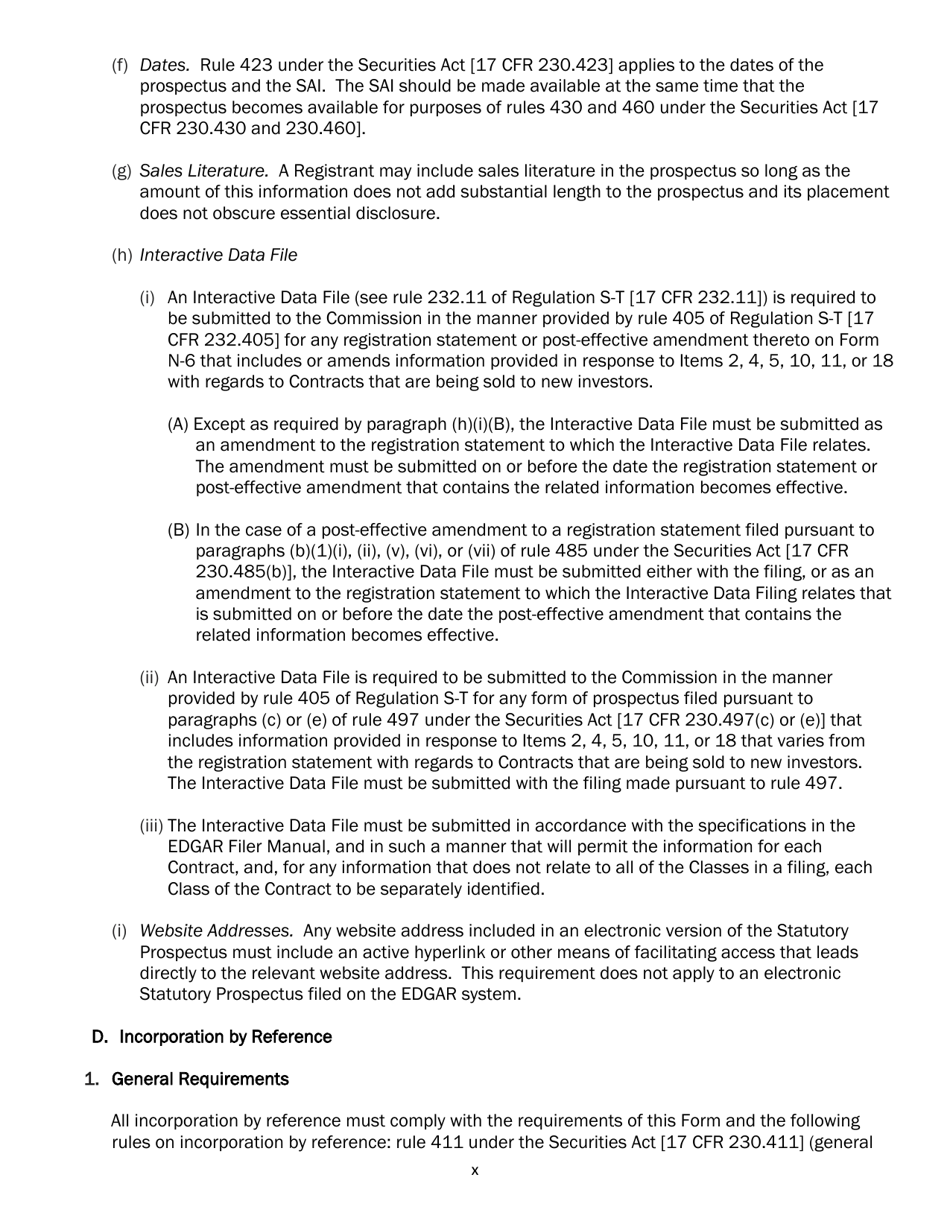

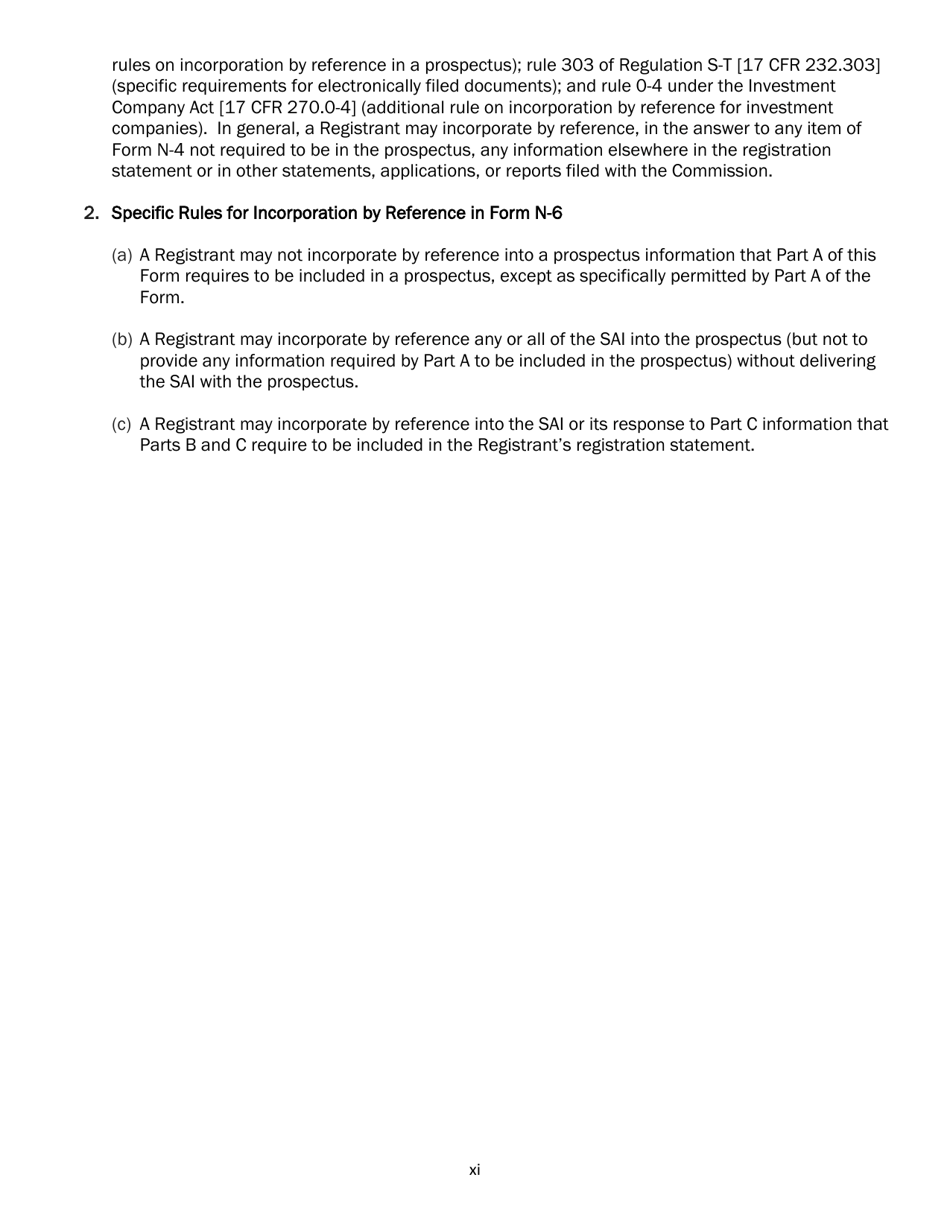

