This version of the form is not currently in use and is provided for reference only. Download this version of

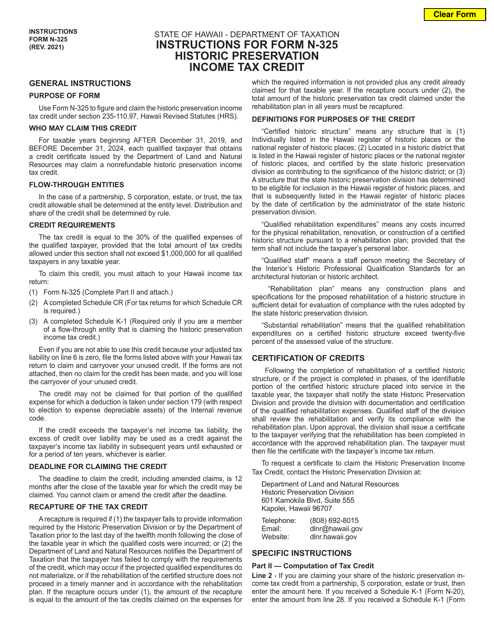

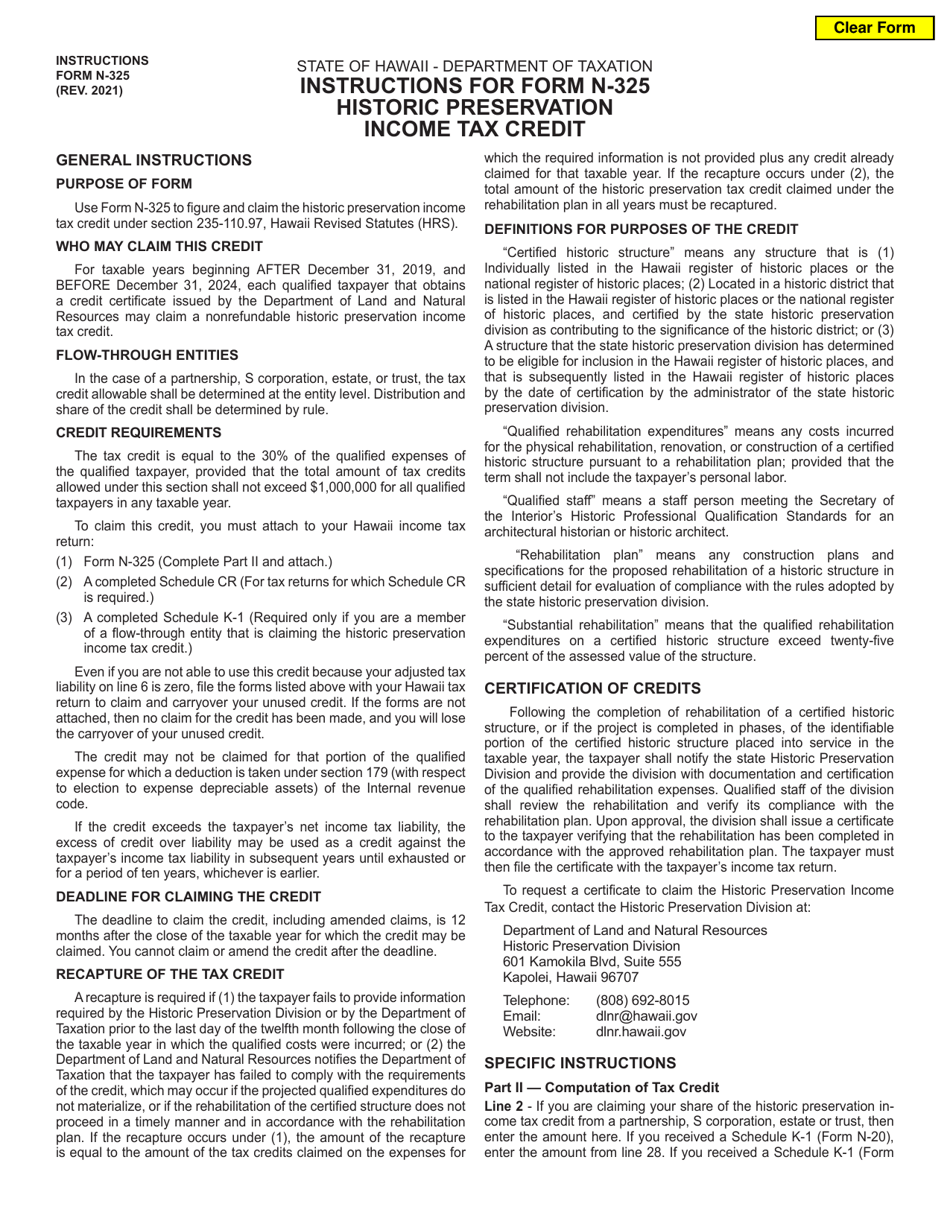

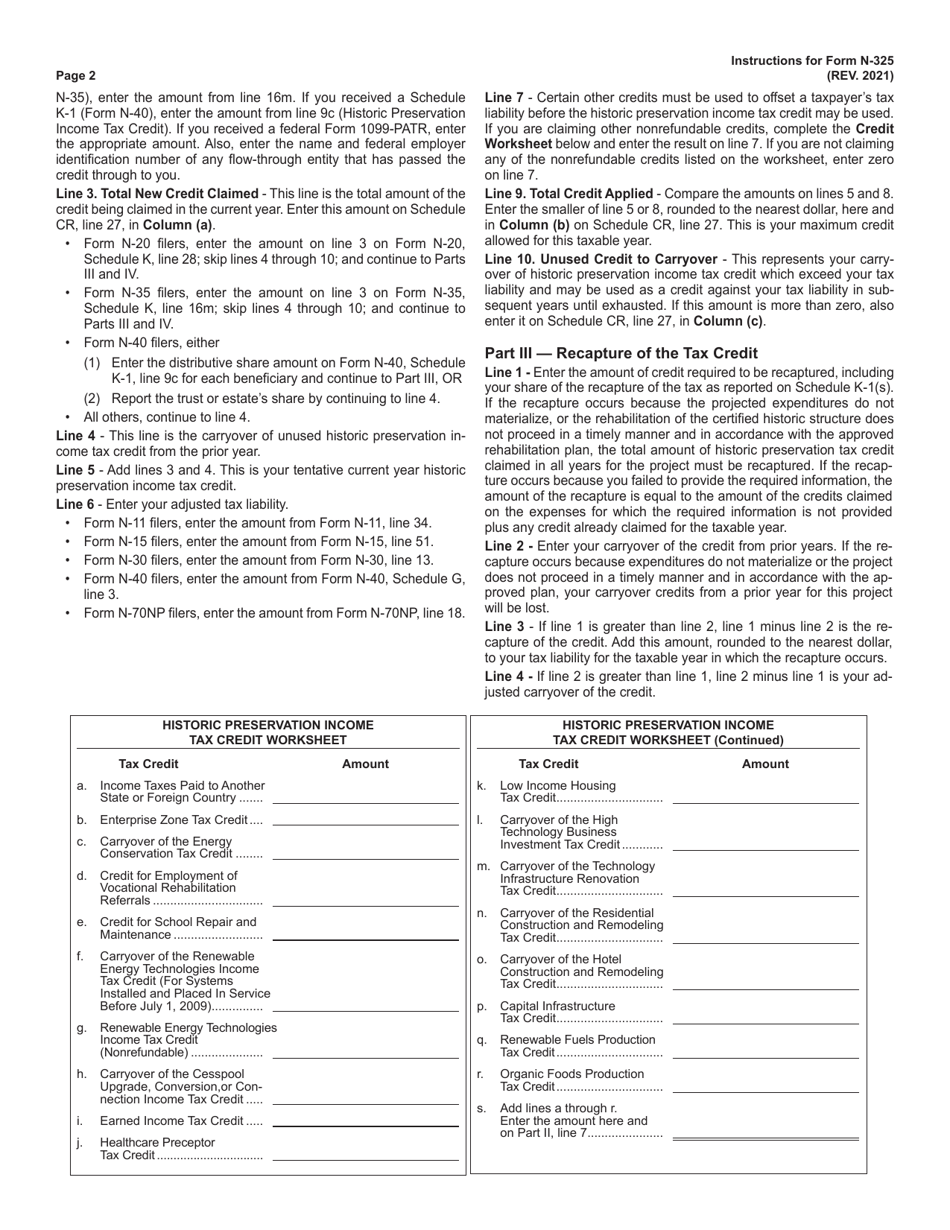

Instructions for Form N-325

for the current year.

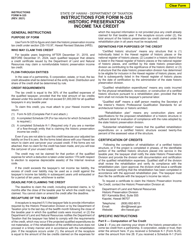

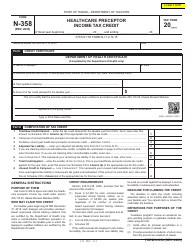

Instructions for Form N-325 Historic Preservation Income Tax Credit - Hawaii

This document contains official instructions for Form N-325 , Historic Preservation Income Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-325 is available for download through this link.

FAQ

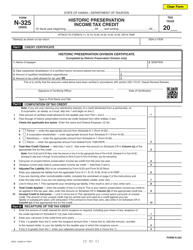

Q: What is Form N-325?

A: Form N-325 is a form used to claim the Historic PreservationIncome Tax Credit in Hawaii.

Q: Who can use Form N-325?

A: Individuals or entities who have incurred qualified expenses for the preservation of historic properties in Hawaii can use Form N-325.

Q: What is the Historic Preservation Income Tax Credit?

A: The Historic Preservation Income Tax Credit is a tax incentive program in Hawaii that provides a credit for qualified expenses incurred for the preservation of historic properties.

Q: What are qualified expenses?

A: Qualified expenses include costs related to the rehabilitation, restoration, or preservation of historic properties in Hawaii.

Q: How do I claim the Historic Preservation Income Tax Credit?

A: To claim the Historic Preservation Income Tax Credit, you must complete and submit Form N-325 along with the required documentation and supporting evidence.

Q: Are there any deadlines for filing Form N-325?

A: Yes, Form N-325 must be filed by the due date of your Hawaii state income tax return.

Q: What documentation do I need to submit with Form N-325?

A: You need to submit documentation that proves your eligibility for the Historic Preservation Income Tax Credit, such as receipts, invoices, and photographs of the historic property.

Q: Is there a limit to the Historic Preservation Income Tax Credit?

A: Yes, there is a cap on the total amount of credits that can be issued each year. It is best to check with the Hawaii Department of Taxation for the current year's credit limit.

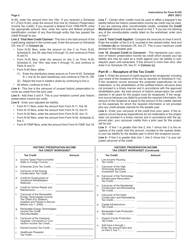

Q: Can the Historic Preservation Income Tax Credit be carried forward or transferred?

A: Yes, unused credit amounts can be carried forward for up to 7 years or transferred to another eligible taxpayer.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.