This version of the form is not currently in use and is provided for reference only. Download this version of

Form RV-2

for the current year.

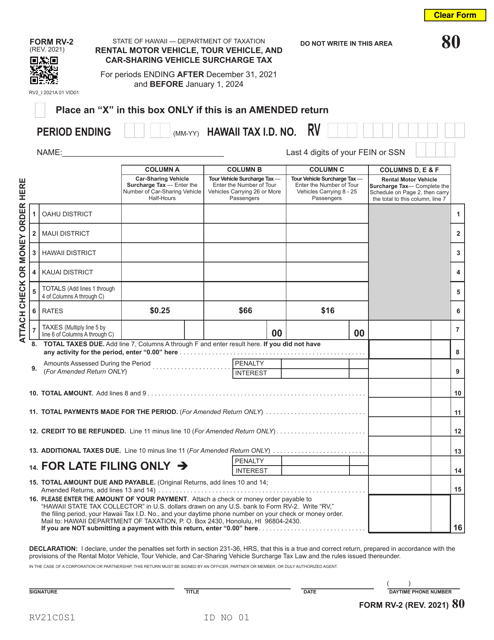

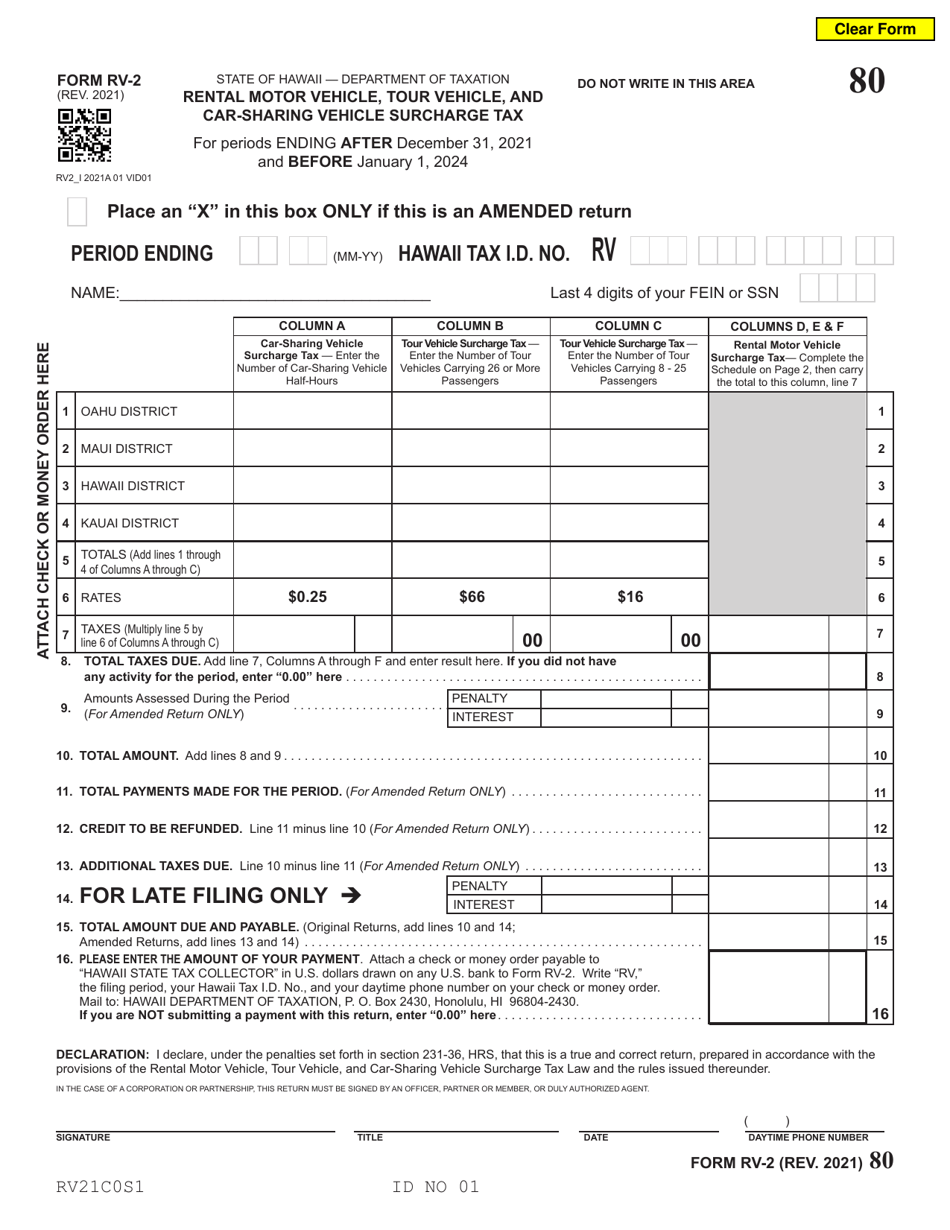

Form RV-2 Periodic Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax - Hawaii

What Is Form RV-2?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RV-2?