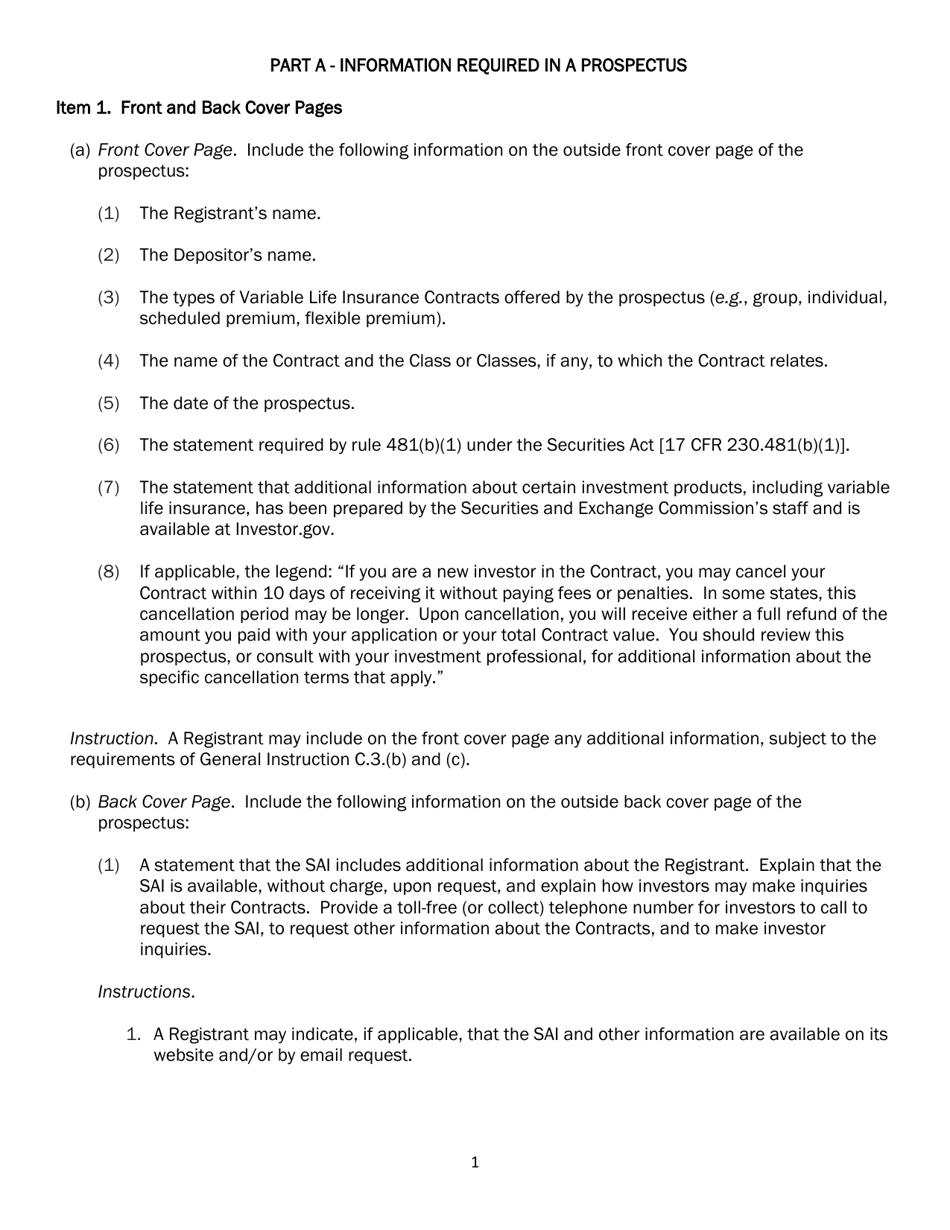

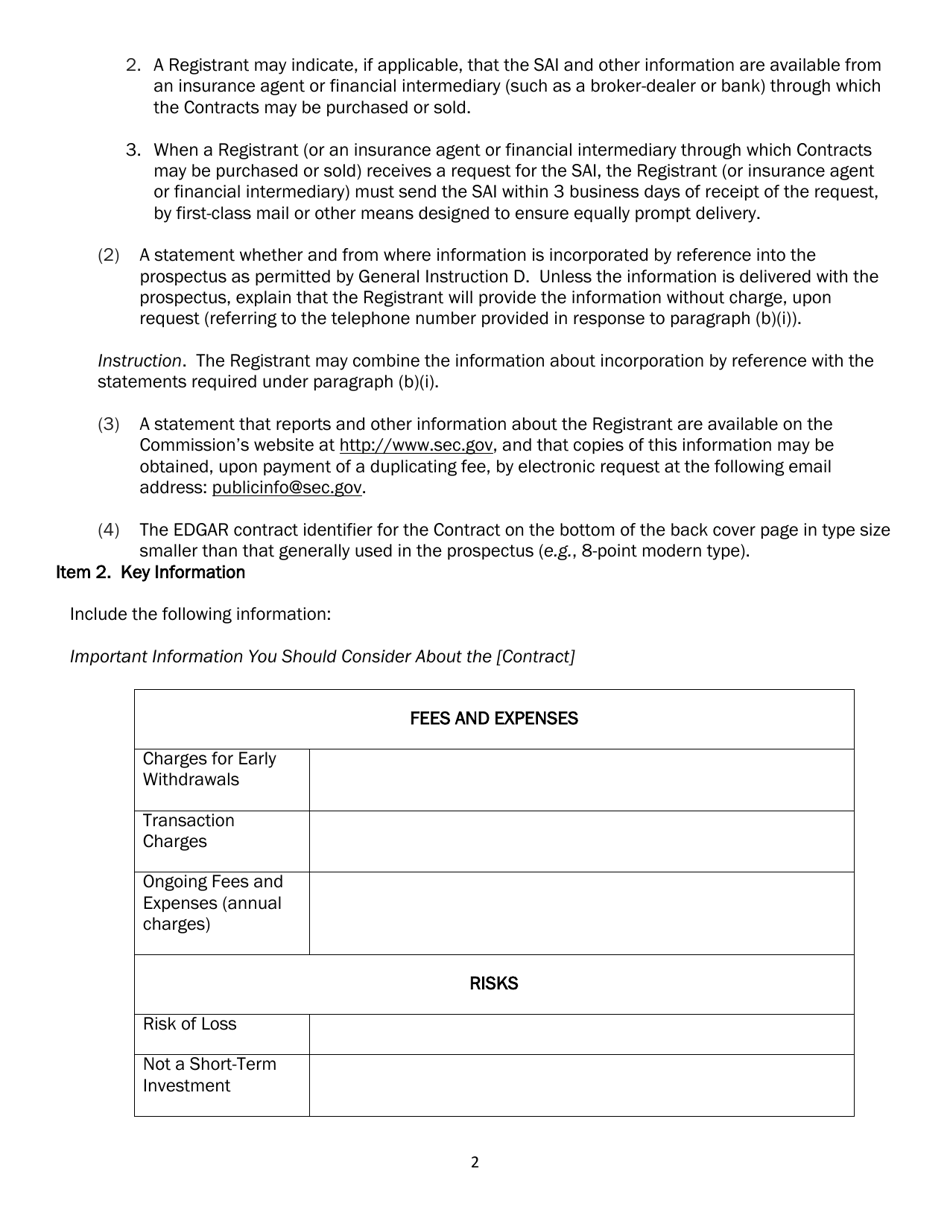

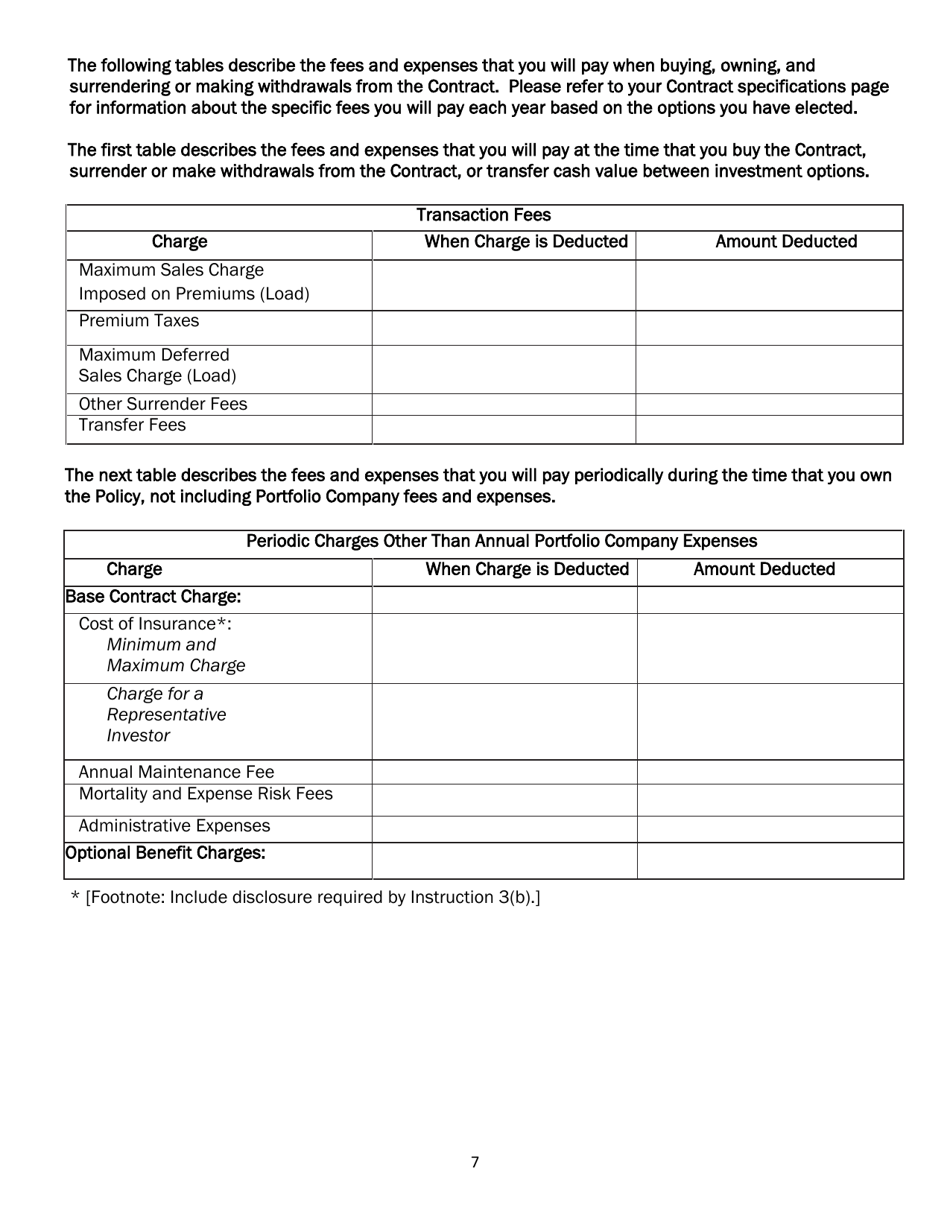

