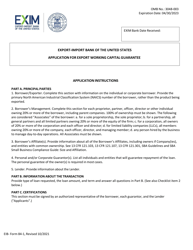

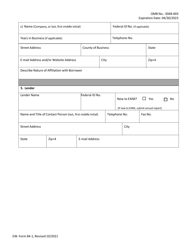

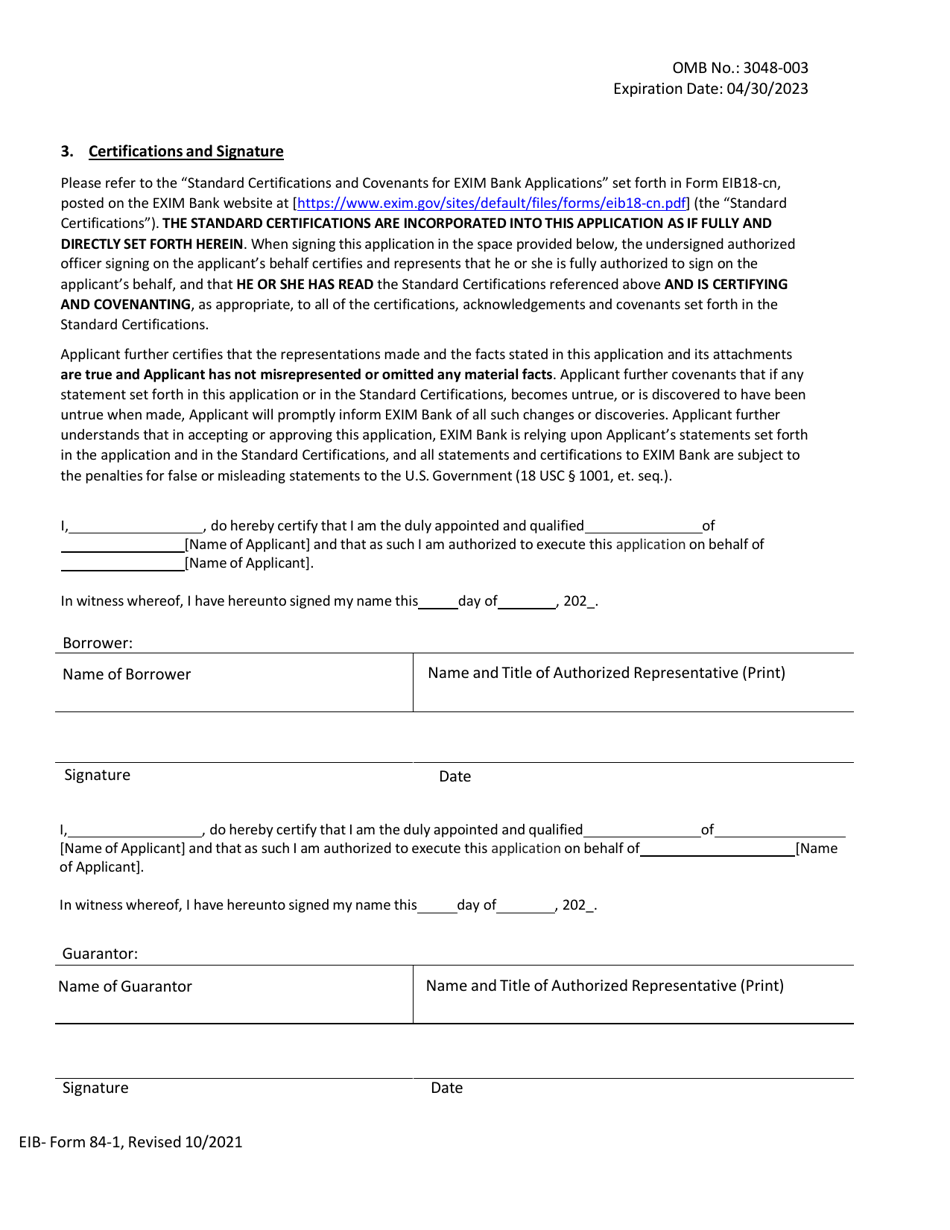

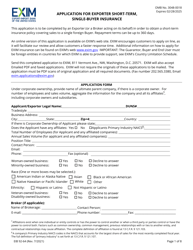

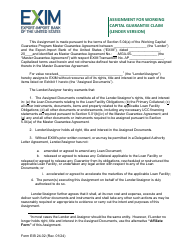

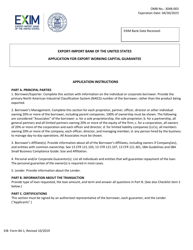

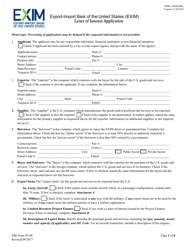

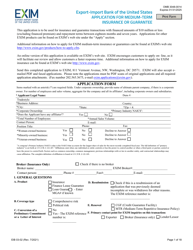

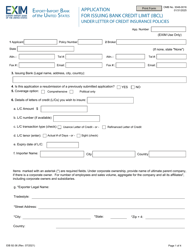

