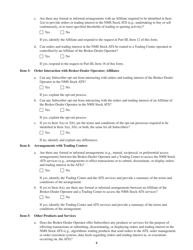

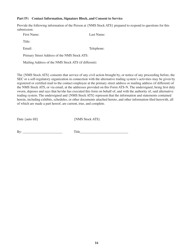

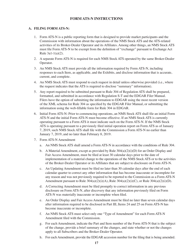

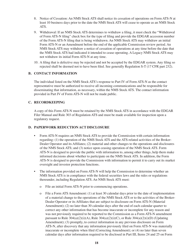

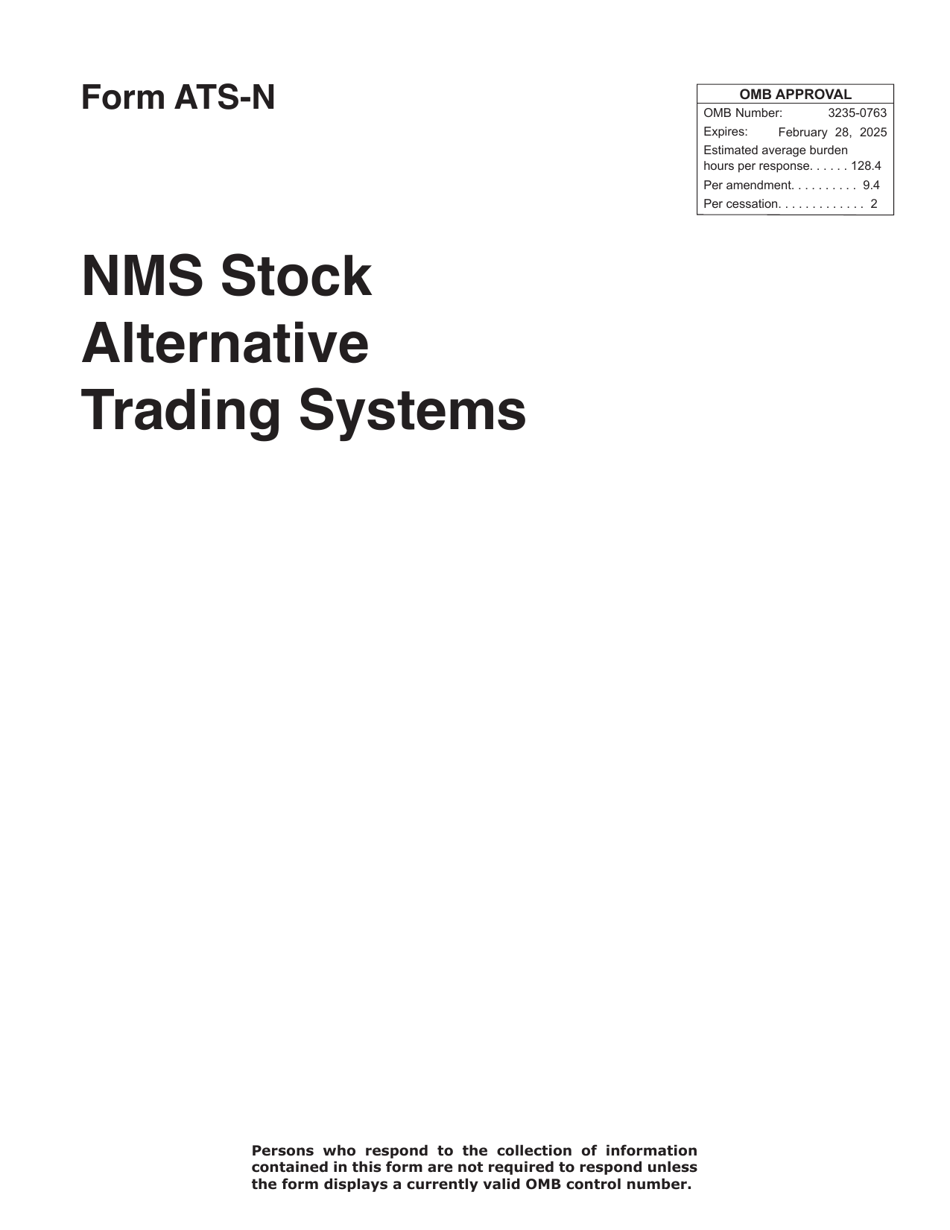

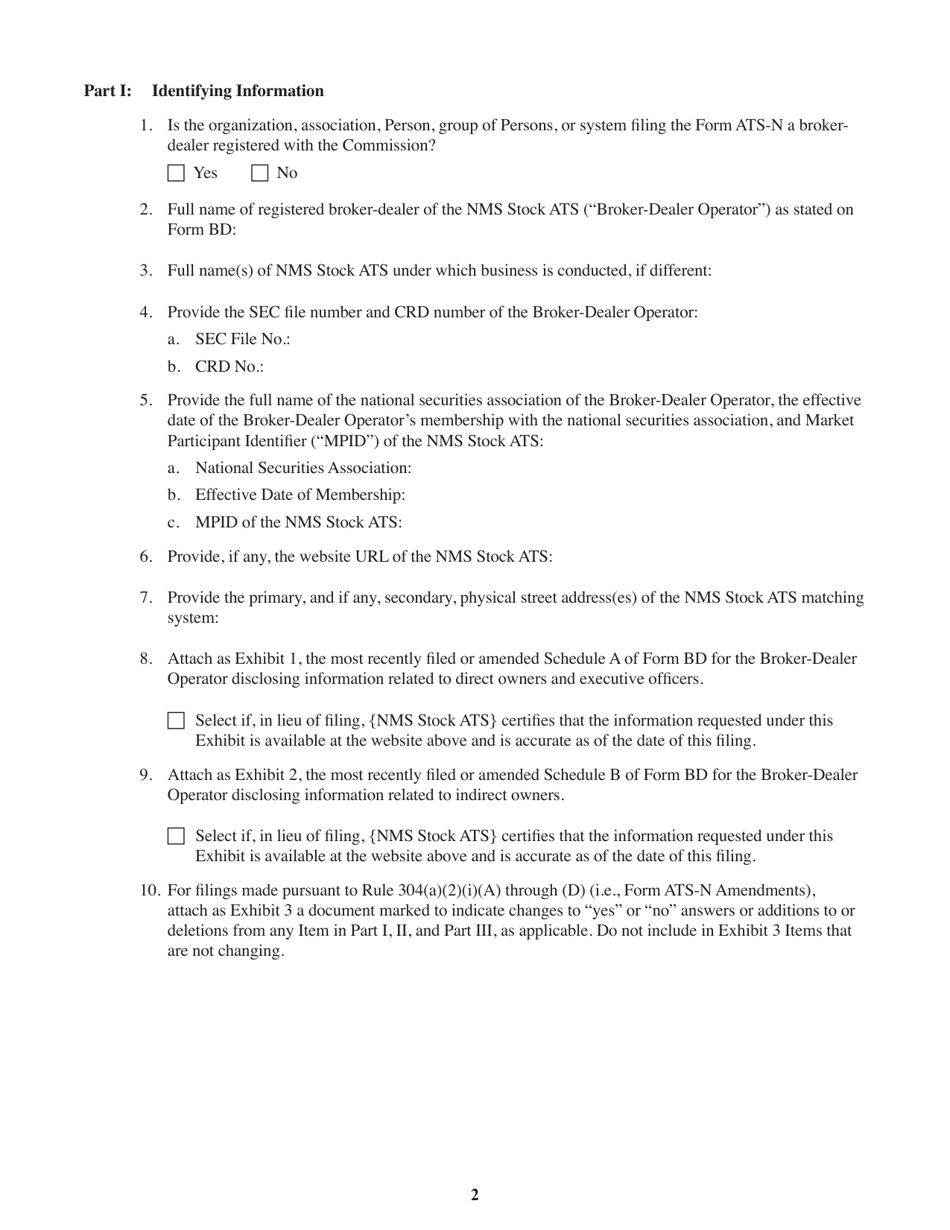

