This version of the form is not currently in use and is provided for reference only. Download this version of

Form DLGF RC-1 (State Form 46373)

for the current year.

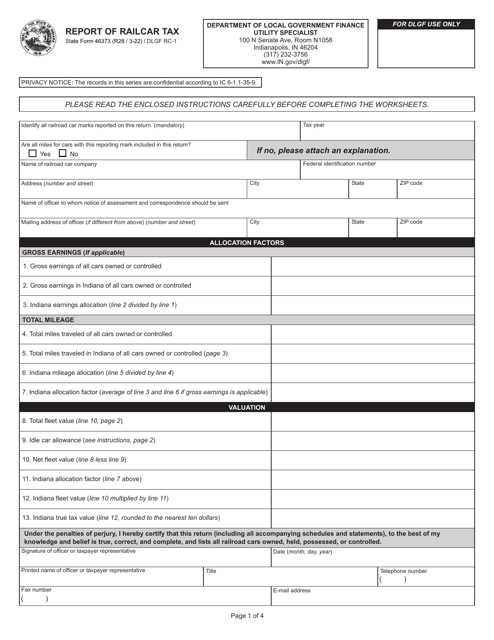

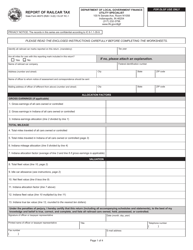

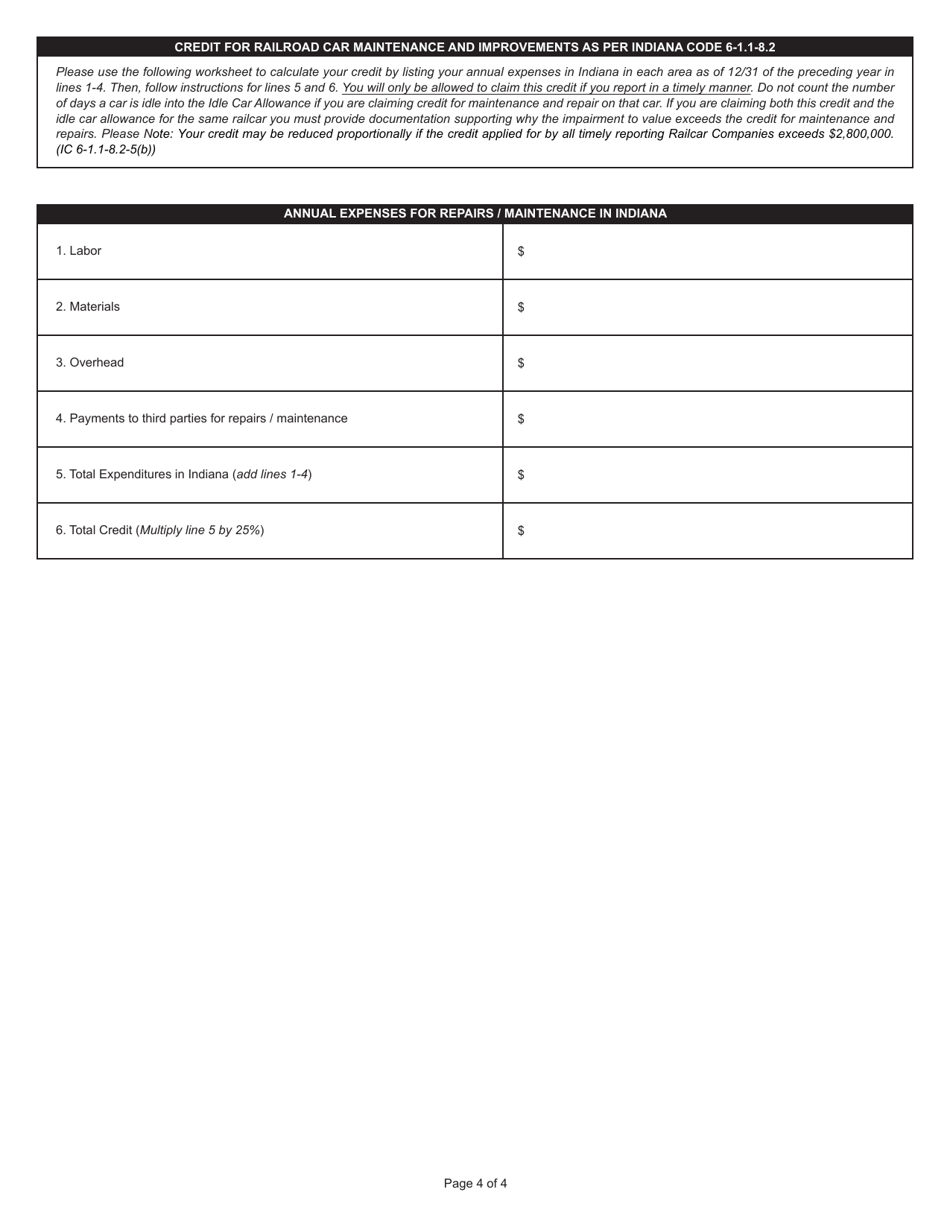

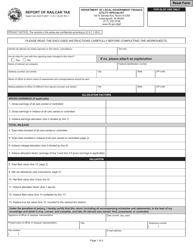

Form DLGF RC-1 (State Form 46373) Report of Railcar Tax - Indiana

What Is Form DLGF RC-1 (State Form 46373)?

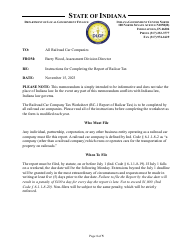

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DLGF RC-1?