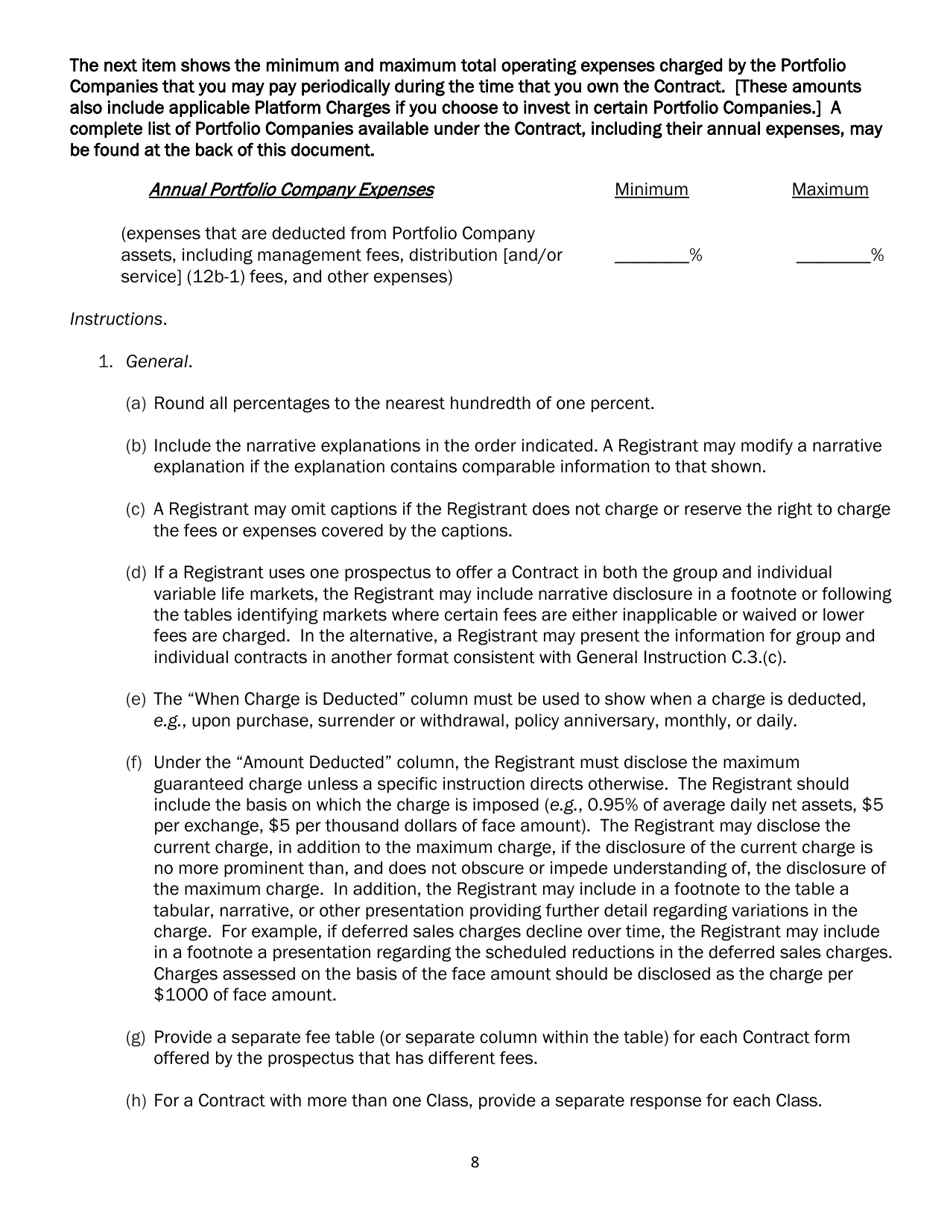

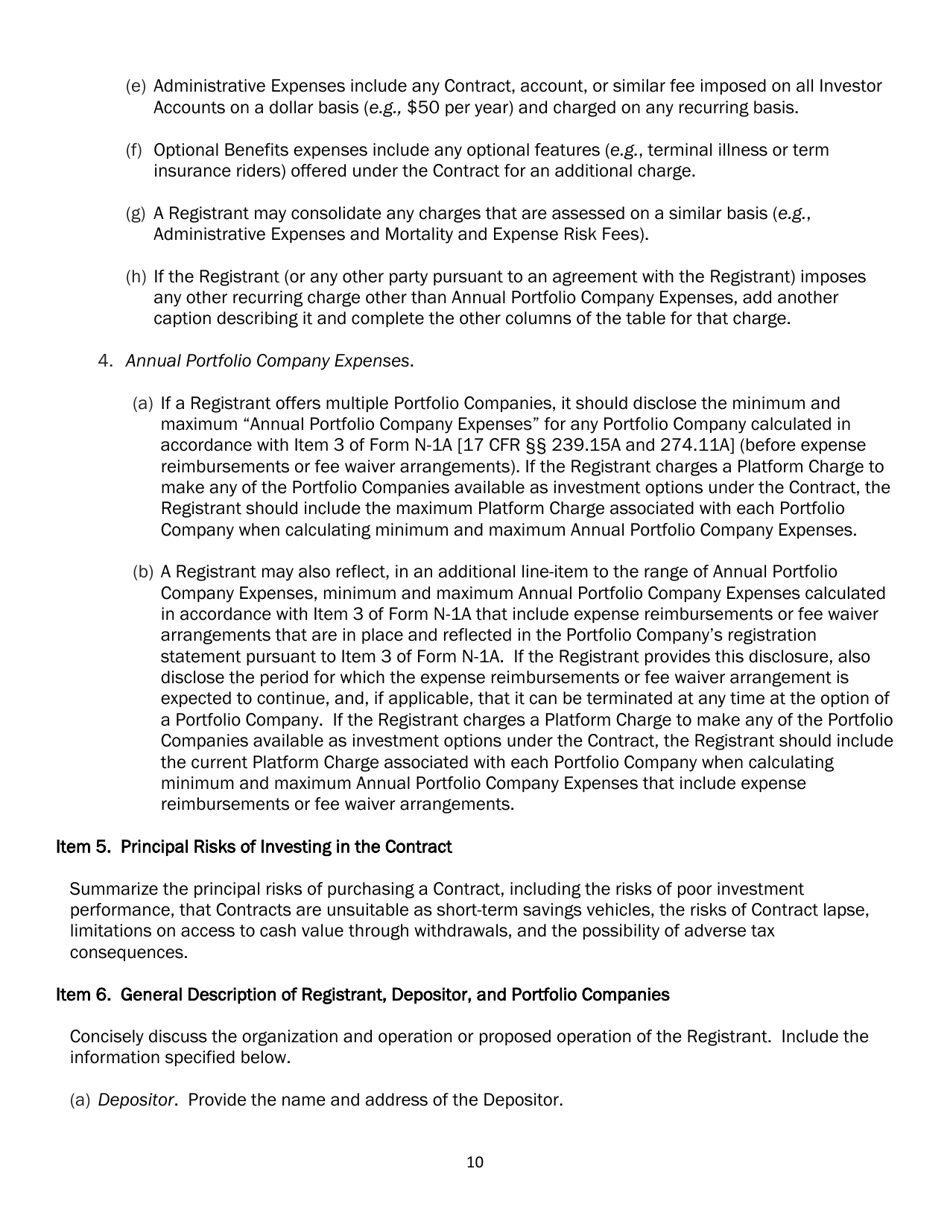