EIB Form 84-1 Application for Export Working Capital Guarantee

What Is EIB Form 84-1?

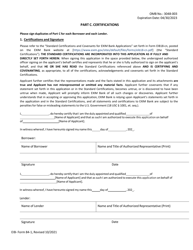

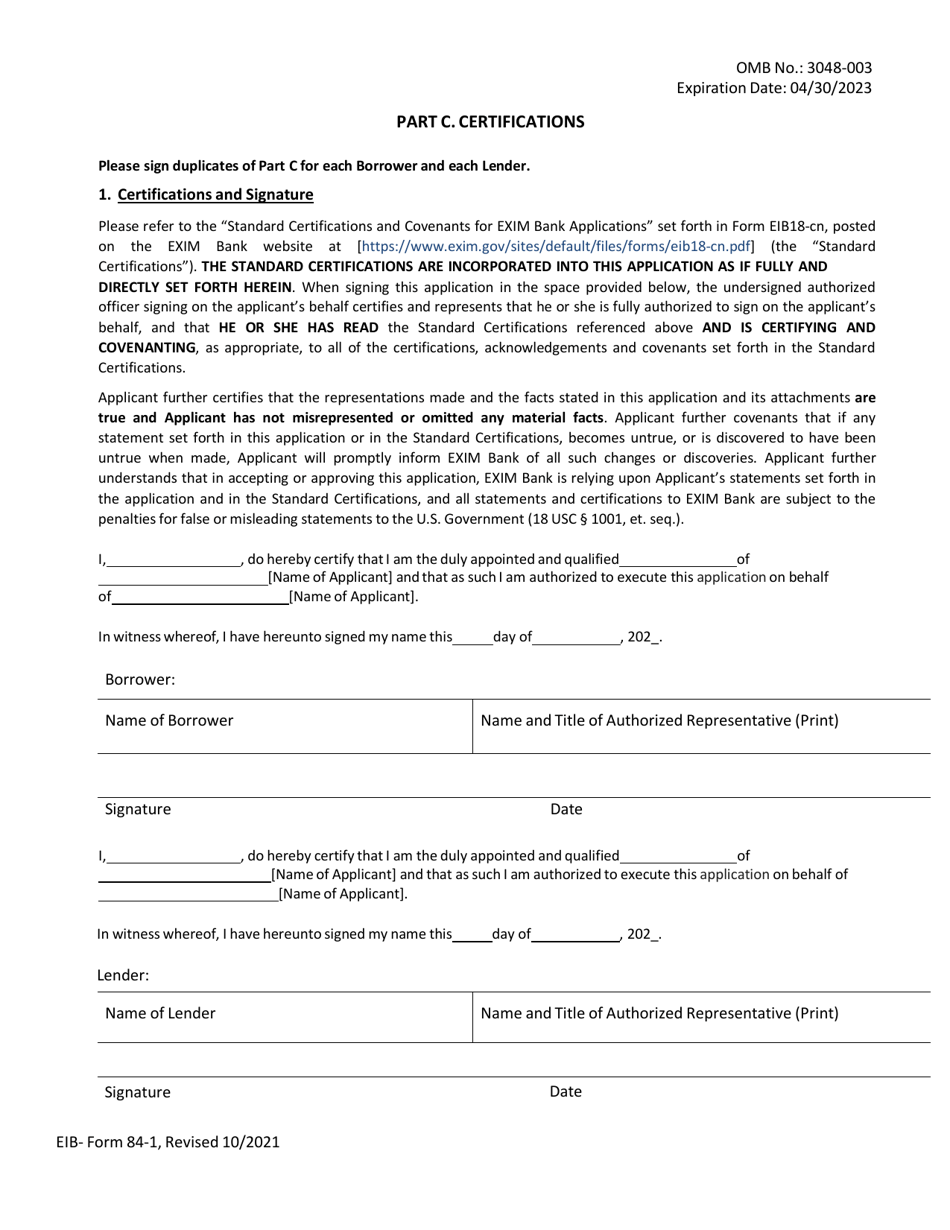

This is a legal form that was released by the Export-Import Bank of the United States on October 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is EIB Form 84-1?