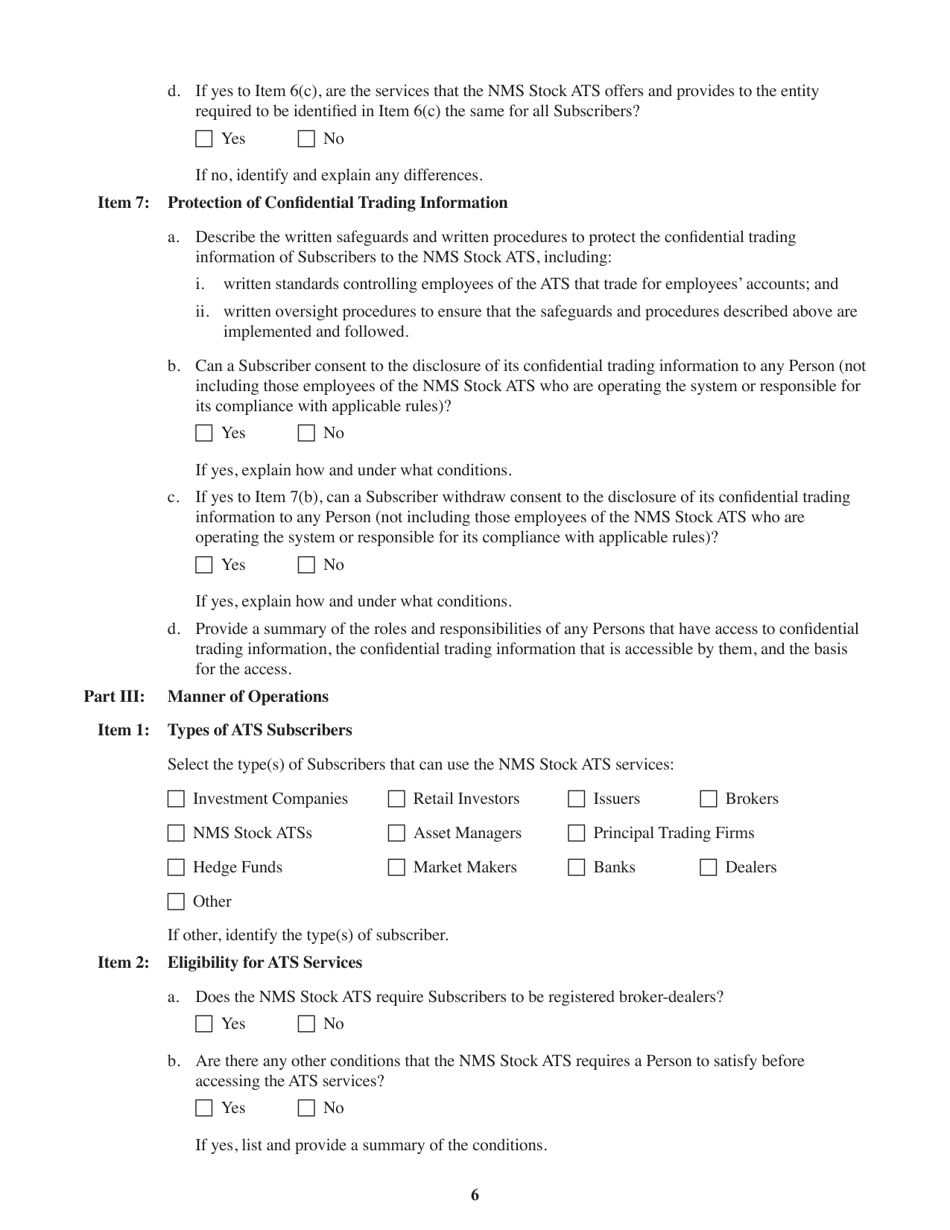

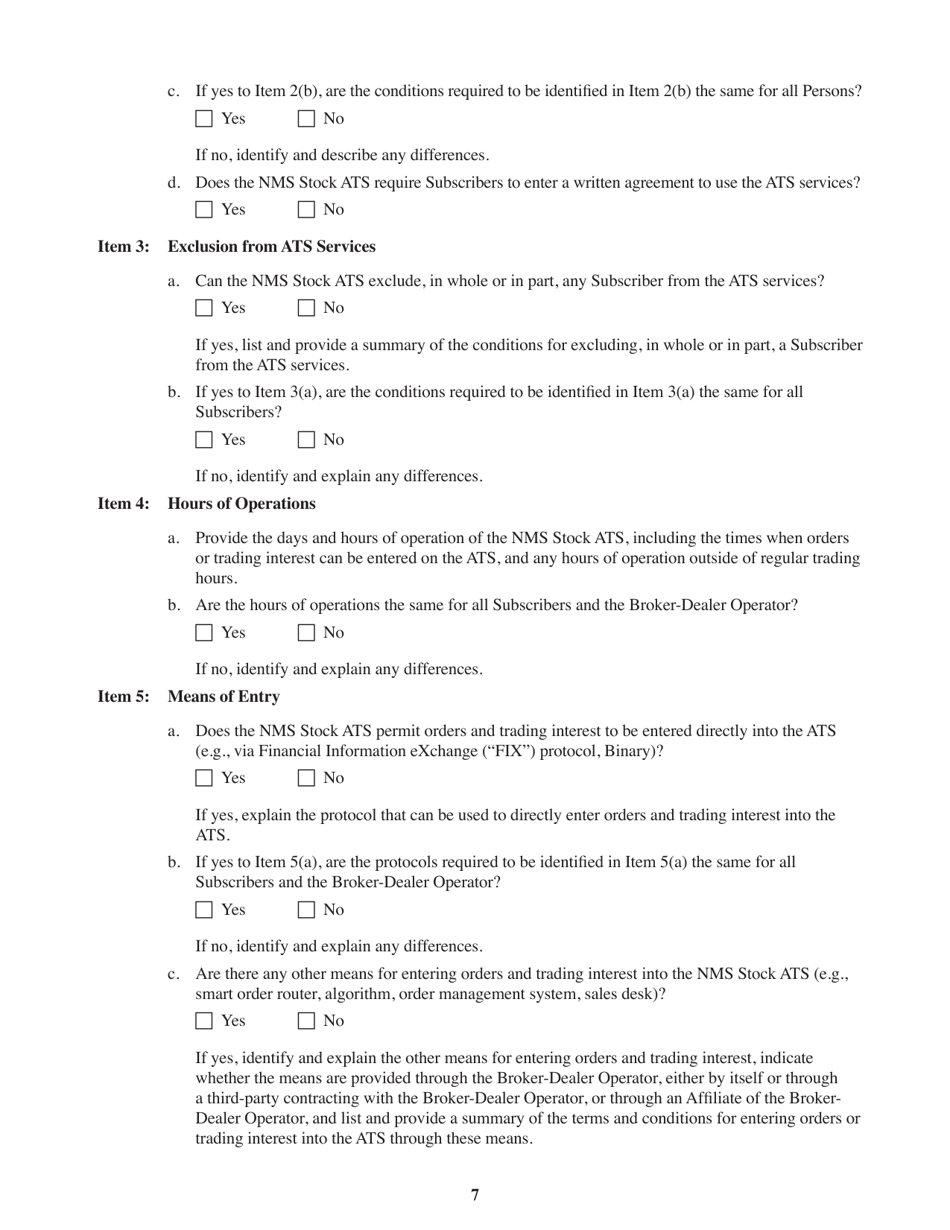

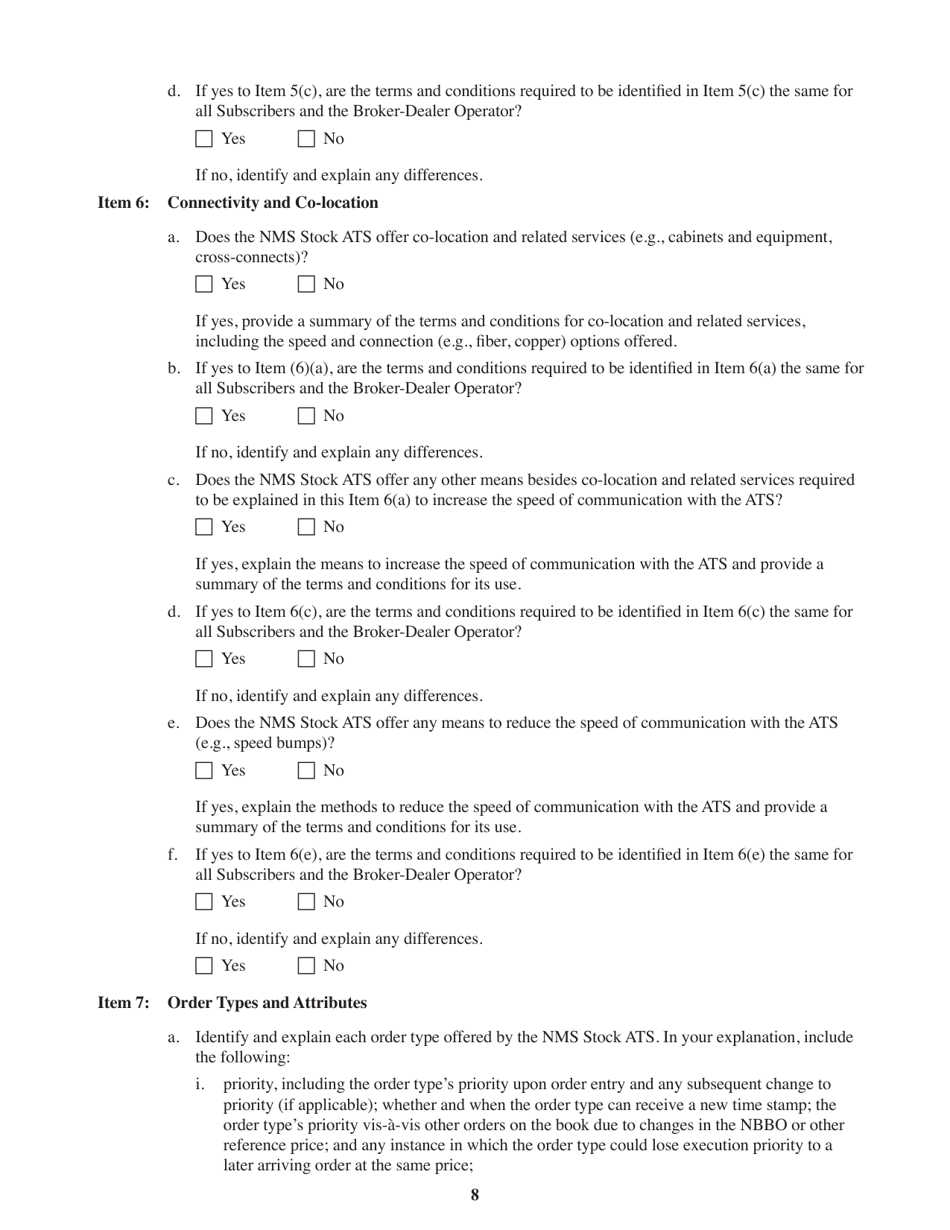