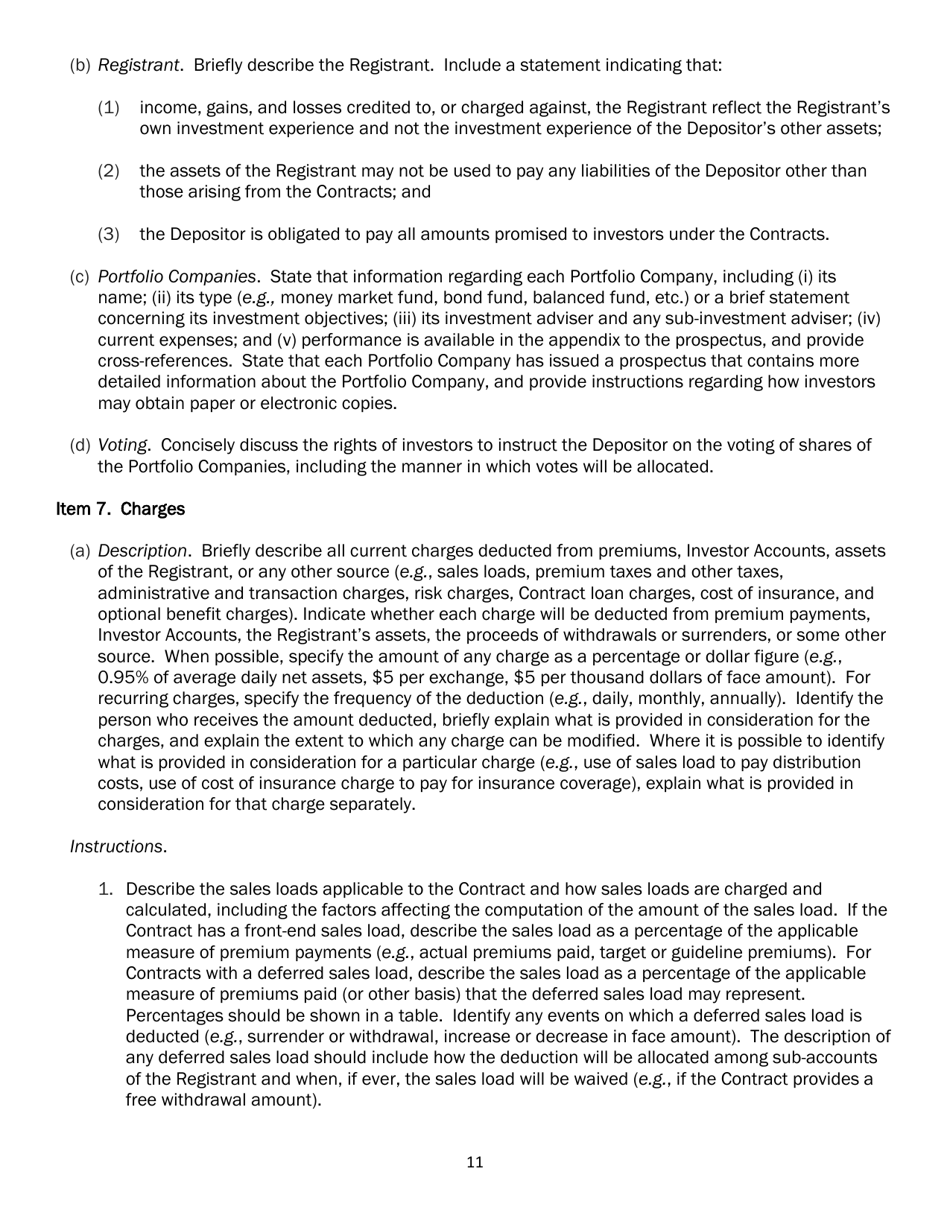

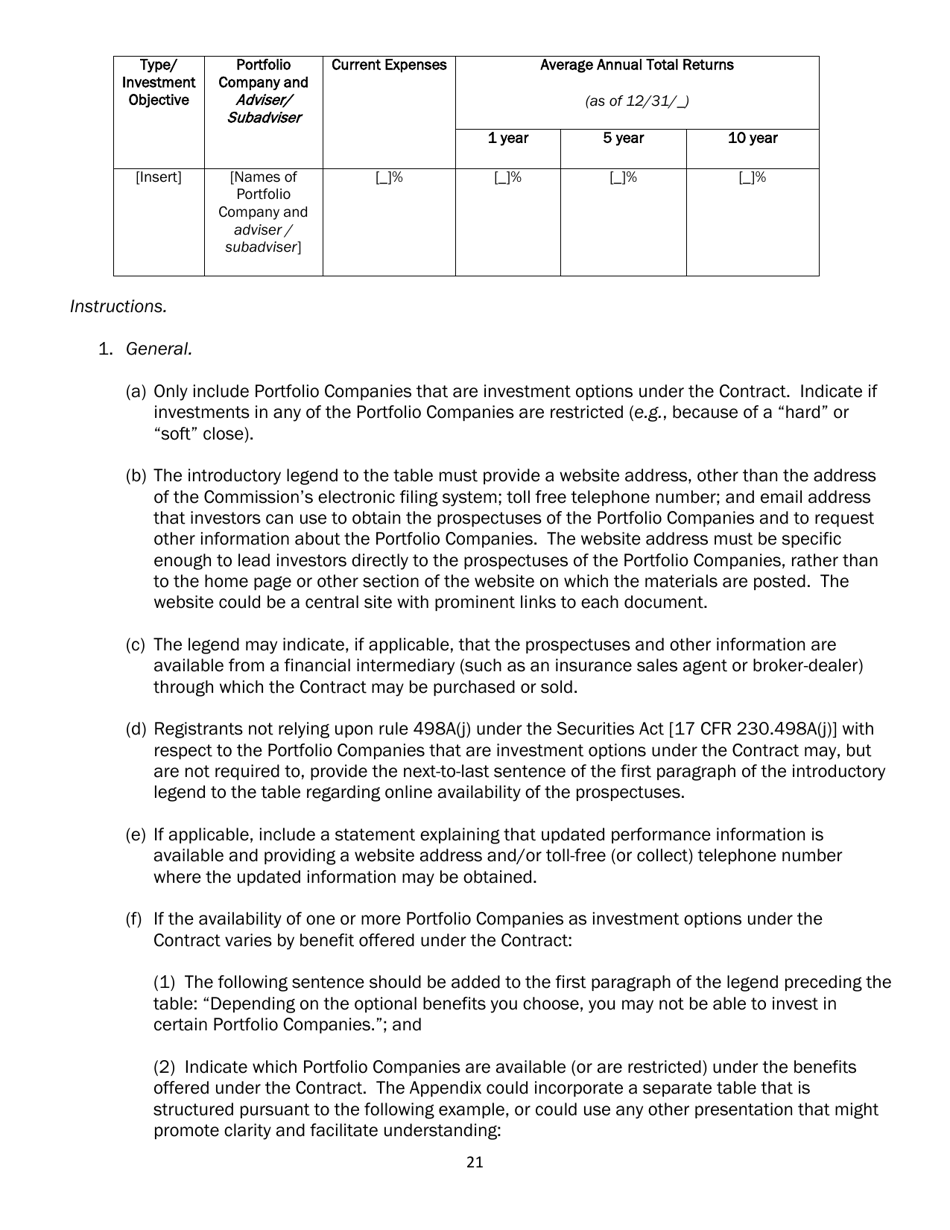

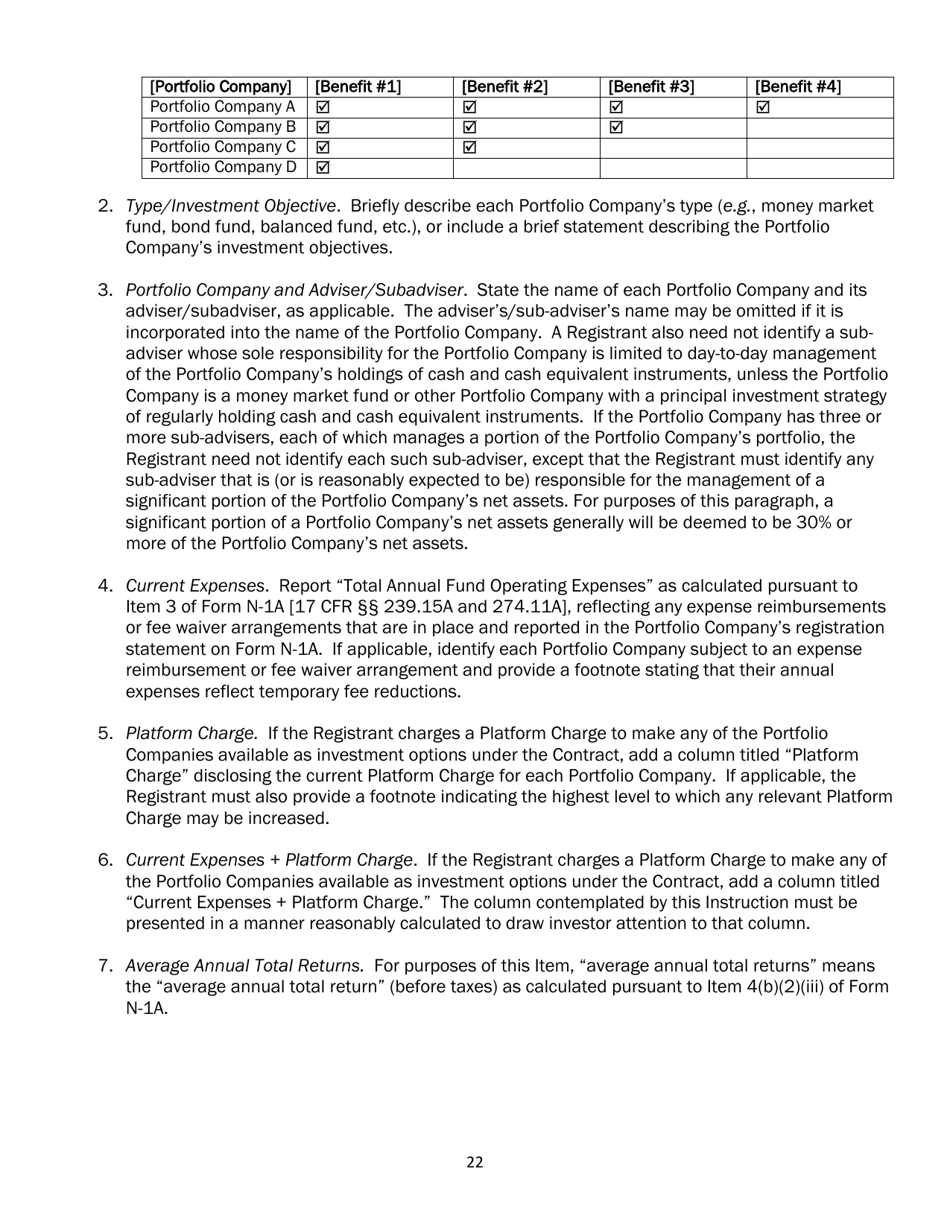