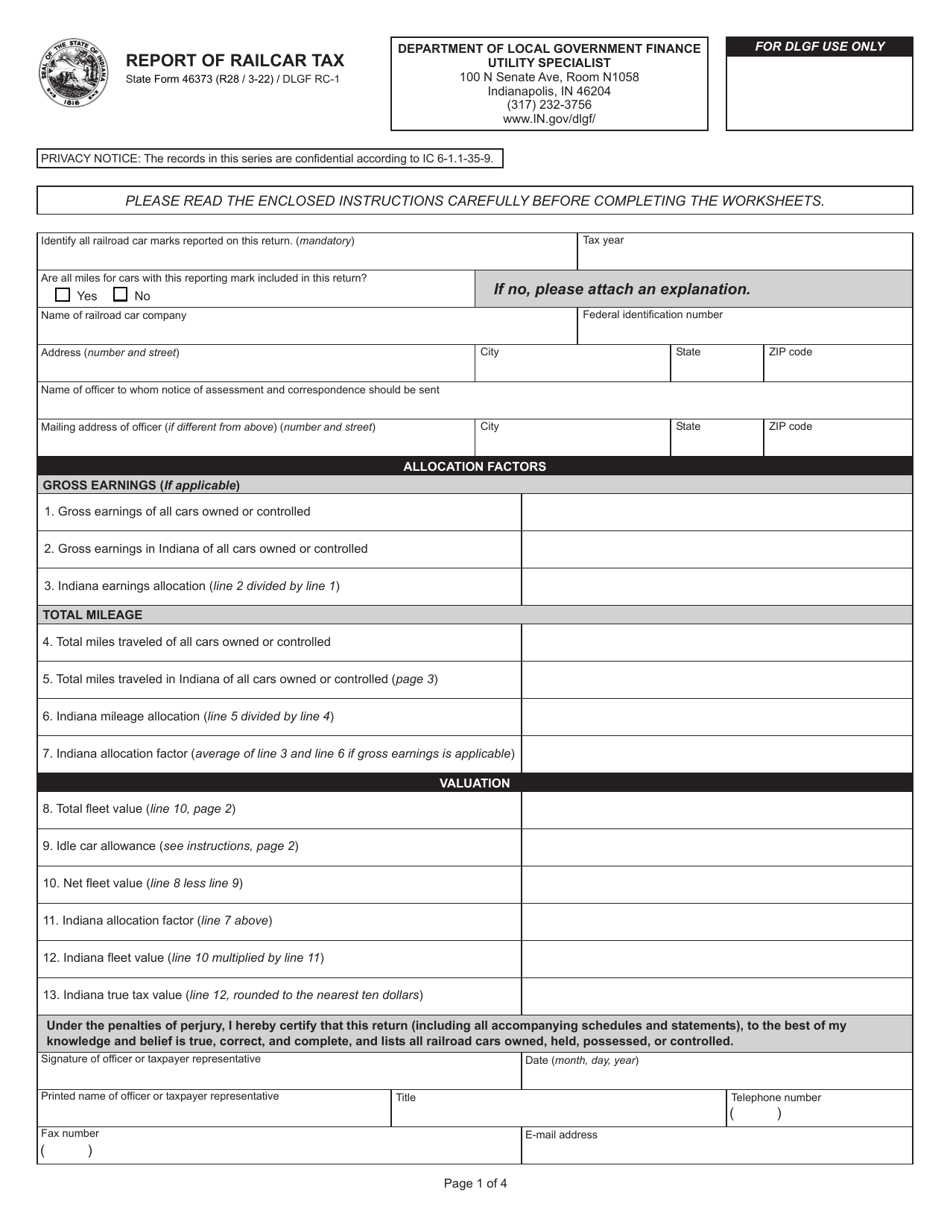

A: Form DLGF RC-1 is a tax form used in Indiana to report railcar tax.

Q: What is the purpose of Form DLGF RC-1?

A: The purpose of Form DLGF RC-1 is to report railcar tax.

Q: Who needs to file Form DLGF RC-1?

A: Anyone who owns or leases railcars in Indiana and is subject to railcar tax needs to file Form DLGF RC-1.

Q: Is there a deadline for filing Form DLGF RC-1?

A: Yes, the deadline for filing Form DLGF RC-1 is typically May 15th of each year.

Q: Are there any penalties for late filing of Form DLGF RC-1?

A: Yes, there are penalties for late filing of Form DLGF RC-1, including potential fines and interest charges.

Q: Is there a fee for filing Form DLGF RC-1?

A: There is no fee for filing Form DLGF RC-1.

