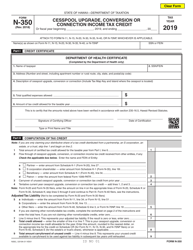

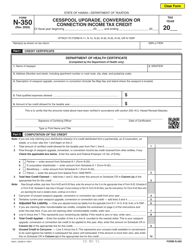

This version of the form is not currently in use and is provided for reference only. Download this version of

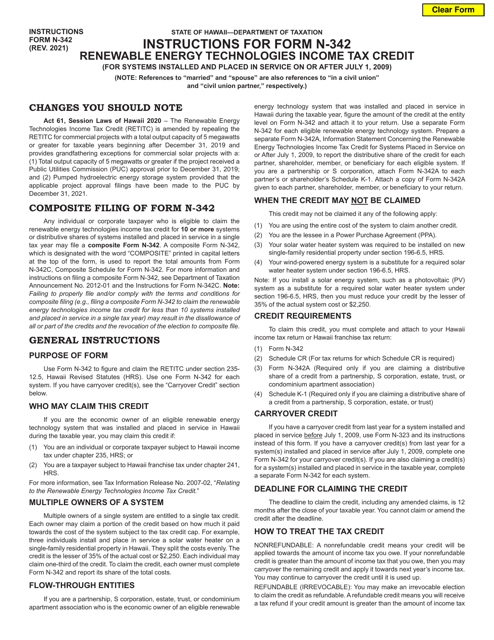

Instructions for Form N-342

for the current year.

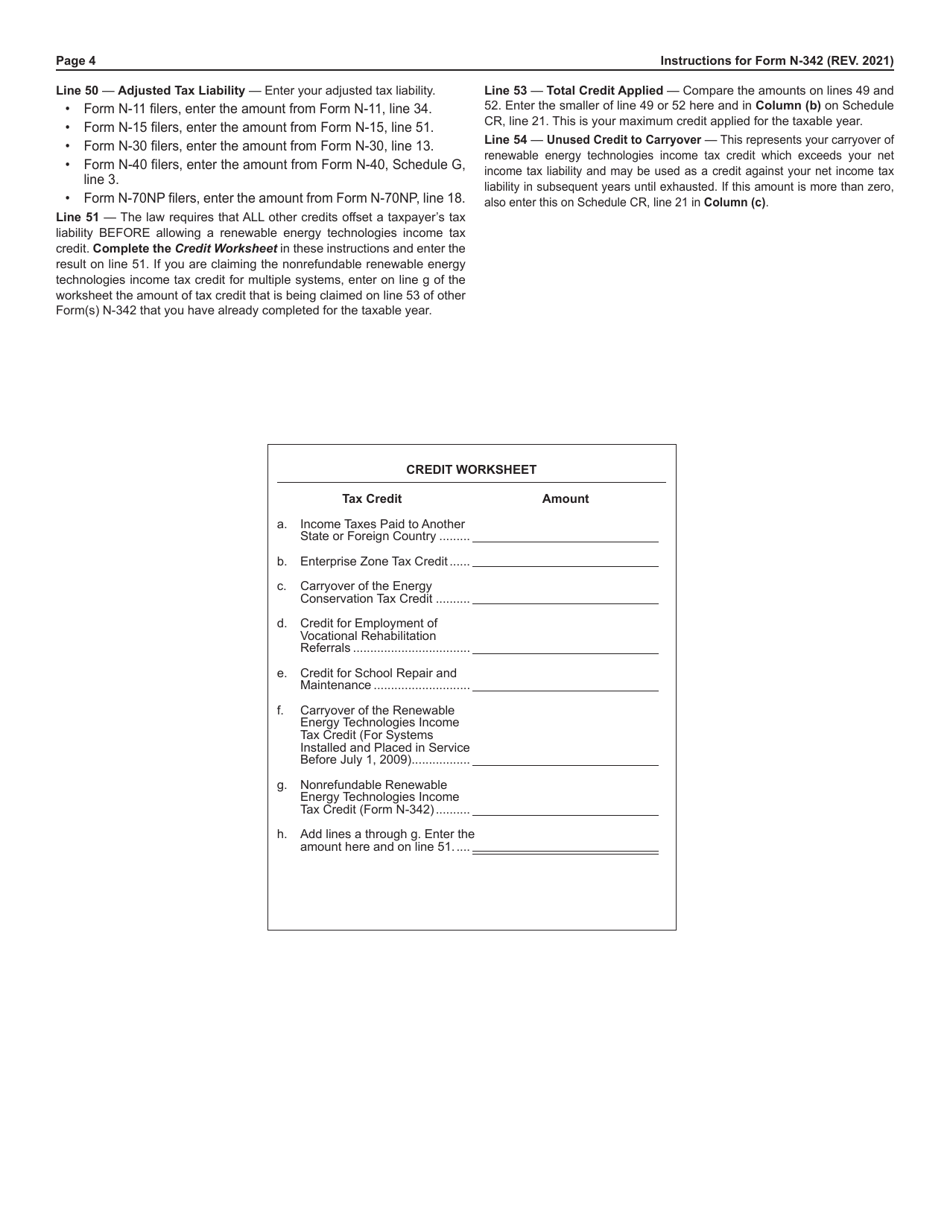

Instructions for Form N-342 Renewable Energy Technologies Income Tax Credit - Hawaii

This document contains official instructions for Form N-342 , Renewable Energy Technologies Income Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-342 is available for download through this link.