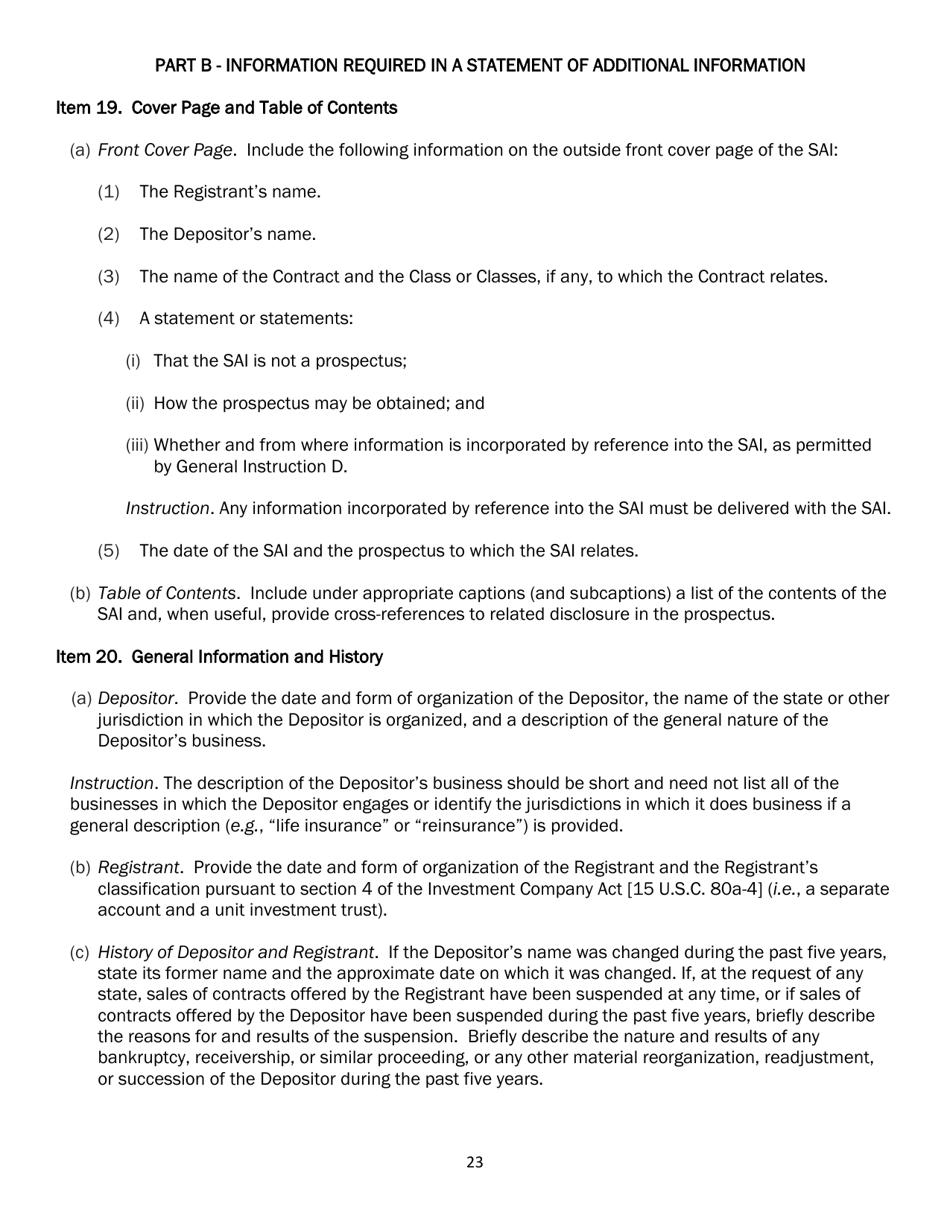

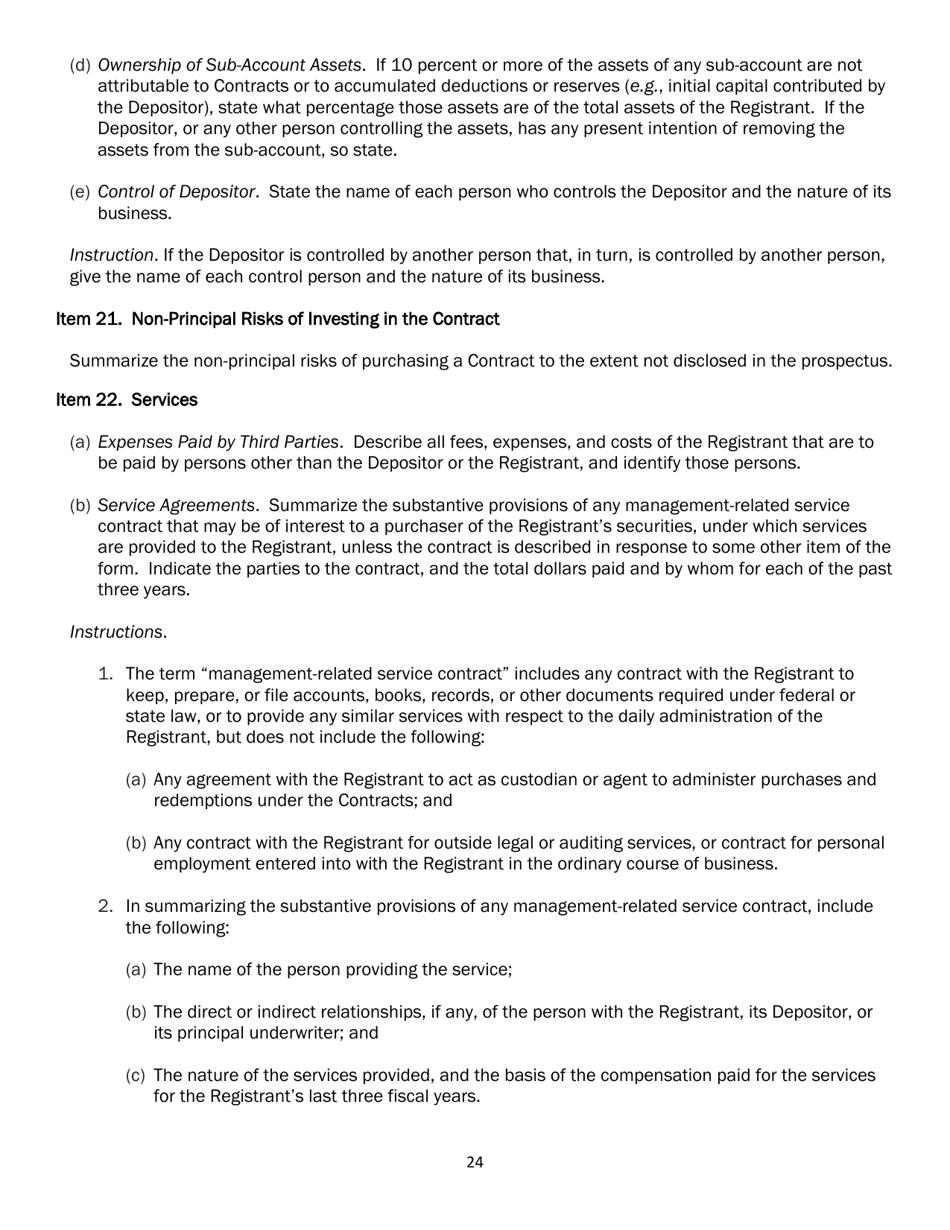

