This version of the form is not currently in use and is provided for reference only. Download this version of

Form RV-3

for the current year.

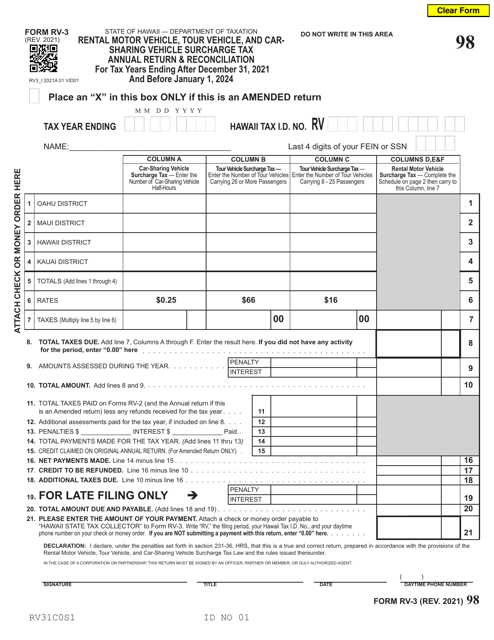

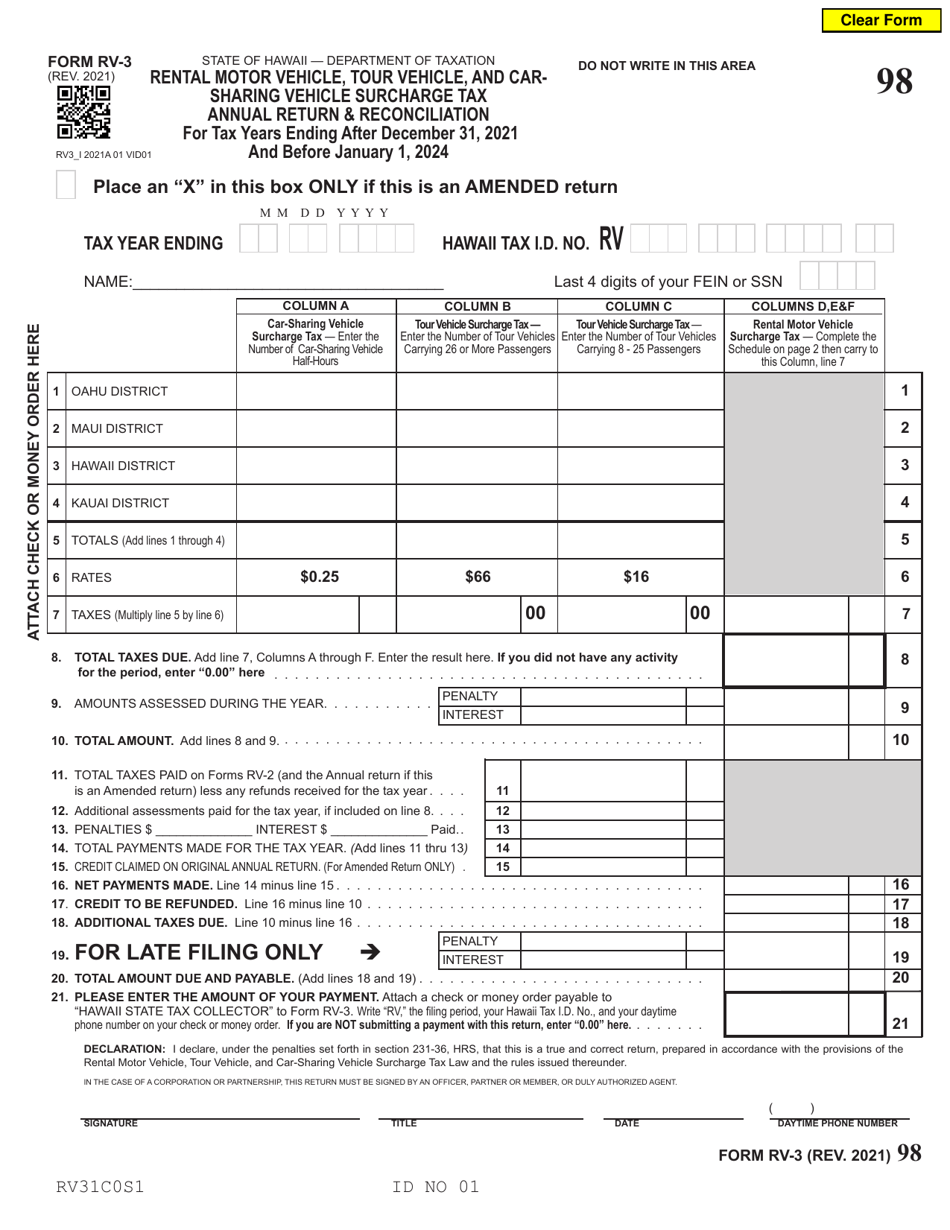

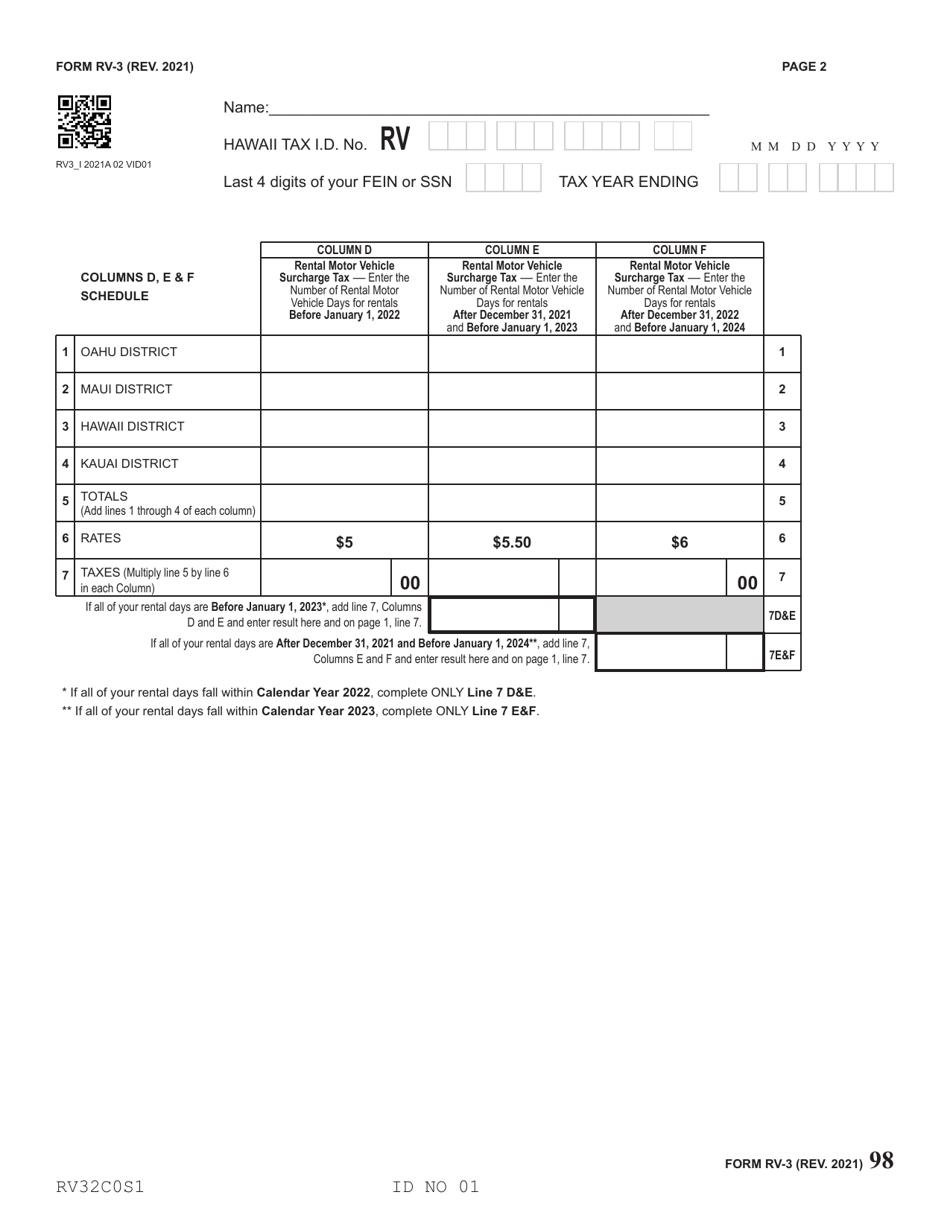

Form RV-3 Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax Annual Return and Reconciliation - Hawaii

What Is Form RV-3?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form RV-3?

A: The Form RV-3 is the Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax Annual Return and Reconciliation.

Q: Who needs to file Form RV-3?

A: Individuals or businesses engaged in the rental or sharing of motor vehicles in Hawaii need to file Form RV-3.

Q: What is the purpose of Form RV-3?

A: The purpose of Form RV-3 is to report and reconcile the surcharge tax on rental motor vehicles, tour vehicles, and car-sharing vehicles.

Q: When is Form RV-3 due?

A: Form RV-3 is due on or before the last day of the fourth month following the close of the tax year.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-3 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.