This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-352

for the current year.

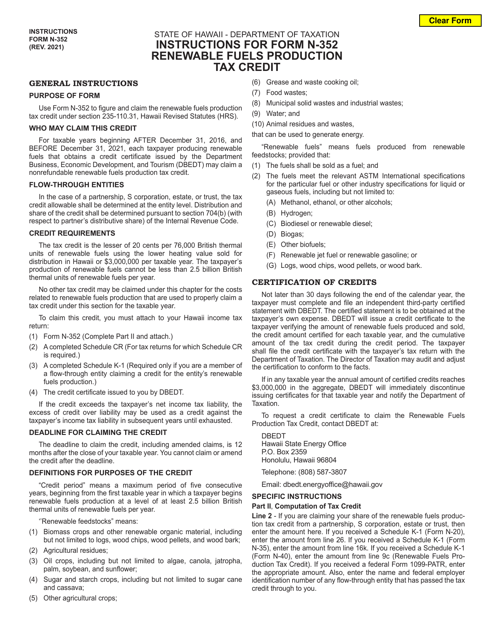

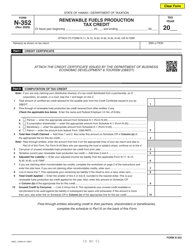

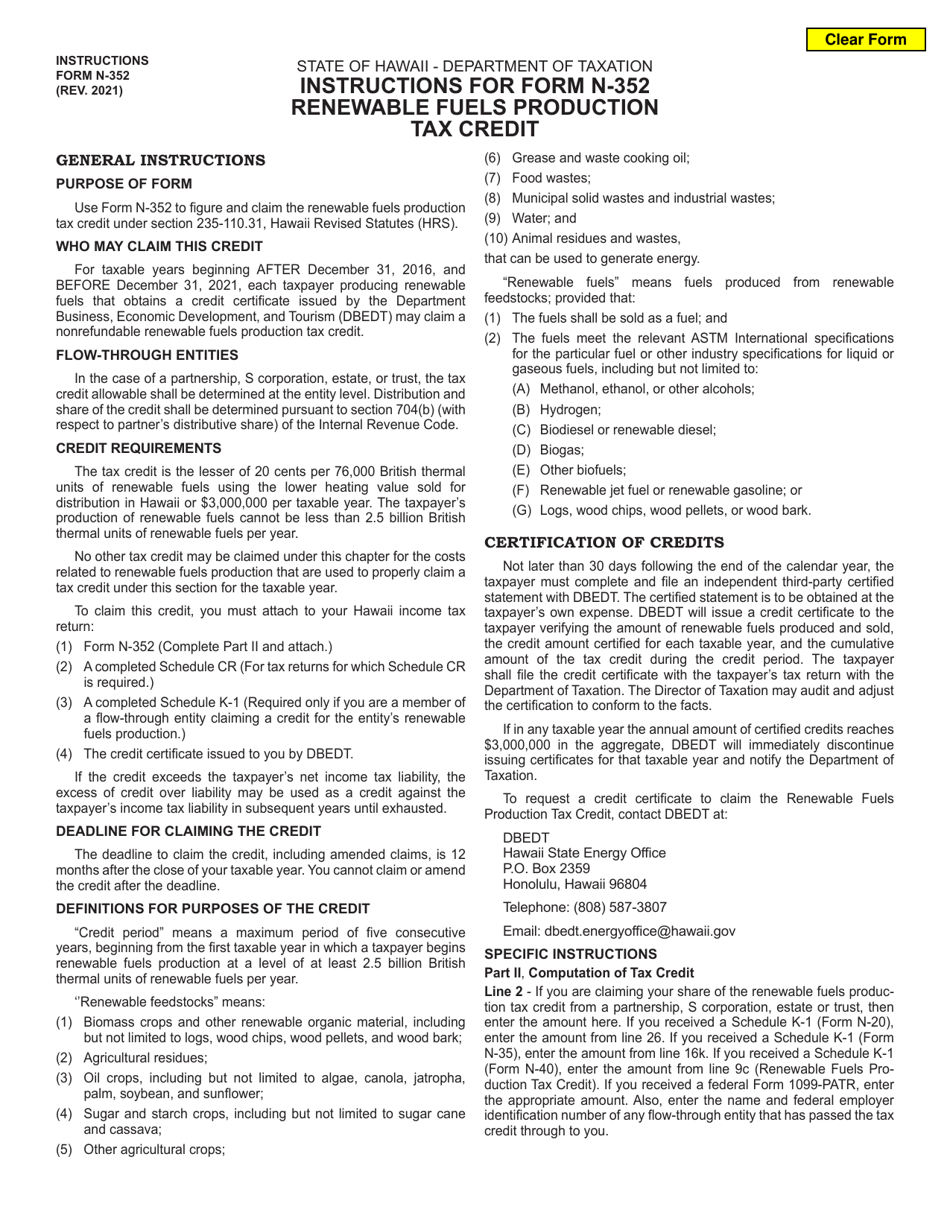

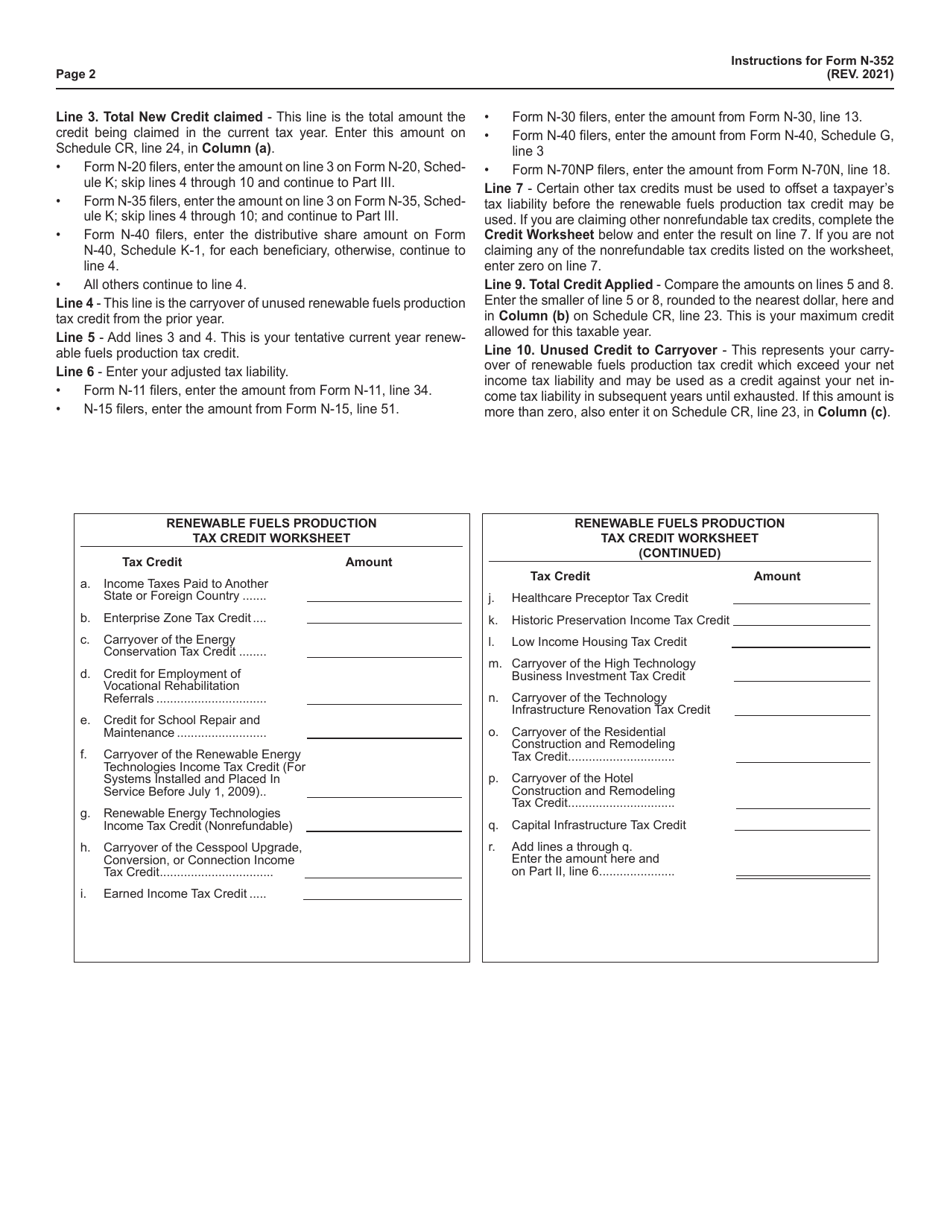

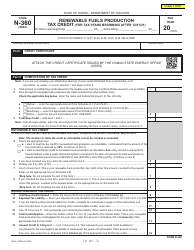

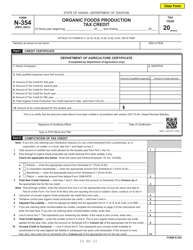

Instructions for Form N-352 Renewable Fuels Production Tax Credit - Hawaii

This document contains official instructions for Form N-352 , Renewable Fuels Production Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-352 is available for download through this link.

FAQ

Q: What is Form N-352?

A: Form N-352 is a form used to claim the Renewable Fuels Production Tax Credit in Hawaii.

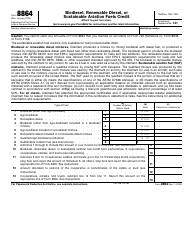

Q: What is the Renewable Fuels Production Tax Credit?

A: The Renewable Fuels Production Tax Credit is a tax credit given to individuals or businesses in Hawaii who produce renewable fuels.

Q: Who can claim the Renewable Fuels Production Tax Credit?

A: Individuals or businesses in Hawaii who produce renewable fuels can claim the tax credit.

Q: How do I fill out Form N-352?

A: You will need to provide information about your renewable fuel production activities and calculate the amount of tax credit you are eligible for.

Q: When is the deadline to file Form N-352?

A: The deadline to file Form N-352 is typically April 20th of each year.

Q: What documents do I need to submit with Form N-352?

A: You may need to submit supporting documentation such as production records or invoices to substantiate your claim for the tax credit.

Q: Can I claim the Renewable Fuels Production Tax Credit if I don't produce renewable fuels in Hawaii?

A: No, the tax credit is specifically for individuals or businesses in Hawaii who produce renewable fuels.

Q: Is the Renewable Fuels Production Tax Credit refundable?

A: Yes, the tax credit is refundable, which means if your credit exceeds the taxes you owe, you may receive a refund for the difference.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.