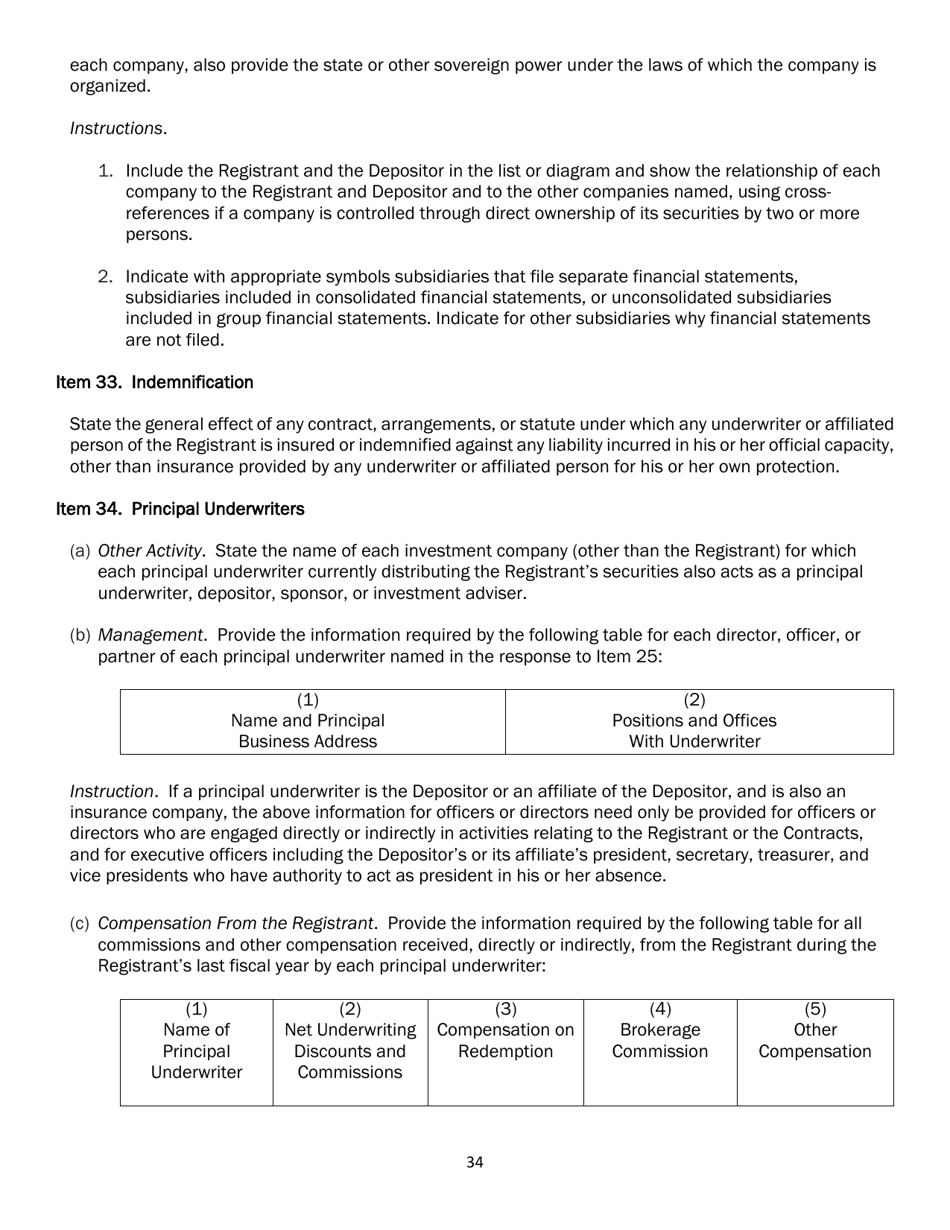

Q: What information does SEC Form 2567 (N-6) require?