FAQ

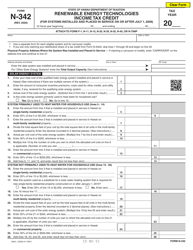

Q: What is Form N-342?

A: Form N-342 is a state tax form used in Hawaii to claim the Renewable Energy Technologies Income Tax Credit.

Q: What is the Renewable Energy Technologies Income Tax Credit?

A: The Renewable Energy Technologies Income Tax Credit is a tax incentive offered in Hawaii to individuals or businesses that install and operate renewable energy systems.

Q: Who can claim the tax credit?

A: Both individuals and businesses in Hawaii can claim the Renewable Energy Technologies Income Tax Credit.

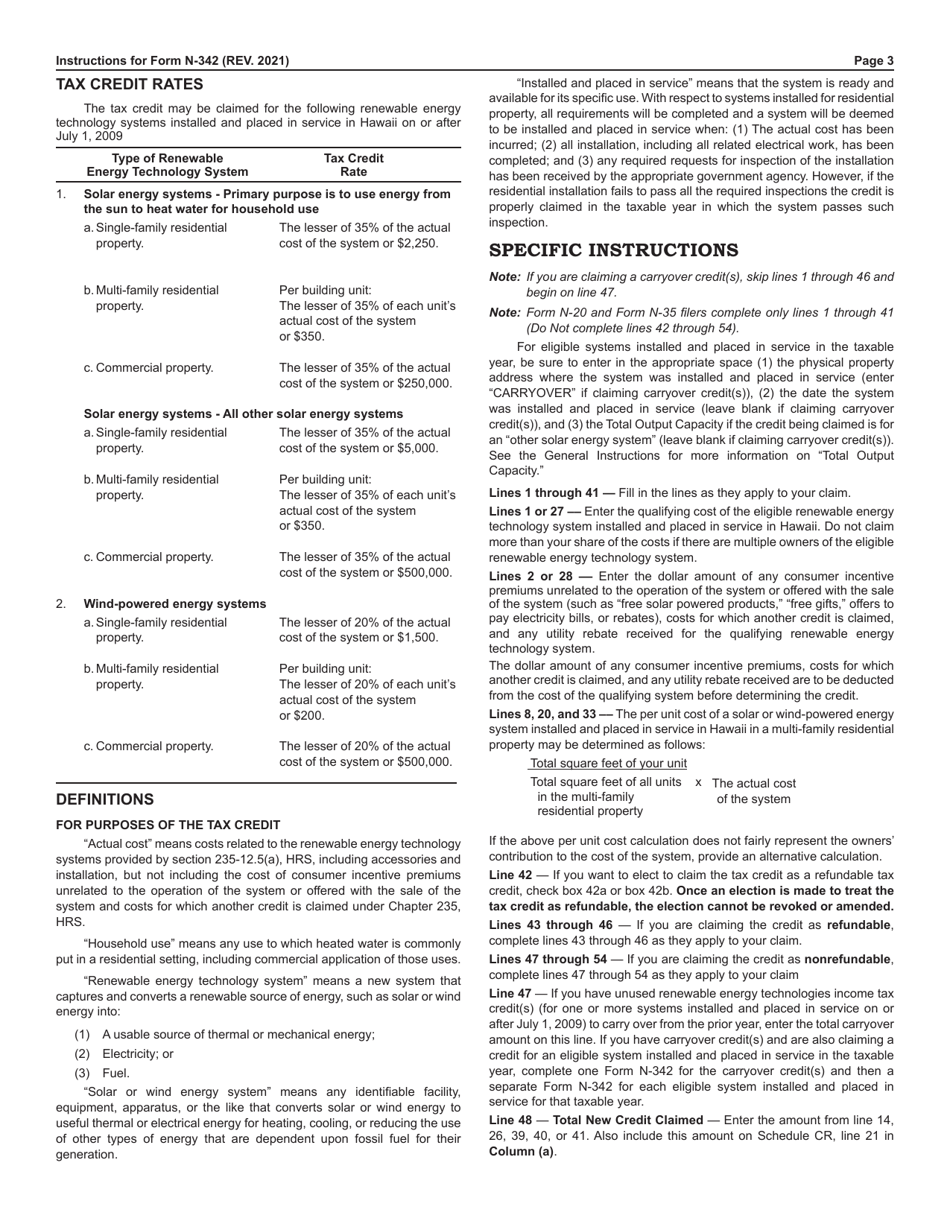

Q: What types of renewable energy systems are eligible for the tax credit?

A: Eligible systems include solar energy systems, wind-powered energy systems, ocean thermal energy conversion systems, and geothermal energy systems.

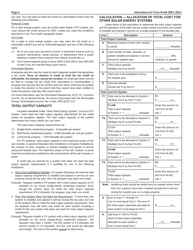

Q: What expenses can be claimed for the tax credit?

A: Expenses such as the purchase and installation costs of eligible systems, as well as costs for permits, inspections, and professional services directly related to the installation, can be claimed.

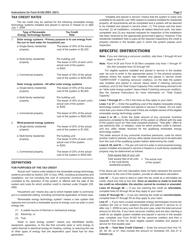

Q: How much is the tax credit?

A: The tax credit amount is based on a percentage of the total amount of expenses incurred for the eligible systems. The percentage varies depending on the type of system and the date it was placed into service.

Q: When is the deadline to file Form N-342?

A: The deadline to file Form N-342 is usually April 20th of the year following the tax year in which the expenses were incurred.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.