This version of the form is not currently in use and is provided for reference only. Download this version of

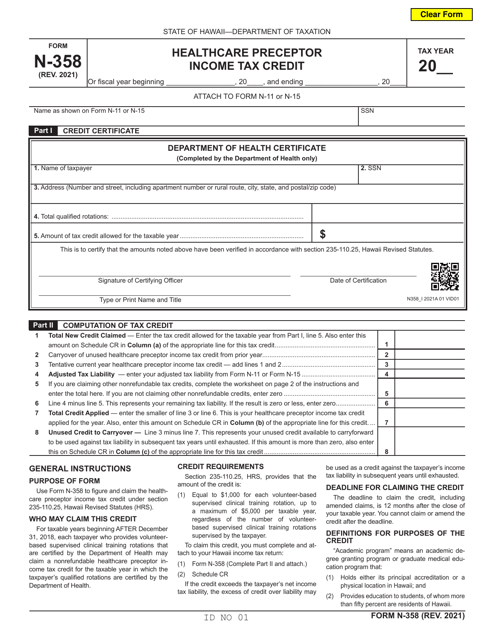

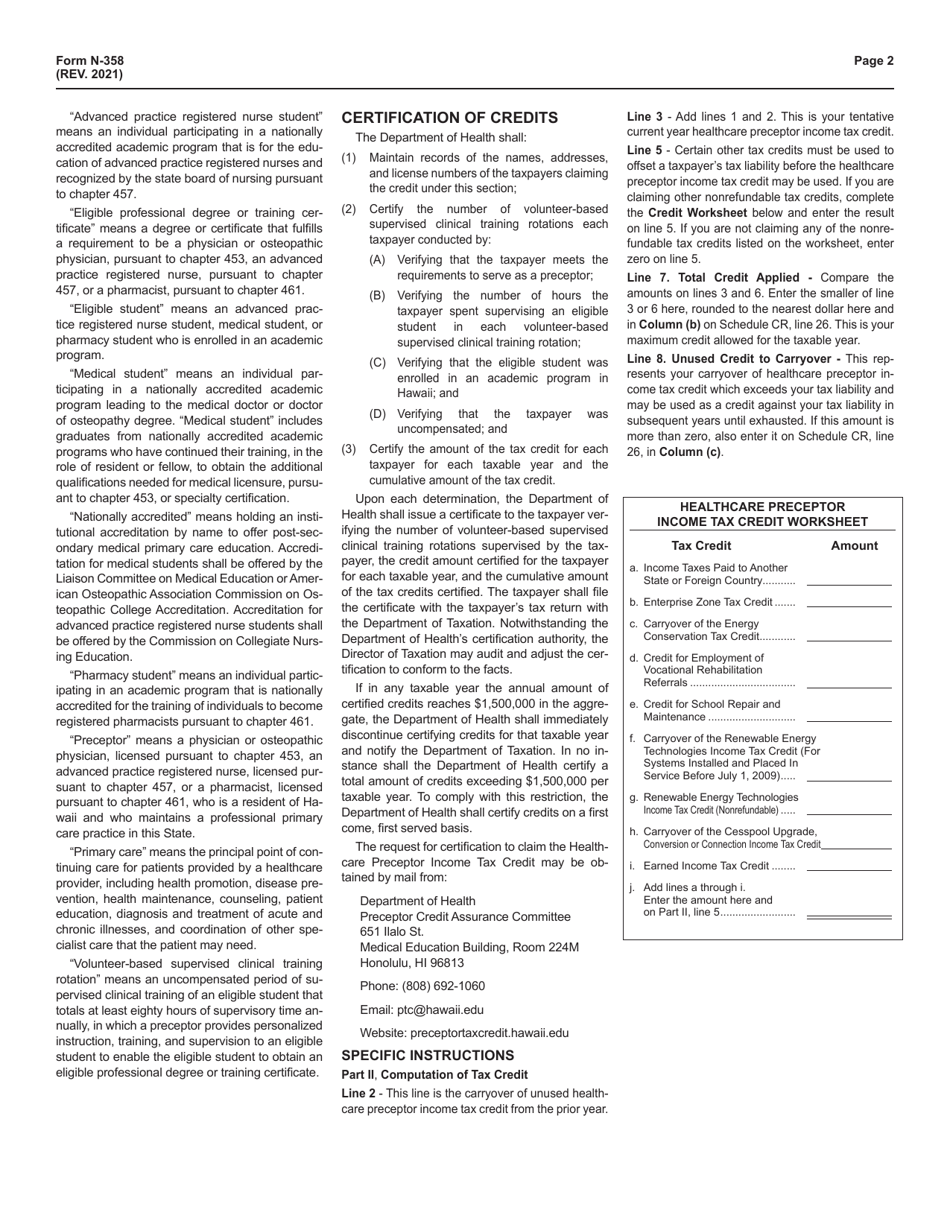

Form N-358

for the current year.

Form N-358 Healthcare Preceptor Income Tax Credit - Hawaii

What Is Form N-358?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-358?