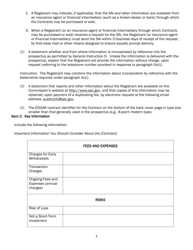

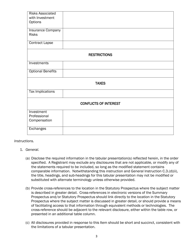

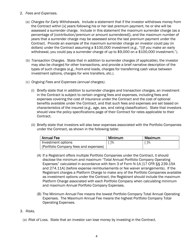

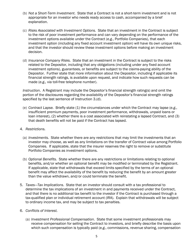

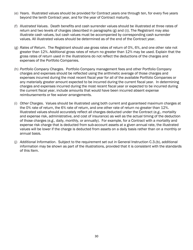

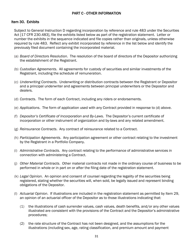

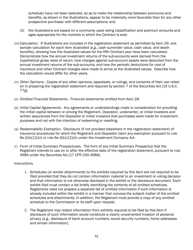

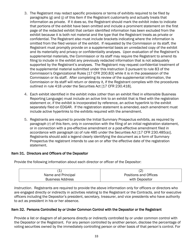

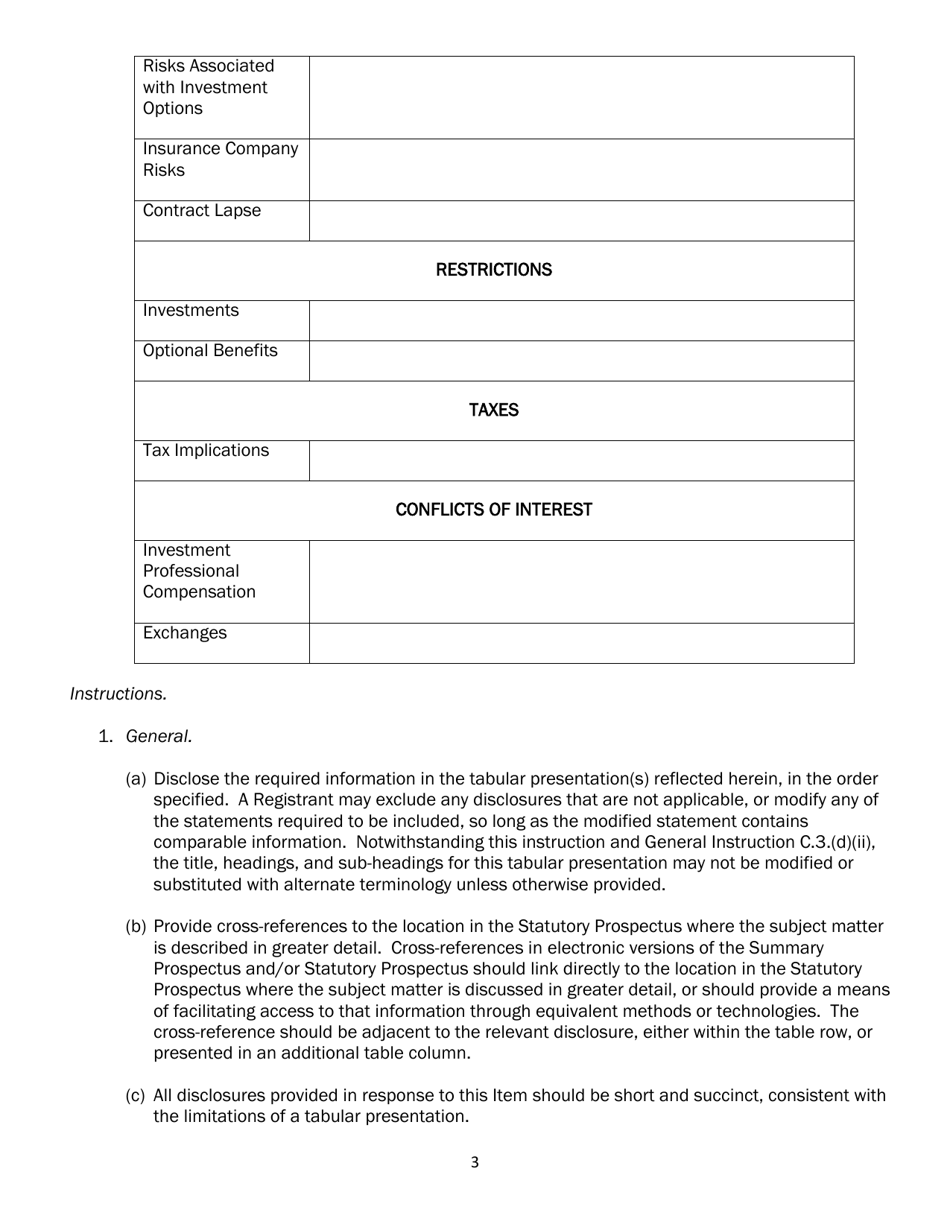

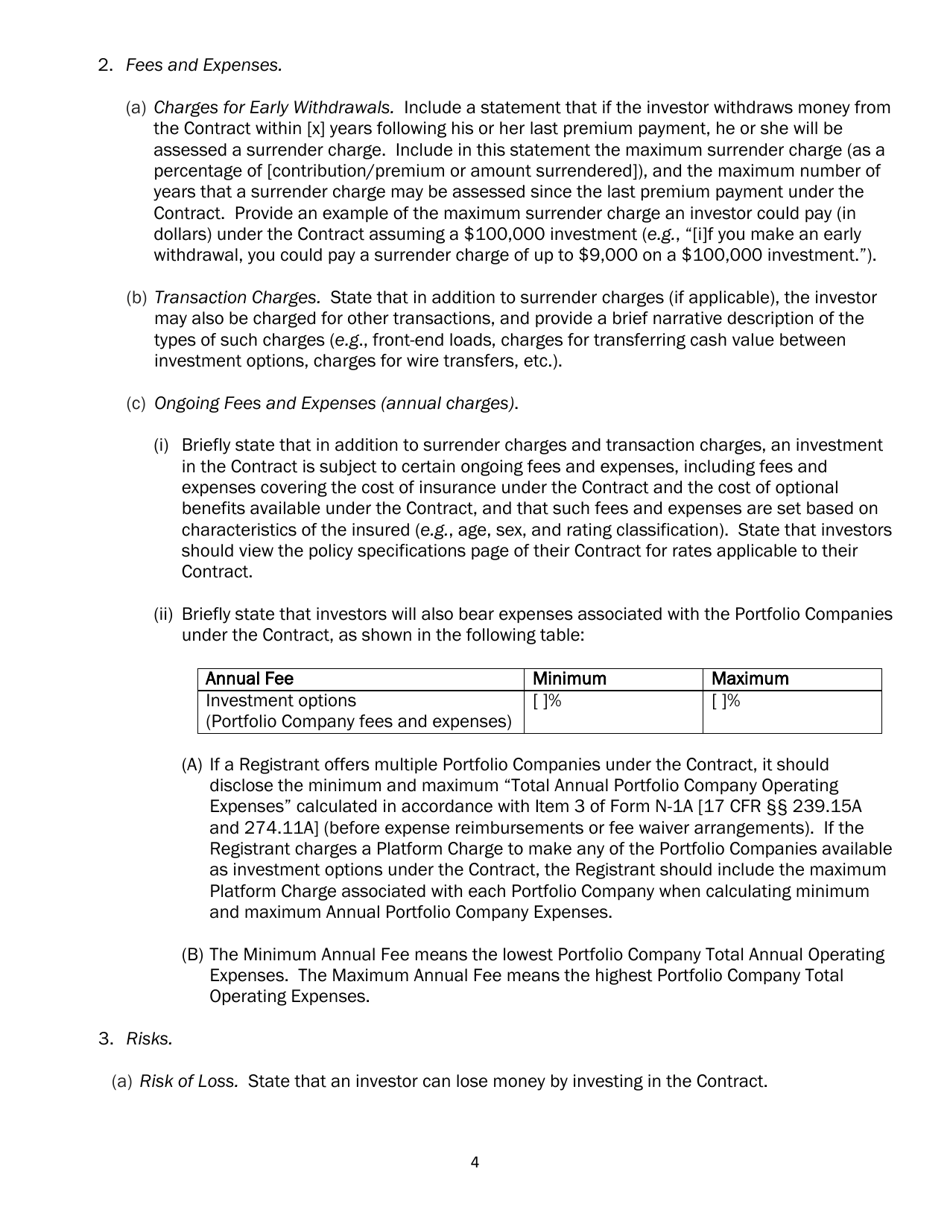

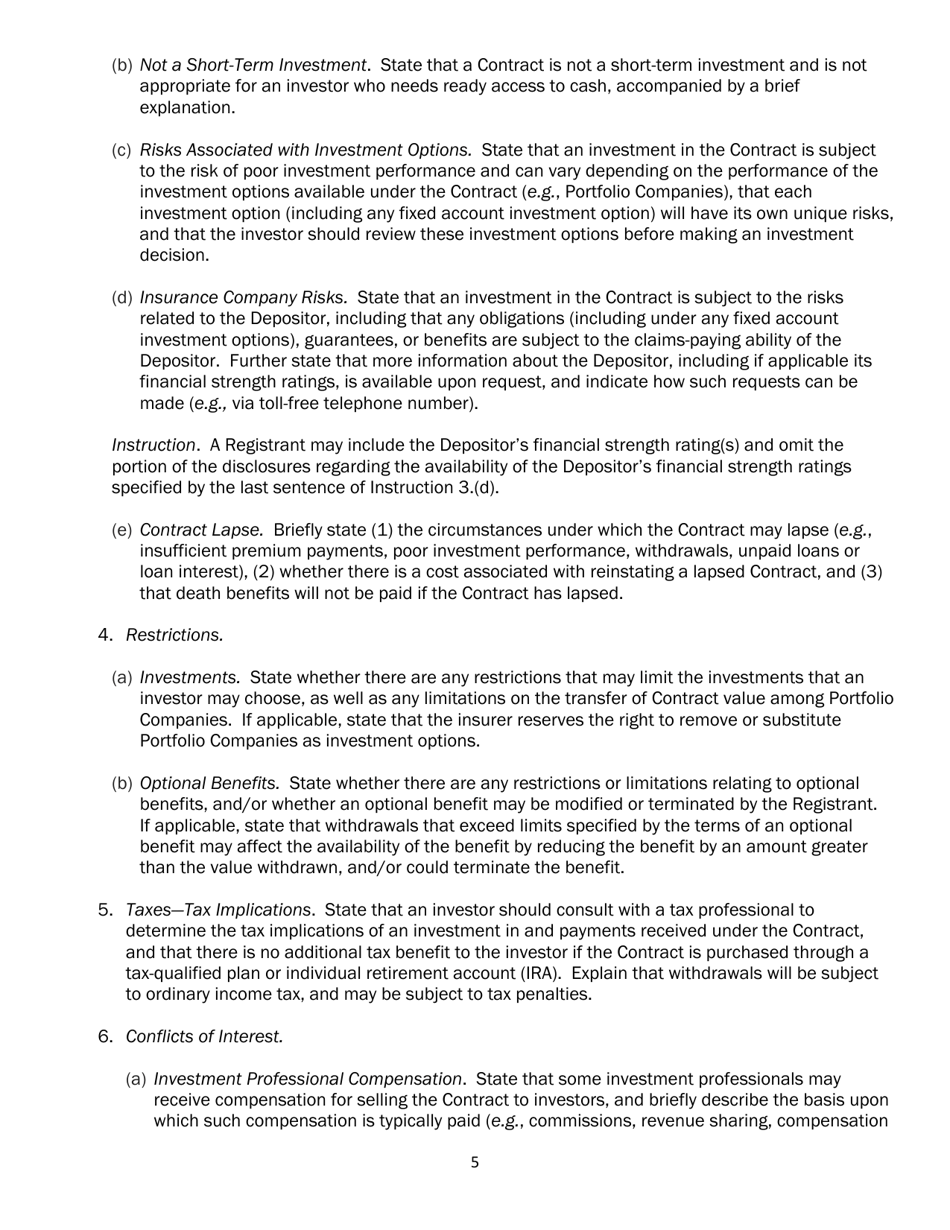

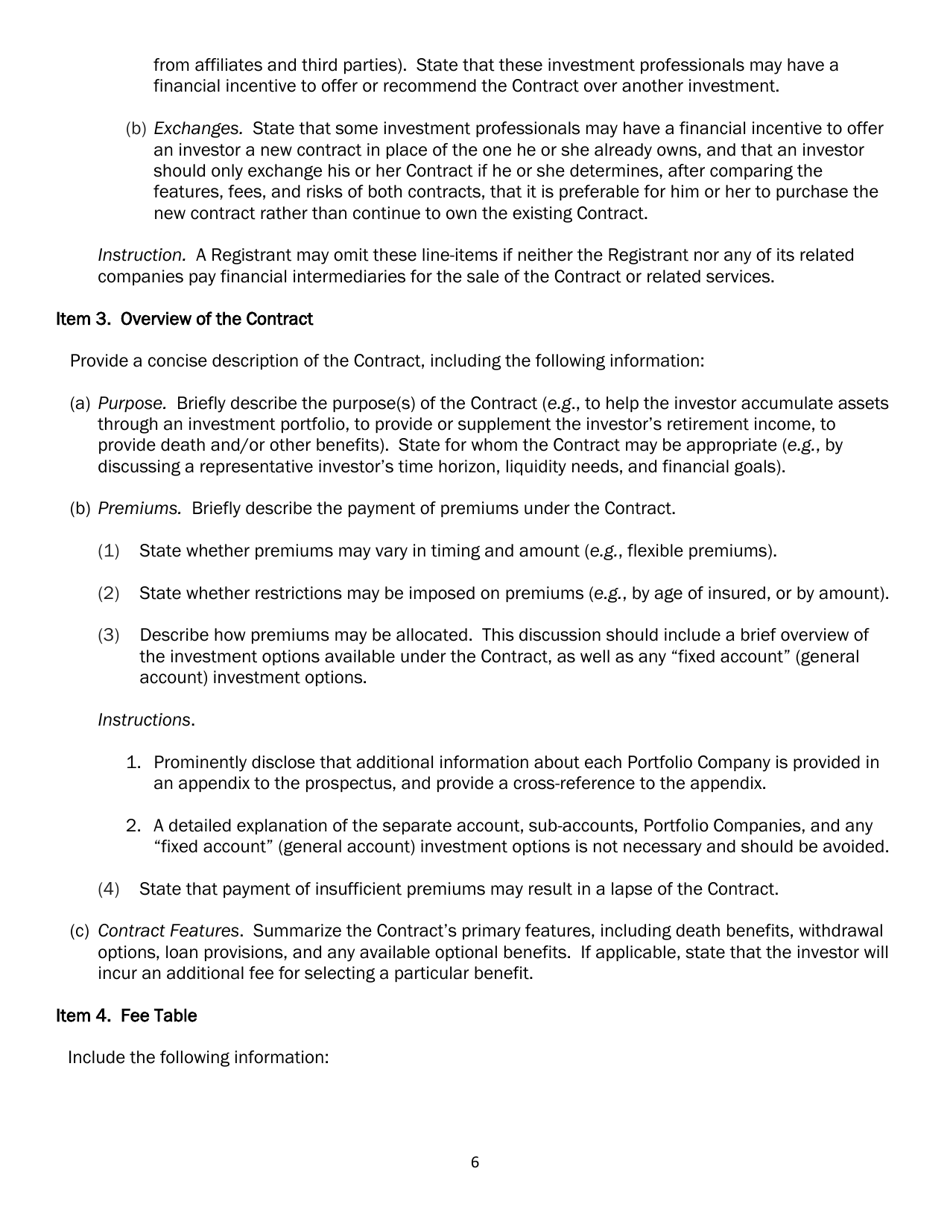

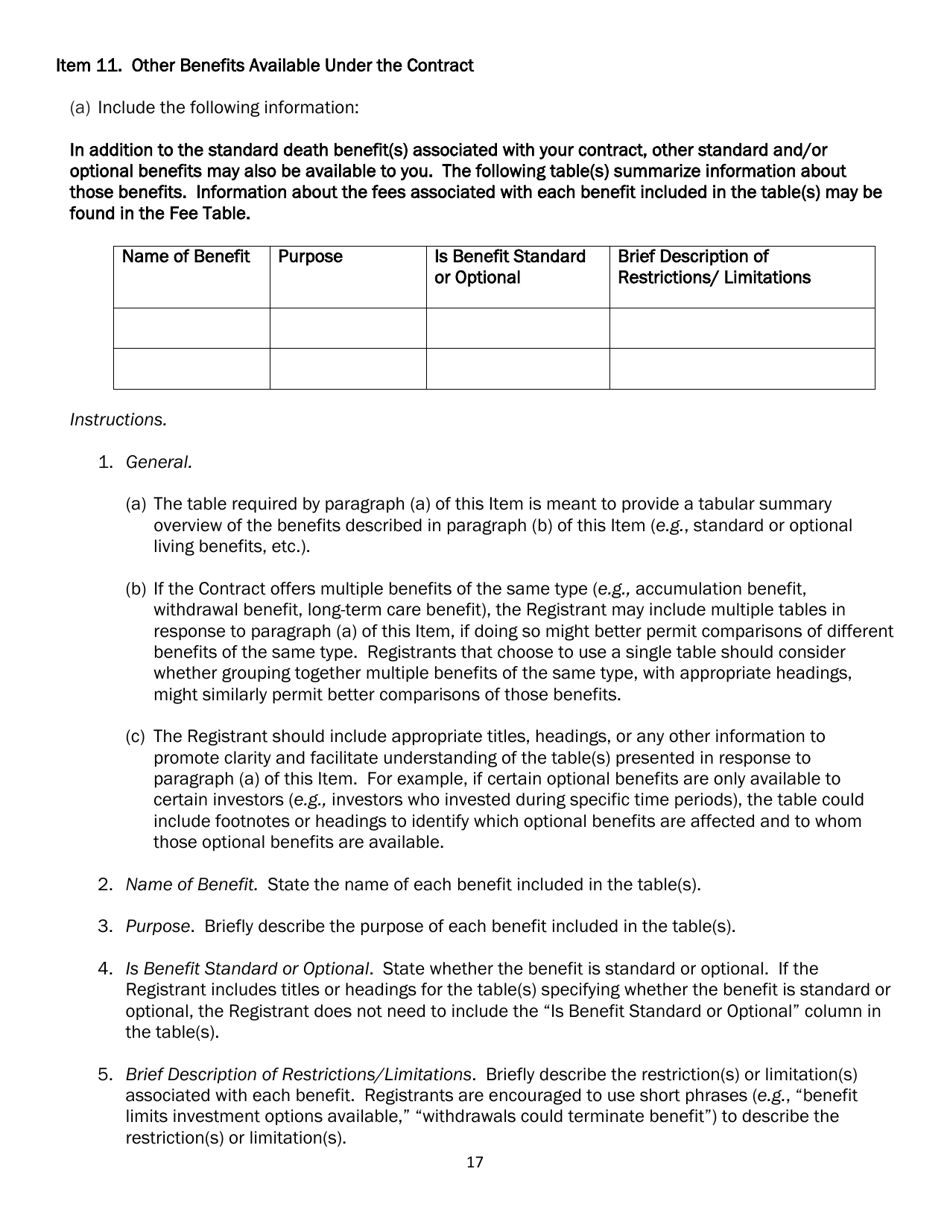

A: SEC Form 2567 (N-6) requires detailed information about the separate account, the variable life insurance policies offered, the investment options available, and other relevant matters.

Q: Who needs to file SEC Form 2567 (N-6)?

A: Insurance companies that organize separate accounts as unit investment trusts and offer variable life insurance policies are required to file SEC Form 2567 (N-6) with the Securities and Exchange Commission.

Q: What is the purpose of filing SEC Form 2567 (N-6)?

A: The purpose of filing SEC Form 2567 (N-6) is to provide transparency and disclosure to investors and regulators about the structure, operation, and risks associated with the separate accounts and variable life insurance policies.

Q: What should investors consider before investing in variable life insurance policies offered by separate accounts?

A: Investors should consider the investment options, fees, risks, and financial strength of the insurance company before investing in variable life insurance policies offered by separate accounts.

Form Details:

- Released on January 1, 2022;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of SEC Form 2567 (N-6) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.