A: EIB Form 84-1 is an application for Export Working Capital Guarantee.

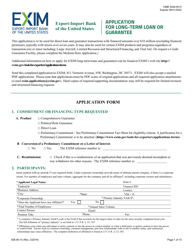

Q: What is an Export Working Capital Guarantee?

A: An Export Working Capital Guarantee is a financial tool that helps exporters obtain working capital funding from lenders.

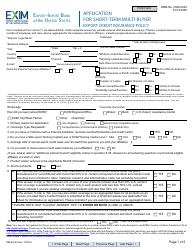

Q: Who is eligible to use EIB Form 84-1?

A: Exporters who meet certain criteria are eligible to use EIB Form 84-1.

Q: What is the purpose of EIB Form 84-1?

A: The purpose of EIB Form 84-1 is to apply for an Export Working Capital Guarantee to support export activities.

Q: How can exporters obtain EIB Form 84-1?

A: Exporters can obtain EIB Form 84-1 by contacting the Export-Import Bank of the United States (EXIM Bank).

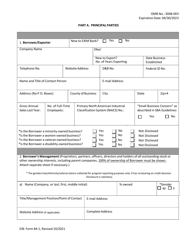

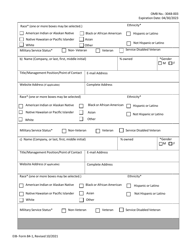

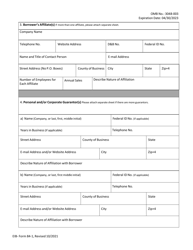

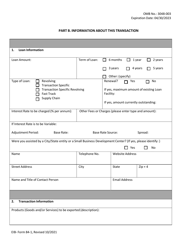

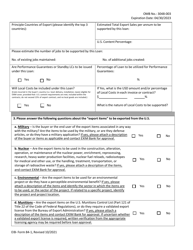

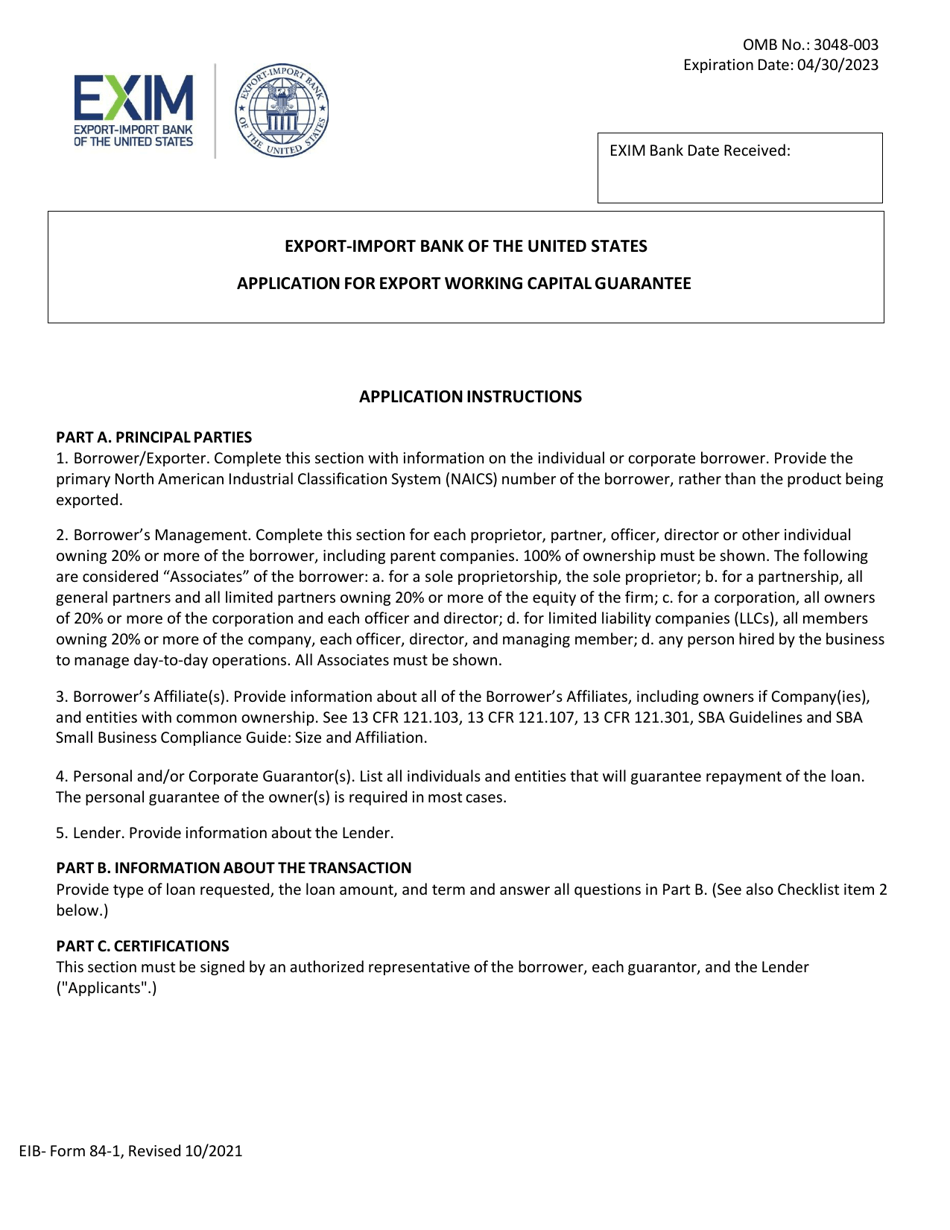

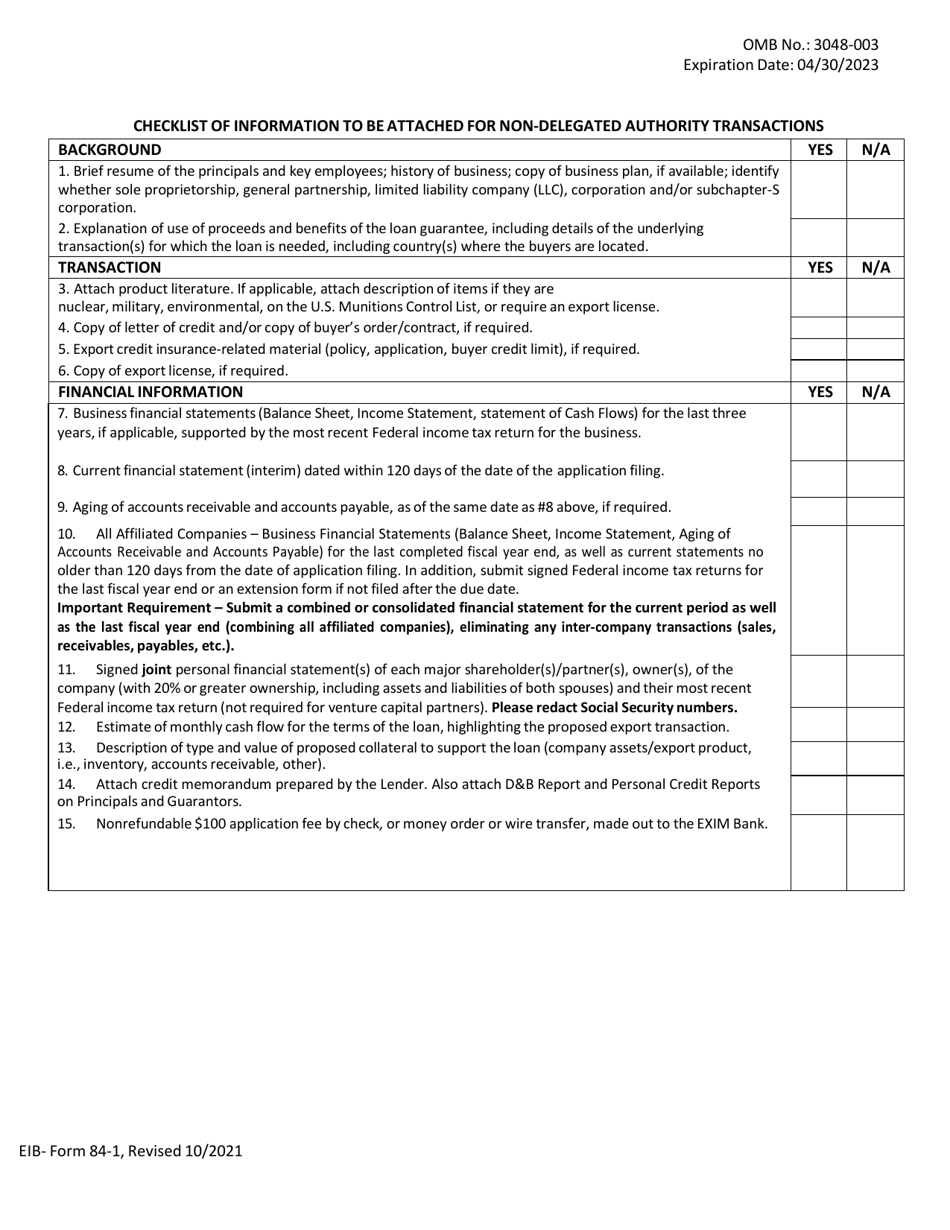

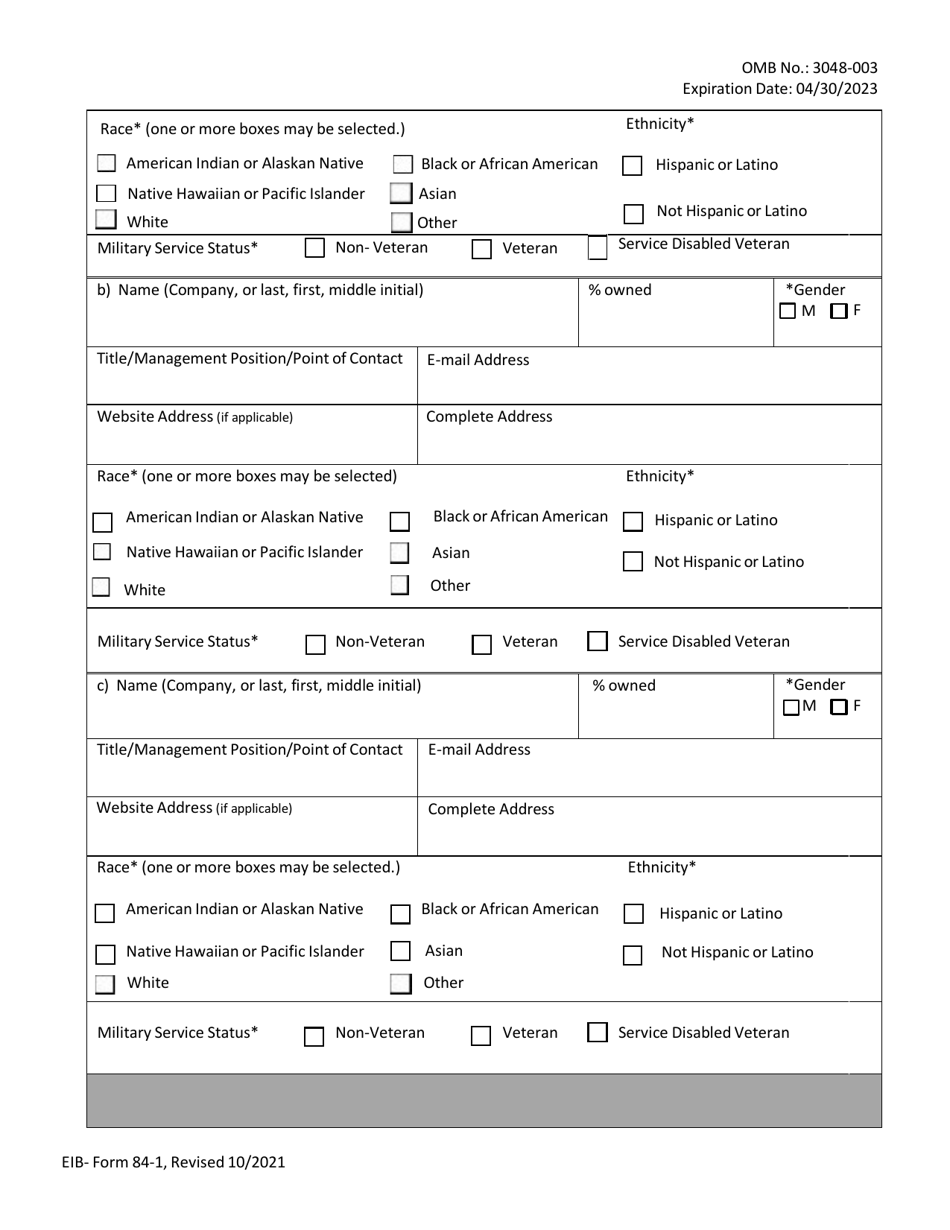

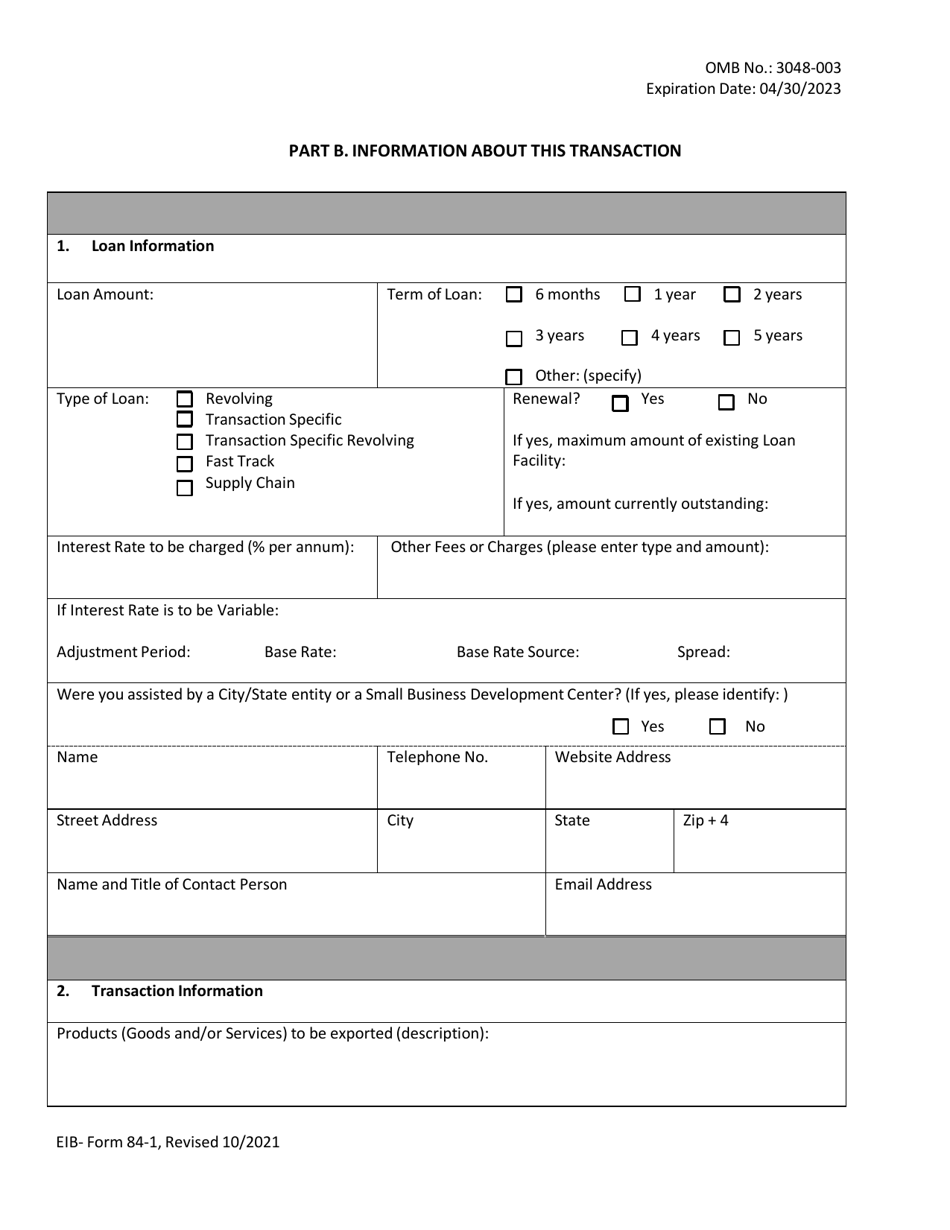

