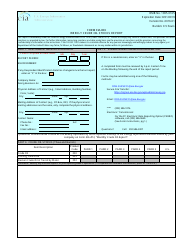

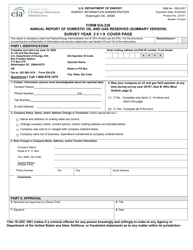

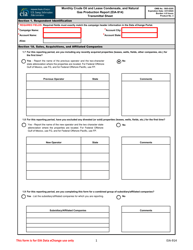

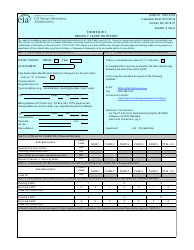

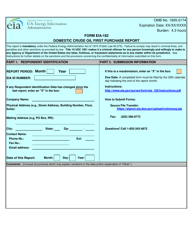

Instructions for Form EIA-856 Monthly Foreign Crude Oil Acquisition Report

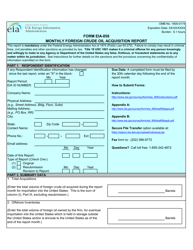

This document contains official instructions for Form EIA-856 , Monthly Foreign Crude Oil Acquisition Report - a form released and collected by the U.S. Energy Information Administration. An up-to-date fillable Form EIA-856 is available for download through this link.

FAQ

Q: What is Form EIA-856?

A: Form EIA-856 is a reporting form used to collect data on monthly foreign crude oil acquisitions by U.S. refiners.

Q: Who is required to file Form EIA-856?

A: U.S. refiners are required to file Form EIA-856.

Q: What data is collected on Form EIA-856?

A: Form EIA-856 collects data on monthly foreign crude oil acquisitions, including volumes, values, countries of origin, and other information.

Q: How often is Form EIA-856 filed?

A: Form EIA-856 is filed on a monthly basis.

Q: Are there any reporting exemptions or extensions for Form EIA-856?

A: Yes, certain refiners may be eligible for reporting exemptions or extensions. Please refer to the instructions for Form EIA-856 for more information.

Q: What is the purpose of collecting data on foreign crude oil acquisitions?

A: Collecting data on foreign crude oil acquisitions helps monitor U.S. energy security and provides valuable information for analyzing trends in the global oil market.

Q: Are there any penalties for non-compliance with Form EIA-856 reporting requirements?

A: Yes, failure to comply with Form EIA-856 reporting requirements may result in penalties, as specified by the U.S. Energy Policy and Conservation Act.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Energy Information Administration.