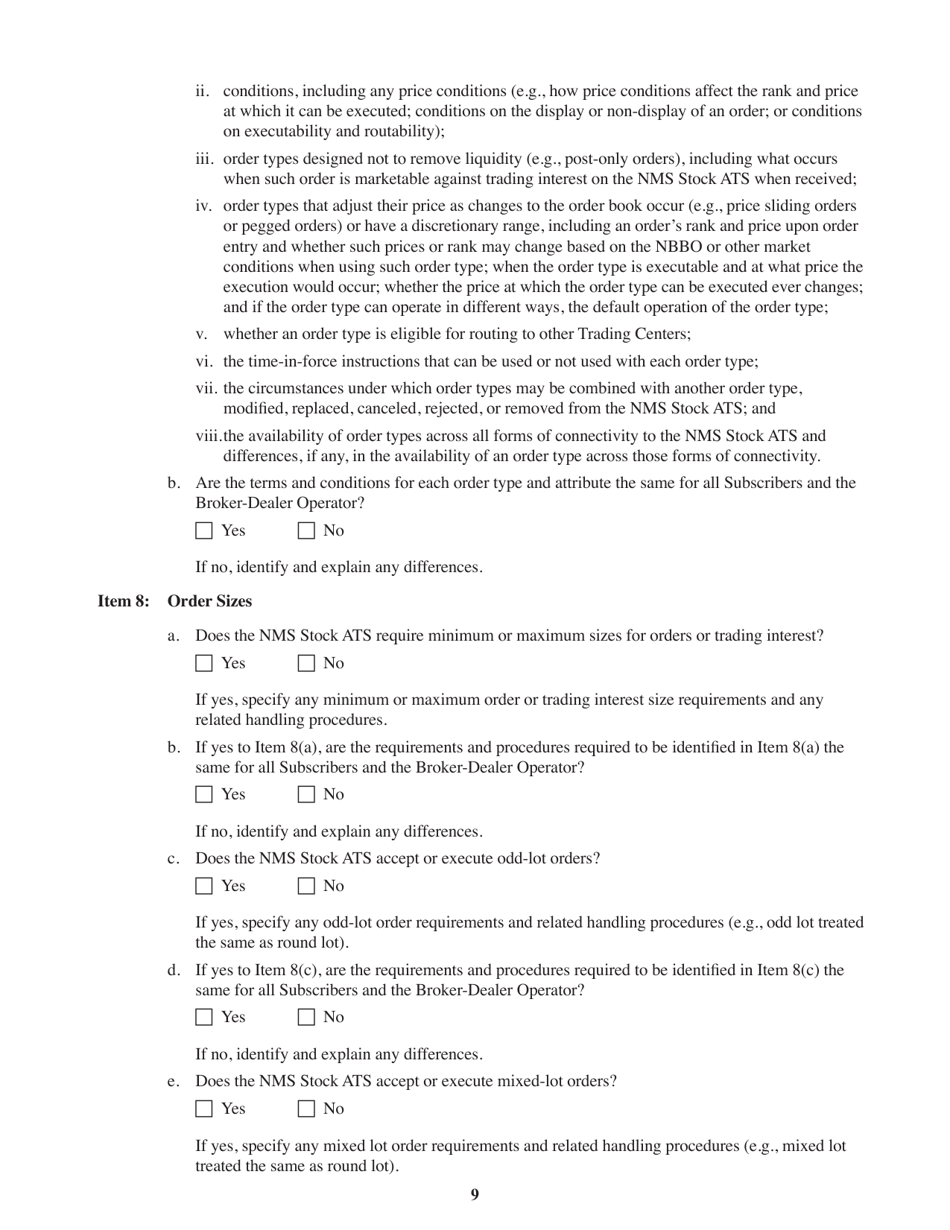

Form ATS-N Nms Stock Alternative Trading Systems

What Is Form ATS-N?

This is a legal form that was released by the U.S. Securities and Exchange Commission and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

