This version of the form is not currently in use and is provided for reference only. Download this version of

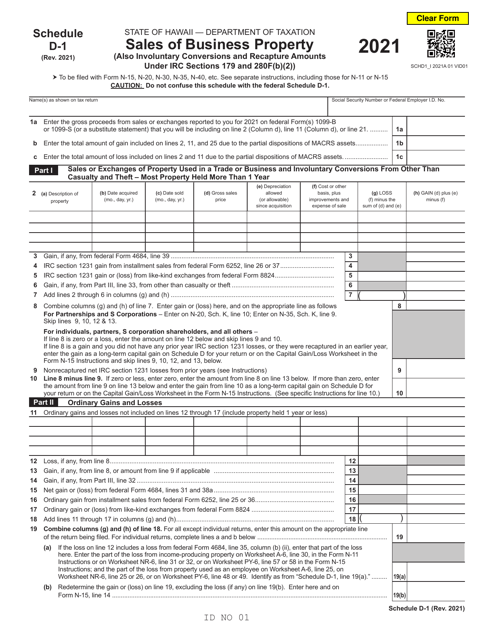

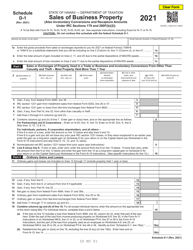

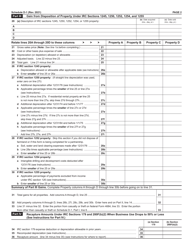

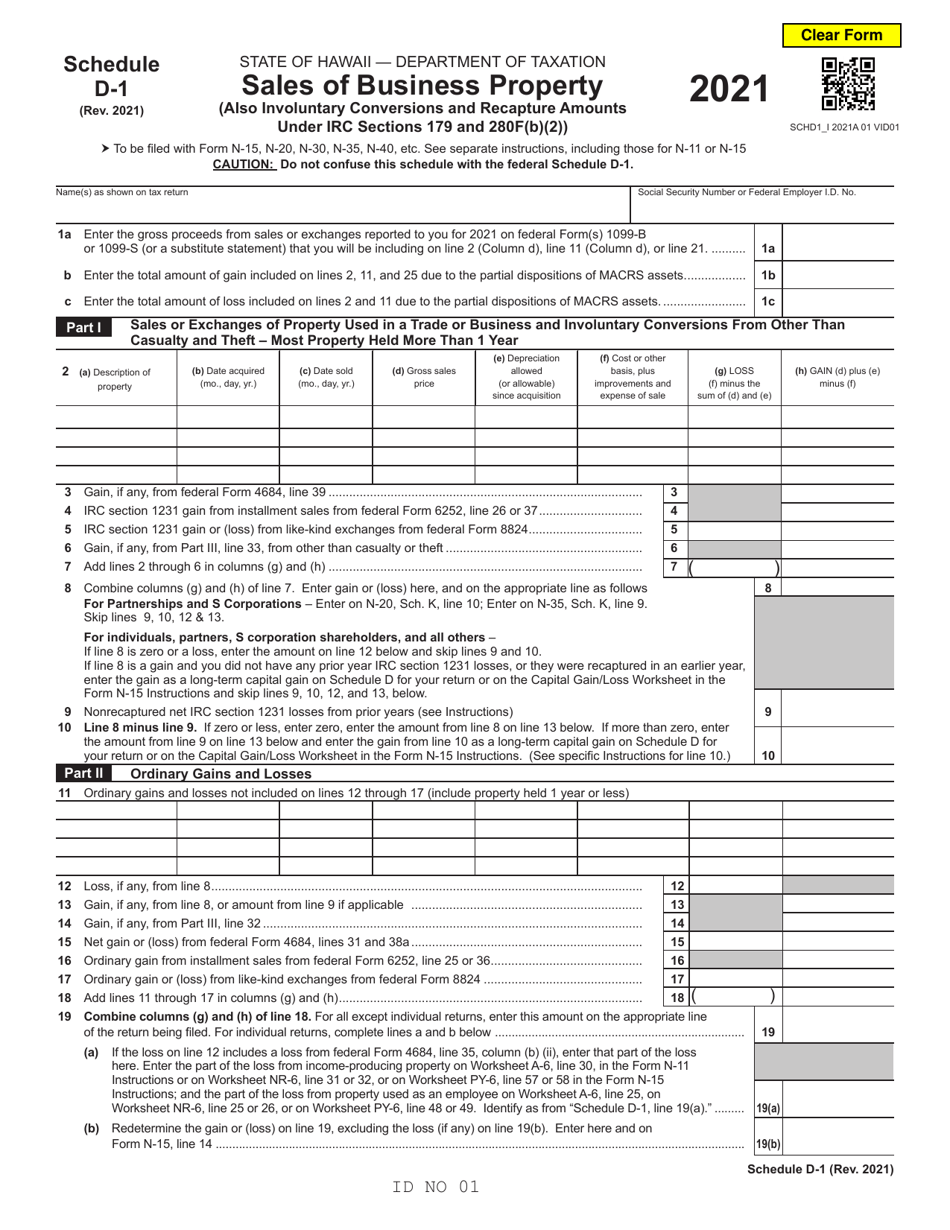

Schedule D-1

for the current year.