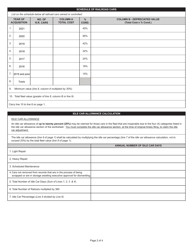

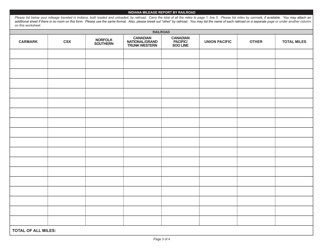

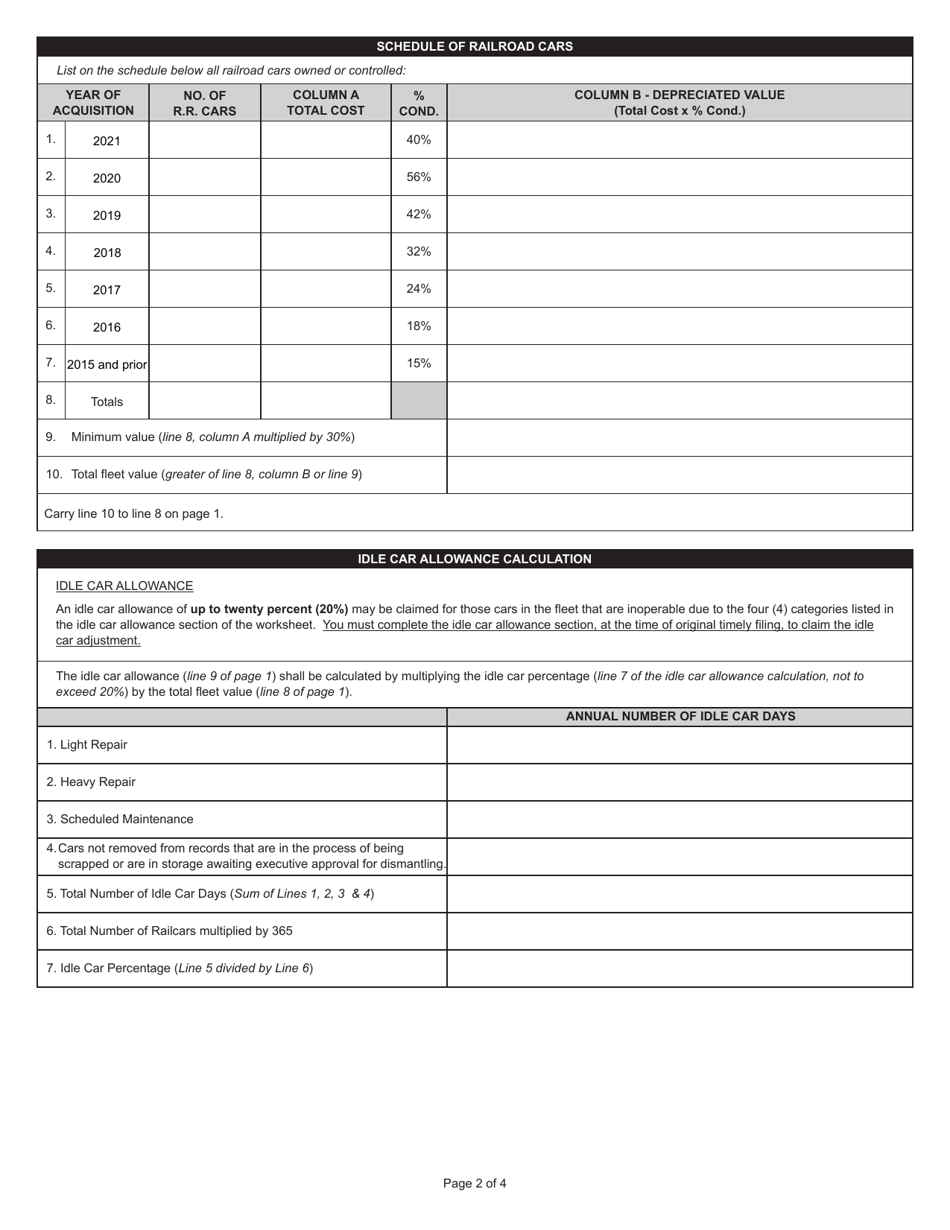

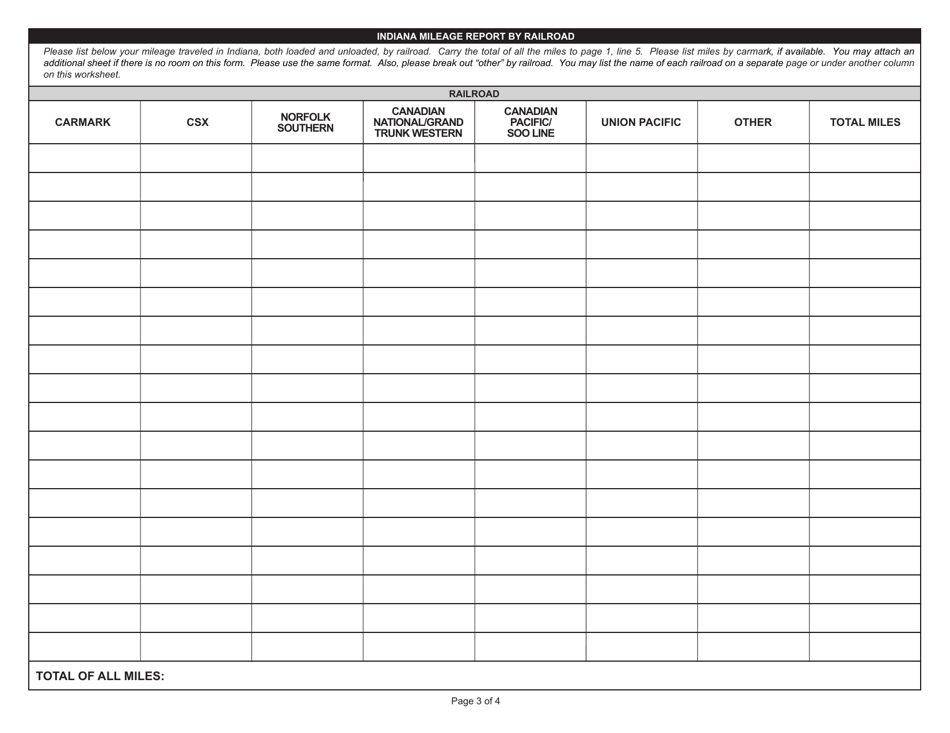

Q: What information is required to complete Form DLGF RC-1?

A: To complete Form DLGF RC-1, you will need information about your railcars, including their identification numbers and values.

Q: Who should I contact for more information about Form DLGF RC-1?

A: For more information about Form DLGF RC-1, you can contact the Indiana Department of Local Government Finance.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DLGF RC-1 (State Form 46373) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.