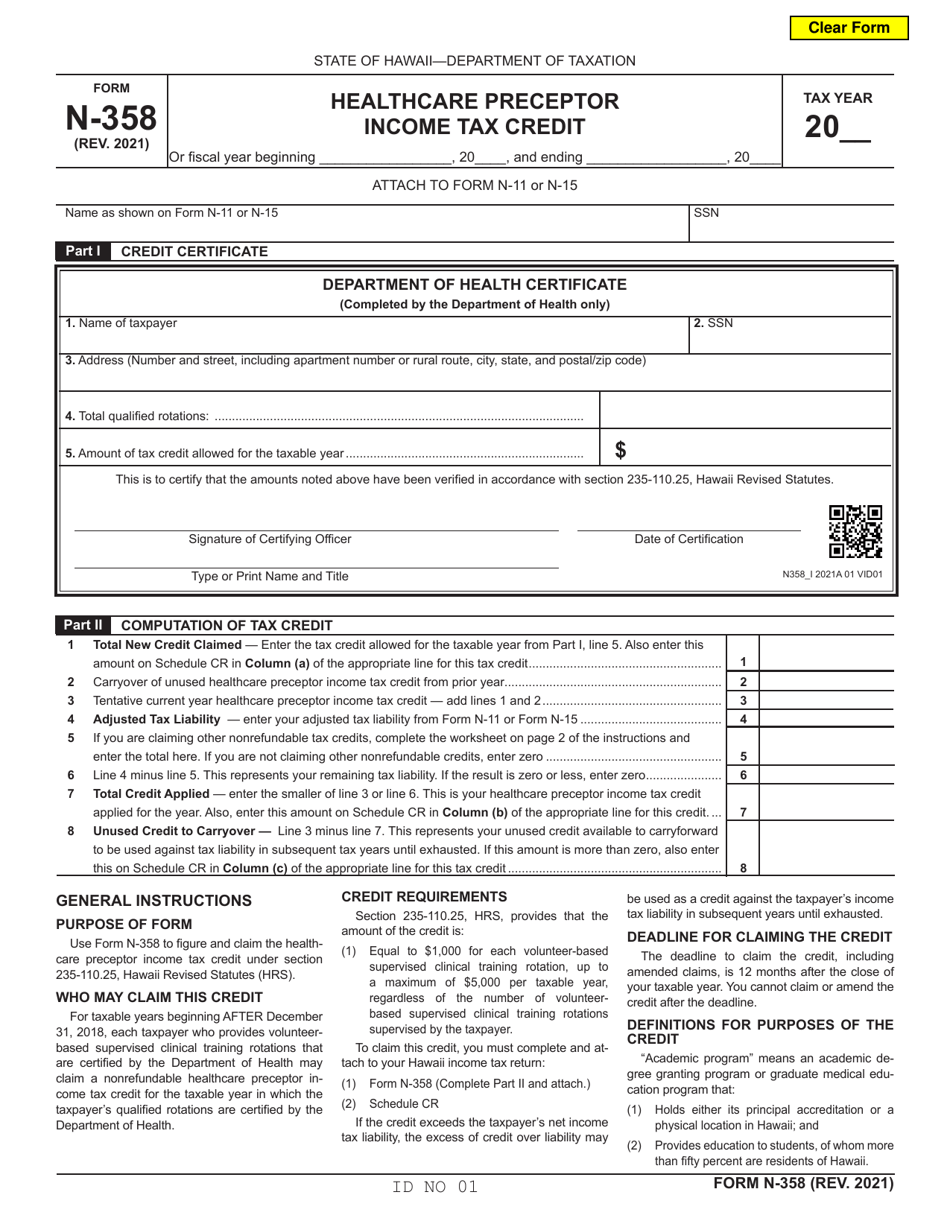

A: Form N-358 is a tax form used in Hawaii to claim the Healthcare Preceptor Income Tax Credit.

Q: What is the Healthcare Preceptor Income Tax Credit?

A: The Healthcare Preceptor Income Tax Credit is a tax credit offered in Hawaii to encourage healthcare professionals to serve as preceptors for health profession students.

Q: Who is eligible to claim the Healthcare Preceptor Income Tax Credit?

A: Healthcare professionals in Hawaii who serve as preceptors for health profession students are eligible to claim this tax credit.

Q: What is the purpose of the Healthcare Preceptor Income Tax Credit?

A: The purpose of this tax credit is to incentivize healthcare professionals to provide training and mentorship to students pursuing health profession careers.

Q: How much is the Healthcare Preceptor Income Tax Credit?

A: The amount of the tax credit can vary, but it is generally up to $5,000 per preceptor per taxable year.

Q: How do I claim the Healthcare Preceptor Income Tax Credit?

A: To claim the tax credit, you need to fill out Form N-358 and attach it to your Hawaii state income tax return.

Q: What documentation do I need to provide with Form N-358?

A: You may need to provide proof of your eligibility as a healthcare professional and documentation confirming your service as a preceptor for health profession students.

Q: Is the Healthcare Preceptor Income Tax Credit refundable?

A: No, this tax credit is non-refundable, which means it can reduce your tax liability but will not result in a refund if it exceeds your tax owed.

Q: Are there any deadlines for claiming the Healthcare Preceptor Income Tax Credit?

A: Yes, you must file your Hawaii state income tax return and submit Form N-358 by the applicable tax filing deadline, which is usually April 20th or 20th of the 4th month following the taxable year.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-358 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.