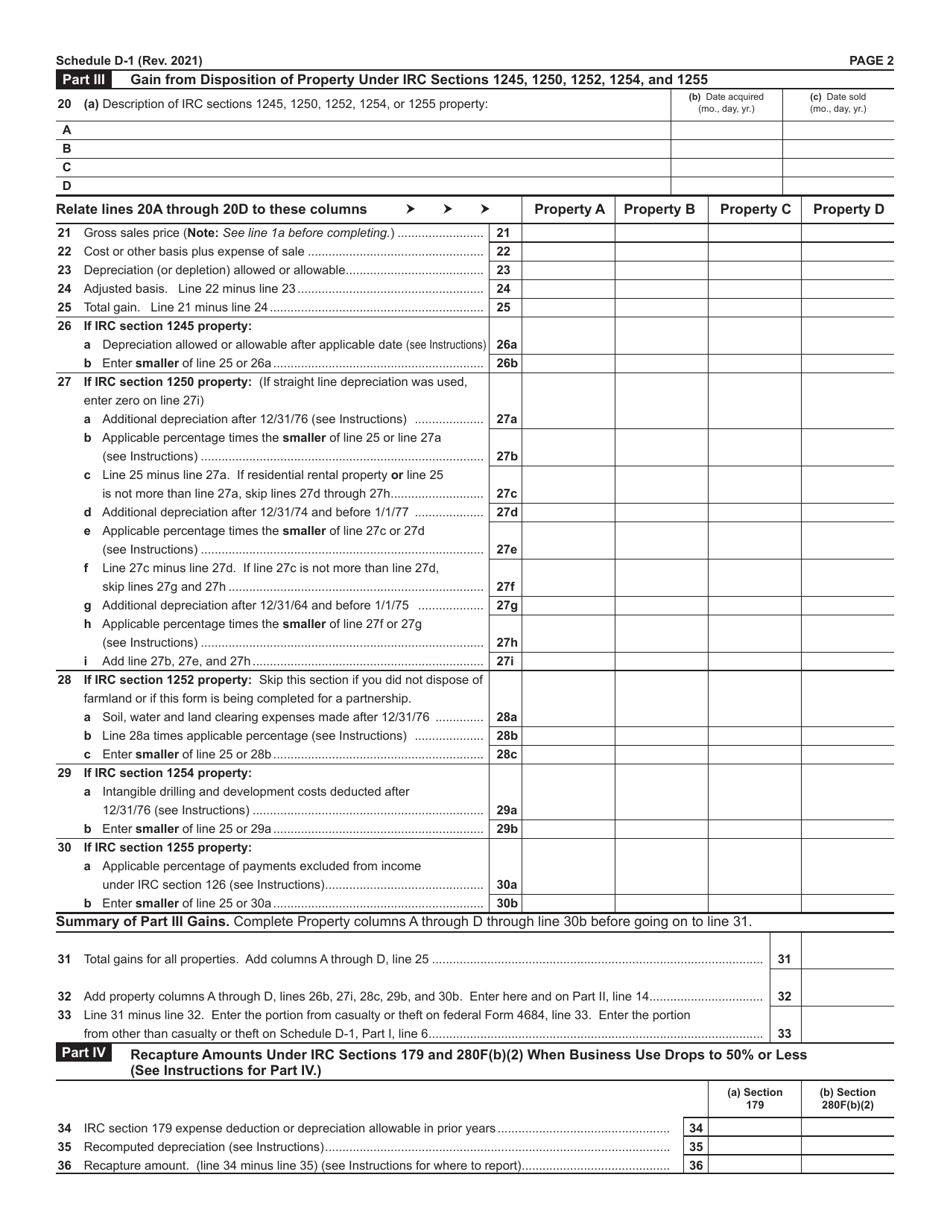

Schedule D-1 Sales of Business Property - Hawaii

What Is Schedule D-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D-1?

A: Schedule D-1 is a tax form used to report the sales of business property.

Q: When is Schedule D-1 used?

A: Schedule D-1 is used when you sell or dispose of property used for business or rental purposes.

Q: What is the purpose of Schedule D-1?

A: The purpose of Schedule D-1 is to calculate and report any gains or losses from the sale or disposal of business property.

Q: Do I need to file Schedule D-1 if I haven't sold any business property?

A: No, you only need to file Schedule D-1 if you have sold or disposed of business property during the tax year.

Q: What information do I need to complete Schedule D-1?

A: To complete Schedule D-1, you will need information about the property sold, the date of sale, the selling price, and the cost or basis of the property.

Q: Are there any special rules or deductions for Hawaii residents when filling out Schedule D-1?

A: Hawaii may have specific rules or deductions for its residents when filling out Schedule D-1. It is recommended to consult the Hawaii Department of Taxation or a tax professional for guidance.

Q: When is the deadline to file Schedule D-1?

A: The deadline to file Schedule D-1 is the same as the deadline for filing your Hawaii state tax return, which is typically April 20th or the next business day if it falls on a weekend or holiday.

Q: What are the consequences of not filing Schedule D-1 if required?

A: Failure to file Schedule D-1 when required may result in penalties and interest on any unpaid taxes.

Q: Can I e-file Schedule D-1?

A: Yes, you can e-file Schedule D-1 if you are filing your Hawaii state tax return electronically.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule D-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.