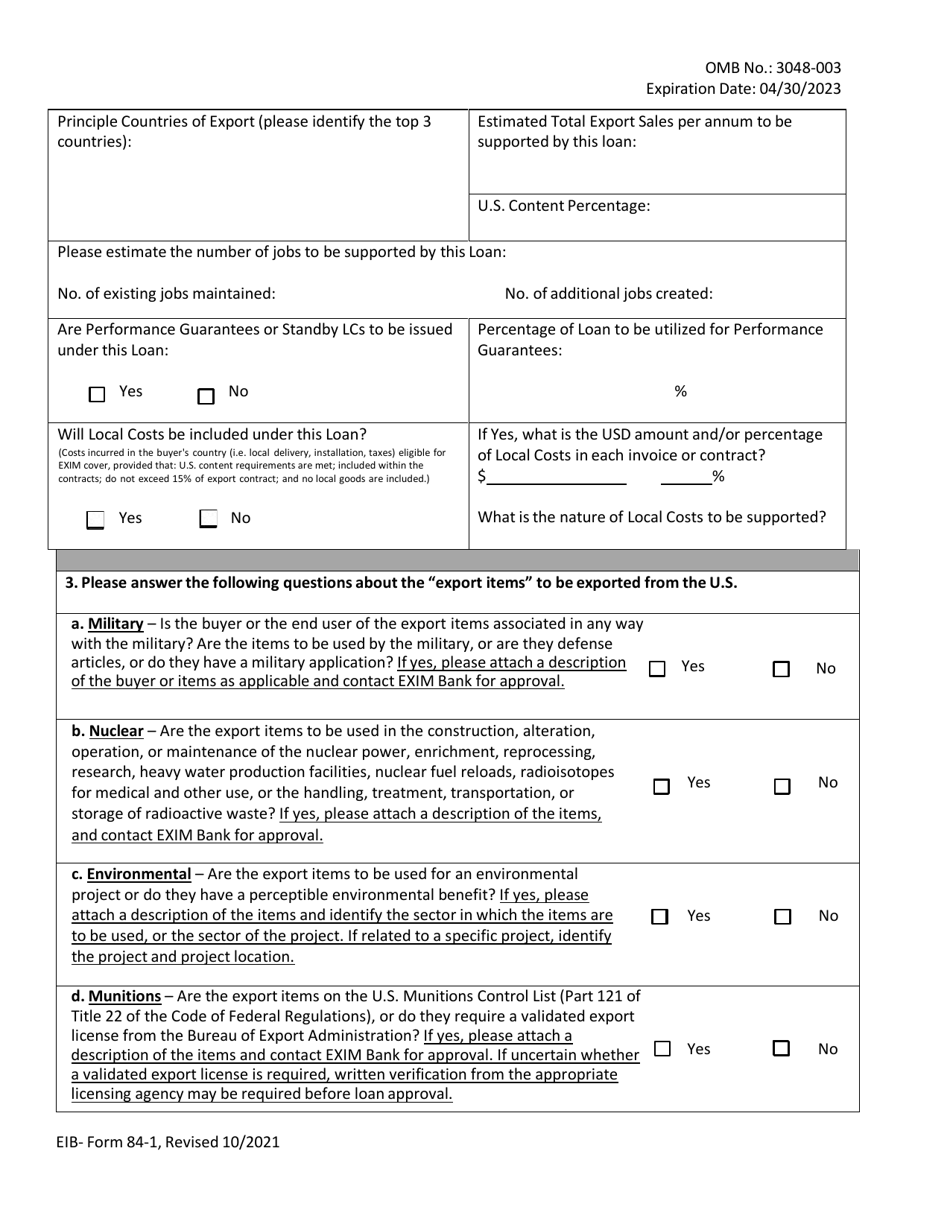

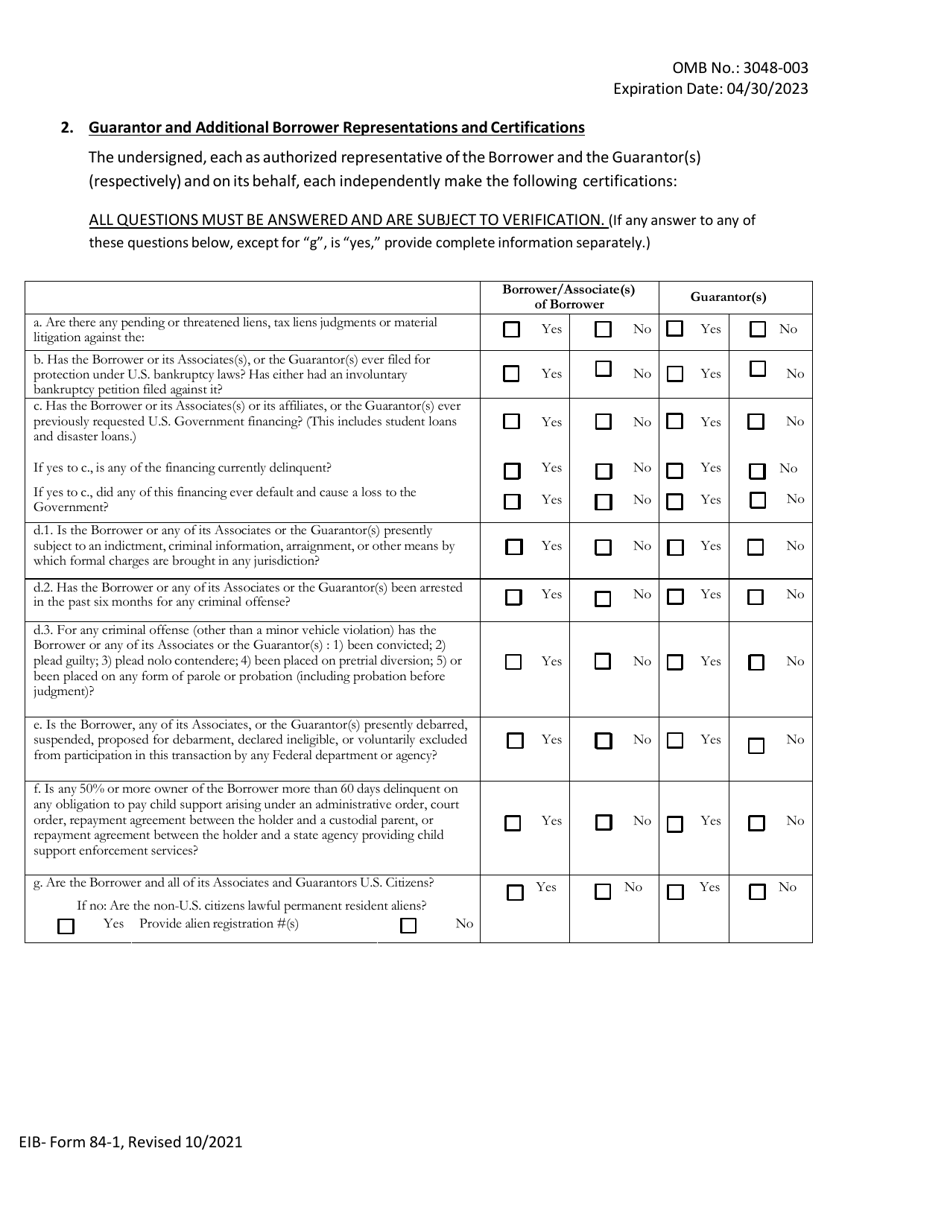

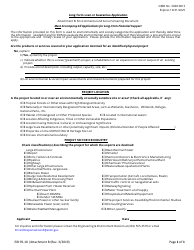

Q: What information is required in EIB Form 84-1?

A: EIB Form 84-1 requires information about the exporter, the proposed export transaction, and the requested working capital guarantee amount.

Q: Are there any fees associated with EIB Form 84-1?

A: Yes, there are fees associated with EIB Form 84-1. The specific fees depend on the size and complexity of the transaction.

Q: How long does it take to process EIB Form 84-1?

A: The processing time for EIB Form 84-1 varies, but it typically takes several weeks.

Q: What is the role of the EXIM Bank in EIB Form 84-1?

A: The EXIM Bank provides the working capital guarantee and facilitates the application process for exporters using EIB Form 84-1.

Form Details:

- Released on October 1, 2021;

- The latest available edition released by the Export-Import Bank of the United States;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of EIB Form 84-1 by clicking the link below or browse more documents and templates provided by the Export-Import Bank of the United States.