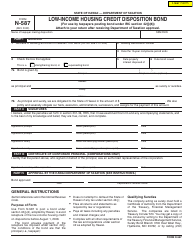

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-586

for the current year.

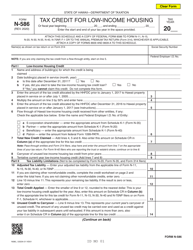

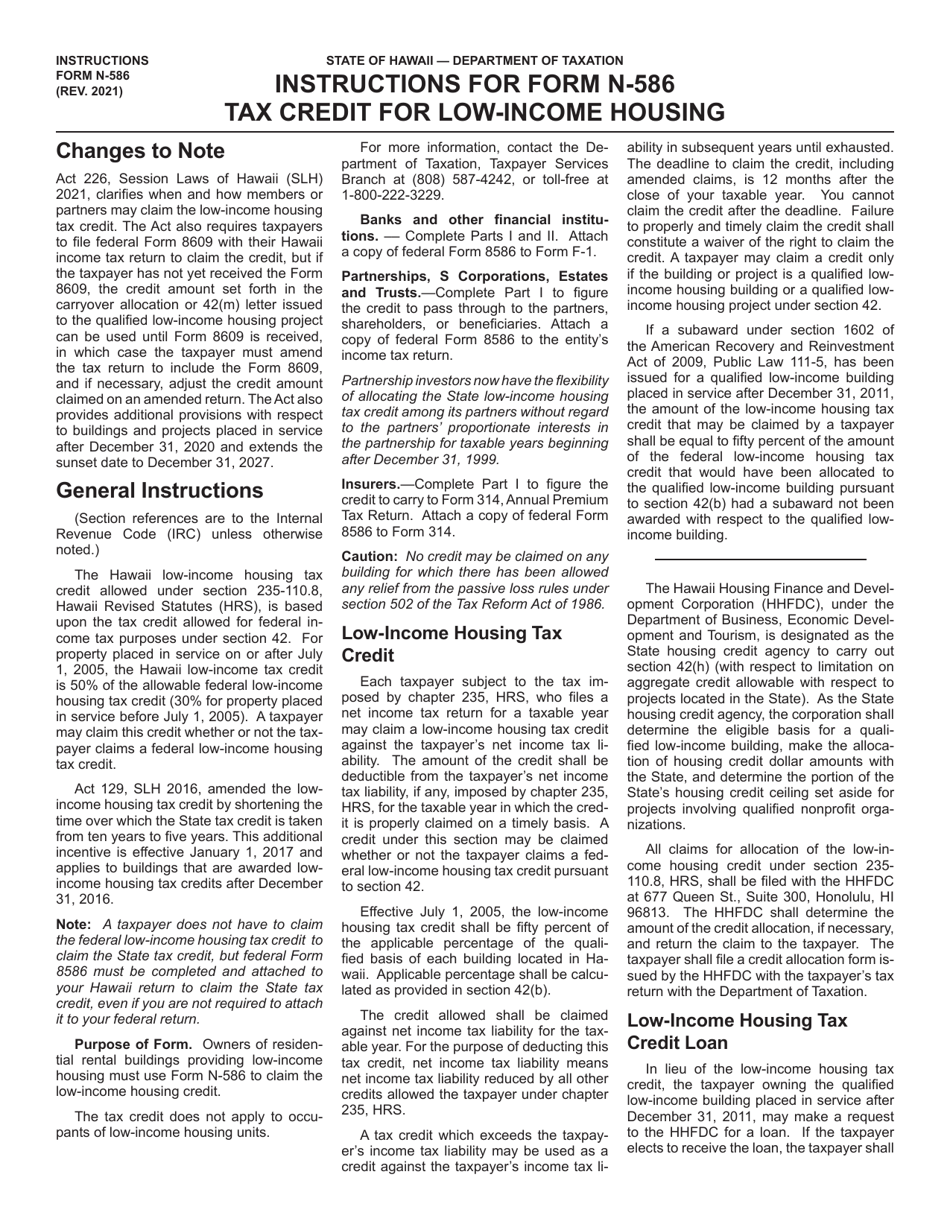

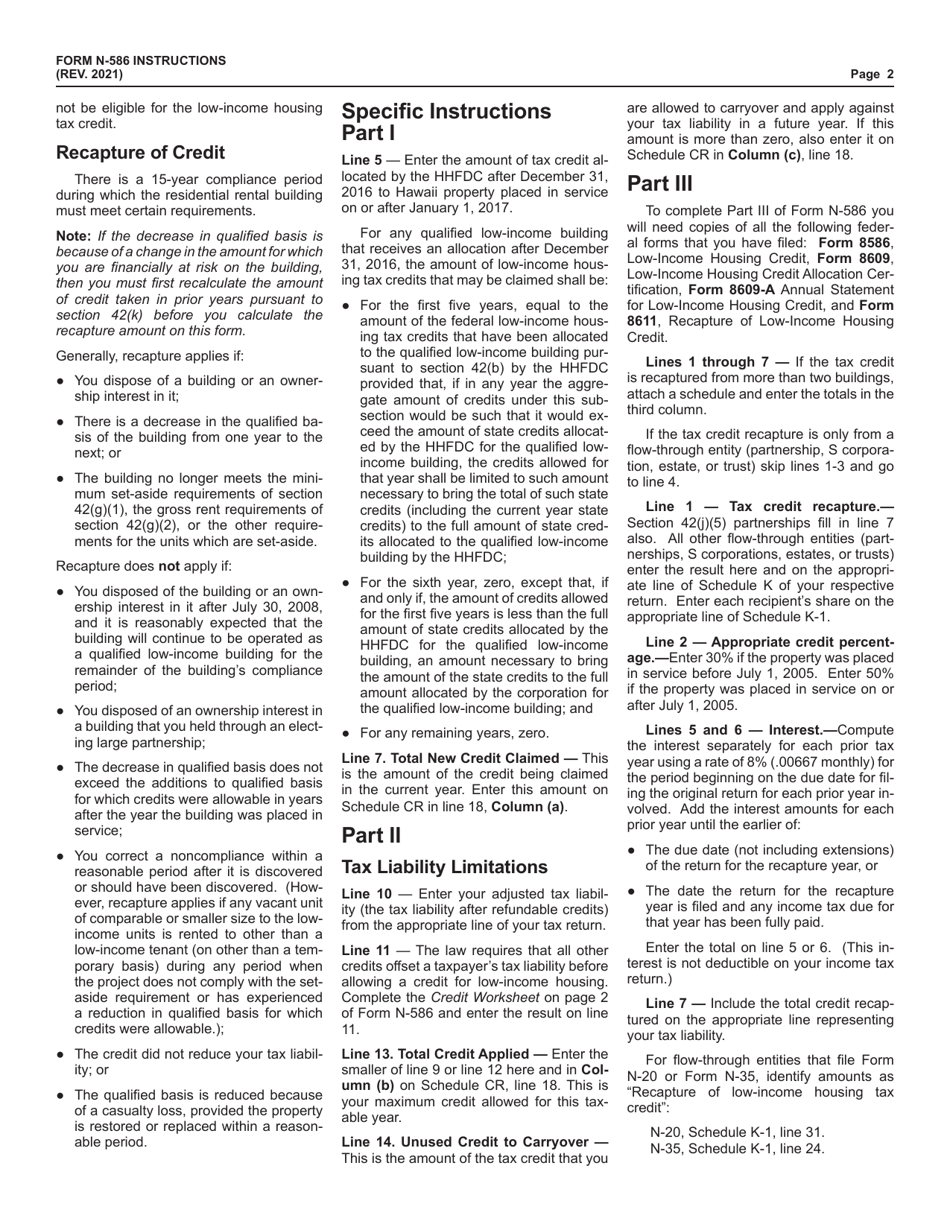

Instructions for Form N-586 Tax Credit for Low-Income Housing - Hawaii

This document contains official instructions for Form N-586 , Tax Credit for Low-Income Housing - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-586 is available for download through this link.

FAQ

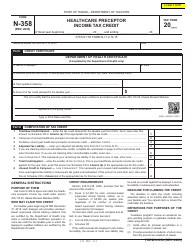

Q: What is Form N-586?

A: Form N-586 is a tax credit form for low-income housing in Hawaii.

Q: Who is eligible for the tax credit?

A: Low-income housing projects in Hawaii that meet certain requirements are eligible for the tax credit.

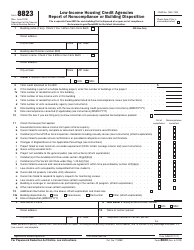

Q: What are the requirements for the tax credit?

A: The low-income housing project must meet specific criteria, including income limits for tenants and compliance with certain regulations.

Q: When is the deadline to file Form N-586?

A: The deadline to file Form N-586 is usually April 20th of the year following the tax year.

Q: What documentation do I need to include with Form N-586?

A: You may need to include documentation such as the project's financial statements, tenant income certifications, and rent rolls.

Q: What is the purpose of the tax credit?

A: The tax credit aims to incentivize the development and maintenance of low-income housing in Hawaii.

Q: Can the tax credit be carried forward or backward?

A: No, the tax credit cannot be carried forward or backward.

Q: Is the tax credit refundable?

A: No, the tax credit is not refundable. It can only be used to offset the taxpayer's Hawaii income tax liability.

Q: What happens if I don't meet the requirements for the tax credit?

A: If you don't meet the requirements, you may not be eligible for the tax credit and may have to pay any claimed credit back.

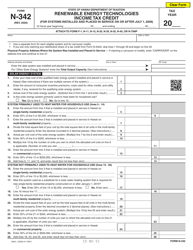

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.