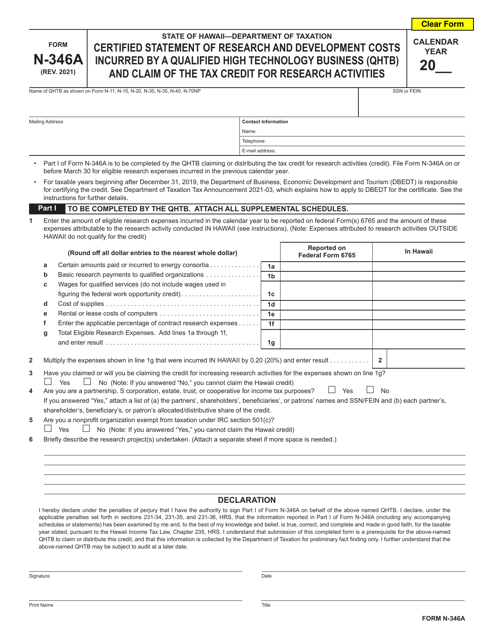

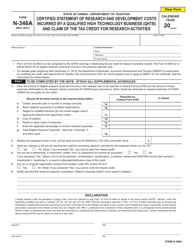

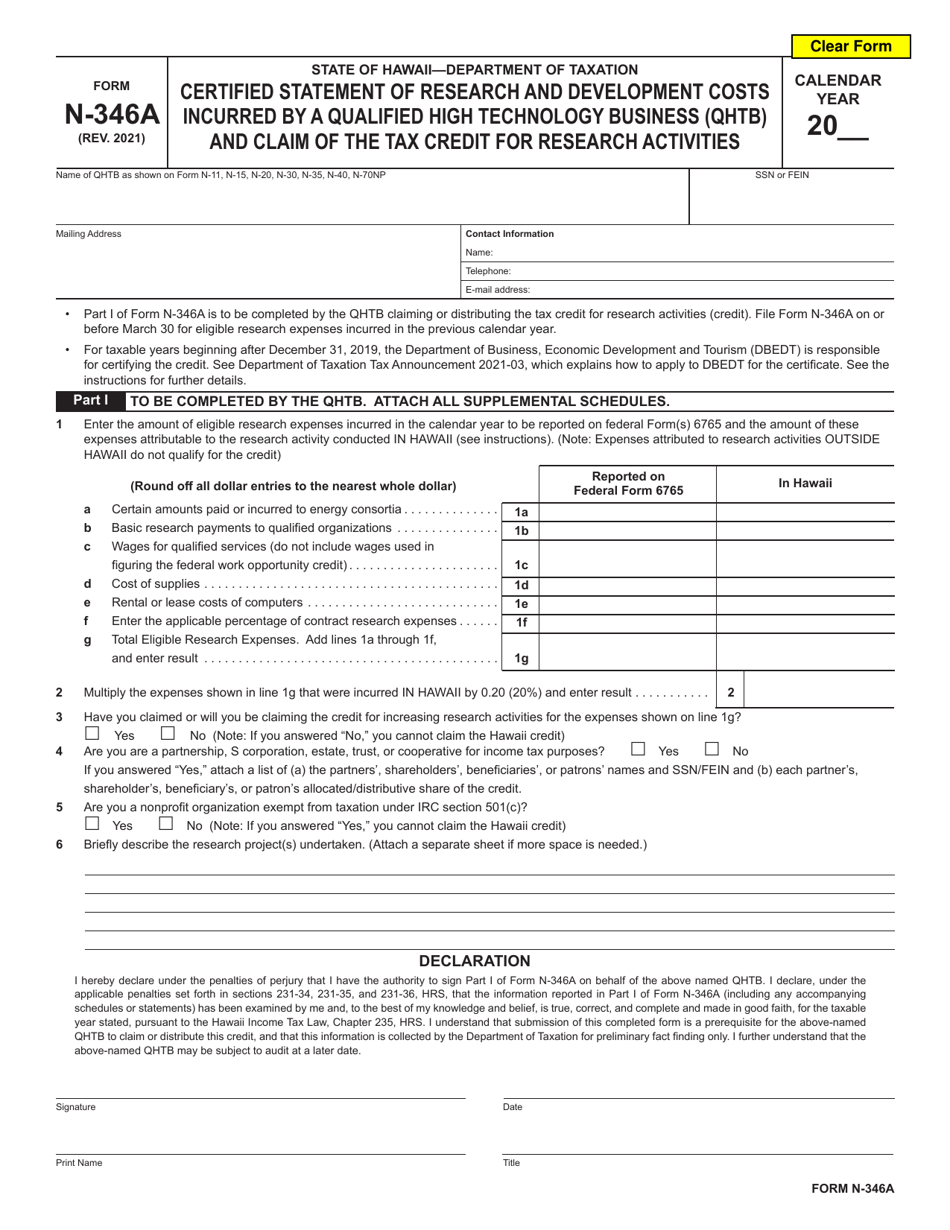

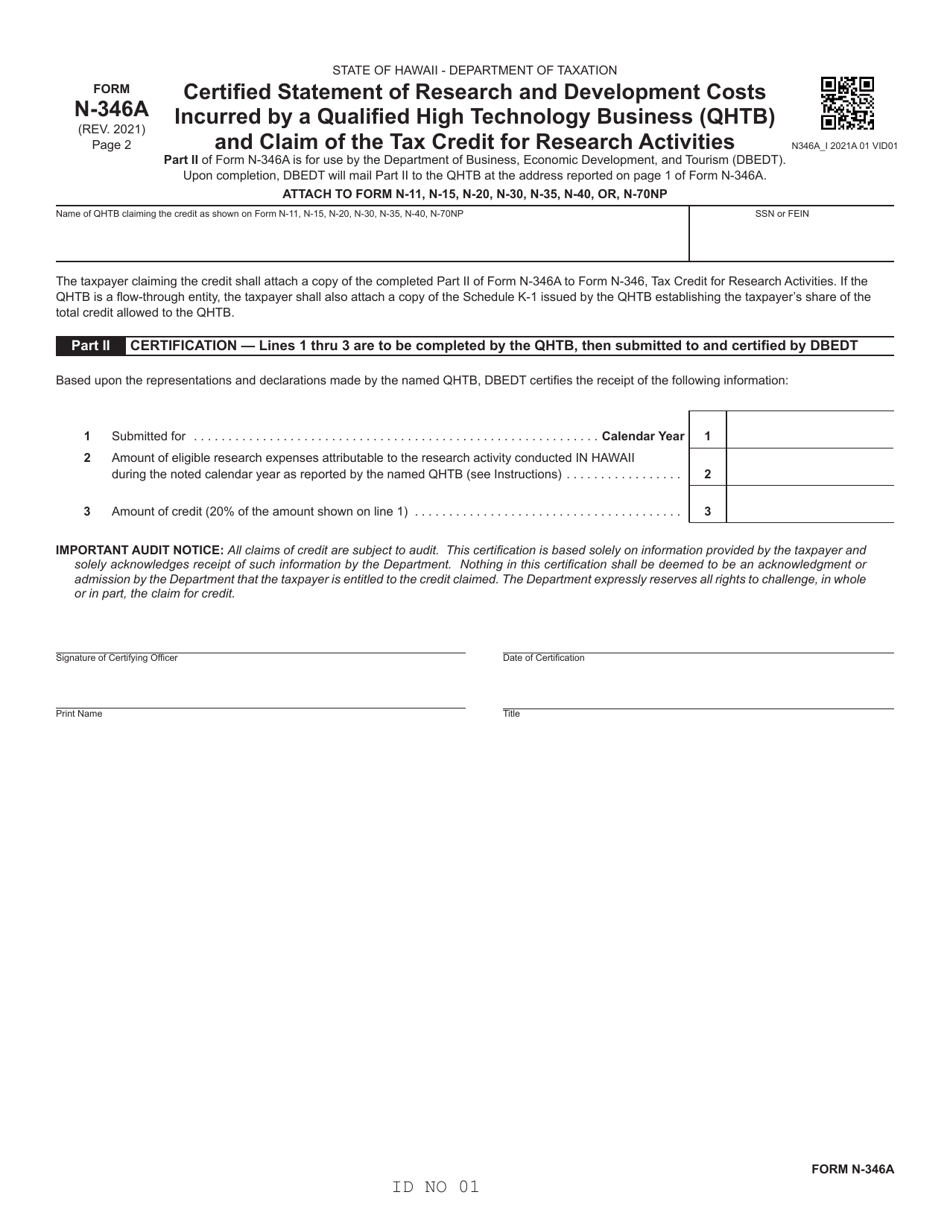

Form N-346A Certified Statement of Research and Development Costs Incurred by a Qualified High Technology Business (Qhtb) and Claim of the Tax Credit for Research Activities - Hawaii

What Is Form N-346A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-346A?

A: Form N-346A is the Certified Statement of Research and Development Costs Incurred by a Qualified High Technology Business (QHTB) and Claim of the Tax Credit for Research Activities in Hawaii.

Q: Who should use Form N-346A?

A: Form N-346A should be used by Qualified High Technology Businesses (QHTBs) in Hawaii to certify their research and development (R&D) costs and claim the tax credit for research activities.

Q: What is a Qualified High Technology Business (QHTB)?

A: A Qualified High Technology Business (QHTB) is a business in Hawaii that meets certain criteria related to research and development activities and high technology.

Q: What is the purpose of Form N-346A?

A: The purpose of Form N-346A is to certify and document the research and development costs incurred by a Qualified High Technology Business (QHTB) in Hawaii, in order to claim the tax credit for research activities.

Q: What is the tax credit for research activities in Hawaii?

A: The tax credit for research activities in Hawaii is a credit that allows Qualified High Technology Businesses (QHTBs) to offset a portion of their research and development (R&D) costs incurred in the state.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-346A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.