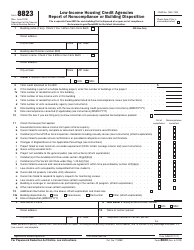

This version of the form is not currently in use and is provided for reference only. Download this version of

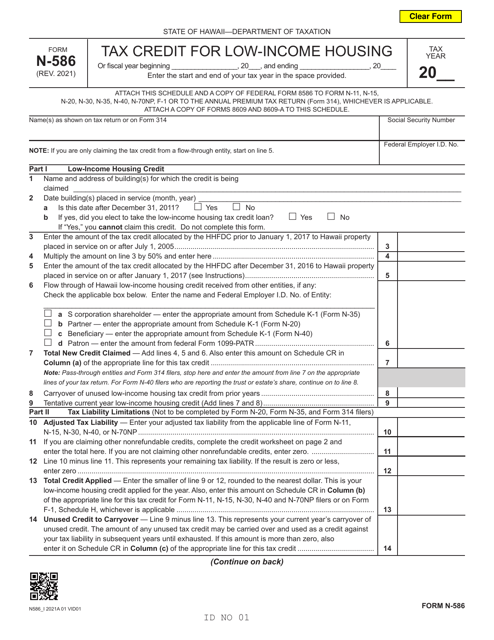

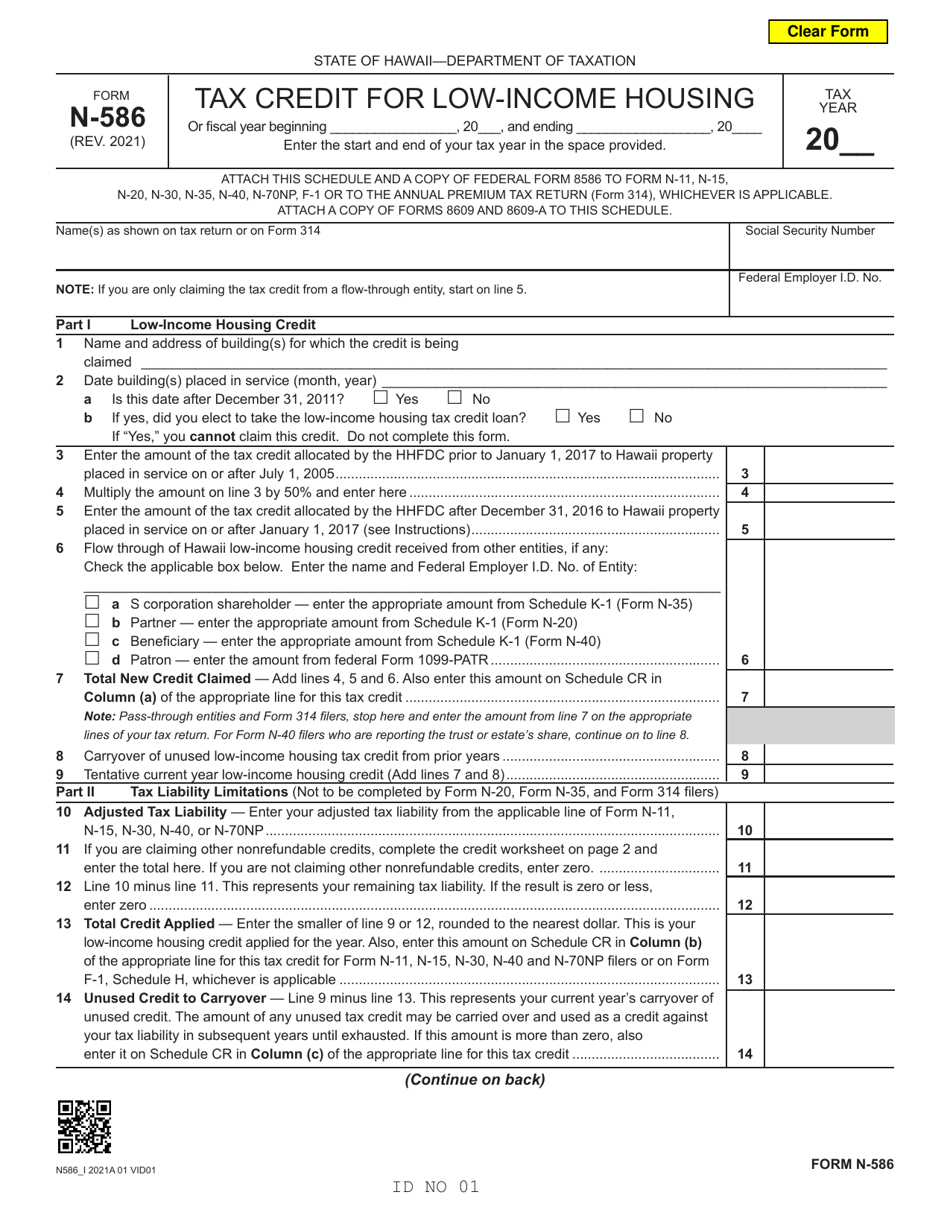

Form N-586

for the current year.

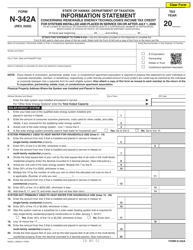

Form N-586 Tax Credit for Low-Income Housing - Hawaii

What Is Form N-586?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

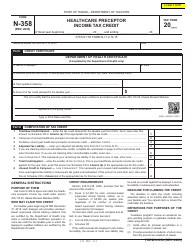

Q: What is Form N-586?

A: Form N-586 is a tax form specifically for claiming the Tax Credit for Low-Income Housing in Hawaii.

Q: What is the Tax Credit for Low-Income Housing?

A: The Tax Credit for Low-Income Housing is a program that provides tax incentives to individuals and businesses who invest in low-income housing projects in Hawaii.

Q: Who is eligible for the Tax Credit for Low-Income Housing?

A: Individuals and businesses who invest in qualified low-income housing projects in Hawaii are eligible for the tax credit.

Q: How do I claim the Tax Credit for Low-Income Housing?

A: To claim the tax credit, you must fill out and submit Form N-586 along with your tax return.

Q: What is the deadline for filing Form N-586?

A: The deadline for filing Form N-586 is the same as your income tax return deadline, typically April 15th.

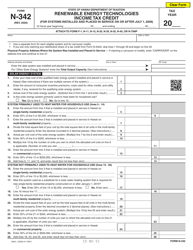

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations and restrictions on the tax credit, such as maximum credit amounts and requirements for maintaining the low-income housing.

Q: Can I carry forward any unused tax credits?

A: Yes, if you have any unused tax credits, you can carry them forward for up to 5 years.

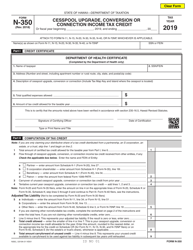

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-586 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.