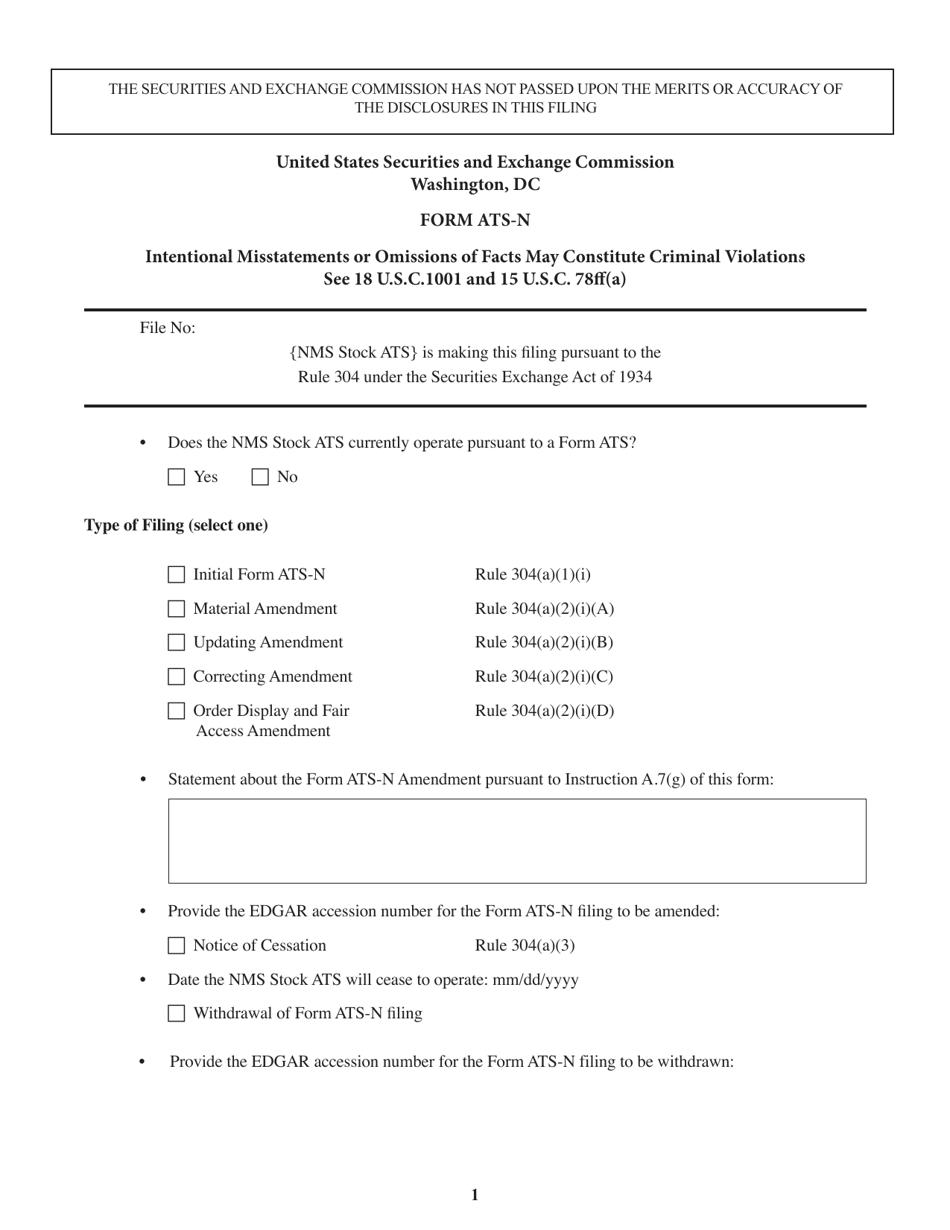

Q: What is Form ATS-N?