A: Form RV-2 is the Periodic RentalMotor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax form used in Hawaii.

Q: What is the purpose of Form RV-2?

A: The purpose of Form RV-2 is to report and pay the surcharge tax on rental motor vehicles, tour vehicles, and car-sharing vehicles in Hawaii.

Q: Who needs to file Form RV-2?

A: Vehicle rental companies, tour companies, and car-sharing businesses in Hawaii need to file Form RV-2.

Q: When is Form RV-2 due?

A: Form RV-2 is due on the last day of the month following the end of the reporting period.

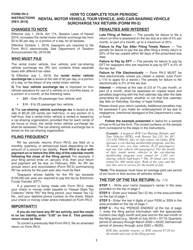

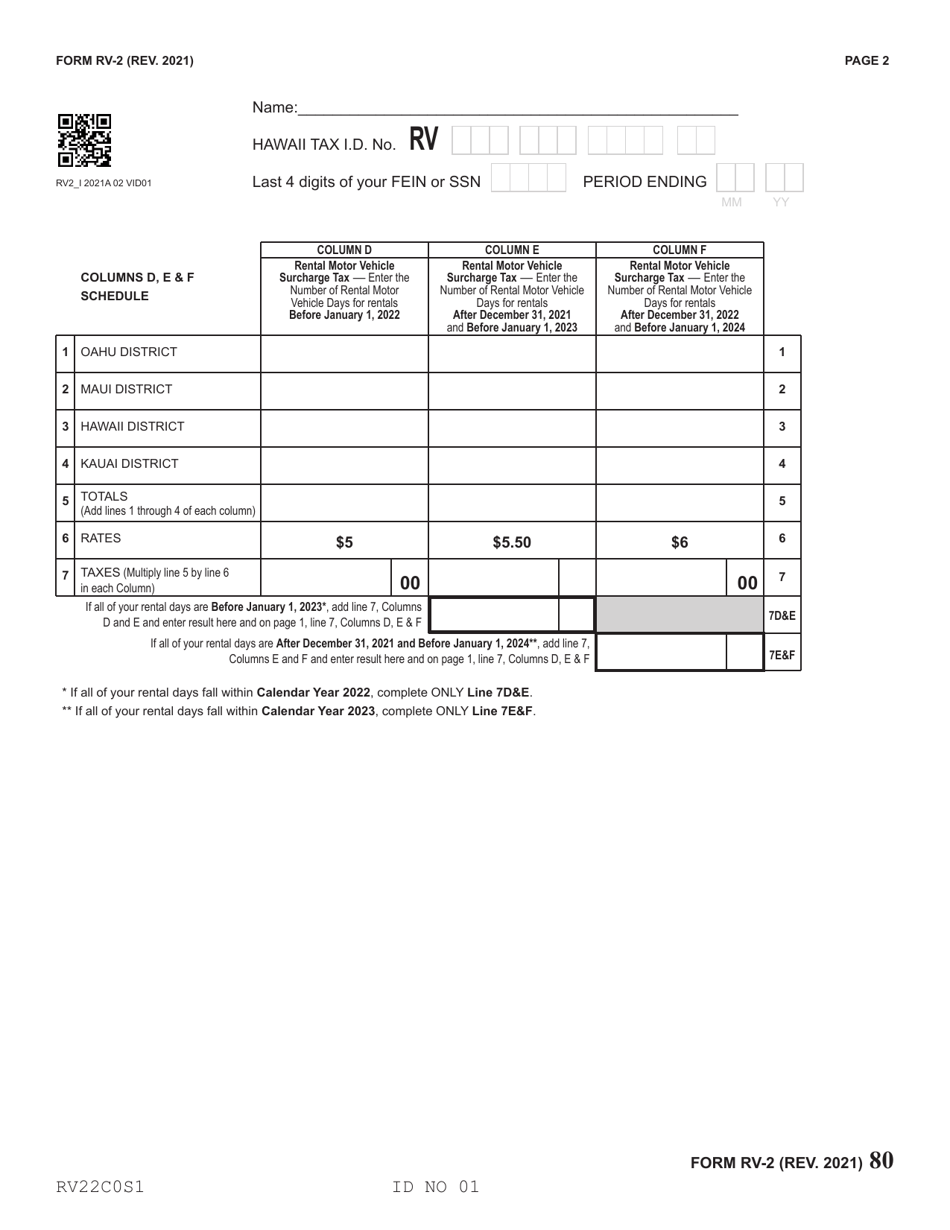

Q: How do I fill out Form RV-2?

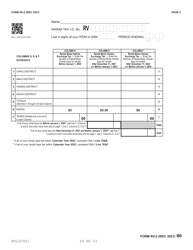

A: You need to provide information about your business, the number of vehicles rented or shared, and the total surcharge tax owed.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-2 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.