This version of the form is not currently in use and is provided for reference only. Download this version of

Form TMR-12

for the current year.

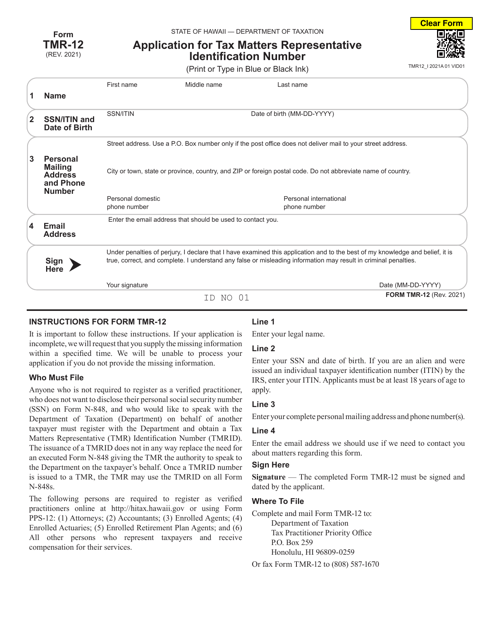

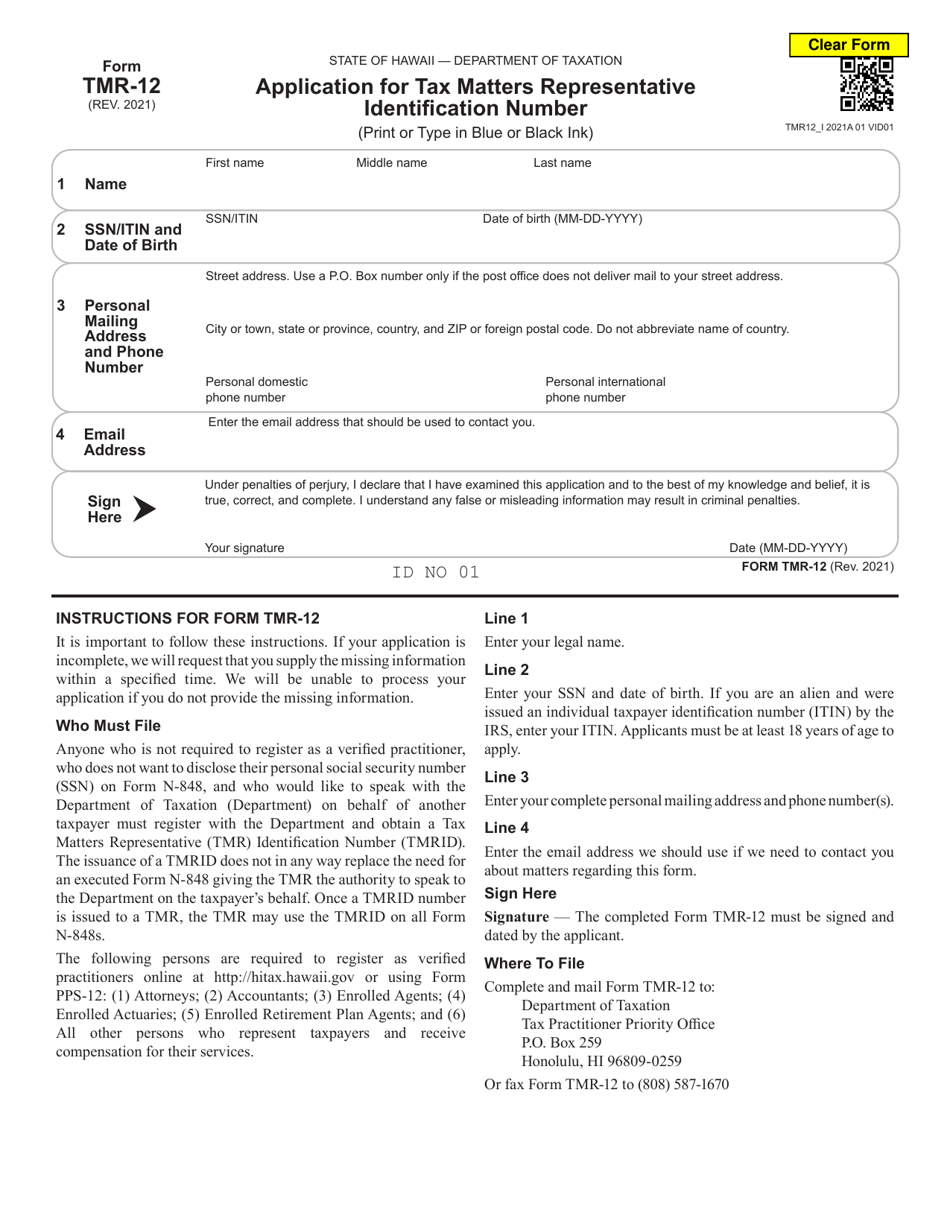

Form TMR-12 Application for Tax Matters Representative Identification Number - Hawaii

What Is Form TMR-12?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TMR-12?

A: Form TMR-12 is the Application for Tax Matters Representative Identification Number for Hawaii.

Q: Who needs to file Form TMR-12?

A: Anyone who wants to become a Tax Matters Representative for Hawaii tax matters needs to file Form TMR-12.

Q: What is a Tax Matters Representative?

A: A Tax Matters Representative is an individual designated to represent and handle tax matters on behalf of an entity or person in Hawaii.

Q: Is there a fee for filing Form TMR-12?

A: Yes, there is a $20 fee for filing Form TMR-12.

Q: What information is required on Form TMR-12?

A: Form TMR-12 requires information such as the representative's name, contact information, and the tax matters for which they wish to be appointed.

Q: What should I do after filing Form TMR-12?

A: After filing Form TMR-12, you should receive an identification number from the Hawaii Department of Taxation, which you can use when representing clients in tax matters.

Q: How long does it take to process Form TMR-12?

A: It may take several weeks to process Form TMR-12, so it's important to submit it in a timely manner.

Q: Are there any additional requirements for becoming a Tax Matters Representative in Hawaii?

A: Yes, in addition to filing Form TMR-12, you may be required to provide evidence of professional qualifications and experience, as well as a good standing certificate from the applicable licensing authority.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TMR-12 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.