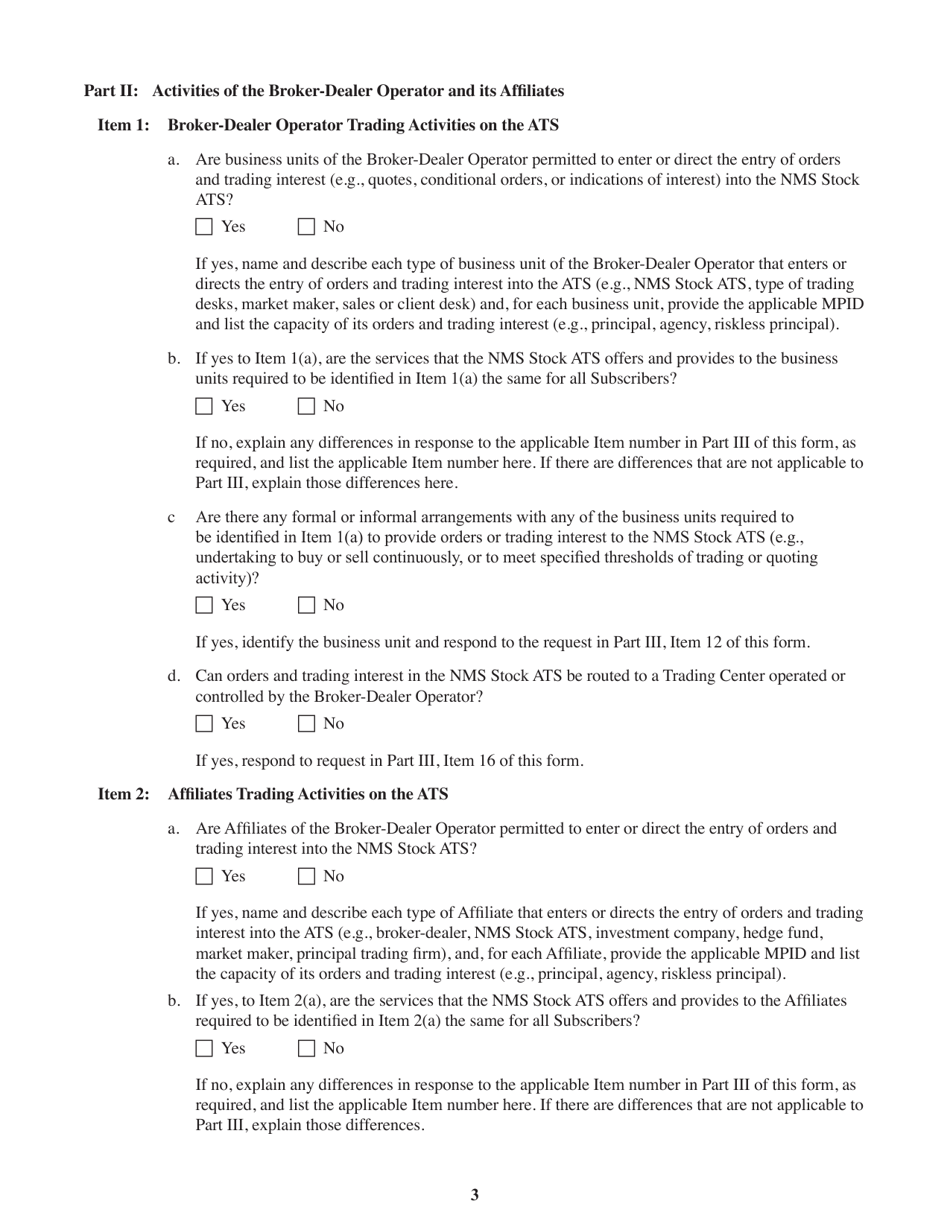

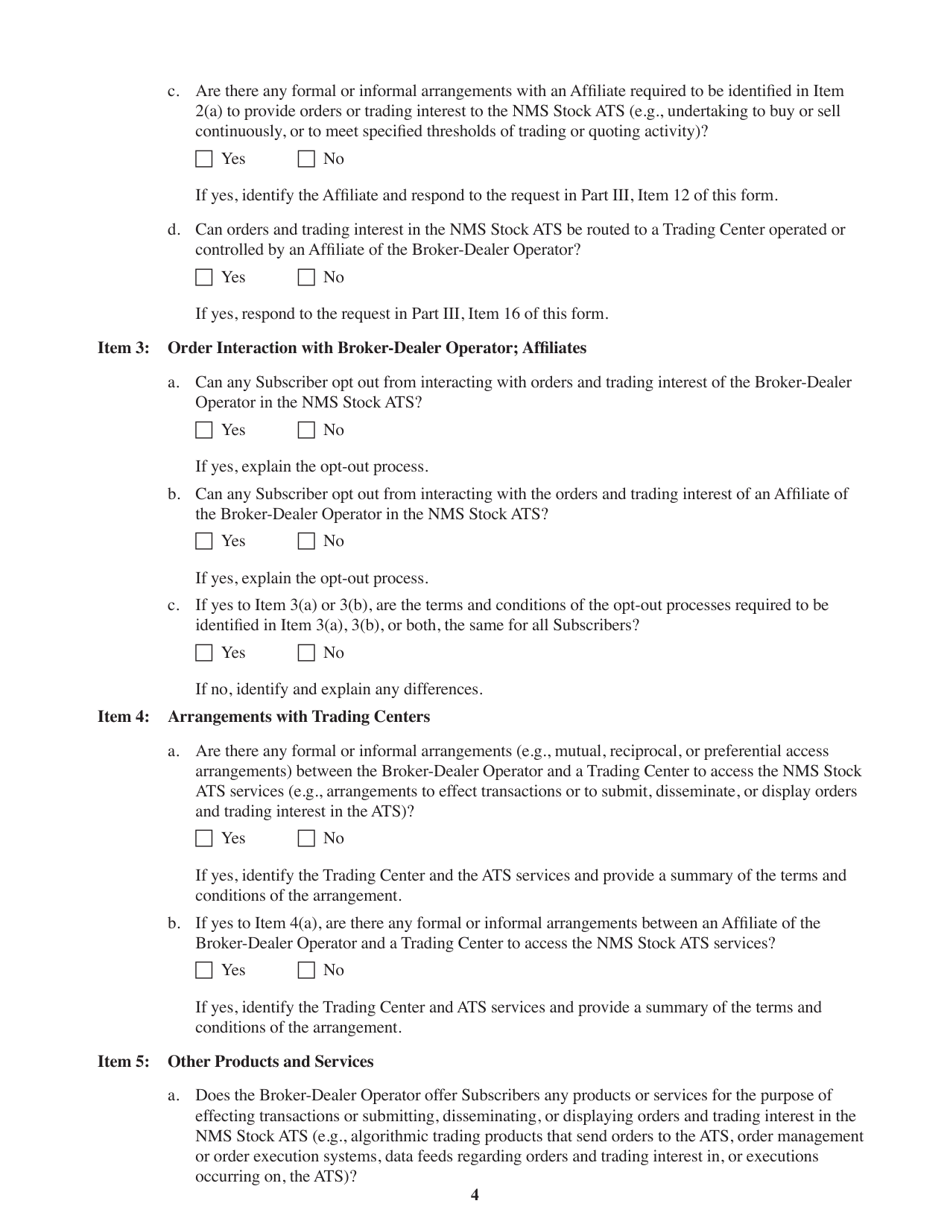

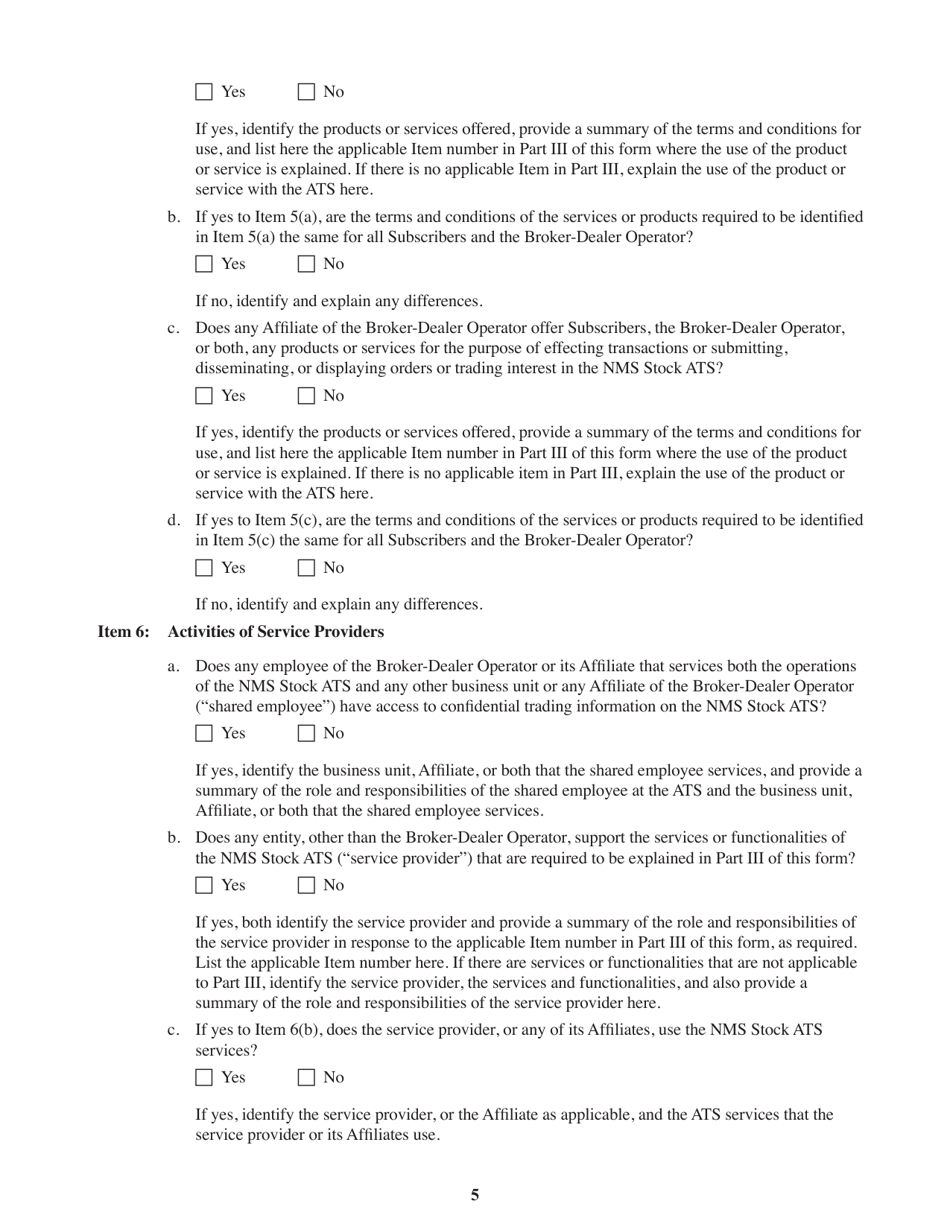

A: Form ATS-N is a form filed by alternative trading systems (ATS) with the U.S. Securities and Exchange Commission (SEC) to provide information about their operations.

Q: What does ATS stand for?

A: ATS stands for Alternative Trading System.

Q: What is an alternative trading system?

A: An alternative trading system is a platform for trading securities that is not a registered national securities exchange.

Q: Why do alternative trading systems file Form ATS-N?

A: Alternative trading systems file Form ATS-N to provide transparency and regulatory oversight to the SEC.

Q: What kind of information is included in Form ATS-N?

A: Form ATS-N includes information about the ATS's operations, trading activities, and compliance with SEC rules and regulations.

Q: Are all alternative trading systems required to file Form ATS-N?

A: No, only alternative trading systems that meet certain thresholds of trading volume or market share are required to file Form ATS-N.

Q: What is the purpose of regulating alternative trading systems?

A: Regulating alternative trading systems helps to protect investors and maintain fair and efficient markets.

Q: Are alternative trading systems regulated by the SEC?

A: Yes, alternative trading systems are regulated by the SEC to ensure compliance with securities laws and regulations.

Q: Can individuals trade on alternative trading systems?

A: Yes, individuals can trade on alternative trading systems, although access may be limited compared to traditional stock exchanges.

Form Details:

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ATS-N by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.